Market valuation- this is an assessment of the market value of property, as well as other objects of civil rights, in respect of which the legislation of the Russian Federation establishes the possibility of their participation in civil circulation.

Market price- this is the most probable price at which a given valuation object can be alienated on the open market in a competitive environment, when the parties to the transaction act reasonably, having all the necessary information, and the transaction price is not affected by any extraordinary circumstances.

Market value assessment

Market price real estate and its calculation is the most common type of market valuation. Market value assessment includes determining the value of an object or individual rights in relation to the object being valued, for example, lease rights, use rights, etc. Often, the market value of a property is obvious to its owners or potential buyers. However, after assessing the market value, its price can be significantly adjusted. To determine this real value, real estate is assessed.

In valuation practice, real estate valuation is usually understood as :

Real estate assessment is carried out in relation to such objects as industrial, social or cultural buildings, industrial complexes; residential buildings, apartments, rooms and other residential premises; office, warehouse and production premises; land plots, perennial plantings - gardens, parks, public gardens, developed plots in garden and dacha associations; structures - roads, bridges, access roads, tanks, fences, etc.; objects of unfinished construction, including objects with suspended construction, mothballed objects and objects with discontinued construction.

Our company determines the market value of real estate objects for making a contribution to the authorized capital of enterprises, registering a pledge (mortgage), changing the accounting value of fixed assets in accounting, concluding insurance contracts and for any other purposes that require establishing the value of the object by an independent appraiser.

There are three main methods for assessing the market value of real estate: the comparison method, the cost method and the income capitalization method.

Market valuation methods

The main method of market valuation is the comparative sales method. This method is applicable when there is a market for land and real estate, there are real sales, when it is the market that forms prices, and the task of appraisers is to analyze this market, compare similar sales and thus obtain the market value of the property being valued. The method is based on comparing an object offered for sale with market analogues.

The method of estimating market value based on costs is practically not applicable to land. It can be used only in exceptional cases of assessing land inextricably from the improvements made on it. Land is considered to be permanent and not consumable, and the cost method is used to value man-made objects. When assessed by this method, the value of land is added to the cost of improvements (buildings, structures), and land is assessed separately by other methods.

Market valuation is also necessary within the framework of regional tax policy. Throughout the world, the basis of the local taxation system is the property tax; part of the local budget is formed from this tax. Of course, with the development of the market itself, with the emergence of real values, a transition to a tax system that would stimulate the development of the real estate market and at the same time ensure the replenishment of local budgets is possible. This explains the unconditional interest in market valuation shown by local administrations.

If you need to get a market assessment of the value of property, contact us usingcontact information . Call us, we will help!

Establishing the cost of goods, works or services so that the tax authorities do not have any complaints about its validity is a very non-trivial task. Especially if we are talking about products that have no analogues on the market.

The general principle for determining the price of any transaction for tax purposes is its compliance with the level of market prices. And based on paragraph 4 of Article 40 of the Tax Code, such a price is recognized as the price formed during the interaction of supply and demand on the market of identical (and in their absence, homogeneous) goods, works, services in comparable economic conditions.

The features of calculating the market price, as well as cases when tax authorities have the opportunity to intervene in the pricing process, are quite clearly stated in the mentioned article. However, disputes regarding the application of certain of its provisions are also not uncommon. And most of them are related specifically to the procedure for determining the market price of a product.

We are looking for identical products

So, if transactions with identical (homogeneous) goods, works or services take place on the relevant market, then their market price is determined on the basis of information provided in official sources (clause 11 of article 40 of the Tax Code). This may be official information about stock quotes on the exchange closest to the location of the seller or buyer, as well as quotes from the Ministry of Finance for government securities and obligations. Information from government statistical bodies and bodies regulating pricing is also suitable, as well as information on market prices published in print publications or the media. In addition, the assessment of the market price for goods, works or services can be carried out in accordance with the Law of July 29, 1998 No. 135-FZ “On Valuation Activities in the Russian Federation” by a licensed appraiser.

As follows from paragraph 9 of Article 40 of the Tax Code, when determining market prices, information on transactions with identical or similar goods under comparable conditions is taken into account. This means that such terms of transactions as the quantity of goods supplied, deadlines for fulfilling obligations, payment terms and other conditions must be taken into account if they may influence the formation of prices.

The obligation to take into account the terms of transactions when implementing price control is confirmed by arbitration practice. Most cases of additional tax assessment based on the size of market prices were lost by the tax authorities precisely because they were unable to provide compelling evidence of the existence of comparable terms of transactions carried out by a tax-paying company and transactions in which the market price was applied (see, for example, the resolution FAS North-Western District dated June 3, 2005 in case No. A56-43517/04, resolution of the FAS West Siberian District dated March 12, 2008 No. F04-1672/2008 (1943-A03-42)).

Paying for “uniqueness”

The main difficulties in checking the price for compliance with the market level will arise for companies selling goods, work or services that have no analogues. If there are no transactions for identical goods on the relevant market, or determination of the market price is impossible due to the absence or inaccessibility of information sources, then the subsequent sales price method is used to determine it.

The essence of the subsequent sale price method is to determine the market price of the assets being sold based on the buyer setting their resale price using the following formula:

C1 = C2 – (Z2 + P2),

C 1– market price of the product;

Ts2– selling price (resale) of the goods to subsequent buyers;

Z2– costs incurred by the buyer of the product during its further sale (resale) and promotion to the market (excluding the purchase price of the product);

P2– the usual profit of the buyer of the product upon its further sale (resale).

As the name suggests, the resale price method can only be used if there is a fact of resale of goods, works or services. If this method cannot be applied, then “as a last resort” the company has the right to use a costly method. Its use comes down to determining the market price of a product using the following formula:

C = Z + P,

C– market price of the product;

Z– direct and indirect costs of the seller for the production (purchase) and (or) sale of goods, as well as costs of transportation, storage and other similar costs;

P– the seller’s usual profit.

It should also be noted that both of these methods have a significant drawback: they do not take into account the impact of inflation on the level of market prices. And in conditions of significant price increases, the values obtained using these methods must be adjusted to changes in the price index. However, the Tax Code does not provide for the possibility of such an adjustment. Another “stumbling block” is the fact that the tax legislation does not have clear definitions of such terms as “ordinary costs” or “normal profit for a given type of activity.”

It would seem that in order to avoid possible errors when independently calculating certain indicators, the most logical thing for a company in this situation would be to turn to an independent appraiser. However, in their recent letter dated July 2, 2008 No. 03-02-07/1-243, specialists from the Ministry of Finance prohibited this, voicing an opinion that boils down to the fact that assessing the market price of a product, work or service that has no analogues on the market , independent appraisers cannot.

However, the same clarifications reserve for the court the right to take into account any factors that are important for determining the results of the transaction, not limited to the circumstances listed in Article 40 of the Tax Code. Moreover, what is interesting is that arbitration judges had previously come to similar conclusions (resolution of the Federal Antimonopoly Service of the Ural District dated April 11, 2006 No. F09-2564/06-S6 in case No. A76-5970/2005).

Thus, even if the company has to face claims from the tax authorities, it is not at all necessary to “accept fate” unless there are really compelling reasons for doing so. There is always the opportunity to defend one’s interests with the help of judges, who often find themselves on the side of the taxpayer when it comes to the methodology for determining the market price for tax purposes.

5.2. Determining the market value of automatic telephone exchange

comparative approach using market

assessment method

5.2.1. The market value of the valuation object is understood as the most probable price at which this valuation object can be sold (alienated) on the open market in a competitive environment, when the parties to the transaction act reasonably, having all the necessary information, and the value of the transaction price is not reflected in any extraordinary circumstances. circumstances, i.e. When:

One of the parties to the transaction is not obliged to sell the object of assessment, and the other is not obliged to purchase it;

The parties to the transaction are well aware of the subject of the transaction and act in their own interests;

The object of the transaction is presented to the open market in the form of a public offer, from which the will of the person making the offer is discerned to conclude an agreement on the terms specified in the offer;

The transaction price represents a reasonable remuneration for the object of evaluation and compulsion to complete the transaction in relation to the parties to the transaction on any part;

Payment for the valuation object is expressed in monetary form.

5.2.2. The comparative approach is based on an analysis of supply and demand prices for telephone exchanges currently prevailing in the primary or secondary market. The assessment is made by determining the average offer price for automatic telephone exchanges similar to the one being assessed and its subsequent adjustment.

5.2.3. The market value (purchase cost) of a vehicle depends on various factors: the consumer properties of the vehicle, the presence of a manufacturer's representative in the region, the availability of a technical service network for this brand of vehicle, the price level for spare parts, maintenance and repair work for the vehicle of this brand; brand prestige, market conditions; geographical location and general economic situation in the region, etc.

5.2.4. Calculation of the cost of a used vehicle as of the valuation date within the framework of the comparative approach when using the market method is carried out according to a certain scheme:

5.2.5. Initial information for determining the market price of automatic telephone exchange can be obtained by an expert from the following sources:

Information from regional periodical reference publications on prices for new and used telephone exchanges;

Data from organizations selling used telephones;

Thematic Internet sites that display information about the market of the region in which the price of automatic telephone exchange is determined;

Reports on the results of a study of the regional market for used vehicles, periodically compiled by the expert (experts), which record the prices requested by sellers (offer price) for specific vehicles, and provide a brief description of the vehicles sold (make, model, release date, mileage, type and engine characteristics, equipment, general technical condition).

5.2.6. When assessing vehicles on a date other than the date of the incident, in some cases it is necessary to take into account the service life as of the date of the incident, and not the year of manufacture. For example: the year of manufacture of the vehicle is 2003, the accident occurred in 2006, the assessment is made in 2007. In this case, it is necessary to evaluate the vehicle not manufactured in 2003, but a 3-year-old vehicle, since at the time of the accident it was 3 years old, i.e. .e. AMTS 2004 release.

5.2.7. Offers for the sale of used telephones are assessed by an expert for suitability for calculating the average cost of the offer. Suitability assessment is carried out in the following sequence:

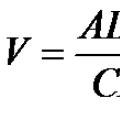

A) the average supply price is determined by the formula:

[rub.], (5.1)

Where is the offer price of the i-th telephone exchange, rub.; i - number of offers, .

When determining the approximate average offer price, it is unacceptable to use prices for automatic telephone exchanges that are obviously different in condition and configuration from the (average) option under consideration;

B) the spread of supply prices is assessed relative to the calculated above average value. The spread should not exceed 20%:

C) if the deviation of the i-th proposal exceeds 20%, this proposal is excluded from the sample.

5.2.8. The final calculation of the average offer price is made taking into account a sample consisting of offers whose deviation from the approximate average cost does not exceed 20%, according to the formula:

[rub.], (5.3)

Where is the offer price of the i-th ATE that satisfies the condition of clause 5.2.7, rub.; - the number of proposals that satisfy the condition of clause 5.2.7, .

5.2.9. The calculated average offer price is the initial price in this method. The average offer price should be adjusted if bargaining is possible during the purchase, since the average purchase price as a result of bargaining, as a rule, is the average offer price (without adjustment for the condition, mileage and completeness of the vehicle).

Since 1994, Russian legislation has classified land plots and everything that is inextricably linked with them as real estate: structures built or under construction on land, buildings that are difficult to move from place to place without causing them disproportionate harm, subsoil plots. This category of real estate is truly immovable.

Another category of real estate is mobile vehicles transporting people and cargo by water, in the air and in space: sea and river vessels, aircraft, artificial Earth satellites.

A special category includes property complexes connected by a single technological cycle - enterprises. They differ from the organizations (often of the same name) and entrepreneurs operating on their basis in that they are an object and not a subject of law.

Each of the listed categories has a separate legal basis. The listed groups of objects have in common their similar qualities as objects of law: all of them must be registered with the relevant government authorities and are legally tied to the place of their registration, intended for many years of use.

In an accounting sense, they refer to fixed assets, are included in the cost of production not entirely, like working capital, but by calculating depreciation. Real estate items are valued as single objects, having a value that is not equivalent to the sum of the value of the things of which they are composed.

When assessing such objects, it can be calculated types of cost:

The issues of market valuation of real estate are of greatest interest to the population. in the residential sector. These are residential buildings, their parts and all real estate inextricably linked with housing: infrastructure, personal plots, green spaces.

When assessing their market value, the following can be most fully observed: free market conditions, virtually unlimited competition between supply and demand.

general information

Attraction appraiser For market valuation of real estate it is usually necessary in the following cases:

- If real estate is seized in .

- When a bank or other lender determines the value of the collateral, for example, for the purpose of concluding mortgage agreement.

- To calculate the ownership of real estate received by the owner free of charge.

- To calculate the value of the bankrupt's property.

- When an object is added to the authorized capital of the company in the form of a non-monetary contribution.

Market valuation differs dates, as of which it is carried out:

Market price from the appraiser’s point of view, the estimated transaction price when:

- The parties have comprehensive information about the condition of the object, the market situation and reasonably take this information into account.

- One party is not obligated sell object, and the other buy.

- The object is put up for free sale through a public offer.

- The parties agree to set the price without coercion.

- Payment for the facility is set in cash.

What is the method?

Object cost the evaluator determines using three different approaches.

Expensive

Assumes that the buyer is reasonable and will not buy the property for a large amount than he would need to create a similar object on his own within a timeframe acceptable to him.

It will have the most significant reliability coefficients for new construction; reconstruction; special objects with a limited market; insurance purposes.

The coefficient decreases when assessing physically or morally worn-out objects. Land valuation this method is carried out separately from building assessments on her.

Comparative

The approach is to study the results recent transactions with similar objects.

The approach is to study the results recent transactions with similar objects.

The appraiser assumes that the buyer is reasonable and will not pay more than similar object, also on the market.

In this case, the cost is calculated by dividing the object into elements that are most taken into account when setting the price. For example, in the price of an apartment main role play by the size of the living area, its location, floor, material from which the house is built. Based on their combination closest to the object being studied, those similar to it are determined.

Reliability of this method on the Russian market is decreasing the widespread opacity of real transactions. Also the method is explicitly doesn't fit for the evaluation of special objects that are not represented or have a limited presence on the market.

Income approach

Based on the thesis that the acquired object must pay for yourself income received from its use within an acceptable period. For example, if the purchased housing (apartment) is intended for, it is necessary to calculate what benefits can be obtained from this.

If it’s for living, wouldn’t it be more profitable for this purpose? The objectivity of such an assessment again rests on the opacity of the Russian market. Real prices Renting real estate is not easy to find out. Moreover, if we assume receiving income in future.

With this approach, it is also necessary to forecast at what price a given property can be sold in the future, whether the price of real estate in a given area is increasing or decreasing, how it will be affected by the upcoming wear and tear of the object.

Reasonable market value is considered when:

After research using all three approaches, the appraiser justifies the establishment of their significance coefficients expertly or mathematically and presents final result as a single figure or as a set of numbers reflecting maximum and minimum values market value depending on the expected effect of certain factors.

Customer of the study can choose of the proposed results, the one that most closely corresponds to the real situation, and most importantly, its valid intentions that may differ from those officially stated in the technical specifications.

Procedure

It includes the following steps:

- Determination of the purpose, date, subject of assessment, type of value.

- Drawing up an agreement between the appraiser and the customer, including approval of the schedule and work plan, costs for their implementation and the amount of remuneration.

- Collection of information about the object and market conditions.

- Analysis of the possibilities of optimal use of the facility.

- Determination of cost using three approaches separately.

- Harmonization of results from different approaches. Establishment of reliability coefficients for each of them, Calculation of the final value.

- Drawing up and approval of the report by the parties.

How is the market price of residential real estate assessed?

Using the cost approach, the appraiser first determines market price of the plot, where the object is located, as undeveloped.

Using the cost approach, the appraiser first determines market price of the plot, where the object is located, as undeveloped.

Then calculates cost of materials and work required at the valuation date to create such an object.

Calculates the percentage of wear of an object using standards or through expert analysis. Defines residual value object as the sum of the cost of land and buildings minus depreciation.

Acting comparison method, the appraiser separately collects information on transactions with similar plots of land, then information on transactions with similar objects in other areas, minus the value of the land under them. Then it is calculated weighted average result.

Approaching the definition of value from the point of view income prospects, the appraiser determines what average annual income can be received from a given object, calculates the capitalization rate and predicts at what price it can be sold at the end of its useful life, taking into account wear and tear and market development prospects. At the end of the work, the weighted average result is determined and written report.

Compiled by the deadline specified in the contract and accepted by the customer report is evidence of work done conscientiously. Appraiser personally signs the report and certifies with his seal.

There are three methods for assessing the market value of real estate:

- - Comparison method

- - Costly method

- - Income capitalization method.

The main valuation method is the comparative sales analysis (SSA) method. The sales comparison method is used if there is a sufficient amount of reliable market information on purchase and sale transactions of objects similar to the one being valued. In this case, the criterion for selecting comparison objects is similar best and most effective use.

Comparative sales analysis is carried out in the following sequence (Fig. 2)

Figure 2. Algorithm for a comparative approach to real estate valuation

Recent sales of comparable properties in the relevant market are highlighted. Sources of information are: the appraiser’s own file, the Internet, an electronic database, real estate firms, real estate brokers’ files, archives of credit institutions (mortgage banks), insurance companies, construction and investment companies, territorial departments for insolvency and bankruptcy, territorial departments of the State Property Committee, etc. .

Measurements traditionally established in the local market are taken as units of comparison. To evaluate the same object, several units of comparison can be used simultaneously.

Elements of comparison include the characteristics of real estate objects and transactions that cause changes in real estate prices. Elements subject to mandatory accounting include:

- -composition of transferred property rights;

- - conditions for financing the purchase and sale transaction;

- -terms of sale;

- - time of sale;

- -location;

- -physical characteristics;

- -economic characteristics;

- - nature of use;

- -cost components not related to real estate.

Verification of transaction information: confirmation of the transaction by one of the main participants (buyer or seller) or an agent of the real estate company; identifying the terms of sale.

If there is a sufficient amount of reliable market information, it is permissible to use methods of mathematical statistics to determine the value by comparing sales.

Adjustment of the value of comparable properties.

Adjustment can be made in three main forms: in monetary terms, percentage, general grouping. Adjustments to the sales prices of comparable properties are made in the following order:

First of all, adjustments are made related to the terms of the transaction and the state of the market, which are carried out by applying each subsequent adjustment to the previous result;

secondly, adjustments are made that relate directly to the property, which are made by applying these adjustments to the result obtained after adjusting for market conditions, in any order.

To determine the magnitude of adjustments, depending on the availability and reliability of market information, quantitative and qualitative methods are used. Justification for the adjustments taken into account is mandatory. The final decision on the value of the result determined by the sales comparison method is made based on an analysis of the adjusted sales prices of comparison objects that have the greatest similarity to the object of evaluation.

The comparative approach has the following disadvantages:

Sales difference. There are no sales of absolutely identical objects; coincidence is observed only in a number of parameters. Transactions may differ in the set of characteristics inherent in the object itself, but also in the terms of the transaction. The greater the differences between comparable sales, the greater the likelihood of obtaining an inaccurate result.

Difficulty in collecting information on actual sales prices. Actual prices are often hidden to evade taxes and duties. Verifying the accuracy of information is significantly difficult.

The difficulty of collecting information about the specific terms of the transaction.

Dependence on market activity. The accuracy of the result depends on the activity and saturation of the market with data on transactions with analogues of the valued object. Using the approach in inactive markets is problematic.

Dependence on market stability.

Difficulty in reconciling significantly different sales data, which may reduce the accuracy of the valuation results.

The comparative approach also has a number of advantages:

Most reliable in active markets for appraising small commercial properties and properties that are bought and sold frequently and are not used to generate income.

Statistically justified.

Allows you to reflect the opinions of typical sellers and buyers in the final assessment.

Sales prices reflect changes in financial conditions and inflation.

Allows you to make adjustments for differences between compared objects.

Given enough information for analysis, it is quite easy to use and produces reliable results.

The cost method is an approach to real estate valuation based on the fact that the buyer should not pay more for the property than it costs to build it again at current prices for land, building materials and labor. This approach to determining cost is fully justified when it comes to new or relatively new buildings.

Most experts recognize that the cost method is useful for verifying estimated costs, but it can rarely be relied upon.

With this approach, the estimated value of a property is determined as the difference between the cost of their complete reproduction or complete replacement and the amount of depreciation plus the cost of a plot of land; it can be determined using formulas (1) or (2):

Tsn = PSV - I + Ts, (1)

Tsn = PSZ - I + Ts, (2)

where Cn is the cost of real estate using the cost method;

PSV - the total cost of complete reproduction of the property being valued;

PSZ - the total replacement cost of the property being valued;

I - the cost of depreciation of the property being valued;

Ts - the cost of a piece of land.

Moreover, the full cost of reproduction (FRP) is understood as the cost of constructing an exact copy of a building at current prices and using the same materials, construction standards, design and with the same quality of work, including all the shortcomings inherent in the object being evaluated.

Full Replacement Cost (FRC) is the cost of a building, at current prices, of equivalent utility to the property being assessed, but constructed with new materials and in accordance with modern standards, design and layout. Assuming that a reasonable buyer would not pay more for an existing building than to build a new one to modern standards, taking into account the risk and construction time, it can be considered that the PVZ is the upper limit of the value of real estate.

The optimal scope of application of the cost approach to real estate valuation, which gives the most objective results, are:

determining the market value of new or relatively new buildings that have little wear and tear and correspond to the most efficient use of the site;

determination of the market value of old real estate objects in the presence of reliable information for calculating depreciation;

determination of the market value of construction projects, determination of the market value of special-purpose objects;

determining the market value of objects with which market transactions are rarely concluded;

determination of the market value of real estate that cannot be assessed using the income approach.

It is a costly method and has its disadvantages:

Costs are not always equivalent to market value.

Attempts to achieve a more accurate assessment result are accompanied by a rapid increase in labor costs.

The discrepancy between the labor costs for the acquisition of the property being assessed and the costs for new construction is exactly the same, since during the assessment process depreciation is deducted from the construction cost.

The problem of calculating the cost of reproduction of old buildings.

Separate assessment of land from buildings.

The problematic nature of land valuation in Russia.

The advantages of the cost approach are as follows:

Most reliable when assessing new or newly built facilities that are ready for the most efficient use.

An assessment based on this approach is most appropriate and (or) the only possible in the following cases:

Technical and economic analysis of new construction or reconstruction;

Assessment of unfinished construction;

Valuation of public-state and special objects, since they are not intended to generate income and the likelihood of finding data on similar sales is low;

Valuation of objects in inactive markets;

Valuation for insurance and tax purposes;

If there is insufficient information to use other approaches.

Real estate valuation using the cost method takes place in the following sequence:

Inspection of the property and familiarization with all available documentation;

Determination of the full cost of reproduction or replacement;

Calculation of all types of wear: physical, functional, external;

Determination of complete depreciation from PSV (PSZ) in order to obtain the cost of buildings and structures;

Real estate value calculation;

General assessment of property by summation.

The main stages of the cost approach to real estate valuation and the corresponding methods are presented in Figure 3.

Figure 3. Algorithm for a cost-based approach to real estate valuation

In theoretical terms, the full replacement cost of buildings refers to the cost estimate, the cost of constructing a copy of the appraised building as of the valuation date. The assessment of the full replacement cost of a building as of the valuation date can be made at the cost of reproduction or at the cost of replacement. The choice of the type of replacement cost for a particular building must be clearly explained in the report to avoid misinterpretation of the result obtained.

The total replacement cost of buildings includes direct and indirect construction costs, as well as business income.

Direct construction costs include the full estimated cost of construction and installation work, which, in turn, includes direct and overhead costs, as well as the profit of the contracting construction organization.

Indirect costs include expenses necessary for construction, but not included in the construction contract. Indirect costs may include:

design and survey work;

valuation, consulting, accounting and legal services;

loan financing costs;

all risks insurance;

tax payments during construction, etc.

On the valuation date, the full replacement cost of buildings will differ from their market value on the same date. The main reason is the loss of value under the influence of various factors causing the aging of the property. The deterioration of the building is due to the deterioration of its physical condition, the discrepancy between the functional characteristics of modern concepts of the real estate market, and the influence of the external conditions of the operation of the object on its value. Since the listed factors are interrelated, their impact on cost is assessed comprehensively.

By general cumulative wear and tear, appraisers understand the loss of value of the property being valued for all possible reasons. The amount of total cumulative depreciation represents the difference between the market value of buildings on the valuation date and its full replacement cost, calculated either as reproduction cost or as replacement cost. Depreciation (I) is usually measured as a percentage, and the monetary expression of depreciation is depreciation (O). Depending on the reasons causing the depreciation of the property, the following types of depreciation are distinguished:

Physical deterioration is the loss of value of buildings as a result of their use and exposure to natural forces.

Functional - represents the loss of value of buildings as a result of the discrepancy between their functional characteristics and market requirements at the valuation date. Such deficiencies include the structural elements of the building, building materials, design, etc., which reduce the functionality, usefulness and, therefore, the value of the building.

External - represents the loss of value of a building or property as a result of the negative impact of factors external to the valued object. External aging may occur as a result of changes in the physical environment of the property being assessed or the negative influence of the market environment.

When calculating total wear and tear, appraisers use the following concepts:

The physical life of a building (PL) is determined by the period of operation of the building, during which the condition of the load-bearing structural elements of the building meets certain criteria (structural reliability, physical durability, etc.). The physical life of an object is laid down during construction and depends on the capital group of the building. Physical life ends when the object is demolished.

Chronological age (CA) is the period of time that has passed from the date the object was put into operation to the date of assessment.

Economic life (EL) is determined by the operating time during which the object generates income. During this period, improvements made contribute to the value of the property. The economic life of an object ends when the operation of the object cannot generate the income indicated by the corresponding rate for comparable objects in a given segment of the real estate market. In this case, the improvements made no longer contribute to the value of the object due to its general wear and tear.

Effective age (EA) is determined on the basis of the chronological age of the building, taking into account its technical condition and the economic factors prevailing on the valuation date that affect the value of the assessed object. Depending on the operating characteristics of the building, the effective age may differ from the chronological age up or down. In the case of normal operation of the building, the effective age is usually equal to the chronological age.

The remaining economic life (REL) of a building is the period of time from the valuation date to the end of its economic life.

The theory of real estate valuation identifies three main methods for calculating depreciation:

- -market sampling method;

- - service life method;

- -method of breakdown.

The market sampling method uses market data for comparable items from which depreciation can be determined. This method allows you to calculate the total amount of wear and tear for all possible reasons, determine the total economic service life, as well as the amount of external (economic) aging.

The service life method is based on the investor's requirement for 100% depreciation of the building over its economic life, as this ensures a full return on the invested capital. Therefore, before the end of the economic service life, wear cannot be 100%. In this method, the actual age and economic life of the building are the main concepts used by the appraiser. The percentage of total wear and tear is defined as the ratio of the actual age of an object to its economic service life. The amount of depreciation is calculated by subsequently multiplying this depreciation coefficient by the value of the full replacement cost.

The breakdown method is mainly used to break down the total amount of depreciation according to the reasons that caused it. The method gives a positive result when there is insufficient information for the similar sales method or the service life method and involves the following steps:

- -calculation of physical deterioration of the building;

- -calculation of external aging;

Determination of the residual value of buildings as the difference between the full replacement cost of buildings and the estimated value of identified physical, functional and external aging.

There are five main ways to calculate different types of depreciation using the breakdown method, which include:

- -calculation of the cost of restoration;

- -calculation of the relationship between age and service life;

- -calculation of functional aging;

- -analysis of paired sales;

- -method of capitalization of rental losses.

Restoration cost calculations include both reversible physical wear and tear and reversible functional aging.

The age-life ratio calculation is used to determine removable and irreparable physical wear and tear for both short- and long-lived components.

Functional aging calculation can be used for all types of functional wear.

The paired sales method and the lease loss capitalization method can be used to calculate fatal functional obsolescence as well as to calculate extrinsic obsolescence.

Cost analysis as a calculation method has certain advantages from the point of view of property management: it allows the management company to more accurately assess the level of depreciation and the amount of insurance, since the amount of net income depends on both of these factors.

Figure 4. Algorithm for the income approach to real estate valuation

The income approach is based on the idea that the value of the property in which capital is invested must correspond to a current assessment of the quality and quantity of income that this property should generate. The most complex and problematic issues of the comparative approach methodology include determining the discount rate associated with the risk of a given real estate investment. The main stages of implementing the income approach are presented in Figure 4.

Costs of bringing an object to the most effective use option

Capitalization of income is the transformation of expected future income into a lump sum currently received, i.e. conversion of income into capital.

In real estate valuation, two main procedures are used to reduce future income to their current value:

using capitalization rate

discount rates.

The capitalization rate is applied to one year's earnings.

This is usually the first forecast year. The cost is calculated using formula (3):

К=Кt/(1+n) (3)

K - current value (i.e. value at the present time), rub.

Кt - income expected by the end of year t (t=1 year), rub.;

n - discount rate (rate of return or interest rate), fractions of a unit.

The value (1/1+n) represents the capitalization factor, or discount factor.

The capitalization ratio is either directly derived from the sales of comparable properties as the ratio of annual income to the sales price (direct capitalization), or is calculated based on the expected rate of periodic return on capital and the specified conditions for investment recovery (return capitalization).

The discount rate is used to construct a discounted cash flow model. In this case, the periodic income of each forecast year, as well as hypothetical sales proceeds, are reduced to the current value.

The discounted cash flow model has the form according to formula (4)

where K is the current value of the ruble;

Kt - income expected by the end of year t, rub.;

n - discount rate, fraction of a unit;

t - time factor (number of years);

1,2,3... - serial number of the year.

The income approach has the following disadvantages:

The need to forecast long-term income flow. The process of obtaining an accurate estimate of the future flow is complicated by the current insufficiently stable situation in Russia; the probability of forecast inaccuracy increases in proportion to the long-term duration of the forecast period.

The influence of risk factors on projected income.

The difficulty of collecting data on the profitability of similar objects. This information is usually confidential, and official information is often untrue.

Advantages of the income method:

This approach is preferable when analyzing the feasibility of investing and when justifying decisions on financing real estate investments.

This approach most clearly reflects the investor’s idea of real estate as a source of income, i.e. This quality of real estate is taken into account as the main pricing factor.

The direct capitalization method is characterized by relative simplicity of calculations, a small number of assumptions, reflects the state of the market and gives especially good results for a stable property with low risks.

The discounted cash flow method is considered the best theoretical method; it takes into account market dynamics and the uneven structure of income and expenses. Used when the property's income and market are unstable and when the property is under construction or renovation.

The income capitalization method also requires extensive market research. The research and data analysis for this method is carried out against the backdrop of supply and demand, providing information about trends in market expectations. The level of income required to attract an investment is a function of the risk inherent in the property.