Unlike physical wear, which is absolute, functional wear is relative. The functional wear and tear of the assessed machines and equipment is considered in relation to analogues, i.e. depends on the basis of comparison.

To accelerate functional wear, i.e. The frequency of changes in generations of machines and technologies is greatly influenced by scientific and technological progress.

In relation to assessment issues, two aspects of the possible difference between a new object and an old one are usually considered. Based on cost items, the following groups of functional wear are distinguished:

Depreciation due to excess capital costs;

Depreciation due to excess production costs.

Depreciation due to excess capital expenditure.

Functional wear and tear (obsolescence), caused by excess capital costs, is the result of technological changes, the emergence of new materials or the inability to optimally use equipment, or imbalances in the production process. This type of functional wear is often called technological obsolescence.

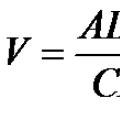

The functional wear coefficient is determined by the formula:

Where: By– productivity of the equipment being assessed;

Pa– performance of new equipment or analogue; n- price deceleration coefficient

Depreciation due to excess production costs.

Functional wear due to excess

production costs, arises either as a result of improved technology or increased efficiency of placement and layout. This type of functional wear is often called operational obsolescence.

Determining the depreciation of plant and equipment caused by operational obsolescence includes the following steps:

Determination of annual operating costs when using the assessed facility;

Determination of annual operating costs when using an analogue;

Determining the difference in operating costs;

Taking into account the impact of taxes;

Determining the remaining economic life of the assessed object or the time to eliminate deficiencies;

Determining the present value of annual future losses using an appropriate discount rate.

Operational obsolescence can be thought of as the present cost of future excess production costs. Depending on the type of excess production costs associated with existing equipment, there are two categories of operational obsolescence:

Operational obsolescence caused by increased investment costs;

Operational obsolescence caused by increased operating costs.

Correctable functional wear.

Correctable functional wear includes loss of value as a result of non-compliance of the design, materials, standards, and design quality with modern requirements. Correctable functional wear is considered wear, the elimination of which generates a revenue stream that exceeds, in current prices, the cost of correcting it. It is called:

Disadvantages requiring addition (lack of necessary elements);

Disadvantages that require replacement (upgrading) of individual elements with elements with other technical characteristics that can improve the consumer properties of the object in question as a whole.

Functional wear and tear is manifested: 1) in the loss of value caused by the appearance of either cheaper objects of the same class, or more economical and productive analogues of another class; 2) non-compliance of the characteristics of the object with modern general regional standards or safety requirements, environmental restrictions, market requirements, etc.; 3) a change in the technological cycle in which the object is traditionally included.

Formula for determining functional wear: V=

There is removable and irremovable.

Calculation methods:

An approach to functional wear and tear - we take an object and an analogue, the analogue is placed in the same conditions as the object, we calculate the costs, the difference in costs is functional wear and tear.

Based on this, a methodology was developed.

Functional impairment that is irreversible based on the difference in basic flight performance and operational characteristics can be calculated using the following relationship:

To use this method, several conditions must be met:

- Both the facility and its analogue must be cost-effective on given lines.

- The cost of a flight hour cannot be taken from the company’s reporting. In terms of cost, it is better to take according to natural parameters (fuel consumption, number of crew members).

Impairment for various equipment that can be supplied or replaced:

- Determine reparable/irreparable wear. If replacement or modification of any equipment is technically possible and pays for itself over the remaining actual service life of the object, then functional wear and tear is considered removable. Otherwise irremovable.

- If depreciation is irreparable, then it is determined by the method of capitalizing differences in costs or profits over the entire service life of the object.

- If wear is removable, then its value is equal to the cost of elimination.

Example: Determine irreparable wear due to operating restrictions in category II; it cannot be converted to category III.

This wear is relative to the analogue (analogue category III). Determine how to affect the cost. We lose 400 thousand rubles per year on an airplane for 15 years.

It is considered a capitalization method.

an=2724000/400000=6.81.

Example: Determine removable functional wear and tear based on the following deficiency: prohibition of flights without an automatic stationary oxygen system for passengers and flight attendants, provided that the analogue and facility does not have this system, the cost of equipment without installation is 4 million, the cost of installation on an aircraft is 500,000, the cost installation during the production of an analogue - 100,000.

Price=4000000+500000=4.5 million

Example: Remediable wear due to the following deficiency: flight restrictions due to lack of TCA aircraft warning system. The cost of equipment without installation is 2,500 thousand. The cost of installation on an aircraft is 550 thousand. The cost of installation in mass production is 100,000.

Removable wear = 2500000+550000-100000 =

Example: Non-compliance of radio communications with international requirements for the frequency range. Sign of wear relative to the analogue.

The cost of new equipment with the installation of old is 700,000. The residual cost of the replaced equipment is 100,000.

Removable wear = 700000 - 100000 =600000

Example: As an analogue of the TU-154m, but without the corresponding equipment, which is listed in the previous examples.

Depreciation according to basic flight technical and operational characteristics = 0.

Total functional wear and tear of an object relative to its analogue = 2724000 + 2950000 + 600000 = 6274000.

Additional functional wear and tear of the object and its analogue relative to modern requirements = RUB 4,500.

Determine the degree of functional additional wear.

Vadd=4500/210000=0.02=2%

9. External (economic) wear and tear. Approaches to its determination: capitalization of loss of income (profit) and a statistical approach.

Economic wear and tear is determined by a decrease in the usefulness of an object as a result of external factors, changes in market, economic, financial conditions, etc. Formula for determining economic wear and tear: E=

Method of capitalizing loss of income. Depreciation as a result of external depreciation for a separate parameter with index m – Adem is determined by the dependence: ADem=a(ONLc;I%)Dm.

ONLc=min((NLci-Ai)/Rci; i=1,..,n)

Where ONLc is the minimum value of the remaining economic life of the aircraft in years;

I% - discount factor;

Dm is the annual loss of income as a result of the influence of an external factor with index m;

NLci is the value of economic life for resource with index i;

Ai – operating time for resource with index i (Ai=0);

Rci – annual operating time for resource with index i;

I – index of the assigned resource.

In the case of the action of several factors, for which it can be determined separately, the generalized value of external wear can be determined from the dependencies: ADem=CN(1-П(1-ADem/CN)).

It is determined by a decrease in the utility of an object as a result of external factors.

Changes in market, economic, financial conditions, etc.

- According to statistics.

- Capitalization method.

Example: Determine the external economic wear and tear of the TU-154m in modern conditions as a result of a drop in demand for general passenger transportation. Flight hours on an average aircraft = 2000 hours per year.

The principle of best use is used, i.e. We take the actual flight time according to the flight time of the fleet of these aircraft of the most efficiently operating companies, where according to statistics it is 1500 hours.

Unlike physical wear, which is absolute, functional wear is relative. The functional wear and tear of the evaluated machines and equipment is considered in relation to analogues, i.e., it depends on the basis of comparison.

The acceleration of functional wear and tear, i.e. the frequency of changes in generations of machines and technologies, is strongly influenced by scientific and technological progress.

In relation to assessment issues, two aspects of the possible difference between a new object and an old one are usually considered. Based on cost items, the following groups of functional wear are distinguished:

- * wear and tear caused by excess capital costs;

- * wear and tear caused by excess production costs.

Depreciation due to excess capital expenditure.

Functional wear and tear (obsolescence), caused by excess capital costs, is the result of technological changes, the emergence of new materials or the inability to optimally use equipment, or imbalances in the production process. This type of functional wear is often called technological obsolescence.

The functional wear coefficient is determined by the formula:

Where: By- productivity of the equipment being assessed;

Pa- performance of new equipment or equivalent; n- price deceleration coefficient

Depreciation due to excess production costs.

Functional wear and tear, caused by excess production costs, occurs either as a result of improved technology or increased efficiency of placement and layout. This type of functional wear is often called operational obsolescence.

Determining the depreciation of plant and equipment caused by operational obsolescence includes the following steps:

- * determination of annual operating costs when using the assessed object;

- * determination of annual operating costs when using an analogue;

- * determination of the difference in operating costs;

- * taking into account the impact of taxes;

- * determination of the remaining economic life of the assessed object or time to eliminate deficiencies;

- * determination of the present value of annual future losses at the appropriate discount rate.

Operational obsolescence can be thought of as the present cost of future excess production costs. Depending on the type of excess production costs associated with existing equipment, there are two categories of operational obsolescence:

- * operational obsolescence caused by increased investment costs;

- * operational obsolescence caused by increased operating costs.

Correctable functional wear.

Correctable functional wear includes loss of value as a result of non-compliance of the design, materials, standards, and design quality with modern requirements. Correctable functional wear is considered wear, the elimination of which generates a revenue stream that exceeds, in current prices, the cost of correcting it. It is called:

- * shortcomings that require additions (lack of necessary elements);

- * disadvantages that require replacement (upgrading) of individual elements with elements with other technical characteristics that can improve the consumer properties of the object in question as a whole

Functional wear

Functional wear and tear (depreciation) is a loss in value caused by the fact that an object does not meet modern standards in terms of its functional usefulness. Functional obsolescence can manifest itself in the outdated architecture of a building, in the convenience of its layout, volume, engineering support, in excess production capacity, structural redundancy, lack of utility, excess of variable production costs, etc. Functional obsolescence is due to the influence of scientific and technological progress in the field of architecture and construction. Functional wear can be removable or irreparable.

Removable functional wear can include the restoration of built-in cabinets, water and gas meters, plumbing equipment, flooring, etc. The criterion for whether wear is removable or not is a comparison of the amount of repair costs with the amount of additional value received. If the additional value obtained exceeds the cost of restoration, then functional wear is removable. The amount of removable wear and tear is determined as the difference between the potential value of the building at the time of its assessment with updated elements and its value at the date of assessment without updated elements.

Irremovable functional wear and tear also includes a decrease in value associated with an excess or deficiency in the quality characteristics of the building. The amount of this type of depreciation is calculated as the amount of losses from rent when leasing a property, multiplied by the gross rent multiplier characteristic of this type of real estate.

Economic (external) wear and tear

Economic wear and tear (obsolescence, depreciation) is a loss of value caused by the influence of external factors. Economic depreciation can be caused by a number of reasons, such as: general economic and intra-industry changes, including a reduction in demand for a certain type of product and a reduction in supply or deterioration in the quality of raw materials, labor, support systems, facilities and communications, as well as legal changes related to to legislation, municipal ordinances, zoning and administrative regulations.

The main factors of economic (external) wear and tear in Russia are the general state of the economy, which in some regions is enhanced by local factors, the presence of discriminatory legislation for certain types of business activities, and fines for environmental pollution.

The ongoing renovation of the building brings it to a more modern look: the architectural appearance of the building has changed, improved plumbing and electrical equipment have been installed, the water supply, sewerage and heating systems have been changed, security surveillance and automation systems have been installed, as a result of which its functional shortcomings are eliminated and we accept them as 0 .

Economic (external) wear and tear is taken as 0, because economic depreciation was not calculated - there were no changes in the external environment of the assessed building.

PVA*(1-I physical /100) * (1-I function /100) * (1-I external /100) =

27831891.87 * (1-43.35/100) * (1-0/100) * (1-0/100) = 15766766.744 (RUB)

Conclusion: the market value calculated using the cost method, taking into account accumulated depreciation as of the valuation date, is RUB 15,766,766.744

]→[Functional obsolescence of machinery and equipment: how to take it into account when assessing]

Functional obsolescence of machinery and equipment: how to take it into account when assessing

Anatoly Kovalev, Doctor of Economics, professor, member of the Expert Council of the SMAO, head. Department of Production Management, MSTU "Stankin"

Vasily Igonin, senior lecturer, Financial University under the Government of the Russian Federation

|

In modern conditions, when economic policy focuses on the development of high-tech and innovative equipment, renewal and modernization of the equipment fleet, issues of functional obsolescence are becoming increasingly important.

Functional obsolescence is one of the manifestations of moral obsolescence to which movable and immovable property is subject. Moral obsolescence covers both functional and technological obsolescence, being a consequence of constant scientific and technological progress (STP). On the one hand, under the influence of scientific and technical progress, new technologies and materials are being introduced, the organization of production is being improved, labor productivity in mechanical engineering is increasing, which causes the cost of reproduction of machines to become cheaper, and identical machines in use are subject to technological obsolescence. Moreover, technological obsolescence develops gradually and covers a wide class of machines and equipment.

On the other hand, the creation and entry onto the market of increasingly advanced new equipment causes a depreciation of the equipment in use. Operating machines are inferior to new similar machines that embody the latest achievements of scientific and technological progress in terms of quality and completeness of certain functions, which is the reason for functional obsolescence. The higher the rate of scientific and technical progress, the correspondingly higher the rate of obsolescence in general.

It is quite problematic to identify and evaluate technological obsolescence in its pure form for a specific valuation object; this factor of cost reduction “sinks” in the general flow of currently observed inflation. In practice, assessments determine only functional obsolescence, which is stipulated by the requirements.

Many methods for determining wear, based on the analysis of statistical data and the derivation of wear curves, give the value of total wear without dividing it into physical wear and functional obsolescence. In this case, there is no need for a separate calculation of functional obsolescence.

At the same time, there are cases when only functional obsolescence occurs, and physical wear and tear is insignificant. This case relates to the assessment of machinery and equipment that have been in long-term storage since their acquisition and, for one reason or another, have never been used. Functional obsolescence with virtually no physical wear and tear can also be observed in new, recently manufactured machines, if a manufacturer continues to produce outdated machine models that may be in demand among a certain category of buyers due to their low price. In this regard, the task of determining the degree of functional obsolescence for assessment purposes remains very relevant.

In the literature one can find recommendations for an approximate determination of the degree of moral (together technological and functional) obsolescence based on a long-term forecast for the average annual rate of moral depreciation of the objects of assessment under the influence of scientific and technical progress for individual industries and productions. Presumably this rate lies in the range from 2 to 8%, and for the construction industry - from 2 to 4%. At the same time, for buildings and structures they offer a power model of the form:

Kmu - coefficient of obsolescence;

I is the average annual rate of moral depreciation of the object of assessment caused by scientific and technical progress in the relevant industry, in fractions of a unit;

However, the indicator of the rate of moral depreciation under the influence of scientific and technical progress is an uncertain value, which is not confirmed by official statistical information, and purely expert judgments about it have no evidentiary force. Therefore, this method is practically not implementable in assessment.

The coefficient of functional obsolescence of a valuation object can be determined based on the method of direct comparison with a new, more advanced analogue object that appeared on the market on the valuation date. In this case, it is necessary to compare the full (excluding wear and tear) cost of the appraised object with the price of a new, more advanced analogue object, adjusted for the difference in the main pricing parameters. The formula for calculating the functional obsolescence coefficient is:

Tsan.kor - the adjusted price of a new, more advanced analogue object;

Sn’ is the total (excluding wear and tear and obsolescence) cost of the valuation object.

The price of a new, more advanced analogue object, adjusted by several parameters (for example, three), is determined by the formula:

Tsan - the original price of the analogue object;

X1, X2, X3 - values of the 1st, 2nd and 3rd parameters of the evaluated object, respectively;

Han1, Han2, Han3 - values of the 1st, 2nd and 3rd parameters of the analogue object, respectively;

B1, b2, b3 - braking coefficient for the 1st, 2nd and 3rd parameters, respectively.

In this method, the choice of parameters by which objects are compared is of great importance. These parameters should reflect the impact of scientific and technical progress on consumer properties, the improvement of which makes a new, more advanced analogue object in the field of operation more profitable than the object being evaluated. When selecting parameters, you should analyze all areas in which an increase in the useful potential and competitive advantages of a new, more advanced analogue object is detected in the following groups of indicators of consumer properties:

- indicators reflecting the expansion of the functionality of the machine for its main purpose, with the addition, as a rule, of new functions;

- indicators characterizing the expansion of the automatic operation mode of the machine using control systems and programmed control;

- indicators characterizing the improvement in the quality of products or services obtained using the machine;

- indicators indicating an increase in the reliability of the machine (failure-free operation, durability, maintainability, storability);

- indicators characterizing the growth of machine productivity per unit of time;

- indicators reflecting the increase in fuel, energy and material efficiency of the machine in use;

- indicators indicating improved ergonomic characteristics and increased comfort in operating the machine;

- indicators reflecting improvement in environmental and aesthetic characteristics.

The above composition of groups of indicators is inherent in almost all types of machinery and equipment; they reflect certain aspects of their useful potential. Manifesting themselves in the sphere of operation (use), they together give an idea of how much higher the utility of a new, more advanced analogue object is than that of the object being assessed.

It must be borne in mind that due to physical wear and tear, the real values of some parameters of the object being assessed may be lower than the original passport values. But since the comparison of both objects is carried out in the “like new” state, the passport values of the parameters are taken from both the object of evaluation and the analogue object.

This method is static; there is no time factor. It follows from the method that functional obsolescence occurs when, in relation to the object being valued, a new, more advanced analogue object appears on the market and the appraiser can compare them in terms of cost and consumer properties. The price of a new analogue object is matched with the full cost of the appraised object in “like new” condition, previously calculated using the cost approach. The method does not answer the question of at what stage of the life of the assessed object the moment of appearance of a more advanced competitor object will occur and, accordingly, its functional obsolescence will manifest itself. If, on the valuation date, a more advanced new analogue object with a known price can be found for the valued object, then the coefficient of functional obsolescence is determined using the specified method as a reference value. After all, you first need to carry out an assessment of the object itself using costly and comparative approaches.

This method can be used as a tool for accumulating statistical information on equipment groups. Such information is collected and systematized based on the results of individual assessments; it contains information about the calculated value of the coefficient of functional obsolescence at a known chronological age on the date of assessment for individual objects. Next, a curve of functional obsolescence as a function of chronological age can be constructed.

The weak point of this method is the uncertainty related to the selection of influencing parameters and factors and the assignment of braking coefficients.

In our opinion, a solution to the problem of determining functional obsolescence should be sought based on statistical research methods. The process of functional obsolescence occurs simultaneously with the process of physical wear and tear, therefore the actually observed depreciation of fixed assets over time is the combined result of these two processes.

Functional obsolescence in its pure form can only be observed in the example of objects that have not been used for a long time, but have been in storage (for conservation, awaiting installation, and for other reasons). In this regard, it is advisable to consider how, for example, official statistics bodies recommend adjusting the book value of the above objects when revaluing fixed assets. The last mandatory revaluation for budgetary institutions was carried out in our country on January 1, 2007 (order of the Ministry of Economic Development of the Russian Federation, the Ministry of Finance of the Russian Federation and Rosstat No. 306/120n/139 dated October 2, 2006, see Rossiyskaya Gazeta dated November 15, 2006. , No. 256). According to Appendix No. 2, the approved reduction factors for the revaluation of equipment intended for installation (assembly) depend on the year of purchase as follows (see Table 1).

As you can see, functional obsolescence is detected only in the second year of the object’s life, and by the beginning of the fourth year it reaches its highest value - 20% and remains at this level. The above data is interesting for valuation practice, since it is taken from an official source.

Based on the data presented, we will construct a functional obsolescence curve in the form of a logistic dependence of the functional obsolescence coefficient on the chronological age of the object being assessed. The procedure for calculating the parameters of a logistic curve as a regression curve is given in the work.

The development of functional obsolescence according to Rosstat data and the logistic curve constructed on the basis of these data as a function of chronological age are shown in Fig. 1.

The logistic curve equation has the following form:

T is the chronological age of the object in years.

Determination coefficient R2 = 0.9, i.e. pretty high.

A characteristic feature of the line of functional obsolescence is the presence at the beginning of the object’s life of a so-called period of wear resistance, during which the coefficient of functional obsolescence is practically close to zero. In the example under consideration, the wear resistance period is one year. From Fig. 1 shows that according to Rosstat, at the beginning of the second year the coefficient increases abruptly to 5%, and according to the logistic curve it smoothly reaches 2.7%.

Thus, the dynamics of the functional obsolescence coefficient is well described by the logistic function, according to which three stages are observed: the first stage is the period of wear resistance, the functional obsolescence coefficient is close to zero and does not exceed 3% by the end of the period; at the second stage, there is an active increase in the coefficient of functional obsolescence at a rate of about 5% per year; at the third stage, the coefficient of functional obsolescence with deceleration approaches the maximum level of 20-22%.

The period of wear resistance at the beginning of the curve depends on the degree of novelty of the model of the object being assessed. If we assume that the replacement of machine models occurs with some frequency, then the degree of novelty of the model of the machine being evaluated is higher, the closer the date of manufacture of the machine is to the beginning of the model replacement cycle. If a machine is manufactured at the beginning of the model change cycle, then it will have a long period of wear resistance, close to the model change cycle. On the contrary, if a machine was manufactured at the end of the model replacement cycle, then its wear resistance period is short and will not exceed 1-2 years. To perform calculations, we can assume that the wear resistance period is on average equal to half the replacement cycle of machine models.

Different types of machines and equipment have different model replacement cycles: for computers, computing and medical equipment - once every 3-4 years; for cars, tractors, agricultural machinery - once every 5 years; for metal-cutting machines - once every 6 years; for forging and pressing machines - once every 7 years.

From this we can conclude that the logistic curve constructed according to Rosstat data, where the wear resistance period is 1 year, corresponds to the case of rapid functional obsolescence, when either the production of the model is discontinued, or the object belongs to equipment with a short model replacement cycle (about 2 years).

Based on the pattern of development of functional obsolescence described above, the following method for determining the coefficient of functional obsolescence is proposed.

First of all, they clarify the question of whether the manufacturer (or several manufacturing enterprises) produces or does not produce machines of the same model as the machine being valued on the valuation date. The range of products offered by manufacturers, presented on the Internet, already provides valuable information to answer the question posed.

If machines of this model are not manufactured (or it is impossible to order their production), then we consider that this object of assessment has a minimum period of wear resistance (1 year), and we calculate the functional obsolescence coefficient depending on the chronological age using the above formula Kfu = 0.22/ exp(3.04 - 1.09t) + 1.

If machines of a given model are still in production at the enterprise (enterprises) on the date of assessment, then the functional obsolescence coefficient is calculated using an adjusted formula, taking into account the duration of the replacement cycle of machine models of a certain type.

The adjustment to the logistic curve of functional obsolescence lies in the fact that as the cycle of replacement of machine models increases, the wear resistance period lengthens, which corresponds to a shift of the logistic curve to the right.

The equation of the logistic curve in generalized form:

A is the upper limit level of the functional obsolescence coefficient, corresponding to the upper asymptote;

B is a parameter that determines the position of the inflection point;

A is a parameter that determines the slope of the line at the inflection point;

T - chronological age, in years.

We increase the shortest period of wear resistance in the original formula by an amount equal to half the replacement cycle of machine models. To do this, it is enough to add half of the turnover cycle to parameter b of the logistic curve. We get the following values for parameter b:

In the original formula with a turnover cycle of 2 years, b = 3.04/1.09 = 2.8;

- with a turnover cycle of 3 years b = 2.8 + 1.5 = 4.3;

- with a turnover cycle of 5 years b = 2.8 + 2.5 = 5.3;

- with a turnover cycle of 7 years b = 2.8 + 3.5 = 6.3.

The adjusted logistic curve formulas are as follows:

- with a turnover cycle of 4 years, Kfu = 0.22/exp(5.23 - 1.09t) + 1;

- with a turnover cycle of 5 years, Kfu = 0.22/exp(5.78 - 1.09t) + 1;

- with a turnover cycle of 6 years, Kfu = 0.22/exp(6.32 - 1.09t) + 1.

In Fig. Figure 2 shows the logistic curves of functional obsolescence, calculated using the above formulas.

Compared to known methods for determining functional obsolescence, the proposed method has a number of advantages. Firstly, the basis for constructing obsolescence curves is the average experimental data contained in official documents of Rosstat, which means compliance with the principle of validity enshrined in the requirements of FSO No. 3. Secondly, the methodology takes into account the main factors that cause functional obsolescence of machinery and equipment: the chronological age of the assessment object and the cycle of replacement of machine models in the classification group to which the assessment object belongs.

Further improvement of the described methodology involves clarifying some parameters of the logistic curve of functional obsolescence by accumulating and analyzing statistical data on the depreciation of machinery and equipment sold on the secondary market after long-term storage and not in operational use.

The following parameters are beyond doubt in the above obsolescence curves:

- In the initial period of wear resistance, the growth of the functional obsolescence coefficient occurs slowly and this coefficient by the end of the period does not exceed 3%.

- The maximum level of the functional obsolescence coefficient is 20-22%.

At the same time, the growth rate of the functional obsolescence coefficient at the second stage of the object’s life needs to be clarified. According to the obsolescence curve obtained from Rosstat, this rate is 5.5% per year, and the maximum level of 22% is reached at the second stage in 4 years. However, there is information in the literature that the increase in functional obsolescence for many types of machines is 2% per year. Therefore, this parameter needs to be tested experimentally. It is also necessary to obtain more reliable data on the renewal cycles of models of machines and equipment of different classes in modern economic conditions.