Let's consider the first example, where we will take into account an asset costing less than 100,000 rubles. enterprise on the general taxation system (OSNO).

Let’s say the organization Trading House “Complex” purchased an HP LaserJet Pro 500 color MFP M570dw laser color MFP for 67,956 rubles. We are faced with the task of taking this OS into account in the 1C 8.3 database.

First, let’s create the document Acceptance for accounting of fixed assets: in the menu OS and intangible assets open the section Acceptance of fixed assets for accounting:

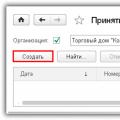

Click the Create button:

Fill in the date of acceptance for accounting of the fixed assets; we select a financially responsible party (MOL) and the location of the property.

In the Non-current assets section, we record the method of receipt of fixed assets, select the multifunctional device from the product group, and indicate the storage warehouse:

Go to the bookmark Fixed assets, press the button Add:

Select the desired OS object. If the required OS is not in the nomenclature list, then we create a new one. Fill in the name and asset accounting group by selecting the OKOF code. The depreciation group in 1C 8.3 will be filled in automatically:

Let's go to the Accounting tab: enter an account where the fixed assets and accounting procedure will be taken into account. The fixed asset has a cost of more than 40,000 rubles, so it is necessary to calculate depreciation in accounting. Check the Accrue depreciation box and indicate the accrual account. Let for this enterprise expenses be charged to account 20.01 - main production in a linear manner for 5 years:

For tax accounting, property worth 100,000 rubles. and less purchased after 01/01/2016 are taken into account as part of fixed assets and are not considered depreciable. The costs of purchasing such property are taken into account immediately as part of material costs.

On the bookmark Tax accounting in the line The procedure for including costs in expenses choose Inclusion in expenses when accounting for:

Dt/Kt. In our case, the enterprise does not apply PBU 18/02 “Accounting for calculations of corporate income tax.” Therefore, the wiring will look like this:

- In accounting, acceptance of fixed assets for accounting – Dt 01.01/Kt 08.04;

- In tax accounting, it is also included in expenses - Dt 20.01/Kt 01.01:

If an organization applies PBU 18/02, then permanent differences in the value of an object accepted for accounting will be reflected in tax accounting entries with a minus. Thus, entries Dt 20.01/Kt 01.01 reflect the cost of fixed assets not recognized as depreciable, removed from tax accounting:

How to set depreciation parameters for accounting and tax accounting in 1C 8.2 (8.3) under OSNO, when depreciation for tax accounting is calculated according to the provisions of Chapter 25 of the Tax Code of the Russian Federation, see our video lesson:

How to capitalize fixed assets worth more than 100,000 rubles.

Let's look at the second example.

Let’s say that the organization Trading House “Complex” under OSNO accepts for accounting a Toyota Camry passenger car for 600,000 rubles, VAT 18%.

We fill out the document Acceptance for accounting of fixed assets in the same way as the first example considered:

On the Tax Accounting tab, in the line Order of inclusion in expenses, select Accrual of depreciation. We check the Accrue depreciation checkbox and indicate the useful life of the OS - 84 months:

We post the document and analyze its movement using the Dt/Kt button. In accounting and tax accounting, the entries will have the following form: accounting for fixed assets - Dt 01.01/Kt 08.04 for the amount net of VAT - 508,474.58 rubles:

Acceptance of fixed assets for accounting under the simplified tax system

For the simplified taxation system (STS), a special accounting of fixed assets (FA) and a document are used Acceptance of fixed assets for accounting filled in differently.

When applying the simplified tax system, depreciation of fixed assets for tax purposes is not charged, and expenses for twelve months are accepted in a special manner. For expenses to be accepted, the debt to the supplier must be repaid.

Expenses can begin to be written off from the last day of the quarter (March 31, June 30, September 30, December 31) in which the OS was put into operation. At the end of the year, the purchased OS must be completely written off.

- In the first quarter, expenses are recognized at a quarterly rate;

- If in the second, then one third for three quarters;

- If in the third quarter, then half the amount for two quarters;

- If in the fourth quarter, then the entire amount is recognized at a time.

If the fixed asset has not been paid in full, then the paid share will be taken into account in proportional shares during the remaining reporting periods of the year after the payment date.

Let's consider the third case.

Let’s say that the organization Garant-Service LLC uses the simplified tax system (income minus expenses) to take into account a Lenovo laptop worth 95,000 rubles.

We fill out Acceptance for accounting of fixed assets in the same way as the first example considered:

After filling out the sections Fixed Assets and Accounting, we move on to Tax Accounting (STS). We indicate the cost of the fixed asset, the date of its acquisition and useful life. The procedure for including costs in expenses – Include in expenses. In the Payment subsection we enter the amount and date of payment accepted for accounting of the fixed assets:

We navigate the document and analyze its movement by button Dt/Kt. In accounting, the entries will be generated: acceptance of fixed assets accounting – Dt 01.01/Kt 08.04:

It is worth remembering that only those individual entrepreneurs or organizations whose residual value of depreciable fixed assets does not exceed one hundred million rubles can apply the simplified tax system.

For more information on how to avoid mistakes when determining the costs of purchasing an operating system for tax accounting when applying the simplified tax system, the object “income minus expenses” in 1C 8.2 (8.3) can be seen in our video:

Entering fixed asset balances in 1C using the example of a car

Let's consider one more case. Often, the commissioning of an OS object occurs before the enterprise begins to use any software products for accounting.

Let’s say Garant-Service LLC 01/01/2015. purchased and put into operation a ŠKODA Rapid car worth RUB 622,000. To start working with the 1C Enterprise Accounting 8.3 database as of December 31, 2015. the enterprise needs to enter the initial balances of the operating system.

We use the Balance Entry Assistant:

Install balance entry date: 12/31/2015 and press the button Enter account balances, by selecting account 01 Fixed assets:

Press the button Add. We create an OS object - a ŠKODA Rapid car. Fill in the name and asset accounting group – Vehicle. We select the code, and the depreciation group in 1C 8.3 is filled in automatically.

On the Initial balances tab, indicate the initial cost of the car - 622,000 rubles. and Accumulated depreciation - the amount of accrued depreciation from the moment the vehicle was put into operation - RUB 124,400.

For this enterprise, fixed assets depreciation expenses are charged to account 26 General business expenses:

On the bookmark Accounting fill out the MOL, the useful life of the OS is 60 months and check the box - Calculate depreciation:

Next bookmark Tax accounting. We fill in: the initial cost of the car, the date of its purchase is 01/01/2015. and useful life - 60 months:

On the bookmark Events fill in the date of registration of the ŠKODA Rapid car with commissioning, as well as the name and number of the document confirming the operation:

Click on the button Record and close. Now the balance appears in the assistant for entering initial balances:

- Dt on account 01.01– 622,000 rubles;

- CT on account 02.01 – 124,400 rubles:

Let's calculate the amount of depreciation for January 2016. for the ŠKODA Rapid car, through the Closing of the month. To do this, in 1C 8.3, in the Operations menu, open the Month Closing section:

In field Period indicate the month of depreciation calculation - January. We forward the documents a month in advance and carry out the operation

Vladimir Ilyukov

Acceptance for accounting and commissioning of fixed assets (FPE) is a fairly common task for accountants. With the release of version 3.0.45, we can talk about the presence in 1C Accounting 8 of two ways to put the OS into operation: regular (three-stage or two-stage) and simplified (one-stage). In the usual case, you need to fill out at least two documents (registrar) and two reference books. In the simplified version, it is enough to register one registrar. In the user’s working database, he will simultaneously reflect receipt, commissioning and fill out the “Fixed Assets” directory.

![]() Today is March 15, 2017, I am publishing this article and suddenly I discover that the 1C company is ahead of me. What a shame! Just two days ago, on March 13, 2017, its author published an article on the same topic. Here is the link http://buh.ru/articles/documents/54524/. Read it, it is quite possible that you will find there something that I missed to say or did not say very clearly. If at the end of the article, in the reviews, you can leave your comment or question.

Today is March 15, 2017, I am publishing this article and suddenly I discover that the 1C company is ahead of me. What a shame! Just two days ago, on March 13, 2017, its author published an article on the same topic. Here is the link http://buh.ru/articles/documents/54524/. Read it, it is quite possible that you will find there something that I missed to say or did not say very clearly. If at the end of the article, in the reviews, you can leave your comment or question.

The simplified method is useful to any organizations that acquire non-current assets from time to time. It will be especially in demand among small businesses, individual entrepreneurs, lawyers and notaries.

To focus on the features of the simplified method, let us recall that the simple method of taking into account consists of three or two successive stages.

First. At this step, the asset is placed on accounting records (AC). It is registered by the same registrar, to which two links are provided in the configuration: “ Purchases > Purchases > Receipts (acts, invoices)> type of operation Equipment" And " OS and intangible assets > Receipt of fixed assets > Receipt of equipment" During the posting process, an entry is created to the debit of subaccount 08.04.1 “Purchase of components of fixed assets.” We'll tell you about it a little later.

Second. Formation of the initial (accounting) cost of the purchased OS. In tax accounting (NU, Art. 257 Tax Code of the Russian Federation) and in accounting (BU, PBU 6/01) algorithms for assessing non-current assets are somewhat different. The general thing is that the accounting value consists of the costs of acquiring a non-current asset, its construction, delivery and bringing it to a state in which it can be used for its intended purpose. The type of recorders used is determined by the type of cost.

Third. After all preparatory actions have been completed with a non-current asset, and it is ready for use for its intended purpose, this event is reflected in the information base by the registrar " Fixed assets and intangible assets > Receipt of fixed assets > Acceptance of fixed assets for accounting" During the process, it generates a posting from the credit of subaccount 08.04.1 “Purchase of components of fixed assets” to the debit of subaccount 01.01 “Fixed assets in the organization.”

The second step may be missing and the three-step method turns into a two-step one: it is a little simpler, but not very much. The fact is that at the first step you will still have to describe the non-current asset in the “Nomenclature” directory as equipment. This is due to the fact that it is attached as a subaccount to subaccount 08.04.1 “Purchase of components of fixed assets.” It should also be noted that before performing the third step, the non-current asset also needs to be described, but in the “Fixed Assets” directory.

Over the years, many of us have become accustomed to the three-stage scheme for commissioning non-current assets in 1C. However, with the advent of the one-step method, the process of accepting OS for accounting in 1C 8.3 has been significantly simplified.

Simplified acceptance of OS accounting in 1C 8.3

Simplified, one-stage commissioning combines the registration procedure (posting to the debit of the subaccount 08.04) and subsequent commissioning. The latter is reflected by writing to the debit of the subaccount on 01.01.

The one-step method is simpler and more convenient. At the same time, it does not replace the simple, three-step (two-step) method. The one-step method comes down to drawing up one document, to which there are two links: “ Fixed assets and intangible assets > Receipt of fixed assets" And " Purchases > Purchases > Receipts (acts, invoices) > transaction type Fixed assets».

To implement the one-stage scheme, the developers of the 1C company attached internal subaccounts to account 08.04 “Acquisition of fixed assets”:

- subaccount 08.04.1 “Purchase of components of fixed assets.” Used in the usual scheme for accepting fixed assets for accounting. Analytics is carried out in the context of elements of the “Nomenclature” directory.

- subaccount 08.04.2 “Purchase of fixed assets.” Used in a simplified scheme for registering fixed assets. Analytics is carried out in the context of elements of the Fixed Assets directory.

Account 08.04 “Purchase of fixed assets” has become a group account and therefore cannot be used in transactions. Instead, subaccount 08.04.1 “Purchase of fixed asset components” is now used in the usual scheme.

In the “Receipts (acts, invoices)” registrar, the developers have added one more to the list of types of operations, this is “Fixed Assets”. It should be selected when the one-step method is used.

In the one-stage method, the accounting value of a non-current asset is not formed from additional costs. It is assumed that there are none. Therefore, it is simply set equal to the price paid to the supplier, but with the following caveat. Value added tax payers deduct input VAT. On the contrary, VAT non-payers (for example, the simplified tax system) include input VAT in the accounting value.

Let's consider an example in which one server is taken into account in both accounting and accounting, and the other is taken into account only in accounting.

The organization LLC Accounting OS bought a Team Server R3-E52 server for 177,000 rubles, incl. VAT 27,000 rubles and Team Server R2-E52 server for 82,600, incl. VAT 12,600 rubles. They must be taken into account as fixed assets. There are no additional costs. The initial cost is equal to the cost of purchasing them from the supplier.

The organization LLC Accounting OS bought a Team Server R3-E52 server for 177,000 rubles, incl. VAT 27,000 rubles and Team Server R2-E52 server for 82,600, incl. VAT 12,600 rubles. They must be taken into account as fixed assets. There are no additional costs. The initial cost is equal to the cost of purchasing them from the supplier.

We will assume that the prepayment has already been made. Opening a new registrar " Purchases > Purchases > Receipts (acts, invoices)" In the form that opens, click on the “Receipt” button and select the “Fixed assets” operation.

In the “Fixed asset” column, use the keyboard to enter the name of our server. The registrar will immediately detect that there is no such server in the information database and will immediately offer to create it. We agree with this proposal.

As a result, without opening the “Fixed Assets” directory, a new element will be created in it. The data in the details card is automatically transferred from the registrar when it is saved. In the process of posting, it creates the following transactions.

We note that subaccount 08.04.2 “Purchase of fixed assets” was used in transit. First, both servers are accounted for as a debit to subaccount 08.04.2 “Purchase of fixed assets.” Then, the same document generates a debit entry to subaccount 01.01 “Fixed assets in the organization.”

Let's comment on lines Nos. 3-4. The entry on line No. 3 registers the commissioning event of the Team R2-E52 server in the information base. Moreover, this entry is reflected in both BU and NU. Then, with entry No. 4, the Team R2-E52 server is removed from the NU. Ultimately, it is taken into account only in accounting.

The reason for this behavior is quite understandable. The accounting cost of the Team R2-E52 server did not exceed 100,000 rubles. Therefore, it does not apply to depreciable property, since clause 1 art. 256 Tax Code of the Russian Federation. If so, then in NU the cost of the Team R2-E52 server cannot be attributed to income tax expenses by writing off monthly or seasonally accrued depreciation. Nevertheless, you can recognize them as expenses, but in a different way. They can be taken into account as part of material expenses, and in full amount at the time of registration of a non-current asset in operation, subp. 3 p. 1 art. 254 Tax Code of the Russian Federation.

It is this legal norm that the document reflected. You can easily verify this if you open the Team Server R2-E52 server card on the “NU Details” tab.

It can be seen that the cost of the Team Server R2-E52 server is included in material costs on the date of its commissioning. We emphasize: it is turned on automatically.

The registration of the Team R3-E52 server happened in a completely different way. The posting in line No. 6 registered the fact that fixed assets with a book value of 150,000 rubles were accepted for accounting in both accounting and accounting records. At the same time, the document takes into account that the Team Server R3-E52 server is classified as depreciable property. Consequently, the costs of its acquisition in NU can be taken into account as expenses as depreciation is calculated. Note that this fact is also automatically noted in the “Fixed Assets” directory, on the “NU Information” tab.

Of course, if necessary, some details can be edited as needed.

Let us formulate the most important advantages and limitations of the simplified, one-step input method.

Advantages of one-stage acceptance for accounting of operating systems in 1C 8.3

- Receipt and commissioning are carried out in one document.

- There is no need to describe non-current assets in the form of equipment in the “Nomenclature” directory.

- In the “Fixed Assets” directory, a new element is created automatically without opening its details card. In the future, of course, you can open it and edit it if necessary.

- Based on the value of the accounting value, the document automatically recognizes the “Procedure for inclusion in expenses” in the NU. In the OSN mode for depreciable property, it is set equal to “Depreciation accrual”. For non-depreciable property, equal to “Inclusion in expenses upon acceptance for accounting.” On the contrary, in the simplified tax system for depreciable property, the order is set to “Include in depreciable property.” For non-depreciable property, equal to “Include as expenses.”

- In the “Fixed Assets” directory, the “Additional” tab has been eliminated. The details located on it were moved to the “Main” tab, in the “Information for the inventory card” subsection. In this subsection, it is very important to pay attention to the “Date of release (construction)” field. The value in this field in certain cases affects the calculation of transport tax. According to the developers, such a dislocation will remind users of the need to fill out this detail when describing vehicles.

Limitations of one-stage acceptance for accounting of OS in 1C 8.3

- It is not possible to attribute additional costs to an increase in the accounting value.

- The useful life is set the same in both the BU and the NU. It is impossible to change it.

- In both BU and NU, the linear depreciation method is automatically installed. It is impossible to change it.

- It is not possible to set a seasonal depreciation schedule.

- There is no way to take into account bonus depreciation.

- Accelerated depreciation of fixed assets is unacceptable, since the special coefficient is set equal to one. It is impossible to change.

- It is impossible to set the “Procedure for inclusion in expenses” equal to “Do not include in expenses”.

- Does not allow obtaining non-current assets on lease.

Those who apply the simplified tax system and set income as the taxable base, reduced by the amount of expenses, have another very useful feature of the one-stage method. First, let us remind you that the registrar “Acceptance for accounting of fixed assets”, on the “Tax accounting (STS)” tab, has a very important tabular part.

If the user does not want to overpay tax according to the simplified tax system, he must remember the need to manually indicate for a specific fixed asset the date of its payment and the amount of payment.

You cannot rest assured that the payment was actually reflected in the information base by the appropriate document. The document “Acceptance for accounting of fixed assets” does not “see” this. Therefore, if you do not reflect the date and amount of payment, the program will consider that there was no payment and expenses for a non-current asset will not be taken into account when forming the tax base in connection with the application of the simplified tax system.

If you use a one-stage scheme, then the payment registered in the database will be detected and automatically reflected in the accumulation register “Registered payments for fixed assets (STS)”. The corresponding entry in the specified register creates the document “Receipt (act, invoice)” if there was an advance payment. Otherwise, this record will be created by the “Write-off from the current account” registrar, entered on the basis of the previously entered “Receipt (act, invoice)” registrar.

It was already noted above that if a non-current asset is put into operation in a one-stage manner, then in the future it is impossible to change the special coefficient for it or establish a depreciation schedule. This raises the question, is it possible to suspend depreciation? Yes, you can suspend depreciation. Then after some time it can be resumed. There is a standard procedure for this in the configuration.

Thus, if the restrictions listed above are not important, then it is advisable to use a simplified scheme for commissioning the OS in the 1C Accounting 8.3 program. It often turns out to be simpler and less labor-intensive than the usual scheme.

Previous articles on this topic.

Fixed assets are buildings, structures, transport, equipment. Such property is used for more than 12 months and costs no less than a certain amount. Acceptance of OS for accounting in 1C 8.3 occurs in several stages. Each of them is reflected in a certain order. Let's look at this in more detail.

Read in the article:

Acceptance of fixed assets for accounting in 1C 8.3 occurs in two stages: first, the receipt of fixed assets is reflected, then their commissioning. In this article, read how to accept fixed assets for accounting in 1C Accounting 8.3 in 3 steps.

Step 1. Reflect the receipt of fixed assets in 1C 8.3

Go to the “OS and intangible assets” section (1) and click on the “Equipment receipt” link (2).

In the window that opens, click the “Create” button (3).

The “Receipt: Equipment (creation)” window will open. In the upper section of the document (4) in the “Organization” field, indicate your organization, in the “Warehouse” field, indicate which warehouse the equipment was received at. In the “Counterparty” and “Agreement” fields, indicate the supplier of fixed assets and the details of the agreement with him. In the “Invoice No.” field, indicate the number of the invoice under which the property was received.

The lower section consists of five tabs (5):

- Equipment;

- Goods;

- Services;

- Returnable packaging;

- Additionally.

In the “Equipment” tab, click the “Add” button (6) and enter data on the received fixed asset. In the “Nomenclature” field, indicate the name of the OS; in the “Quantity” and “Price” fields, indicate the quantity and price of the received equipment. “Accounting account” 1C 8.3 will be determined automatically, depending on the type of equipment received (fixed assets, equipment to be installed). When all the data has been entered, you can save the document; to do this, click the “Post and close” button (7). Now the purchase of fixed assets is reflected in accounting as the debit of account 08 (if you bought fixed assets) or 07 (if you bought equipment that requires installation).

Step 2. Put fixed assets into operation

The second stage is the acceptance of the OS for accounting in 1C 8.3 - commissioning. A fixed asset ready for operation is placed on the balance sheet on the basis of a transfer and acceptance certificate. For this purpose, create a document “Acceptance for accounting of fixed assets”. To do this, go to the section “Fixed assets and intangible assets” (8) and click on the link “Acceptance for accounting of fixed assets” (9).

In the window that opens, click the “Create” button (10). The “Acceptance for accounting of fixed assets” window will open.

In the upper section of the “Acceptance for accounting with OS” window (11), fill in the fields:

- "Organization";

- "Type of operation." In this field, you can select one of three values: “Equipment”, “Construction objects” or “Based on inventory results”;

- "OS Event". In this field, select the appropriate operation from the list, for example, “Acceptance for accounting with commissioning”;

- "MOL." Specify the financially responsible person;

- "Location of OS". Indicate in which department the fixed asset will be operated.

The lower section of the window consists of five tabs (12):

- Non-current asset;

- Fixed assets;

- Accounting;

- Tax accounting;

- Depreciation bonus.

In the “Non-current asset” tab (13), indicate the appropriate “Method of receipt”, for example “Purchase for payment”. In the “Equipment” field, select from the “Nomenclature” directory the equipment that you are putting into operation. Also indicate the “Warehouse” where it is located. In the “Account” field, the accounting account in which the object was reflected upon receipt of goods will be automatically set (Step 1).

In the “Fixed Assets” tab (14), you need to create a new fixed asset object. To do this, click on the “Add” button (15), and then on “+” (16).

A window will open for filling in data on the fixed asset. In this window, fill in the fields:

- "Assets accounting group". In this field, you must select a suitable group from the list, for example, “Machinery and equipment (except office)”;

- "Name";

- "Full name".

In the “Accounting” tab (19) indicate:

- "Accounting procedure". Specify “Depreciation”;

- "Method of calculating depreciation." Here, select the depreciation method for the object, for example linear;

- “Method of reflecting depreciation expenses.” In this reference book, indicate in which accounting account depreciation should be calculated;

- "Useful life (in months)." Here, indicate how many months the fixed asset will be depreciated in accounting.

In the “Tax Accounting” tab (20), fill in:

- “The procedure for including costs in expenses.” Here you can select one of the methods from the list, for example, “depreciation calculation”;

- "Useful life (in months)." In this field, fill in how many months the object will be depreciated in tax accounting.

All data for commissioning the fixed asset has been completed. Now you can save and post the document. To do this, click “Record” (21) and “Pass” (22). Fixed assets in 1C 8.3 Accounting are registered. The fixed asset was put into operation, and entries were made in the accounting records to debit account 01 “Fixed Assets”.

I propose to consider in this article a detailed example of accepting fixed assets for accounting in 1C 8.3 in the form of step-by-step instructions. The accounting procedure for such assets is determined by PBU 6/01 “Accounting for Fixed Assets”.

When purchasing a fixed asset, an accounting entry is generated 08.04 – 60.01 (details - ). It follows from this that the equipment is simply listed “in warehouse” under account 08.04 “Purchase of fixed assets” and is not operated, and depreciation is not charged on it.

In order for the purchased equipment (machine, car, computer, etc.) to begin to be listed as a fixed asset in the organization and to begin to be depreciated, it is necessary to correctly take it into account.

Let's figure out what it means to accept for accounting in 1C 8.3. From an accounting point of view, this means that it needs to be moved from account 08.04 to account 01.01 “Fixed assets in the organization.” The program also requires parameters for calculating depreciation both in accounting and in .

For all this, there is a document “Acceptance for accounting of fixed assets”. Let's look at it in more detail.

Creating and filling out the document “Acceptance for accounting of fixed assets”

To create a new document, go to the “OS and” menu, then click the link “Acceptance for accounting of OS”. A window with a list of documents will open. In this window, click the “Create” button. A window for creating a new document will appear:

In the header of the document we will indicate the organization, division (location of the OS), the financially responsible person and the OS event.

Get 267 video lessons on 1C for free:

Let's move on to the first tab “Non-current asset”. We select the equipment that we want to take into account. We will also indicate the warehouse where it is stored.

On the “Fixed Assets” tab, enter a list of fixed assets to be accepted for accounting. In our case, this will be one line that corresponds to the equipment:

In addition to selecting a fixed asset, you need to assign an inventory number on this tab. By default, this number is automatically substituted from the “Fixed Assets” directory (the “Directories” menu, then the “Fixed Assets” link).

Briefly about this directory: it stores all the parameters of the fixed asset and changes documents during operation.

For example, we can change the inventory number in our created document, which was taken from the directory. After posting the document in the directory, this number will also change. Entries in such a directory are also called fixed asset cards.

Setting up parameters for calculating depreciation of fixed assets in 1C 3.0

Fixed assets are equipment, vehicles, buildings, machines, computers - all the property that is used by companies to produce products or provide services. Another important feature of a fixed asset is its useful life; it must be more than 12 months. There is also a cost criterion; it is different for accounting and tax accounting. Acceptance of OS for accounting in 1C 8.2 is carried out in several stages. Read step-by-step instructions on how to register an operating system in 1C 8.2.

Read in the article:

In 1C 8.2, the acceptance of fixed assets for accounting consists of two stages:

- purchase of fixed assets. At this stage, the receipt of property is reflected in the debit of account 08 “Investments in non-current assets”;

- acceptance of fixed assets for accounting. Equipment ready for use is reflected in accounting as the debit of account 01 “Fixed Assets”.

Below, read the instructions on how to register an operating system in 1C 8.2 in 9 steps.

Purchase of fixed assets in 1C 8.2

Step 1. Create an invoice for the receipt of fixed assets in 1C 8.2

Go to the “Purchase” section (1) and select the “Receipt of goods and services” link (2). A window will open to create an invoice for receipt.

To create an invoice, click the “Add” button (3) and select the “Equipment” link (4). An invoice form will open for you to fill out.

Step 2. Fill in the details in 1C 8.2 in the invoice for the receipt of fixed assets

In the form that opens, enter the following information:

- date of receipt of the fixed asset (5);

- your organization (6);

- supplier of fixed assets (7);

- details of the contract with the supplier (8);

- to which warehouse the property was received (9).

Step 3. Fill in the “Equipment” tab in the invoice

In the “Equipment” tab (10), click button 11, then button 12. The nomenclature directory will open - a list of your organization’s property.

In the item reference book, click the “Add” button (13). A window will open to create a new item. Enter information about the fixed asset into it.

In the window that opens, indicate the short (14) and full (15) name of the fixed asset. In the “Unit of measurement” field (16), select the value “Pieces”. To save, click “OK” (17). Data on the fixed asset is recorded in the program.

Select new equipment (18) from the list and click on it so that it is included in the invoice being created.

Now the invoice 1C 8.2 reflects the purchased property (19). Next, fill in the information from the supplier’s invoice. Please indicate:

- number of equipment (20);

- price (21);

- VAT rate (22).

Step 4. Fill in the “Additional” tab in the invoice for the receipt of property

In the “Additional” tab (23), indicate the number of the invoice from the supplier (24) and its date (25). Click the "OK" button (26). Expenses for the purchase of fixed assets are fixed in the program.

The first stage is completed, now the purchased equipment is reflected in the accounting records as a debit to account 08 “Investments in non-current assets”.

Acceptance of fixed assets for accounting in 1C 8.2

At the first stage, we formed the value of the fixed asset by debiting account 08 “Investments in non-current assets”. Now we need to capitalize it and transfer the value of this property to the debit of account 01 “Fixed Assets”.

Step 1. Open the “Acceptance for accounting of fixed assets” form in 1C 8.2

Step 2. Fill in the basic data in 1C 8.2 in the form “Acceptance for accounting of fixed assets”

In the form that opens, indicate:

- date of acceptance for accounting (3);

- your organization (4);

- the division to which the fixed asset belongs (5);

- warehouse where the fixed asset is located (6);

- equipment (7). In this directory, select the equipment that was indicated in the delivery note;

- select from the directory “Acceptance for accounting” (8).

Step 3. Fill in the data on the fixed asset in 1C 8.2

In the “Fixed Assets” tab (9), click the “+” button (10), and click on “…” (11). The fixed assets directory will open.

In the window that opens, click the “Add” button (12). A card for creating a new fixed asset will open.

In this card:

- fill in the name of the fixed asset (13);

- select OS group (14) from the directory;

- indicate the full name of the fixed asset (15);

- select from the directory the OKOF code related to your fixed asset (16);

- select the OS accounting group (17) from the directory;

- in the “Asset Type” field, select the value “Fixed Asset Object” (18);

- select the depreciation group of your fixed asset from the directory (19);

- select the code for ENAOF (20) from the directory.

Click the "OK" button (21). Now a new fixed asset has been created in the fixed assets directory.

Attention!

It is important to know that depreciation can be calculated regardless of whether you actually use the fixed asset or not. Even if the fixed assets remain in the warehouse, depreciation can be calculated on it. It is not accrued provided that the OS is placed into conservation. Moreover, the period of such preservation is more than 3 months.

Select this fixed asset in the “Fixed asset” field (21) of the “Acceptance for accounting of fixed assets” form.

Step 4. Fill out the “Accounting” tab in 1C 8.2

In the “Accounting” tab (1), fill in:

- Accounting procedure (2). Select “Depreciation calculation”;

- MOL (3). Specify the financially responsible person;

- Method of admission (4). Select “Purchase for a fee”;

- Check the “Accrue depreciation” box (5);

- Method of calculating depreciation (6). Select the method you need from the directory, for example “Linear”;

- Method of reflecting depreciation expenses (7). Select the method that indicates the depreciation account suitable for your fixed asset (20,23,25,26,44);

- Useful life (8). Enter the useful life in months for your fixed asset.

Step 5. Fill out the “Tax Accounting” tab in 1C 8.2

In the “Tax Accounting” tab (1), fill in:

- procedure for including costs in expenses (2). Select “Depreciation calculation”;

- check the “Accrue depreciation” box (3);

- useful life in months (4).

All data in the “Acceptance for accounting of fixed assets” form has been completed. Click “OK” (5) to generate accounting entries. Acceptance of OS for accounting in 1C 8.2 has been completed.

In accounting and tax accounting, you can set different depreciation methods. But this is a very labor-intensive option. As a result, you will have significant differences between accounting and tax data that need to be adjusted. Therefore, the simplest option is to charge depreciation equally.