Dmitry Dementiy, Adaptation of material by Christopher Ratcliff Effective web communications agency Texterra

Armchair daredevils can jump from greater heights. Image source: YouTube screenshot

Red Bull Stratos is not experiential marketing. This project is more related to content marketing. Red Bull marketers created content that brought 8 million people to their screens and made them empathize with the hero. But even people with vivid imaginations couldn't feel anything close to what Baumgartner felt as he looked down. In other words, if we call Red Bull Stratos experiential marketing, then the target audience for this event was one person.

Felix Baumgartner experienced free flight and literally felt inspired by Red Bull. Unlike the audience, he and only he received the experience. Isn't it too expensive to send a capsule into the stratosphere for one person?

Experiential Marketing is about creating connections between a brand and consumers by providing the latter with an emotionally and intellectually engaging experience. This definition reflects the second name of the concept under consideration: experiential marketing (from the English. experience- experience, experience).

Please note that we are talking about consumers' own experiences, and not about empathizing with the experiences of others. Agree, a person jumping from a height of 39 km gets a much more vivid impression compared to a spectator watching such a jump from the sofa.

The definition of experiential marketing is well illustrated by the campaign organized by the Tim Hortons restaurant chain.

Passers-by were invited to visit a newly opened restaurant in a small Canadian city and take part in an “Experiment in the Dark.” Upon entering the restaurant building, visitors found themselves in complete darkness. Waiters, navigating in space using night vision devices, escorted guests to the table and offered coffee. They asked visitors to rate the taste of the drink. Needless to say, all participants in the experiment liked the coffee?

Representatives of Tim Hortons explained this by the effect of sensory deprivation: when people were deprived of the ability to perceive what was happening through their eyes, their ability to taste the coffee increased. The emotional involvement that participation in the experiment provided should not be discounted.

Signs of Experiential Marketing

You can simply identify that you are dealing with experiential marketing. First, you personally participate in a brand-sponsored activity as a potential or existing customer. Secondly, the action is accompanied by at least one of the following phenomena:

- You are experiencing emotions.

- You sense something unusual. These feelings are associated with a specific product. We can talk about the taste of coffee, the feeling of flying, the aroma of perfume, the complex of sensations of a participant in a test drive of a racing car, etc.

- You yourself are active. For example, you try coffee, test a new operating system, go on a trip to Africa.

- You think, analyze, compare. For example, participants in the “Dark Experiment” accurately compared the taste of the coffee offered to the drink they drink every day. The test drive participant probably analyzes the driving characteristics of the new car model.

Please note again that the key feature of experiential marketing is your personal participation in the action organized by the brand. Directors of Latin American TV series evoke emotions in viewers, and masters of the pen can help you taste the meat that a brave traveler eats from a knife. But if you haven't gone through the experience yourself, we're not talking about experiential marketing.

How to Use Experiential Marketing Online

Large companies operating offline are doing well. First, their marketers see their customers face to face. Secondly, they have large marketing budgets. All that remains is to be a little smarter and organize an event within the framework of the concept of experiential marketing. In the video below you can see how Virgin Atlantic handled this task.

But what about small Internet companies that do not have the opportunity to organize street performances and know their clients only by email addresses? Nothing could be easier if the company’s marketers have the ingenuity. In this case, they understand that experiential marketing is not limited to large-scale promotions and experiments, and they can interact with the client at a distance.

The following ideas will help you use experiential marketing online:

- Offer potential clients a trial version of your product or service. This is the most obvious idea, widely used by software manufacturers and service providers. According to various studies, consumers are more willing to buy a product if they can experience using the free version.

- Conduct training and information events. Modern online services, for example, Google+ Hangouts, will save you from the need to rent premises or travel to clients in another city. Agree, good webinars and online conferences force participants to act and think, and also evoke emotions in them.

- Use email marketing as an experiential marketing tool. See how the Liters e-book store copes with this task.

In the letter, the seller asks to leave feedback about the purchase.

- Have you ever communicated with Amazon customer support? A typical dialogue with these guys looks like this:

- Give your clients gifts. This is another obvious way to use experiential marketing in the online environment. A cup with the company logo, six months of free use of the program, a loyalty card - these pleasant little things evoke positive emotions in consumers and enrich their experience of interacting with the brand.

Hello, my Kindle is frozen and the screen saver is always on. Rebooting doesn't help, tell me what to do?

Hello Dmitry! My name is Vijaya, I will be happy to solve your problem. But first, let me know, what is your mood today?

Thank you, I'm in a good mood. And you?

Oh, I'm very glad that you are in a good mood. And thank you very much for being interested in mine. I'm doing great, the weather is good today. Your problem is solved, reboot your Kindle and enjoy reading.

Now do you understand why Amazon support is considered the most loyal to customers among large Internet companies? Customer service managers consciously do everything to ensure that consumers experience only positive emotions. Use this experience to implement experiential marketing through your customer service team.

Don't rush into the stratosphere

To use experiential marketing, you don't have to spend money on super-expensive projects and force customers to participate in them. There are many simple and inexpensive ways to evoke emotions in a client, give him a feeling, or make him think and act. Use them to create emotional and intellectual connections between customers and your business.

Specific problems in the application of the CAPM arise in developing capital markets, for which it is quite difficult to justify the model parameters (risk-free return, market risk premium, beta coefficient) based on local capital market data due to the lack of information efficiency and low liquidity of tradable assets.

A number of empirical studies prove the incorrectness of using CAPM specifically in developing markets compared to developed ones (for example, , , ). A noted feature of emerging markets is the significance of specific risks associated with government policies for regulating the economy, institutional protection of investors and corporate governance. Due to the correlation between emerging markets and the global capital market, these risks are not eliminated by diversifying a global investor's capital.

Another problem of developing markets is the lack of stationarity and dynamic changes associated with the liberalization of local capital markets.

Beckert and Harvey argue that when assessing the required return, developed and developing markets must be considered from different perspectives, since the degree of integration of the local market into the global financial market should be taken into account. The degree of integration is not a constant value, it changes over time. This leaves an imprint on the formation of rates of return.

In a 1995 paper, Beckert argues that the presence of barriers to capital flows and international investment automatically means that risk factors in emerging markets are different from those in developed countries.

The work proves that the level of integration into the global capital market (or the presence of barriers to the movement of capital) should determine the choice of model for justifying the cost of equity capital.

An alternative view is argued in the work of Rouwenhorst. The author came to the conclusion that in terms of influencing factors there is no difference between developed and developing markets. Factors explaining return on equity that are found to be significant in developed markets are also significant in developing markets. These factors include:

· company size;

· variables reflecting the degree of operational and financial risk;

· liquidity of shares;

· growth prospects.

Active research on testing modifications of the CAPM taking into account the underdevelopment of capital markets has been carried out in South American countries (Argentina, Brazil, Venezuela). The choice of modification is recommended to be linked to the degree of development of the local financial market and its integration into the global capital market.

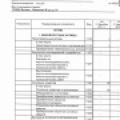

Scheme 1. Modifications of CAPM depending on the degree of integration and market segmentation.

The Godfrey-Espinosa model focuses on calculating the beta coefficient and the market risk premium based on local market data with the introduction of the country risk premium (CRP) in the adjustment of the global risk-free rate of return, and also, in order to avoid double counting of risk, introduces an adjustment into the investment risk premium multiplier (1-R2), where R2 is the coefficient of determination of the regression equation connecting the company’s profitability in the local market with the variability of the country risk premium.

Gonzalez's work tests the CAPM model on a sample of companies whose shares are traded on the Caracas Stock Exchange (Venezuela). Using the regression method on data for a 6-year period (1992-1998), the author comes to the conclusion that the CAPM model does not work in the Venezuelan market.

This conclusion was mainly made due to the rejection of the hypothesis that there is a positive relationship between risk and stock returns. However, the results of Gonzalez F.'s study showed that, firstly, the relationship between risk (as an indicator of which the beta coefficient was used) and profitability is linear, and, secondly, systematic risk is not the only factor influencing expected profitability on own capital.

Similar results were obtained in M. Omran's study on the Egyptian capital market. The sample included 41 companies with the most liquid shares. The data panel was compiled for the period December 2001-December 2002. based on logarithmic stock returns obtained from weekly observations.

Omran M.'s empirical tests indicate that market risk is a significant factor in explaining the expected returns of Egyptian stocks. The revealed paradox of the study is that the return on a portfolio made up of shares of companies with low beta coefficients (mainly companies that produce consumer goods and providing financial services) is higher than the return on a portfolio made up of shares of companies in the construction, textile and hospitality sectors with more high beta values. According to the author, the reason for this discrepancy is the state nationalization of the 1950-1960s, which had a greater negative impact on the risks of the industrial and construction sectors of the economy than on companies producing consumer goods, as well as financial institutions.

Interesting studies in emerging markets are devoted to the choice of investment risk measures. As a rule, in such works, testing is carried out within the framework of several models: CAPM and its alternatives. For example, Hwang and Pedersen test three models: the classic CAPM and two models that use asymmetric risk measures - LPM-CAPM (Lower Partial Moment CAPM) and ARM (Asymmetric Response Model).

The peculiarity of alternative models is that, according to the authors, they are suitable for cases of abnormal distribution of returns and an illiquid local capital market. The study was conducted on a sample of 690 companies in growing markets over a 10-year time period (April 1992-March 2002). Based on the results of the work, Hwang S. and Pedersen C. concluded that the CAPM is not inferior to alternative models in its explanatory power. In a cross-sectional sample, the explanatory power of the CAPM reached 80% for the panel data of weekly and monthly returns, and 55% for the data of daily returns. No significant benefits were found for asymmetric risk measures. In addition, when conducting the analysis, the authors divided the sample of 26 developing countries by region, and then divided the entire observation period into two periods - before and after the 1997 Asian crisis.

Thanks to this, Hwang S. and Pedersen C. identified a significant impact of local risks in emerging capital markets, which is consistent with the results of the work cited above.

A study by Dairil Collins tests different measures of risk for 42 emerging market countries: systematic (beta), total (standard deviation), idiosyncratic, one-sided (one-sided deviation, one-sided beta and VaR8), and market size (determined by the average capitalization of the country ), skewness and kurtosis indicators.

Testing was carried out using an econometric approach (as in most similar works) from the position of an international investor over a 5-year time period (January 1996-June 2001) based on weekly returns. Depending on the size of the capital market, liquidity and degree of development, the initial sample of 42 countries was divided into three groups: first level - countries with a large capital market size (for example, Brazil, South Africa, China), as well as with a small market size, but economically and informationally developed; the second level is smaller emerging markets (Russia), the third level is small markets (such as Latvia, Estonia, Kenya, Lithuania, Slovakia, etc.).

According to the results of the study, for some markets the beta coefficients were lower than expected, which gives a false signal that there is low risk for investors. The conclusion of the work is that the beta coefficient (and therefore the CAPM model) is incorrect to apply to the entire set of developing countries. D. Collins argues that there is no single risk indicator that would be suitable for any developing country.

For first-level countries, the most appropriate risk indicator is a coefficient that takes into account market size, for the second level - indicators of one-sided risk (in comparison with others, the VaR indicator showed the best results), for the third level - either standard deviation or idiosyncratic risk. Idiosyncratic risk is that part of any financial market that does not depend on the overall level of financial risk existing in a given economy. Also called unsystematic risk in contrast to systematic risk.

A similar conclusion about the appropriateness of various measures of systematic one-sided risk for countries with excellent stock market characteristics is made in . An analysis was carried out of the applicability of a number of one-sided risk measures (BL, HB, E-beta) for 27 emerging markets (the sample included Asian and Latin American markets, African and Eastern European markets, including Russia) over the period 1995-2004. The MSCI Emerging Markets Index is used as the global portfolio, and ten-year US government bonds (Tbond) are used as the risk-free rate. It is shown that for markets with a large asymmetry in the distribution of returns (high skewness), the most appropriate measure of systematic risk is HB-beta. For markets with observed significant abnormal returns, BL-beta has an advantage over other risk measures.

An empirical study of the benefits of DCARM was conducted in countries with similar geographical and macroeconomic characteristics in Central and Eastern Europe. An analysis of the factors shaping profitability for companies from 8 countries of the former socialist camp was carried out: the Czech Republic, Slovakia, Hungary, Poland, Slovenia, Estonia, Latvia and Lithuania for the period 1998-2003. The authors show the importance of unilateral risk measures along with the preservation of the influence of factors specific risk.

The effect of market segmentation on the level of required return of investors was studied by Campbell Harvey. The paper argues that the cost of capital in segmented markets will be higher than in integrated markets because investors will demand greater compensation for bearing local, idiosyncratic risk. This suggests that any increase in the degree of financial inclusion should lead to a decrease in the cost of equity capital.

Rene Stulz proposed diagnostic parameters that allow the inclusion of a country risk premium (CRP) in the risk-return model of a global investor.

The degree of integration (the presence of barriers to the movement of capital) and the covariation of profitability in the local and global markets should be taken into account. Characteristics of formal and informal barriers to the movement of capital observed in segmented markets are given in the work.

A number of studies specifically examine the impact of capital market liberalization on the cost of equity capital. For example, in the work, based on the dividend yield model (Gordon model), the authors show that the liberalization of segmented capital markets leads to a reduction in the cost of equity capital by an average of 50%. A similar study based on an analysis of changes in dividend yield and growth rates for 20 emerging markets (including the countries of South America, Asia and Africa) is presented in the work. The author chose a temporary date when foreign investors have the opportunity to buy shares of companies on the local market as an external sign of liberalization. The work shows a reduction in capital costs as a result of liberalization by an average of almost 50%.

The event study method with an assessment of the accumulated excess return based on the price dynamics of depositary receipts (ADR) of 126 companies from 32 local markets made it possible to show for the time period 1985 - 1994. in the works, reducing the cost of equity capital by 42%.

The work of Dairil Collins and Mark Abrahamson analyzes the cost of equity using the CAPM model in 8 capital markets of the African continent (Egypt, Kenya, Morocco, etc.) from the perspective of a global investor. The study was conducted highlighting 10 main sectors of the economy. Two time periods have been identified, characterizing different degrees of openness of economies (1995-1999 and 1999-2002).

The authors show a decline in the risk premium over time in African capital markets. The greatest changes occurred in Zimbabwe and Namibia, the smallest in Egypt, Morocco and Kenya. The average cost of equity for 2002 is about 12% in US dollars. The sectors with the largest weight in the economy demonstrate the lowest cost of capital.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Similar documents

The essence, concept, goals and objectives of marketing research. Desk marketing research. Collection of primary information. Sampling design. Data processing and report generation. Using the results of marketing research.

test, added 10/26/2015

The concept and essence of marketing research. The current state of the beauty salon market in Novosibirsk. Marketing research, obtaining primary information about the state of demand for products. Development of a marketing research program.

test, added 06/05/2013

Theoretical foundations of consumer research. Analysis of the modern perfumery and cosmetics market in Russia. Conducting marketing research of consumer preferences and analyzing the data obtained. Conclusions based on the results of marketing research.

course work, added 10/08/2010

Stages of marketing research, their essence and the procedure for collecting information. A variety of research methodologies, advantages and disadvantages of the methods used. Survey as a method of collecting primary marketing information, its types and directions.

course work, added 01/10/2015

Marketing research: essence, directions, stages. The concept of the questionnaire and its structure. Development and main mistakes when compiling questionnaires. Characteristics of the supermarket TS "Monetka". Drawing up a questionnaire for marketing research, analyzing the results.

course work, added 11/15/2011

Modern theories of integrated marketing research. Concept and methods of marketing research. Algorithm for its implementation. Results of marketing research and their analysis. Techniques and methods for implementing research technology at an enterprise.

test, added 07/06/2010

The concept and purpose, stages and principles of conducting marketing research, the significance of its results for building a strategy for the future activities of the enterprise. Contents of the market segmentation process. Requirements for product positioning.

test, added 03/19/2014

Marketing research tools (questionnaires, mechanical devices), their characteristics, varieties, features and areas of application. Product range and product nomenclature, their brief description and purpose. The concept of product life cycle.

test, added 10/18/2010

Concept, types and methods of marketing market research. Its basic principles and stages. The need to introduce marketing in domestic transport. Types of transport services. Marketing approaches to organizing work in road transport.

presentation, added 08/27/2017

Conducting marketing research

Introduction

Experiential marketing is everywhere. It is present in a wide variety of markets (consumer, industrial, services, technology) and manifests itself in a wide variety of industries. Many organizations are turning to the power of experiential marketing to develop new products, establish communications with consumers, improve sales relationships, select business partners, design retail spaces and create electronic websites. And this trend continues to grow. Marketers are increasingly moving away from traditional marketing of features and benefits to creating experiential experiences for their customers.

The purpose of this course work is to examine the theoretical foundations of empirical marketing. To achieve this goal, the course work solves the following research tasks: consider the essence of empirical research and its stages, social research, study empirical experiences, and also consider the scale and range of application of empirical marketing.

Empirical Marketing Research

The essence of empirical marketing research

Experiential marketing is about creating connections between a brand and consumers by providing the latter with emotionally and intellectually engaging experiences. This definition reflects the second name of the concept under consideration: experiential marketing (from the English experience - experience, experience).

Speaking about the essence of marketing research, we can unconditionally classify it as scientific research. Indeed, basically it is such, since it is aimed at solving clearly defined problems; designed to provide practice with reliable and valid information; when conducting it, scientific methods of collecting and processing information, etc. are used. And yet there is one circumstance that requires clarification in this regard.

How, for example, does marketing research differ from sociological research, which is based on clear scientific principles? Let us point out the following important circumstances in this regard. Marketing research (hereinafter referred to as MI) is not only the process of collecting and analyzing information, but also a specific, additional method of communication, a channel of communication with the market for relevant goods, potential partners, and consumers. Often, on behalf of the customer, already in the process of conducting marketing research, a distribution network can be formed (sometimes even using teams of interviewers conducting the research).

It is necessary to distinguish two main types of MI, due to its general focus and the very goals of research activity.

Theoretical and applied research ("purely" theoretical marketing research probably cannot exist, since the basic economic laws operating in marketing are studied in microeconomics courses and a number of other similar disciplines), the purpose of which is to identify and search for mechanisms for solving marketing problems through the development of new approaches to their study and interpretation. For example, we may be talking about developing new approaches to classifying consumers, qualitatively new ones, features of market research, developing new concepts for product promotion and advertising, etc.

Empirical marketing research is scientific research aimed at obtaining fact-recording knowledge, i.e. establishing and generalizing social facts using direct or indirect registration of events characteristic of the social phenomena, objects, processes under study.

Let's consider empirical methods of marketing research:

1. Observation.

This method assumes that the researcher is in close proximity to the object of interest, for example, a moral and legal conflict, and has the opportunity to see and record all phases of its sociodynamics.

Observation can be participatory, when the researcher takes on the role of one of the participants in the fragment of legal relations being studied. This provides additional opportunities for delving into the essence of a legal conflict and into the motivational spheres of its participants.

With routine, non-participant observation, the information collected may not be as in-depth. But its advantages are that, remaining as an outside observer, the sociologist has a greater chance of maintaining a position of impartiality and objectivity, and avoiding elements of evaluativeness in stating judgments.

It is necessary to distinguish between hidden observation, when the participants in the legal relations under study do not suspect that the sociologist is interested in them, and open observation, when the participants are aware of the study being conducted.

Such a gradation of observations is also possible, such as extensive, when a fairly extensive subject is in the field of view, occupying a significant place in social space, and intensive, when the subject of research attention is not large in volume and completely fits into the field of view of one sociologist. In the second case, observation turns out to be extremely focused and more effective.

The observation method is convenient for studying local, fragmentary, small in volume and number of participants, and easily accessible objects.

2. Analysis of documents.

When a certain legal reality is beyond the reach of direct empirical study (for example, it disappeared from the present and remained in the historical past), but some single texts or sets of written documents remain from it, then for a sociologist these latter can serve as a source of information. Documents as artifacts, that is, artificial, secondary facts, are capable of testifying to real, once existing, primary facts of the legal life of society and the individual. Various legislative acts, codes, government decrees, protocols of investigative actions and court proceedings, written evidence from participants in various legal procedures, as well as journalistic and artistic works covering various legal problems - all this can provide sociologists with the necessary information. When analyzing them, the sociologist becomes a lawyer, and the lawyer becomes a sociologist. The same event looks for the first as a typical social fact, and for the second as a characteristic legal phenomenon-case. Brought together, both of these views, sociological and legal, provide a three-dimensional image of the socio-legal reality under study, allowing us to capture in it such properties and facets that researchers, if they acted separately, could pass by without noticing them. The advantage of the sociology of law as a theoretical discipline lies precisely in the fact that its representative develops in himself simultaneously the strengths of both a sociologist and a lawyer.

If documents are not of a purely legal nature, but due to certain circumstances are of interest to a sociologist, then he is faced with the difficult task of identifying purely legal information from their contexts. One means of solving this problem is content analysis. It is used in the presence of voluminous text material in order to identify the number of certain content-semantic units in it. For example, an analysis of all issues of the central newspaper Pravda for 1937 and counting the total number of executions of “enemies of the people” that it reports can provide quite eloquent information about the state of the Soviet justice system, about the degree of its civilization, humanity, and justice. Sociologists of law often refer to the example of content analysis associated with the activities of the International Institute of Human Rights in Strasbourg. In 1971, his staff attempted to identify the words that were most often found in official legal documents at the state and international level. The first three places were occupied by the words law, equality and freedom, respectively. That is, the priority values of the political and legal activities of the international community have been identified, serving as guidelines for the practical efforts of states and peoples [4].

To collect information characterizing the state of various, archaic and modern forms of customary law, folklore - ancient myths, folk tales, legends, as well as various ethnographic materials - may be of particular interest.

When using this method, we are talking about a scrupulously methodical reading of texts according to a pre-compiled multi-stage program. In such cases, the required information can be collected literally bit by bit and over a fairly long period of time.

Sociologists of law, endowed with artistic flair, can successfully work with the literary works of outstanding writers as sources of socio-legal information. Thus, French sociologists are inclined to believe that good material on the sociology of property is available in the novels of O. Balzac's "Human Comedy", and on the sociology of the family - in E. Zola's multi-volume epic "Rugon-Macquart". Similarly, for Russian (and not only Russian) sociologists, an invaluable source of information on the sociology of law and crime is the work of F. M. Dostoevsky.

Document analysis is important in cases where sociologists are dealing with structures of the legal system whose activities are strictly documented. If we take into account that a certain part of this documentation is of a closed nature and the information contained in them is designed for specific professionals, then it should be recognized that law enforcement agencies need their own sociological personnel. With their analytical research, they could provide significant assistance in self-improvement of the legal system.

3. Survey (interviewing, questioning, testing).

Among sociological methods of collecting primary information, surveys occupy an important place. It is used in cases where observation is impossible or impractical. It is resorted to when necessary to identify the state of public opinion regarding any significant events in the social and legal life of the state and civil society. Polls are important on the eve of such events in the political and legal life of society, such as referendums. Covering not too many citizens, they are test measurements of the state of public opinion and a kind of rehearsal for the upcoming

Interviewing looks like a personal conversation between a sociologist and a person of interest. Such a conversation most often has a question-and-answer nature and can take place either in person or by telephone. The responses received are recorded, processed, summarized, and compared with the results of other similar interviews.

The conversation-interview can be recorded on a tape recorder. The recording itself can be used in different ways, depending on the interviewer’s research preferences. For example, in 1959, the American Truman Capote published a book that was created on the basis of tape recordings of his conversations with two young convicted criminals. After some time, its Russian translation came out (Ordinary Murder. - M., 1965).

Questioning differs from interviewing in that it can be not only individual, but also group. In addition, it presupposes that the sociologist has a pre-compiled questionnaire. Its advantage is that it allows you to survey a large number of people simultaneously. Another clear advantage of surveying is that it can be not only personal, but also anonymous. This second option is often preferable to sociologists over the first, since it allows respondents to give sincere answers to questions that are called “sensitive” in everyday language.

Testing is a method of complicated questioning. Specialists compose a special kind of questionnaire (test), which contains a significant number of heterogeneous questions. The purpose of the test is to force the respondent to “speak out” or “let it slip,” that is, to give answers to questions that he would not answer during a regular interview or questionnaire. At the same time, tests make it possible to identify the unconscious attitudes of individuals, hidden even from their own understanding.

This technique is important when studying the motivational sphere of individual legal consciousness. It has great promise in criminological research.

4. Sociological experiment.

To confirm their hypothesis and to refute assumptions that contradict it, sociologists can model the socio-legal situation they need. A model of this kind can be either completely real, that is, situational-empirical, or mental, imaginary.

Legal relations are an area to which individuals are very sensitive and react to all manifestations of which extremely sharply. It is always very difficult to conduct any real experiments on its “territory”. As for thought experiments in the field of law, culture has come to the rescue of sociologists. For a long time there have been talented dramas, novels, short stories, created by brilliant word artists, exploring the most diverse aspects of legal relations, the most complex structures of individual legal and criminal consciousness. Created by the play of creative imagination, they are nothing more than thought experiments. And sociologists, of course, should not ignore classical and modern works of art with a legal and criminological orientation. At the same time, they will have to use the methodology of sociological analysis of documents, which in this case will be literary texts, in the conditions of thought experiments not created by themselves.

5. Biographical method.

It can also be attributed to document analysis, but it can also be considered an independent method. It is a way of studying biographical data in order to collect the necessary information of a psychological, sociological, moral and legal nature. The biographical method allows you to formulate hypotheses and find evidence regarding the characteristics of the attitude of a particular person or a certain category of individuals to certain socio-legal phenomena and processes, as well as make assumptions about the nature of their legal consciousness and the typical features of their socio-legal behavior.

The active use of the biographical method in modern socio-legal theory began in the first decades of the 20th century. and is associated with the publication of the works of W. Healy “Criminal” (1915) and “Mental Conflicts and Incorrect Behavior” (1917), Z. Freud “Dostoevsky and Parricide” (1928). Many Western researchers, including F. Znaniecki, C. Cooley, G. D. Lasswell, D. G. Mead, W. A. Thomas, when constructing their theoretical hypotheses, turn to the study of personal documents, letters, diaries in order to acquire reliable information about the motives of social behavior of the people they are interested in. By analyzing family relationships, heredity and continuity of generations, human actions in critical life situations, relationships with others, not only conscious but also unconscious inclinations are revealed that affect the characteristics of both law-abiding and illegal behavior of individuals.

Empirical data of a biographical nature, together with the general logic of inductive-deductive constructions, make it possible to reconstruct the most complex motivational conflicts in the inner life of individuals who find themselves in extraordinary conditions of situations of suicide, committing a crime, imprisonment, etc.

Conclusion: the above methods can be used in different proportions, in relation to various socio-legal material and develop in each individual case into a special model of research activity. Let us designate the most significant of these models:

1. Pilot study.

Its essence lies in the fact that it is of an exploratory nature and allows researchers to test their tools in a small area of the problem field that interests them. This is a kind of micromodel of a future full-scale study. Its task is to identify the weak points of the planned program, make the necessary adjustments to it in advance, clarify the initial premises of the hypothesis, more accurately outline the boundaries of the subject under study, and more clearly define the problem and the tasks arising from it.

2. Descriptive research.

This type of research includes a comprehensive, as complete as possible description of the legal phenomenon. Its features, structural and content properties, and functionality are identified. At the same time, researchers are in no hurry to make final assessments, generalizations and conclusions. Their task is to create the necessary empirical prerequisites for all this.

3. Analytical research.

This is the most complex and in-depth version of scientific research, not limited to sliding along the phenomenal surface of socio-legal realities. The task here is to move from the phenomena into the depths of the problem, to the essential parameters of recorded socio-legal phenomena and facts, to the reasons and grounds for their occurrence and to the conditions of functioning.

The results of analytical studies are of the greatest scientific value and practical significance. Based on them, the customers for whom this work was carried out take certain practical steps to correct, reorganize, and improve specific areas of social and legal reality.

Let us consider empirical social research in France in the second half of the 19th century - the beginning of the 20th century.

Speaking about the prehistory of empirical sociology in the 19th century, it should be noted the special role of the French scientist and political figure Frederic Le Play (1806-1882). Empirical sociology is a direction focused on the study of specific facts of social life using special methods. He attached particular importance to the collection of specific social facts, only on the basis of which he considered it possible to draw reasonable conclusions. F. Le Play's main work - "European Workers" - was published in 1855. It contains the results of a study of working families and their budgets, which for the French researcher acted as the main indicator of the level and lifestyle. Le Play investigated various sources of income for workers using statistical methods, and based on the results obtained, he proposed his program for social reform of their situation. His approach has not yet lost its significance in the preparation and conduct of empirical social research of certain professional groups of the population.

Le Play's main area of scientific interest is the study of the family. He was one of the first to explore it using empirical methods. Chief among them were statistical ones. However, Le Play resorted to using others, including direct observation of individual cases and their subsequent description. The French researcher considered the family as the basic unit of the social system of society, in which it fully reproduces itself.

Le Play developed a methodology and methodology for theoretical and empirical research of the family. Within the framework of the first - theoretical - direction, he formulated a typology of family, including its three main varieties: patriarchal, unstable, intermediate. The first type is a traditional three-generation family with common property and the dominance of the father (patriarch), characteristic of the village and peasantry. The unstable type is the two-generation nuclear isolated family, most often found in the upper strata of society and among the industrial working class. The intermediate type is a type of patriarchal family in which one of the heirs owns the household, and the rest receive their share of money, which creates the opportunity for them to work elsewhere. At the same time, ties with the parental home are not severed; it continues to remain a “fortress” in which one can always hide from the difficulties and shocks of life.

In his theoretical analysis of the family, Le Play drew attention to it as the main factor of social control. He believed that the state can pursue its internal policy and successfully solve basic management tasks only by relying on the family and creating the necessary conditions for its functioning and stable development.

As for the methodology of empirical research of the family, it received its most complete expression within the framework of the monographic method developed by Le Play, of which he is one of the founders. In the book "European Workers" he left a description of the lifestyle of 57 families engaged in various fields of activity - agricultural, craft, handicraft, industrial, living in a number of regions of several European countries, differing in their level of economic development. The main attention in this description was paid to the family budget, the structure of income and expenses, i.e. something that could be clearly expressed in quantitative terms.

The monographic method of research opposed the historical method developed at that time. The essence of the first was to combine a theoretical analysis of the family with specific data and materials about its life, i.e. with what we would now call field research data. At the same time, the emphasis was placed on considering factors in the family’s social environment that had a profound impact on it. This includes the place of residence, the nature of the work activities of family members, the level of income, etc. Le Play's student Henri de Tourville did especially a lot in terms of using the monographic method for family research.

In general, Le Play was an ardent supporter of preserving and strengthening the family, and in its traditional norms. - To do this, he proposed adopting a series of laws aimed against the fragmentation of family property and family property, stimulating the development of family production. The scientist attached particular importance to the preservation of family property, which acts not only as a means of production, but also as a strong moral factor and an instrument for the development of family continuity. Since he believed that the family is the only structural unit of society that is capable of protecting a worker from market fluctuations, and a person from social storms and adversities, the reforms of society for which he called for implementation should, in his opinion, primarily concern families .

Considering the development of empirical social research in France in the 19th and early 20th centuries, one cannot ignore the scientific research in this area by G. Tarde. They are associated, first of all, with the study of the social aspects of crime, elucidation of its causes as a social phenomenon and analysis of the effectiveness of the French penitentiary system. The subject of Tarde’s attention and interest should not be surprising; one must take into account the fact that for 25 years he worked in the justice system, mainly in the courts, and carefully studied the problems of criminology. The result of his theoretical and empirical research was a “portrait” - both physical and social - of a criminal. It contained a number of traits and characteristics (both physical and social) of a delinquent (criminal) personality type, which was the result of an analysis of a large number of criminal cases.

Based on a generalization of significant statistical material on crimes committed, Tarde also considered the issue of the prevalence and social characteristics of certain types of crimes not only in France, but also in the world as a whole. In particular, he concluded that the number of bloody crimes committed in countries with a warm climate is growing, and in countries with a cold climate it is decreasing.

The works of Tarde and Le Play were important for the subsequent development of not only empirical sociology, but also criminology, whose representatives still highly appreciate the ideas and works of French scientists.

Ministry of Education and Science of the Republic of Kazakhstan

International Academy of Business

FACULTY OF ECONOMICS, MANAGEMENT AND ENTREPRENEURSHIP

DEPARTMENT OF FINANCE AND AUDIT

COURSE WORK

in the discipline "Financial Management"

Empirical studies of the CAPM model

3rd year student F – 0706 full-time group

Chernousova Alexandra Pavlovna

Scientific adviser:

Ph.D., Associate Professor

Aitekenova R.K.

ALMATY 2010

Plan

Introduction

Chapter 1. Concept, essence and goals of the CAPM model

1.1 Concept and essence of the CAPM model

1.2 CAPM model calculation process

Chapter 2. Possibility of using variants of the CAPM model

2.1 Black's two-factor CAPM model

2.2 Essence of the D-CAPM model

Chapter 3. Empirical research on the applicability of the CAPM model in emerging markets

3.1 Criticism of the CAPM and alternative risk measures

3.2 Review of empirical studies of the risk-return concept in emerging markets

Conclusion

List of used literature

Application

Introduction

To determine the relevance of this topic, it is necessary to determine what it is and what the goals of empirical research are.

Empirical research is a scientific factual study.

Any scientific research begins with the collection, systematization and synthesis of facts. The concept of “fact” has the following basic meanings:

1) A certain fragment of reality, objective events, results related either to objective reality (“facts of reality”) or to the sphere of consciousness and cognition (“facts of consciousness”).

2) Knowledge about any event, phenomenon, the reliability of which has been proven, i.e. synonym for truth.

3) A sentence that captures empirical knowledge, i.e. obtained through observations and experiments.

The internal structure of the empirical level is formed by at least two sublevels:

a) direct observations and experiments, the result of which are observational data;

b) cognitive procedures through which the transition from observational data to empirical dependencies and facts is carried out.

The activity-based nature of empirical research at the level of observations is most clearly manifested in situations where observation is carried out during a real experiment. By tradition, experiment is contrasted with observation outside the experiment. Let us note that the core of empirical research is an experiment—a test of the phenomena being studied under controlled and controlled conditions. The difference between experimentation and observation is that the experimental conditions are controlled, while in observation the processes are left to the natural course of events. Without denying the specificity of these two types of cognitive activity, one should pay attention to their common generic characteristics.

To do this, it is advisable to first consider in more detail what is the peculiarity of experimental research as a practical activity. Experimental activity is a specific form of natural interaction, and fragments of nature interacting in an experiment always appear as objects with functionally distinct properties.

Thus, the main goal of this course work can be considered experiments in the application of the “risk-return” concept and determining its feasibility in connection with changes in country risks and markets.

At the moment, the “risk-return” concept is key in corporate finance, as it allows one to quantify the investment and credit risk of the company’s capital owners in terms of profitability and build effective investment and financial decisions taking into account the obtained assessment. There are still ongoing disputes regarding the correctness of risk assessment methods and the construction of a model for linking the expected risk with the return required by investors that is adequate to external conditions.

Chapter 1. Concept, essence and goals of the model CAPM

1.1 Concept and essence of the model CAPM

Capital Asset Pricing Model (CAPM) - a model for assessing the profitability of financial assets serves as a theoretical basis for a number of different financial technologies for managing profitability and risk used in long-term and medium-term investing in shares.

The long-term valuation model or cost of capital model was developed by Harry Markowitz in the 50s.

The CAPM looks at a stock's performance in relation to the performance of the overall market. Another underlying assumption of the CAPM is that investors make decisions based on only two factors: expected return and risk.

The point of this model is to demonstrate the close relationship between the rate of return and the risk of a financial instrument.

It is known that the greater the risk, the greater the profitability. Therefore, if we know the potential risk of a security, we can predict the rate of return. Conversely, if we know the return, then we can calculate the risk. All calculations of this kind regarding profitability and risk are carried out using a long-term asset valuation model.

According to the model, the risk associated with investments in any risky financial instrument can be divided into two types: systematic and unsystematic.

Systematic risk is caused by general market and economic changes that affect all investment instruments and are not unique to a particular asset.

Unsystematic risk is associated with a specific issuing company.

Systematic risk cannot be reduced, but the market impact on financial asset returns can be measured. As a measure of systematic risk, the CAPM uses the β (beta) indicator, which characterizes the sensitivity of a financial asset to changes in market returns. Knowing the β indicator of an asset, it is possible to quantify the amount of risk associated with price changes in the entire market as a whole. The higher the β value of a stock, the more its price rises when the overall market rises, but vice versa - shares of a company with large positive β fall more strongly when the market as a whole falls.

Unsystematic risk can be reduced by constructing a diversified portfolio from a sufficiently large number of assets or even from a small number of anti-correlated assets.

Because any stock has its own degree of risk, this risk must be covered by profitability for the instrument to remain attractive. According to the long-term asset valuation model, the rate of return of any financial instrument consists of two parts:

1. risk-free income

2. bonus income

In other words, any return on a stock includes a risk-free return (often calculated using government bond rates) and a risk return, which (ideally) corresponds to the risk level of the security. If the profitability indicators exceed the risk indicators, then the instrument brings more profit than it should according to its risk level. And vice versa, if the risk indicators turned out to be higher than the profitability, then we do not need such an instrument.

1.2 Model calculation process CAPM

The relationship between risk and return according to the long-term asset pricing model is described as follows:

D = Db/r + β (Dr-Db/r), where

D - expected rate of return

· Db/r - risk-free income

· Др - profitability of the market as a whole

β - special beta coefficient

Risk-free income is that part of the income that is included in all investment instruments. Risk-free income is measured, as a rule, at government bond rates, because those are practically risk-free. In the West, risk-free income is approximately 4-5%, but in our country it is 7-10%.

The total return of a market is the rate of return of the index for that market. In Kazakhstan, this is an indicator of the KASE stock market.

Beta is a special coefficient that measures the riskiness of an instrument. While the previous elements of the formula are simple, clear, and quite easy to find, β is not so easy to find; free financial services are not provided by β companies.

The regression coefficient β serves as a quantitative measure of systematic risk that cannot be diversified. A security that has a β-ratio of 1 replicates the behavior of the market as a whole. If the coefficient value is above 1, the security's reaction is ahead of the market change in both one and the other direction. The systematic risk of such a financial asset is above average. Less risky are assets whose β-coefficients are below 1 (but above 0).

The concept of β-ratios forms the basis of the Capital Assets Pricing Model (CAPM). Using this indicator, the amount of risk premium required by investors for investments that have a systematic risk above average can be calculated.

Beta coefficient is the slope angle of a straight line from a linear equation of the type y = kx + b = β·(Dr-Db/r) + Db/r. This straight line is a straight line of regression of two data sets: index and stock returns. A graphical display of the relationship between these arrays will give a certain set, and the regression line will give us a formula and show us the dependence of the correlation on the scatter of points on the graph.

Let's take the formula y = kx + b as a basis. In this formula, we replace k with the coefficient β, here it is equivalent to risk.

We get y = β x + b. For calculations, we will take approximate indicators for the risk-free rate of return of Corporation X and the return of the KASE index for the period from 04/15/2007-04/15/2008.

Calculations, to simplify operations, were carried out in the MSExcel program. The data table is presented in the Appendix.

Graph 1: Beta Coefficient Image

Thus, the graph shows that the beta coefficient is equal to 0.503, therefore, the return on the stock of Corporation X is growing more slowly. Than the profitability of the market on which it is listed.

Calculating an additional coefficient, the correlation coefficient R2, will show how much a change in the index moves the stock price. In this example, the share of Corporation X depends very little on the KASE index, because the correlation coefficient is 0.069.

Therefore, the Long-Term Asset Pricing Model (CAPM) can help you decide which stocks to add to your investment portfolio. This model demonstrates a direct relationship between the risk of a security and its profitability, which allows it to show a fair return relative to the existing risk and vice versa.

In our case, the securities portfolio is made up of stocks with minimal risk. Investors are thought to be risk averse, so any security other than a risk-free government bond or Treasury bill can expect investor acceptance only if its expected return compensates for the additional risk involved. risk.

This premium is called the risk premium; it directly depends on the value of the β-coefficient of a given asset, since it is intended to compensate only for systematic risk.

Unsystematic risk can be eliminated by the investor himself by diversifying his portfolio, so the market does not consider it necessary to establish a reward for this type of risk.

Chapter 2. Possibility of using model variants CAPM

2.1 Two-factor model CAPM in Black's version

As mentioned above, the classic CAPM models in the Sharpe-Lintner or Black version are, strictly speaking, not implemented in the Kazakhstan market. Perhaps the failure in testing the classical versions of the CAPM model is due to the fact that the Kazakh market belongs to developing markets, to which the traditional CAPM model is not suitable, since emerging markets are “by definition” less efficient than developed ones, and the initial assumptions of the model are not met in them CAPM. Other versions of the capital asset valuation model have been proposed in the literature, most of them are based on the CAPM model and are its modification.

Unfortunately, many popular models are modifications for a specific case and do not have an economic interpretation.

One of the most plausible and theoretically sound models is the D-CAPM model proposed by Estrada (2002b, 2002c).

The main difference between the D-CAPM model and the standard CAPM model is the measurement of asset risk. If in the standard model risk is measured by the dispersion of returns, then in the D-CAPM model risk is measured by half-dispersion ( semivariance), which shows the risk of a decrease in profitability relative to the expected or any other level chosen as the base.

Semi-variance is a more plausible measure of risk because investors are not afraid of the possibility of rising returns, but investors are afraid of the possibility of falling returns below a certain level (for example, below the average level).

Based on the half-variance, it is possible to construct an alternative behavioral model based on a new measurement of risk, as well as to construct a modified CAPM model. The new pricing model was called Downside CAPM, or D-CAPM, in academic publications.

As shown in emerging markets returns are better described by D-CAPM compared to CAPM. For developed markets, the difference in the two models is much smaller. In this regard, the question arises of the applicability of the D-CAPM model for the Kazakh stock market.

Black's model is essentially two-factor. The factors in this case are unobservable traded portfolios: any of the efficient market portfolios and a portfolio orthogonal to it. This may provide another method for validating the model. The idea of the method is as follows. Using the available time series of returns on various assets using factor analysis methods, it is possible to identify the two most significant factors and form abstract portfolios based on factor coefficients.

If you use the principal component method to isolate factors, then by definition these factors and, consequently, the generated portfolios will be orthogonal (located at right angles, perpendicular.). Then one of the portfolios can be considered as a market efficient portfolio, the other - as an asset with zero beta. But the model does not work in emerging markets.

When constructing a standard capital asset pricing model, it is assumed that the distribution of returns is normal. The normal distribution is symmetric and is completely determined by the mathematical expectation and variance. In the standard behavioral model, investors' actions are influenced by expectation and dispersion of returns (standard deviation of returns).

Evidence suggests that the distribution of returns is not symmetrical. It can be assumed that in this case, investors' actions will be influenced not only by the expected value and dispersion of returns, but also by the coefficient of distribution asymmetry.

It is intuitively clear that investors, other things being equal, prefer distributions with a positive skewness coefficient. A good example is the lottery. As a rule, in lotteries there is a big win with a low probability and a small loss with a high probability. Many people buy lottery tickets even though their expected return is negative.

According to investors, they primarily seek to preserve the original value of their investment and avoid reducing the original value of the investment below a certain target level. This behavior of investors corresponds to a preference for positive asymmetry.

Therefore, assets that reduce portfolio asymmetry are undesirable. Therefore, the expected return of such an asset must include a premium for this risk. Asymmetry can be incorporated into a traditional pricing model. Models that take asymmetry into account are discussed in .

These models assume that, other things being equal, investors prefer assets with higher returns, assets with lower standard deviation, and assets with greater skewness. Accordingly, an alternative behavioral model of investors can be considered based on three indicators of the distribution of asset returns. The set of efficient portfolios in the space of mean, variance and skewness is described. For a given level of dispersion, there is an inverse relationship between return and skewness. That is, in order for an investor to hold assets with less asymmetry, they must have a higher return. That is, the premium must be negative.

As with variance, the return on an asset is affected not by the asymmetry of the asset itself, but by the contribution of the asset to the asymmetry of the portfolio, that is, coasymmetry. Coasymmetry must have a negative premium. An asset with greater co-skewness should have a lower return than an asset with less co-skewness.

The results show that skewness helps explain the variation in returns across spatial data and significantly improves the significance of the model. The paper shows that if markets are completely segmented, then returns are affected by total dispersion and total asymmetry. In fully integrated markets, only covariance and coskewness matter.

Harvey and Siddique derive the following model to account for asymmetry:

where At and Bt are functions of market dispersion, asymmetry, covariance and co-asymmetry. The coefficients At and Bt are similar to the β coefficient in the traditional CAPM model.

Harvey and Siddique ranked stocks by historical co-skewness and created an S- portfolio consisting of the 30% of stocks with the lowest co-skewness, 40% of stocks with intermediate co-skewness values, and an S+ portfolio of the 30% of stocks with the highest co-skewness relative to the market portfolio.

For econometric testing, the following models were used in the work:

μi = λ0 + λMi + λS βSi + ei

μi = λ0 + λMiβS + λSKS βSKSi + ei

where μi is the average value of the excess of return over the risk-free rate (excess return), λ0, λMi, λSi are the estimated parameters of the equations, are errors, λSKS, βSKS is the beta coefficient of the standard model, βSi, βSKSi are the beta coefficients of assets in relation, respectively, to portfolio S- and the spread between the returns of the portfolios S- and S+.

It is shown that the inclusion of an additional factor significantly improves the fit of the model to real data. It is therefore concluded that asset pricing models for emerging markets need to take into account the level of integration and possibly the co-asymmetry measure.

2.2 Essence of the model D - CAPM

One of the most common modifications to the standard pricing model is based on the use of semi-variance as a measure of asset risk. In the classical theory, following Markowitz, the dispersion of return is taken as such a measure, which equally interprets both deviations up and down from the expected value.

![]()

Unlike variance, semivariation “punishes” only downward deviations:

![]()

The root of a semivariation is called downside risk- risk of downward deviation. It should be noted that this measure has its advantages and disadvantages.

Among the shortcomings, we note that the positive side of the risk associated with exceeding expectations is thrown out. In addition, such “risk” cannot be used as volatility (changeability), and then for pricing derivative financial instruments.

On the other hand, the use of semi-variance within portfolio theory allows us to relax some of the assumptions of the traditional financial asset pricing model (the assumption of a normal distribution of returns and the assumption that investor behavior is determined by expected returns and the dispersion of asset returns).

It is noted that, firstly, the standard deviation can only be used in the case of a symmetric distribution of returns.

Second, standard deviation can be directly used as a measure of risk only when the distribution of returns is normal. These conditions are not supported by empirical data.

In addition, the use of beta coefficients, which are derived within the framework of the traditional behavioral model, as a measure of risk in emerging markets is disputed by many researchers; the possibility of using semi-variation, on the contrary, is confirmed by empirical data.

The use of semivariation is also supported by intuitive considerations. Typically, investors do not avoid the risk of above-average returns; they avoid the risk of below-average returns or below some target. Since investing in emerging markets is very risky for a Western investor, the Western investor primarily avoids the risk of losing the original value of his investment, or, in accordance with the work, avoids reducing this value below a certain target level. Therefore, as a measure of risk in emerging markets, it is advisable to use semi-variance and, accordingly, standard semi-deviation.

In studies [Sintsov, 2003], a model was tested in which risk is measured using the lower partial moment of the second order, that is, semi-variation. On the one hand, the use of semi-variation is the most popular modification of the CAPM model; on the other hand, the use of semi-variation allows the use of available statistical methods for empirical testing of the pricing model.

In this behavioral model, a measure of the interdependence of the profitability of a given asset and a market asset is the so-called semi-covariance, which is analogous to the covariance in the standard model:

Semi-covariance is also unbounded and scale dependent. But it can also be normalized by dividing it by the product of the standard semi-deviation of a given asset and the market portfolio:

Similarly, by dividing the covariance by the half-variance of the market portfolio, you can find the modified beta coefficient:

The modified beta coefficient is used in an alternative pricing model. This model proposed in was called D-CAPM ( Downside Capital Asset Pricing Model):

![]()

Thus, the beta coefficient in the traditional CAPM model is proposed to be replaced by a modified beta coefficient, which is a measure of the risk of an asset in a new behavioral model in which investor behavior is determined by the expectation and semi-dispersion of returns.

The modified beta coefficient can be found as the ratio of the semi-covariance of the asset and the market portfolio and the semi-variance of the market portfolio. Additionally, the modified beta coefficient can be found using regression analysis.

One of the possible imperfections of a developing market - strong asymmetry in asset returns - is taken into account in the D-CAPM model. It turned out that the modified beta coefficient of the D-CAPM model is better suited to describe the average return on the Kazakhstan securities market compared to the standard beta coefficient.

The DCAPM model partially addresses the problem of underestimating required returns in emerging markets when using the standard CAPM model. Therefore, the use of the D-CAPM model in emerging markets seems preferable. There is also a theoretical basis for this, since the D-CAPM model has less stringent underlying assumptions compared to the standard CAPM model.

However, rigorous testing shows that the D-CAPM model does not fit the dynamics of emerging market returns. Thus, none of the capital asset pricing models: the standard CAPM model in the Sharpe-Lintner version, the CAPM model in the Black version, the D-CAPM model does not correspond to the securities market data.

Perhaps the main reason for the failure of attempts to describe an emerging market with simple model representations is the low liquidity of assets. Large spreads in bid and ask quotes are the best reflection of investors' concerns about the vast majority of assets. The lack of potential buyers and sellers is a serious risk for any investor with a reasonable investment horizon, and presumably any market-fitting model must take this into account.

Chapter 3. Empirical studies of the possibility of using the model CAPM in emerging markets

3.1 Criticism of the CAPM and alternative risk measures

A number of empirical studies in the 70s of the twentieth century proved the advantages of the CAPM in predicting stock returns. Classic works include: , , .

However, criticism of the CAPM in academic circles began almost immediately after the publication of works on the model. For example, the work of Richard Roll emphasizes the problems associated with defining a market portfolio.

In practice, the market portfolio is replaced by a certain maximally diversified portfolio, which is not only available to the investor on the market, but also amenable to analysis (for example, a stock index). The problem with working with such a proxy portfolio is that the choice of it can significantly affect the results of the calculations (for example, the value of beta).

The works of R. Levy, M. Bloom and Scholes-Willims focus on the problem of stability of the key CAPM parameter - the beta coefficient, which is traditionally estimated using linear regression based on historical data using the Ordinary Least Squares (OLS) method.

This is, in essence, a question about the stationarity of the economy and the possibility of constructing risk assessments based on past data. Based on the results of calculations and analysis of the dynamics of the beta coefficient of a number of individual stocks and portfolios of securities, R. Levy came to the conclusion that for any stock its beta coefficient is not stable over time and therefore cannot serve as an accurate assessment of future risk. On the other hand, the beta of a portfolio consisting of even 10 randomly selected stocks is quite stable, and therefore can be considered as an acceptable measure of portfolio risk. M. Blum's research has shown that over time, the beta coefficient of the portfolio approaches one, and the company's internal risk approaches the industry average or market average.

An alternative model solution to the problem of stability of CAPM parameters is estimates obtained in the futures contracts market, when expectations for prices of financial assets are taken as a basis. This approach is implemented by the MSRM (Market-Derived Capital Pricing Model).

The work of Benz and Roll raises the problem of the correct application of the CAPM for small companies, i.e. focuses on the problem of size (size effect, small firm effect).

Another area of criticism is the time periods for calculating CAPM parameters (the so-called investment horizon problem). Since in most cases the CAPM is used to analyze investments with a horizon of more than one year, calculations based on annual estimates become dependent on the state of the capital market. If the capital market is efficient (future returns are not determined by past dynamics, stock prices are characterized by a random walk), then the investment horizon is not significant and calculations based on annual indicators are justified. If the capital market cannot be considered efficient, then the investment time cannot be ignored.

The CAPM thesis about the significance of only systematic risk factors is also problematic. Non-systematic variables such as market capitalization or price/earnings ratio have been empirically proven to influence required returns.

Research in the 1980s and 1990s showed that the CAPM beta was unable to explain industry differences in returns, while company size and other characteristics were able to do so.

Another area of criticism concerns the behavior of investors, who often focus on pure rather than speculative risk. How

Practice shows that investors are ready to invest in assets characterized by positive volatility (i.e., returns exceeding the average level). Conversely, investors have a negative perception of assets with negative volatility. Bilateral dispersion is a function of deviation from the average both towards an increase in the stock price and towards a decrease. Therefore, based on the calculation of two-way variance, a stock that exhibits volatility in an upward direction is considered a risky asset to the same extent as a stock whose price fluctuates in a downward direction.

Empirical research, for example, shows that investor behavior is motivated by one-sided downside risk aversion as opposed to overall risk (or two-sided variance).

The dispersion of expected returns is a rather controversial measure of risk for at least two reasons:

Two-way dispersion is a valid measure of risk only for assets whose expected return has a symmetric distribution

Two-way variance can only be used directly when the symmetric distribution is normal.

Another critical area concerns assumptions about the probability distribution of security prices and returns. As practice shows, simultaneous fulfillment of the requirements for symmetry and normality of the distribution of expected stock returns is not achieved. The solution to the problem is to use not classical (two-sided) variance, but one-sided (semivariance frameworks). This decision is justified by the following arguments:

1) the use of one-sided dispersion is justified for various distributions of stock returns: both symmetric and asymmetric.

2) one-way dispersion contains information provided by two characteristics of the distribution function: dispersion and skewness coefficient, which makes it possible to use a one-factor model to estimate the expected return of an asset (portfolio).

The problem of profitability asymmetry is solved through the lower partial moment (LPM) method, which makes it possible to construct an equilibrium financial asset pricing model, known as LPM - CAPM.

In a 1974 paper, Hogan and Warren analytically showed that replacing the traditional portfolio return variance with a one-sided one for risk assessment and moving to a mean-semivariance framework does not change the fundamental structure of the CAPM.

3.2 Review of empirical studies of the risk-return concept in emerging markets

Specific problems in the application of the CAPM arise in developing capital markets, for which it is quite difficult to justify the model parameters (risk-free return, market risk premium, beta coefficient) based on local capital market data due to the lack of information efficiency and low liquidity of tradable assets.

A number of empirical studies prove the incorrectness of using CAPM specifically in developing markets compared to developed ones (for example, , , ). A noted feature of emerging markets is the significance of specific risks associated with government policies for regulating the economy, institutional protection of investors and corporate governance. Due to the correlation between emerging markets and the global capital market, these risks are not eliminated by diversifying a global investor's capital.

Another problem of developing markets is the lack of stationarity and dynamic changes associated with the liberalization of local capital markets.

Beckert and Harvey argue that when assessing the required return, developed and developing markets must be considered from different perspectives, since the degree of integration of the local market into the global financial market should be taken into account. The degree of integration is not a constant value, it changes over time. This leaves an imprint on the formation of rates of return.

In a 1995 paper, Beckert argues that the presence of barriers to capital flows and international investment automatically means that risk factors in emerging markets are different from those in developed countries.

The work proves that the level of integration into the global capital market (or the presence of barriers to the movement of capital) should determine the choice of model for justifying the cost of equity capital.

An alternative view is argued in the work of Rouwenhorst. The author came to the conclusion that in terms of influencing factors there is no difference between developed and developing markets. Factors explaining return on equity that are found to be significant in developed markets are also significant in developing markets. These factors include:

· company size;

· variables reflecting the degree of operational and financial risk;

· liquidity of shares;

· growth prospects.

Active research on testing modifications of the CAPM taking into account the underdevelopment of capital markets has been carried out in South American countries (Argentina, Brazil, Venezuela). The choice of modification is recommended to be linked to the degree of development of the local financial market and its integration into the global capital market.

Scheme 1. Modifications of CAPM depending on the degree of integration and market segmentation.