Income tax is calculated using two methods: the accrual method and the cash method.

Under the accrual method, income is recognized in the reporting (tax) period in which it occurred, regardless of the actual receipt of funds, other property (work, services) and (or) property rights. For income relating to several reporting (tax) periods, and if the relationship between income and expenses cannot be clearly defined or is determined indirectly, income is distributed by the taxpayer independently, taking into account the principle of uniform recognition of income and expenses. For industries with a long (more than one tax period) technological cycle, if the terms of the concluded contracts do not provide for the phased delivery of work (services), income from the sale of the specified work (services) is distributed independently in accordance with the principle of formation of expenses for the specified work (services) . For income from sales, the date of receipt of income is the date of sale of goods (work, services, property rights), determined in accordance with paragraph 1 of Article 39 of the Tax Code of the Russian Federation, regardless of the actual receipt of funds to pay for them. When selling goods (work, services) under a commission agreement (agency agreement) by the taxpayer-committent (principal), the date of receipt of income from the sale is the date of sale of the property (property rights) belonging to the committent (principal), indicated in the notice of the commission agent (agent) about the sale and (or) in the report of the commission agent (agent).

Income tax is determined as the rate multiplied by the tax base.

The tax amount at the end of the tax period is determined by the taxpayer independently. At the end of each reporting (tax) period, taxpayers calculate the amount of the quarterly advance payment based on the tax rate and the actually received profit subject to taxation, calculated on an accrual basis from the beginning of the tax period until the end of the first quarter, half a year, nine months and one year.

The tax rate is set at 20 percent, with:

- - the amount of tax calculated at a tax rate of 2% is credited to the federal budget;

- - the amount of tax calculated at a tax rate of 18% is credited to the budgets of the constituent entities of the Russian Federation.

The tax period for taxes is the calendar year. The tax reporting period is the first quarter, half year and nine months of the calendar year. At the same time, the amount of advance quarterly payments is determined taking into account the previously accrued amounts of advance payments. During the reporting period (quarter), payment of advance payments is made in equal installments in the amount of one third of the actually paid quarterly advance payment for the quarter preceding the quarter in which the monthly advance payments are made.

Taxpayers have the right to switch to calculating monthly advance payments based on the actual profit received to be calculated. In this case, the amount of advance payments is calculated by taxpayers based on the tax rate and the actual profit received, calculated on an accrual basis from the beginning of the tax period to the beginning of the corresponding month.

The amount of advance payments payable to the budget is determined taking into account the previously accrued amounts of advance payments. The taxpayer has the right to switch to paying a monthly advance payment based on actual profit by notifying the tax authority no later than December 31 of the year preceding the period in which the transition to this advance payment system takes place. At the same time, the payment system cannot be changed by the taxpayer at the end of the tax period.

Organizations whose sales revenue over the previous four quarters did not exceed an average of 3,000,000 rubles for each quarter, as well as budgetary organizations, foreign organizations operating in the Russian Federation through a permanent representative office, pay only quarterly advance payments based on the results of the reporting period.

Taxpayers, regardless of whether they have an obligation to pay tax and (or) advance payments for tax, the specifics of calculation and payment of tax, are required to submit appropriate tax returns at the end of each reporting and tax period to the tax authorities at their location and the location of each separate division.

Taxpayers submit tax returns (tax calculations) no later than 30 days from the end of the relevant reporting period.

Tax returns (tax calculations) based on the results of the tax period are submitted by taxpayers no later than March 31 of the year following the expiring tax period. The organization, which includes a separate division, at the end of each reporting and tax period submits to the tax authorities at its location a tax return for the organization as a whole with distribution among separate divisions.

Tax payable upon expiration of the tax period is paid no later than the deadline established for filing tax returns for the corresponding tax period, i.e. no later than March 31 of the year following the expiring tax period.

Quarterly advance payments are paid no later than the deadline established for filing tax returns for the corresponding reporting period, i.e. no later than 30 days from the end of the reporting period.

Monthly advance payments due during the reporting period are paid no later than the 28th day of each month of that reporting period.

Taxpayers who calculate monthly advance payments based on actual profits received make advance payments no later than the 28th day of the month following the reporting month.

So, income tax is one of the most important taxes in the tax system of the Russian Federation and serves as a tool for the redistribution of national income. This is a direct tax and its final amount depends entirely on the final financial result. Payers of income tax are Russian organizations and foreign organizations operating in the Russian Federation through permanent representative offices and (or) receiving income from sources in Russia. The object of income taxation is profit, which includes income received minus the amount of expenses incurred.

We can say that income tax is a very complex economic category, which is enshrined in law. Revenues from income tax occupy one of the leading positions in budget revenues and its regulation is of national importance, both for the state and for taxpayers - enterprises and organizations.

Topic: Organization and methodology for conducting tax audits on corporate income tax

Type: Coursework | Size: 35.33K | Downloads: 193 | Added 01/24/13 at 18:33 | Rating: +3 | More Coursework

University: VZFEI

Year and city: Ufa 2012

Introduction 2

Chapter I. General characteristics of corporate income tax 4

1.1 Payers of income tax 4

1.2 Object of taxation 7

Chapter II. Organization and methodology for conducting a tax audit 15

2.1 Desk tax audit 15

2.2 On-site tax audit 23

Conclusion 27

List of used literature 29

Introduction.

The development of market relations in Russia, the global financial crisis, a sharp drop in government revenues and the federal budget deficit contributed to the formation of a new look at the relationship between government and business, the problems of tax planning, accounting and control. The reform and transformation of financial, legal, law enforcement institutions and mechanisms is accompanied by the convergence of corporate interests, monitoring of financial indicators and analysis of the economic results of the enterprise in connection with national tasks, including in the form of paying taxes.

In the current conditions, activities to modernize the Russian economy and ensure the required level of income for the budget system of the Russian Federation occur simultaneously with the imposition on entrepreneurs of a high degree of responsibility in fulfilling the obligation to pay taxes. In the budget message of the President of the Russian Federation dated May 25, 2009. “On budget policy in 2010-2012” D.A. Medvedev noted: “We must clearly understand that deliberate tax evasion is nothing more than depriving society of resources that are especially necessary in modern conditions. Therefore, such actions must be strictly suppressed.”

This, in turn, requires unconditional compliance with tax legislation.

Tax control is a complex and time-consuming function that involves checking compliance with legislation on taxes and fees, carefully checking the correctness of calculation, completeness and timeliness of payment of taxes and fees, and monitoring the implementation of identified violations.

Since January 1, 2002 The procedure for paying income tax is determined by the norms of Chapter 25 of the Tax Code of the Russian Federation. Control over the correctness of calculation, timeliness and completeness of the payment of income tax by taxpayers is carried out by tax authorities when conducting desk and documentary audits.

Tax accounting is carried out in order to generate complete and reliable information on the accounting procedure for tax purposes of business transactions carried out by the taxpayer during the reporting period, as well as to provide information to internal and external users to monitor the correctness of calculation and timely transfer of income tax to the budget.

In this regard, the peculiarity of the income tax audit will be to establish the reliability of accounting data and the correctness of its reflection in tax accounting for the purpose of determining income tax.

The purpose of writing a term paper is a detailed study of the elements of taxation of corporate income tax, the correctness of determining the income and expenses of an organization, the calculation of the tax base, the correct application of tax rates, the procedure for calculating and the timing of payment of this tax.

The following tasks will contribute to achieving this goal:

- studying special educational literature;

- studying the Tax Code of the Russian Federation;

- use of the accounting and legal system Consultant-Plus;

- use of periodicals and Internet resources to study the issue of taxation on corporate income tax.

List of used literature:

- Romanov A.N. Organization and methods of tax audits: Textbook. allowance. M.: University textbook, 2009. -288s

- Kuzmenko V.V. Organization and methods of tax audits. Textbook allowance. M.: University textbook. INFRA - M.2012.-186p.

- Levkevich M.M. Small business: accounting and taxation.

- Bayanduryan G.L. Federal taxes and fees. Textbook allowance. M.: Master: NIC INFRA-M., 2012 - 240 p.

- Nesterov G.G., Terzidi A.V. Tax accounting. Textbook. - M.: Reed Group, 2011. - 304 p.

- Anashkin A.K. Safety precautions for tax audits. Practical guide. - M.: TSENTRKATALOG, 2008. -352 p.

|

Verification checkpoints |

||||||

|

Profit of the reporting period |

Income tax benefits |

Taxable income |

||||

|

Purpose of the audit |

Checking the reliability of the calculations made to determine the financial result |

Checking the accuracy and completeness of calculations of indicators included in the tax base |

Checking the accuracy of tax accrual for other types of activities and the procedure for their transfer |

Checking the accuracy of the accrual of contributions to the funds and the completeness of posting to the relevant accounting accounts |

Checking the reliability of the company's benefits by category |

Checking the correctness and reliability of the volume of taxable profit, the reality of calculating income tax and the completeness of its transfer to the budget |

|

Information base |

F. No. 2, financial results report |

F. No. 2, statement of financial results, business transactions on accounts 90, 91, 84, 99, etc. |

Constituent documents and charter of the enterprise in terms of types of activities permitted by law; cost journals by type of activity |

Constituent documents and charter of the enterprise, estimates for the formation of the targeted use of funds |

Tax legislation in terms of benefits provided; Appendix No. 8 “Calculation of tax on actual profit” |

Determined in different ways based on “Calculation of tax on actual profit”, payment documents for advance payments, General Ledger |

|

Audit areas |

Organizational and legal, financial analytical, tax confirmation |

tax confirming |

tax |

tax |

tax |

tax |

End of table. 15.2

|

Components of the audit methodology |

Verification checkpoints |

|||||

|

Profit of the reporting period |

Profit of the reporting period, adjusted for tax purposes |

Profit and income taxed differently than the profit of the reporting period |

Contributions to reserve and other funds |

Income tax benefits |

Taxable income |

|

|

Techniques and procedures |

Comparisons, comparisons |

Tracking |

Documentary research, legal regulation, calculations, comparisons, comparisons |

Documentary research, legal regulation, calculations, comparisons, comparisons |

Legal regulation, calculations, comparisons, comparisons |

Legal regulation, calculations, comparisons |

|

Possible violations |

Hiding part of the profit |

Understating profits, concealing certain types of income, including unreasonable expenses in production costs |

Concealment of profits received from other activities |

Lack of entries in the accounting registers on the formation of these funds, or allocated to other accounts |

Lack of supporting documents for preferential taxation |

Concealing part of taxable profit |

The practice of conducting audits of such descriptions shows that documents of proper quality are not drawn up and there are often cases when decisions to write off are made by the chief accountant and the head of the enterprise, while an investigation into the reasons for the formation of such debts is not carried out, the debts of enterprises are not confirmed by reconciliation acts, and an in-depth examination of such debts write-offs sometimes reveal cases of abuse and sometimes theft of the MC, both by individual officials and groups of persons. Often, fines paid that are not related to business contracts or imposed on specific officials are attributed to the financial results of the organization, and not to the profits remaining at the disposal of the enterprise or the perpetrators. When writing off losses from natural disasters or other extreme cases, an inventory of damaged property is not carried out, and losses are written off according to established acts, and, as a rule, for such write-offs, documents from the relevant local authorities confirming the fact of a natural disaster that occurred in the area are not attached as justification. .

When checking financial results, the auditor must also check the correctness of the calculation and timeliness of contributions to the budget of income tax, the correctness of the distribution of profits between the founders, and the correctness of the formation of special funds. In addition to checking the accrual and payment of income tax, compliance with the deadlines for its accrual and payment is checked. The main thing in the auditor’s work is to determine the reliability of the calculation of the taxable base, confirm the correctness of the calculation of income tax and expenses incurred from profits after taxes and mandatory payments.

Article 313 of the Tax Code of the Russian Federation provides for a system for organizing tax accounting as follows: use of data from accounting registers with complete coincidence of accounting and tax accounting data); introduction of additional accounting registers (if the registers contain insufficient information to fill out the declaration); maintaining independent tax accounting registers. Most organizations use the second option, bringing accounting and tax accounting closer together if possible, and where this is not possible, they introduce separate analytical accounts and use additional details in the accounting registers. Auditors must evaluate the effectiveness of such tax accounting organization.

In forming an opinion on the financial statements, the auditor must obtain and evaluate evidence on qualitative aspects such as existence, completeness, measurement and measurement, classification, presentation and disclosure.

Table 1 - Assessment of information on qualitative aspects of reporting

|

Qualitative aspect of reporting |

Evaluation of information |

|

Existence |

The income tax expense and tax liability to the budget reflected in the financial statements actually exist and relate to the audited reporting period |

|

Income tax expense and tax liability to the budget are reflected in the financial statements in full |

|

|

Assessment (measurement) |

The income tax expense and tax liability to the budget indicated in the financial statements are correctly calculated and truly reflect the results of the organization’s activities. |

|

Classification |

The organization's tax liability is correctly allocated to current and deferred liabilities |

|

Presentation and disclosure |

The liability for payment and refund of taxes, as well as income tax expense, are correctly classified and disclosed in the financial statements in sufficient detail. |

Auditors must study primary documents and analytical tax accounting registers, reporting, appendices to the tax return, the reliability of accounting and taxable profits, the correct application of rates and benefits, and the accuracy of adjustments to accounting profits for tax purposes. It is necessary to take into account that tax accounting data must reflect the procedure for forming the amount of income and expenses, the procedure for calculating the share of expenses taken into account for tax purposes in the current tax (reporting) period, the amount of the balance of expenses (losses) subject to expense in the following tax periods , the procedure for forming the amounts of created reserves, as well as the amount of debt for settlements with the budget for income tax.

Table 2 - Sources for generating income tax reporting information

|

Reporting indicator |

Reporting form |

A source of information |

|

Profit calculated according to accounting rules |

Gains and losses report |

Accounting registers |

|

Profit calculated according to the rules of tax legislation |

Tax accounting registers |

|

|

Current income tax expense |

Gains and losses report. |

Accounting and tax registers |

|

Current obligation or income tax asset |

Gains and losses report |

Accounting registers |

|

Deferred tax liability or asset |

Gains and losses report |

Accounting registers |

At the first stage of the audit, it is necessary to evaluate the internal control system of the audited organization.

Table 3 - List of questions for assessing the internal control system for income tax calculations

|

Test name (question) |

Auditor's findings |

||

|

Does the enterprise have legislative and regulatory acts on the calculation and payment of income tax? |

The enterprise needs acquire legislative and regulatory acts on the calculation and payment of income tax |

||

|

Does the enterprise have an employee responsible for the correct calculation and payment of taxes? |

It is necessary to make an appropriate proposal for changes in the staffing table and job descriptions of the enterprise |

||

|

Does the chief control accountant correctness tax calculations |

It is necessary to find out who is entrusted with control |

||

|

Has an accounting system been developed? policy for tax purposes |

Check the availability of an order on accounting policies for tax purposes. |

||

|

Is the method of determining revenue from the sale of goods, products, works, services reflected in the accounting policy for tax purposes? Are income recognized in the reporting (tax) period in which they occurred, regardless of the actual receipt of funds (accrual method) |

It is necessary to check the definition of revenue for tax purposes in accordance with paragraph 1 of Art. 271 NKRF |

||

|

Is the accounting policy for taxation purposes of the enterprise written down the procedure for estimating inventories of material resources, written off for production |

It is necessary to check the actual procedure for assessing inventories and calculating the actual cost of material resources written off for production |

||

|

Is the accounting policy for tax purposes reflecting the procedure for calculating depreciation of intangible assets? |

It is necessary to check the actual order of amortization of intangible assets |

||

|

For tax purposes, is the accounting policy established for calculating depreciation on fixed assets? |

It is necessary to check the actual order of depreciation on fixed assets |

||

|

Does the enterprise’s accounting policy provide for the creation of reserves for future expenses and payments, in particular a reserve for future expenses for vacation pay, a reserve for the payment of annual remuneration for long service, for warranty repairs and warranty service? |

It is necessary to check the actual procedure for creating reserves for upcoming expenses and payments and its compliance with Articles 224 and 267 of the Tax Code of the Russian Federation |

||

|

Is the accounting policy of the enterprise reflecting the method of accounting for OS repair costs? |

It is necessary to check the actual method of accounting for OS repair costs and compliance with Art. 260 NKRF |

||

|

Does the enterprise have an estimate of entertainment expenses for the year? |

It is necessary to check the actual procedure for determining the amount of entertainment expenses |

||

|

Have the company established rules and regulations for travel and entertainment expenses, advertising expenses? |

It is necessary to check and adjust the actual amounts according to established standards (Article 264 of the NKRF) |

||

|

Is there a limit on the payment of compensation for the use of personal cars for business trips? |

It is necessary to check and adjust actual amounts according to established standards |

||

|

Is there a procedure established for writing off losses from markdowns of raw materials, supplies, finished products and goods? |

It is necessary to check the actual write-off of losses |

||

|

Is the value of gratuitously received property taken into account for tax purposes? property from other enterprises |

It is necessary to evaluate the value of property received free of charge at market prices |

||

|

Has the procedure for maintaining tax accounting for depreciable property and operations with fixed assets been determined? |

It is necessary to determine the amount of losses from the sale of depreciable property and the number of months during which the amount of the loss should be included in the composition of non-operating expenses and the amount of expenses attributable to each month |

||

|

Has the list of direct costs and the procedure for assessing work in progress, balances of finished products, and shipped goods been determined? |

Check the actual distribution of direct costs for the balance of work in progress, the balance of finished products, goods shipped in accordance with Article 319 of the Tax Code of the Russian Federation |

||

|

Is there a procedure for determining expenses for trading operations? |

Check that the current month's expenses are divided into direct and indirect. Direct costs include the purchase price of the goods and the costs of delivering purchased goods to the warehouse of the buyer of the goods. All the remaining expenses incurred in the current month are recognized as indirect expenses and reduce the income from sales of the current month. Direct costs are distributed to the balance of goods in the warehouse and to goods sold at an average percentage |

||

|

Is the loss carried forward? |

Check the availability of documents confirming losses in previous tax periods. Make sure that the total amount of the transferred loss corresponds to the tax base calculated in accordance with Article 274 of the NKRF (clause 2 of Article 283 of the NKRF) |

||

|

Are income and expenses determined on the basis of primary documents and tax accounting documents? |

Check the compliance of the definition of income with Art. 249, 250 and 251 of the Tax Code of the Russian Federation, expenses incurred Art. 252,253-264, 270 of the Tax Code of the Russian Federation |

||

|

Are income received in kind taken into account when determining the tax base based on the transaction price, taking into account the provisions of Art. 40 Tax Code of the Russian Federation |

Check the actual definition of income for tax purposes |

||

|

Is the tax rate set at 20% |

Check the actual application of the tax rate, compliance with Art. 284 NKRF |

||

|

Are tax payment deadlines met? |

Check the procedure for calculating tax and advance payments in accordance with Art. 286 Tax Code of the Russian Federation |

When auditing income taxes, it is advisable to use regulatory documents, as well as data from primary documents, accounting registers and reporting.

Consistently executing the program, auditors check:

- - the correctness of reflection in accounting and reporting of actual profits (losses) from the sale of products (works, services);

- - the reliability of accounting data on the costs of production and sale of products (works, services), the completeness and correctness of the reflection in the accounting of the actual costs of their production and sale and compliance with the procedure for accounting for the costs of production of finished products;

- - reliability and legality of reflection in the financial statements of other income and expenses (non-operating for tax purposes);

- - correctness of income tax calculations.

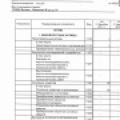

Table 4 - Description of the audit procedures used and their results for the audit of taxable profit

|

List of audit procedures |

Scope of inspection |

Method of performing audit procedures |

results |

|

|

Establishing the correctness of reflection in the reporting of actual revenue from sales of main products (works, services) |

F. No. 2 of the annual report, General Ledger (current balance) on the account loan. 90.1 for the reporting period |

Verify the data f. 2 with data on the General Ledger (current balance) for the loan account 90.1 and determine the amount of the discrepancy. The results of the reconciliation are reflected in the working document |

The amount reflected in the General Ledger (current balance sheet) for the loan account. 90.1, corresponds to the amount received after reducing revenue according to reporting form No. 2 by the amount of VAT and excise taxes |

|

|

Checking the correctness of reporting the actual costs of production of sold products |

F. No. 2 of the annual report, General Ledger (current balance), primary documents, accounting registers for the Debit account. 90 for the reporting period |

They determine from the credit of which accounts expenses were written off to the debit of the accounts on which expenses are formed, as well as the timeliness and legality of their reflection in accounting and tax registers: order journals, books, statements. The results of the reconciliation are reflected in the working document |

The amount reflected in the accounting registers corresponds to the data in Form No. 2 of the actual costs of producing sold products (works, services) |

|

|

Difference between income and expenses |

These declarations correspond to the results received during recalculation |

|||

|

Checking the correctness of determining taxable profit from sales of main products (works, services) |

F. No. 2 of the annual report, tax registers, income tax return (sheet 02) |

Monitor the correctness of determining the amount of profit according to tax registers and sheet 02 with attachments of the tax return |

There is no upward adjustment of profits by the amount of excess of actual costs included in the cost of products (works, services) over the entertainment expenses established by the standards |

|

|

Checking the correctness of determining profit from other sales |

Form No. 2 of the annual report, General Ledger, (current balance sheet), acts of liquidation of fixed assets, act of acceptance and transfer of fixed assets, PKO, other primary documents, bank statements and accounting registers for account 91 for the reporting period |

The data reflected in Form No. 2 under the items “Other Income” and “Other Expenses” is verified with the data reflected in the account. 91. Adjust income data for the amount of VAT and other similar mandatory payments |

Data reflected in f. No. 2, correspond to the results obtained in account 91 with appropriate adjustments for the amount of VAT and other mandatory payments |

|

|

Checking the correctness of reporting profit (loss) from other operations |

F. No. 2 of the annual report, General Ledger (negotiable balance sheet) and primary documents on the basis of which accounting entries were made for the debit and credit of account 91 |

The data shown in Form No. 2 under the items “Other Income” and “Other Expenses” is reconciled with the data in the General Ledger under Account 91. If a difference occurs, the amount of hidden income taxation is determined. The results of the reconciliation are reflected in the working document |

The data reflected in Form No. 2 corresponds to the data in the General Ledger for credit and debit account 91 |

|

|

Checking the correctness of exclusion from taxable profit of certain types of income in accordance with legislative acts |

Targeted revenues, targeted financing, capital investments in the form of inseparable improvements to the leased property made by the tenant |

Reconcile data from accounting and tax registers |

Income in accounting corresponds to income in tax accounting registers |

|

|

Checking the correctness of income tax calculations |

Income tax return |

The accuracy of the calculation provided by the organization is verified with the calculation obtained as a result of the audit. The results of the reconciliation are reflected in the working document |

The declaration data corresponds to the reconciliation results |

The verification of primary documents and entries in accounting registers is carried out using a continuous method, in which all documents and entries in accounting registers are checked. With the sampling method, a part of the primary documents is checked in each month of the audited period. The method of checking individual transactions is determined by the auditor conducting the checks independently.

The reliability of financial and economic transactions is established through formal and arithmetic verification of documents or using special documentary control techniques.

During a formal check, the correctness of filling out all document details is established; the presence of unspecified corrections, erasures, additions to the text and numbers; authenticity of signatures of officials and financially responsible persons. An arithmetic check determines the correctness of the calculations in the documents.

The reliability of business transactions reflected in primary documents, if necessary, can be established by conducting counter-inspections at enterprises with which the inspected enterprise has economic ties.

Based on primary documents, accounting registers, and reporting data, the auditor, when determining the actual revenue from sales of the main products, checks in the following order:

- 1. Reconciles the data reflected in reporting form No. 2 under the article “Revenue from sales of products (works, services”) with the data in the General Ledger under the credit of account 90.1. The total amount of the discrepancy should be the amount of value added tax, as well as the amount of excise taxes. In cases of discrepancy between the amount reflected in the General Ledger under the credit of account 90.1 and the amount received after reducing revenue by the amount of VAT and excise taxes according to reporting form No. 2, the auditor is obliged to identify the reason for the discrepancy and reflect this in the working documentation.

- 2. Reconciles the data in the General Ledger with the data of the order journal No. 11 (when maintaining a journal-order form of accounting) or with accounting registers reflecting the amount of sales of finished products (when maintaining a memorial form of accounting) on the credit of account 90.1. After reconciling the reporting data and the data reflected in the accounting registers, the auditor proceeds to verify the correctness of the execution of transactions for payment and shipment of finished products (works, services).

One of the main types of verification is a comparison of the amounts reflected in the credit of account 90.1 in the settlement documents presented to the customer and the amounts reflected in the accounting records in the debit of account 62 “Settlements with buyers and customers”.

When auditing, the auditor must take into account the rules for recording transactions in accounting and the requirements of tax legislation. Income and expenses of ordinary activities obtained from accounting data are adjusted in accordance with the requirements of Chapter. 25 Tax Code of the Russian Federation.

When performing work under a contract in which the customer's materials are used, the release of materials to the contractor from the customer is not considered as a sale.

Such contracts qualify as contracts for the processing of raw materials supplied by customers, i.e. raw materials accepted by the contractor without payment and not belonging to him. The contractor will account for raw materials on off-balance sheet account 003 “Materials accepted for processing” and on account 90.1; for the customer, its value will not be reflected and will not be included in the tax base.

In cases where amounts are reflected in the debit of account 90.2 without the presence of credit turnover, the auditor must determine the amount of indirect costs and make sure that for tax purposes only indirect costs are recognized and there is no income hidden from taxation.

The auditor needs to pay attention to the reflection in accounting and taxation of property received free of charge. In accordance with paragraph 8 of Art. 250 of the Tax Code of the Russian Federation, the taxable profit of an enterprise increases by the cost of fixed assets received free of charge. Therefore, at the time of receipt of fixed assets, the amount of this cost should be recognized as income. But in accordance with clause 8 of PBU 9/99, the value of assets received free of charge is taken into account as part of other income. First, the cost of fixed assets received free of charge is accounted for as the debit of account 98 “Deferred income”, then it is written off monthly from account 98 to the credit of account 91.1. In order to avoid double taxation, taxable profit must be reduced by the amount of income that is debited monthly from account 98 to the credit of account 91.1.

You should also check how an organization that pays a single tax on imputed income for one of its activities distributes general business and general production expenses. It must distribute these incomes in proportion to the revenue received from each activity.

In accordance with clause 21, current income tax is recognized as income tax for tax purposes, determined on the basis of the amount of conditional expense (conditional income), adjusted to the amount of permanent tax liability (asset), increase or decrease in deferred tax asset and deferred tax liability of the reporting period.

In the absence of permanent differences, deductible temporary differences and taxable temporary differences that give rise to permanent tax liabilities (assets), deferred tax assets and deferred tax liabilities, the contingent income tax expense will be equal to the current income tax.

By Order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n, the forms of financial statements were approved. To comply with the requirements of PBU 18/02, special lines have been introduced into Form No. 2 to reflect tax assets and liabilities. Form No. 2 does not use permanent tax liabilities and the amount of conditional income tax expense (income), although they are reflected in account 99 “Profits and losses” and, together with deferred tax assets and liabilities, participate in the calculation of income tax. The amount of income tax expense is formed in the income statement as a set of amounts reflected under the items “Deferred tax assets”, “Deferred tax liabilities” and “Current income tax”. Disclosure of these indicators in form No. 2 is provided for in clause 24 of PBU 18/02.

In Form No. 2, income tax expense consists of current income tax, deferred tax assets and liabilities. The formula for determining net profit may look like this:

PE = BPDN + ONA - ONO - TNP,

where PE is net profit;

BPDN - accounting profit (loss) before tax;

OTA - deferred tax asset;

IT - deferred tax liability;

TNP - current income tax.

The amounts of conditional expenses and permanent tax liabilities and assets are included in the calculation of the net profit (loss) of the enterprise, although they are not included in Form No. 2. These indicators are included in the current income tax.

When checking the correctness of filling out the report, it is necessary that the amount of the line “Net profit (loss)” of the reporting period corresponds to the balance of account 99 at the end of the reporting period.

PBU 18/02 states that the current income tax is equal to the conditional expense (conditional income), increased by the permanent tax liability and deferred tax asset and reduced by the permanent tax asset and deferred tax liability:

TNP = UR + PNO - PNA + SHE - IT.

If we make transformations in this formula, we get:

UR + PNO - PNA = TNP - SHE + IT.

From this equality it follows that if we take conditional expense and permanent tax liabilities (assets) as elements of income tax expense, then the amount of net profit will be the same as if we take current income tax as such elements , deferred tax assets and liabilities. Thus, the requirements of paragraph 24 of PBU 18/02 are met, which state that permanent tax liabilities, deferred tax assets, deferred tax liabilities and current income tax must be reflected in the profit and loss statement. This also complies with the requirements of international financial reporting standards. Users of financial statements should see not a conditional tax, but the real amount of income tax, deferred assets and tax liabilities that arise for the organization.

The most important area of an income tax audit is the verification of expenses. An effective and high-quality audit of income tax is possible only if the collected audit evidence allows us to express an opinion with a high degree of confidence on the correctness of calculation and timely acceptance of expenses for tax purposes. The purpose of a tax audit of expenses is to check the compliance of the applied procedure for accounting for expenses with the requirements of tax legislation.

Expenses are subject to verification in the context of expense groups and accounting objects, with familiarization with which the verification of the formation of expenses should begin. A tax audit of expenses should include three stages: checking the legality of incurring costs to expenses, checking the validity and documentary evidence of expenses, checking the timeliness of attributing amounts to expenses of the reporting (tax) period.

At the first stage, it is necessary to determine the compliance of the expenses accepted for tax accounting with the list of expenses recognized as expenses for income tax purposes.

Ch. 25 of the Tax Code of the Russian Federation provides for an open list of expenses, which is due to the impossibility of providing for all expenses. At the same time Art. 270 of the Tax Code of the Russian Federation provides a list of expenses that are not taken into account for tax purposes. The first stage of the tax audit of expenses should be aimed at establishing the facts of the existence of such expenses and excluding them for the purposes of calculating corporate income tax.

The second stage is associated with checking compliance with the requirements established by Art. 252 of the Tax Code of the Russian Federation and are mandatory for recognizing costs as expenses. In accordance with the requirements of this article, expenses must be justified (economically justified), documented and incurred to carry out activities aimed at generating income. Economic justification is a fundamental point for assessing the legality of attributing costs to expenses that reduce the taxable base for income tax.

A necessary component of an income tax audit is checking documentary evidence of expenses incurred. Expenses that are not documented in primary documents cannot be recognized for profit tax purposes.

The absence of primary documentation for the receipt of materials or goods and their transfer for further use may be a reason for refusal to recognize expenses.

The absence of documents threatens with sanctions for gross violation of the rules for accounting for income, expenses and taxable items (Article 120 of the Tax Code of the Russian Federation): the fine for a single violation is 5,000 rubles, for a repeated violation - 15,000 rubles. If the lack of primary documents led to an underestimation of the tax base, the fine will be 10% of the amount of unpaid tax, but not less than 15,000 rubles. Therefore, the auditor needs to pay close attention to the primary accounting documents, which not only must be available, but also filled out correctly. The documents must have signatures of authorized persons that do not differ from the signatures of the same persons on other documents of the organization, a clear seal, if its presence is required. The document must not contain erasures; it must indicate the number and date of its preparation. An accountant must be attentive to the design of his internal documents and control of primary documents received from counterparties.

Until expenses are documented, they are not expenses for tax purposes. Documents are necessary to confirm the fact of expenses incurred, which is a condition for their inclusion in tax expenses. The main purpose of the requirement for documentary evidence is tax control. Primary documents are needed to ensure that the expenses are real and that the tax base is calculated correctly. And this is possible if the documents are available to the organization, which can present them upon request. Costs become expenses at the moment of receipt of documents confirming them, therefore even those expenses for which art. 272 of the Tax Code of the Russian Federation establishes the moment of recognition as the date of signing of the primary document; it cannot be written off at a time when the organization itself does not yet have the document. Art. 313 of the Tax Code of the Russian Federation obliges to calculate the tax base based on the results of each reporting and tax period based on tax accounting data and establishes that tax accounting itself is “a system for summarizing information for determining the tax base for a tax based on data from primary documents...”. Consequently, the tax base at the end of the period should be calculated on the basis of data from primary documents available at the time of calculation.

The Tax Code of the Russian Federation does not establish a list of documents that must be drawn up when performing expense transactions; it does not contain any special requirements for their completion. In paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, from January 1, 2006, stipulates that in tax accounting, costs can be included in tax calculations if there are documents indirectly confirming them. For example, if no documents have been received from the counterparty, then a unilateral document can be considered a document drawn up in accordance with Russian legislation. Neither in Chapter 25 The Tax Code of the Russian Federation and the Law “On Accounting” do not say that the purchase of goods, works or services can only be confirmed by bilateral documents. The law does not in any way limit the range of documents that can be used to confirm business transactions, but only puts forward requirements for the list of details and form. It must be approved either by the statistical body or by the accounting policy of the organization. The possibility of drawing up a unilateral act is also recognized by the Civil Code of the Russian Federation, directly indicating it in Art. 753 (it talks about construction contracts).

Unilateral documents can be recognized by the auditor in the case when the document was received in the next tax period and the date of signing the document does not correspond to the time of the transaction. For example, the parties signed the acceptance certificate for work performed for the organization in December 2008 only in March 2009. Tax authorities may refuse to consider it a document drawn up in accordance with Russian legislation, which requires drawing up a primary document at the time of the transaction, and if this is not possible, then immediately after its completion (Clause 4 of Article 9 of the Law “On Accounting”). Therefore, such an act can only serve as indirect confirmation of expenses, and the primary document will be a unilateral document drawn up based on the results of the actual acceptance of the work result in December 2008.

Until the costs are documented, they are not expenses for income tax purposes. The Law “On Accounting” exempts organizations from the obligation to use unified forms of primary documents and allows them to develop forms of primary documents independently.

Tax authorities have the right to request from taxpayers both tax and accounting data (letter of the Ministry of Finance of Russia dated December 4, 2007 No. 03-02-07/1-468). The letter states that tax accounting is formed on the basis of primary accounting documents and information reflected in the accounting registers. Consequently, to check the correctness of calculation, completeness and timely payment of tax, not only tax, but also accounting and accounting data are required. Auditors should also pay attention to this.

An income tax audit is a complex and lengthy process. Auditors are constantly working on how to reduce audit time as much as possible without reducing its quality or increasing audit risk. One of the most effective ways to solve the problem is to develop procedures in the form of internal audit firm standards.

In our country, this method of control is a relatively new thing, but it is rapidly developing.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

In the article we will talk about the audit of income tax, its features, goals and objectives that it solves, and we will present the main methods and stages of this type of control.

General information:

Profit is the result of an enterprise’s activities, which is subject to a special tax.

This payment is transferred to the local and federal budgets by all organizations located in Russia.

Income tax audit is a very responsible procedure. After all, thanks to this payment, the lion’s share of the revenue part of the territory’s budget is formed.

The auditor checks:

- the correctness of the formation of the tax base for this tax;

- justification for using benefits;

- controls the status of payments to the budget;

- analyzes accounting methods;

- conducts an audit of the correctness of tax calculations;

- controls the preparation of reports for the tax office.

The activities of audit companies are regulated (as amended on March 4, 2014) “On Auditing Activities.”

Goals

The purpose of an income tax audit is to confirm the correctness of calculations for this payment to the budget, the timeliness of payment, the completeness of the amount, and compliance with the standards of current legislation.

If we consider the audit process based on qualitative aspects:

Tasks

The auditor should analyze:

- correct determination of tax rates and tax base;

- the procedure for maintaining analytical and synthetic accounting of settlements for this payment;

- assessing the correctness of the calculation of the tax base in accordance with the norms established by law;

- reflection of deferred tax amounts in financial statements;

- timely transfer of payment to the budget.

Depending on the characteristics of the enterprise’s activities, the tasks for the audit may be expanded and supplemented with other items.

Legality

The audit of income tax is regulated by current legislation, namely the law of December 30, 2008 307-FZ.

The authorized federal executive body - the Ministry of Finance of the Russian Federation - acts as a regulator of the activities of auditors.

It is this government structure that develops and adopts regulations, standards, establishes the procedure for the certification system, and monitors auditors’ compliance with the law.

Also, when performing his duties, the auditor is guided by the rules.

Aspects when checking

The audit of income tax calculation includes checking the main documents of the enterprise:

- , balance sheet, primary documentation, which confirms the company’s income and expenses.

In addition to the listed items, the auditor analyzes the accounting registers for account No. 68, subaccount “Calculations for income tax.”

Enterprise audit methodology:

All work of audit companies related to income tax is divided into three broad stages. Knowing about the features of each of them, the accounting department can carefully prepare and independently verify the documents subject to verification.

So, the order of work is as follows:

- Introductory stage.

- Main stage.

- The final stage.

At each of them, specialists use certain methods that help achieve solutions to all income tax audit problems. Let's look at each in detail.

Introductory stage

This is the first stage from which the audit begins. Upon completion, the specialist must identify the degree of compliance with the current legislation of the taxation procedure used by the enterprise, and identify the degree of potential tax violations.

The familiarization stage includes the following procedures:

- assessment of tax and accounting systems;

- audit risk analysis;

- materiality level budgeting;

- study of the main factors that influence tax indicators;

- studying the tasks and powers of employees involved in the calculation and payment of income taxes;

- assessment of the organization of document flow adopted at the enterprise.

This is the audit plan at the first stage - introductory, that is, the auditor develops strategy and tactics, determines the scope of the work ahead.

The specialist collects and studies information about the activities of the audited enterprise and determines the most important areas of control.

The auditor analyzes unusual transactions that occurred during the period under audit. For example, a change in the method of calculating tax, the emergence of new services in the organization.

Main stage

The name suggests that this is the most important audit period.

At this stage, the auditor is engaged in an in-depth study and control of those areas of tax accounting in which problems, inconsistencies and inaccuracies were discovered, that is, shortcomings were identified taking into account the level of materiality.

So, the specialist solves the following tasks:

- checking the company's tax reporting;

- analysis of the correctness of determining the tax base;

- drawing up a forecast of tax consequences for the enterprise (this procedure is carried out if incorrect use of tax legislation standards is identified).

Let us dwell in detail on the types of violations that a specialist can detect during an income tax audit.

The main mistakes are:

- incorrect formation of the base that is subject to taxation;

- inclusion of expenses that are economically unjustified;

- violation of the procedure for maintaining the accounting method adopted in the organization;

- incorrect use of benefits;

- errors in calculating tax deductions;

- lack of an internal system that exercises control over the calculation of income tax;

- errors in mathematical calculations (arithmetic errors).

It is clear that this stage is the longest and most important.

The auditor is required to have knowledge of tax legislation, the ability to analyze various business transactions, and see documents “through and through.”

Photo: description of audit procedures (example)

The final stage

The last point that the audit program includes is the final stage of the auditors’ work.

The audit is coming to an end, the specialist formalizes the results of the income tax audit. The auditor draws up a package of documents and transmits the results to the management of the organization.

In his conclusion, he indicates the identified errors and violations, gives a general conclusion on the calculation of tax, gives recommendations and advice.

Emerging nuances:

Income tax audit is a complex job that should only be performed by highly qualified specialists.

The auditor must pay attention to the following nuances:

- Take into account and analyze all income and expenses, paying special attention to those of them whose share is the greatest.

- Familiarize yourself with all acts received from the Tax Inspectorate for the period subject to audit.

- Carefully check the correctness of the definition of taxable turnover.

- Make sure that all amounts taken into account when calculating income tax correspond to accounting data.

A competent specialist has all the information related to the income tax audit. He will definitely take into account all the subtleties and nuances regarding this procedure.

Separately, it is worth noting the audit under the simplified tax system, which includes:

- checking fixed asset accounting;

- order of conduct;

- control over the formation of the tax base;

- identification of income and expenses that are not taken into account when calculating the tax base;

- timely and complete calculation and payment of income tax.

Example on an organization (LLC)

Let's consider an example of conducting an income tax audit in the limited liability company "Team". This organization was founded in 1999.

The authorized capital is 10,000 rubles. There are 4 founders who are employees of the company, each of them has equal shares of 25%.

Komanda LLC carries out activities related to the wholesale and retail supply of components for computer equipment.

Retail is carried out through a retail outlet, wholesale through a wholesale department. There are 30 employees in the organization.

The main activity is wholesale trade, the share of which in total sales is 85% for 2013.

The work of Komanda LLC is automated; there is a website on the Internet through which the organization promotes its products. The company is actively developing, offering a wide range of products and expanding its area.

Wholesale trade of Komanda LLC is subject to the general taxation regime, retail trade is subject to the payment of a single tax on imputed income.

The specialist who is appointed to conduct an income tax audit initially studies and analyzes the following indicators:

- accounting policy;

- basic methods of accounting and tax accounting;

- methods of storing documentation related to the company’s activities;

- the procedure and timeliness of recording business transactions in the accounting registers;

- critical areas of accounting.

During the audit, the compliance of the activities of Komanda LLC with current legislation was checked.

The specialist did not identify any violations. The auditor then studied the specifics of the work and the adopted accounting system. The next stage is the determination of intra-economic risk.

Based on the results of this work, the auditor concluded that the company does not engage in risky activities, does not conduct foreign economic operations, carries out wholesale and retail trade, and does not have branches or subsidiaries.

The result is a low level of on-farm risk, amounting to 50%.

However, when assessing the internal control system, the specialist noticed that Komanda LLC does not have any controls.

Taking into account the assessment of the accounting and internal control system, the auditor assessed the risk at 80%. This indicator indicates a low, insufficient internal control system.

The specialist accepted the audit risk as 5%, respectively, the risk of non-detection is:

5% (50% * 80%) = 12,5%.

This indicator refers to low values.

Then the auditor selectively checked the primary documents that Komanda LLC provides to its customers. The specialist did not identify any errors.

The sections “Accounting for materials” and “Fixed assets” are also in order. No comments. The depreciation calculation was carried out correctly. All reconciliation acts with suppliers are signed on both sides.

The only remark that the auditor made concerns the violation in document OD 1 d (Appendix No. 7).

As a result, deviations arose in the cost of goods sold and direct costs of the trading organization, which is associated with differences in tax and accounting.

No violations were identified regarding the calculation and payment of income tax. All operations are carried out in a timely manner, the declaration is submitted electronically. The audit of current tax payments also did not reveal any violations.

In conclusion, the auditor indicated that the identified error did not lead to an understatement of the income tax base, recommended establishing an internal control system, and gave general advice on maintaining tax and accounting records.

Common mistakes in 2019

There are quite a lot of controversial issues regarding the calculation and payment of income tax. To avoid misunderstandings, it is necessary to adhere to current legislation and comply with established standards and requirements.

Knowledge of the laws will help you avoid mistakes related to income tax.

Bank income tax audit

Audits of banking organizations are annual mandatory procedures.

The main goal is to monitor the state of financial and economic activities of credit institutions, obtain an opinion on the liquidity and profitability of the bank, and assess the degree of risk of the operations performed.

Such verification is carried out by auditors who have the appropriate license.

The conclusion obtained based on the results of control is published together with the annual report and balance sheet.

Specialists conducting bank audits must know the specifics of the activities of banks and be able to analyze financial reports, including documents reflecting the accrual and payment of income taxes.

A bank audit is carried out on the basis of a contract concluded between the audit company and the management of the credit institution.

This document reflects the obligations and rights of the parties. Based on the audit, specialists develop recommendations in the interests of the bank’s founders.

Income tax audit solves many problems. Therefore, enterprises are recommended to enter into contracts with independent audit firms.