with changes from 03/11/2019

See also article"KVR 2018 – applied without errors"

Often in public sector institutions the question arises about attributing certain expenses to the field of information and communication technologies, which in turn are subject to payment at the expense of CVR 242. We will consider the procedure for attributing expenses to CVR 242 or 244 in this article.

What are KVR 242 and 244?

The description of KVR 242 and 244 is contained in the Procedure, approved. by order of the Ministry of Finance of Russia dated 06/08/2018 No. 132n (hereinafter referred to as Order No. 132n):

- KVR 242 "Purchase of goods, works, services in the field of information and communication technologies" (clause 51.2.4.2 clause 51 of Order No. 132n)

For this type of expenses, expenses of the federal budget and budgets of state extra-budgetary funds of the Russian Federation for the implementation of measures for the creation, taking into account trial operation, development, modernization, operation of state information systems and information and communication infrastructure, as well as expenses for the use of information and communication technologies are subject to reflection. in the activities of federal government bodies, including federal government institutions under their jurisdiction, and management bodies of state extra-budgetary funds of the Russian Federation.

Also, for this type of expenses, expenses of the budget of a constituent entity of the Russian Federation, the budget of a territorial state extra-budgetary fund, the local budget for the implementation of informatization measures, in terms of regional (municipal) information systems and information and communication infrastructure, are reflected, if a decision is made by the financial authority of a constituent entity of the Russian Federation ( municipal formation) on the application of expense type 242 “Purchase of goods, works, services in the field of information and communication technologies.”

- 244 “Other procurement of goods, works and services” (clause 51.2.4.4 clause 51 of Order No. 132n)

This CWR includes, in particular, the purchase of goods, works, services in the field of information and communication technologies for the needs of constituent entities of the Russian Federation (municipal entities), governing bodies of territorial state extra-budgetary funds, unless otherwise established by an act of the financial authority of the constituent entity of the Russian Federation (municipal entity) ), as well as expenses of state (municipal) budgetary and autonomous institutions for similar purchases.

What expenses are related to ICT?

If you have any questions on this topic, discuss them with our expert toll-free number 8-800-250-8837. You can view the list of our services on the website UchetvBGU.rf. You can also join our mailing list to be the first to know about new useful publications.

Expenses of public sector institutions are detailed by codes of types of expenses (hereinafter referred to as CWR). The procedure for applying the CVR is regulated by the provisions of paragraph 5.1 of Section III of the Instructions, approved by Order of the Ministry of Finance of Russia dated July 1, 2013 N 65n.

Incorrect use of expense type codes is a reason for claims from regulatory authorities. What to look for when choosing expense type codes in 2018? What recommendations do financial department specialists give? Let's find out in this article.

Changes in the application of CVR from 01/01/2018

On January 1, 2018, amendments to Directive No. 65n came into force, which also affected the use of CVR.

The changes affected, in particular, the code of types of expenses 244. The name of the code was shortened, now it is “Other purchase of goods, works and services”. The description of CWR 244 has also changed - references to the possible classification of expenses as not related to the ICT sector have been removed. Let us remind you that recipients of budget funds allocate expenses in the field of ICT (implementation of informatization activities) to CWR 242 “Purchase of goods, works, services in the field of information and communication technologies.”

As of January 1, 2018, the description of CVR 523 “Consolidated Subsidies” has been changed. The new edition stipulates that this element is subject to reflection of expenses for the provision of consolidated subsidies to the budgets of the budget system of the Russian Federation, including consolidated subsidies for co-financing the expenditure obligations of the constituent entities of the Russian Federation (municipalities), providing for expenses for a set of measures, including both measures for capital investments in facilities state (municipal) property, and activities not related to capital investments in state (municipal) property.

- 522 “Subsidies for co-financing of capital investments in state (municipal) property” - regarding subsidies for co-financing of capital investments in state (municipal) property;

- 523 “Consolidated subsidies” - in terms of consolidated subsidies for co-financing a set of activities, including capital investments in state (municipal) property.

At the same time, the reflection of expenses for the provision of subsidies for co-financing capital investments in state (municipal) property objects, together with co-financing of activities not related to capital investments in state (municipal) property objects, by type of expenditure 521 “Subsidies, with the exception of subsidies for co-financing capital investments is not provided for in objects of state (municipal) property.

The names and descriptions of KVR 631, 632, 633, 634 have been clarified. These amendments are of a technical nature and do not affect the procedure for applying the codes.

The application of CVR 814 “Other subsidies to legal entities (except for non-profit organizations), individual entrepreneurs, individuals - producers of goods, works, services” has been narrowed from 01.01.2018 to two areas. This code should include:

- expenditures of the budgets of the budgetary system of the Russian Federation on the formation of the authorized capital of a state (municipal) unitary enterprise;

- expenses of state (municipal) institutions for the provision of grants to organizations, except non-profit organizations, individual entrepreneurs.

If you have any questions on this topic, discuss them with our expert toll-free number 8-800-250-8837. You can view the list of our services on the website UchetvBGU.rf. You can also join our mailing list to be the first to know about new useful publications.

The budget classification, which contains a grouping of budget indicators at all levels by profits and expenses, as well as all sources of financing that are attracted to cover deficits. Thanks to this classification, it is possible to compare the indicators of all budgets. Codes for types of expenses and income are systematized in order to have complete information about the generation of income and the implementation of budget expenditures.

Budget classification

The budget classification of the Russian Federation was adopted in 1996, and in 2000 it was significantly changed and supplemented. The budget classification includes sections codes for types of budget income, codes for types of budget expenditures, sources of financing deficits, and operations of the public administration sector. In addition, sources of internal financing for budget deficits and external financing of the federal budget, types of internal debt of the Russian Federation, its constituent entities and municipalities, as well as types of external debt of the country are indicated. This article will focus on one of the sections that lists expense type codes. carried out according to the following criteria.

The functional section reflects budget funds aimed at carrying out the main activities of the state. For example, defense, management and the like. A classification of codes for types of expenses is compiled in this way: from section through subsections to target items, then the types of expenses themselves are revealed. The type of departmental classification is associated with the management structure, it displays the grouping of legal entities that receive budget funds, that is, they are the Type of economic classification demonstrates the division of government expenditures into capital and current, it also reflects the composition of labor costs, all material costs and the purchase of services and goods. This is classified according to the following principle: from the category of expenses into groups, then from subject items into subitems.

Functional classification

Functional classification is a grouping of budget expenditures at all levels of the Russian Federation system, which reflects the expenditure of funds (purchase of goods, defense needs, etc.) to perform all the main functions of the state. There are four levels of classification: from sections to subsections, from which target items are identified, then the types of expenses are determined for each. For example, state administration and local self-government are coded 0100, and the judiciary is coded 0200. International activities - 0300, national defense - 0400, state security and law enforcement - 0500, promotion of basic research, scientific and technological progress - 0600, industry, construction and energy - 0700, agriculture and fishing are given the code 0800, and the protection of natural resources, geodesy, cartography and hydrometeorology - 0900.

Next comes transport, communications and computer science, road management - 1000. Market and development of its infrastructure - 1100, housing and communal services - 1200, Ministry of Emergency Situations - 1300, education - 1400, art, culture and cinematography - 1500, media - 1600, healthcare and physical education - 1700 Social policy is given code 1800, public debts - 1900, state reserve funds and replenishment of reserves are coded 2000. Budgets of other levels are financed under code 2100, the elimination and disposal of weapons (including under international treaties) - 2200, 2300 - special expenses for mobilizing the economy, space - 2400. Coded 3000 are the so-called other expenses. And KOSGU code (Classification of operations of the general government sector) 3100 belongs to target budget funds. Next comes the detailing, which can be seen in the following example. In section 0100 (state government and local self-government), subsection 0101 is the activity of the head of state (president of the country), the target article is 001, indicating the maintenance of the head of state, the type of expenses is 001, that is, monetary maintenance. In the same way, budgets are built at each level, taking into account the specifics and specifics. Functional classification is necessary to determine federal needs, where budget investments are directed.

Departmental classification

This grouping of expenses relates to recipients of funds from the budget, and every year this list is re-approved by law, that is, the budgets of each subject of the Federation and each local budget must be approved by the relevant authorities. The KOSGU comparative table includes all government bodies, all extra-budgetary funds, all self-government bodies and municipal institutions that must apply CWR (expense type codes). Since 2016, autonomous and budgetary institutions have been using them mandatory. The KOSGU code is the main component of the classification of budget expenditures. The structure of such a code is: the corresponding group, subgroup and element from 18 to 20 bits. The rules of application and the list of types of expenses are the same in all budgets of the country’s system. Code 100 denotes expenses for ensuring the functioning of municipal bodies and management bodies of extra-budgetary state funds and government institutions. Code 200 - purchase of goods and services. This also includes work for municipal and state needs. Code 300 - social payments to citizens. Code 400 denotes capital investments in municipal state property.

Interbudgetary transfers are carried out under code 500. Subsidies to autonomous, budgetary and non-profit organizations - code 600. Municipal public debt - code 700, and 800 - other budgetary investments. Here the classification is detailed down to subgroups (such as 340, 110, and so on) and elements (such as 244, 119, 111). For autonomous and budgetary institutions the list is greatly reduced. Only the following codes are used: 111, 112, 113 - wages and other payments to workers, 119 - insurance contributions, payment of benefits, 220 and 240 - purchase of goods, services, works (for social security such purchases are coded 323), and social payments citizens - 321. Scholarships - 340, grants, bonuses to individual individuals - code 350, other payments to the population - code 360. Capital investments - 416 and 410, and for capital investments in construction - 417. For the execution of judicial acts, code 831 is used. Payment of taxes , fees and other payments - code 850. Contributions to an international organization are coded 862, and payments under agreements with international organizations and governments of other states - 863.

Linking by classification

Distribution of costs requires the mandatory management of a table of correspondence between KOGSU codes and the above codes, and this is done by all government agencies and local governments, all institutions and extra-budgetary funds. Especially for autonomous and budgetary institutions, the Ministry of Finance has provided an additional clarifying table of compliance with KOSGU and KVR. If expenses are paid according to codes that do not correspond to departmental details, this is considered an inappropriate expenditure of budget funds and is subject to liability, including criminal liability. The examples of classification linking given below will help you correctly draw up such documentation.

Today, no institution or organization can live without constant costs for information and communication technologies. They are paid differently at the municipal, regional and federal levels; even for autonomous and budgetary institutions there are some features in payment. The recipients of budget investments are different bodies. ICT at the federal level is paid using code 242 (refers to the purchase of goods, services and works - the ICT sector). At the municipal and regional level, this code is used only with a corresponding decision of the financial authority of a constituent entity of the Russian Federation or municipal entity. If such a decision has not been made, ICT is paid for using code 244 (other purchases of goods, services and works). In the same way, budget expenditures are carried out in territorial extra-budgetary funds. For autonomous and budgetary institutions, ICT expenses are provided for under code 244, but code 242 is not provided.

Purchase of equipment

For example, the situation is this: how to document the costs of purchasing GLONASS equipment to equip vehicles, what type of expenses should be applied here? If this is a defense order, then the expense type code will be 219, if not, then one of the elements of type 244 (other purchases of goods, services and works). It is necessary to accurately determine the article, sub-article of KOSGU and then correctly reflect these expenses in the financial statements. Defining an article is not such a simple matter. For example, a car antenna is purchased, installation and configuration are paid for (not a defense order). These expenses are also reflected under code 244, because a car antenna cannot be included in other elements of the expense type. This is not a code 241 because it is not a scientific or research work or an experimental design work. This is not code 243, because this product cannot be classified as intended for major repairs of municipal property. And this is not code 242, because the antenna is not a means of communication in itself, and its installation is not an information technology service.

Only code 244 remains, and using it in this case is the only correct solution. Or another situation. A new elevator car is being installed (not a defense order), and it is necessary to determine the type of expenses of such costs. The installation of an elevator involves the replacement of an old cabin with a new one (major repair contract) or the elevator cabin is installed initially (change in technical characteristics, contract for reconstruction or construction). In the first case, expenses must be reflected in element 243 (purchase of goods, services, work for major repairs of municipal property). In the second case - element with code 410 (budget investments). Or, for example, you buy a DVR. If this is a defense order, the costs should be reflected under code element 219, and if not, then again the required code is 244 (for the same reasons as antenna costs).

Business trip

In 2016, municipal government institutions, when planning budgets and executing them, must ensure the comparability of indicators, that is, conduct analytics of accrued expenses by their types, and not just by KOSGU codes, the details of which are preserved. Now this needs to be done simultaneously using both KOSGU codes and VR codes. The procedure for assigning travel expenses to the corresponding codes has also changed. What code is used to pay for a business trip and services associated with it (ordering tickets, their delivery, hotel reservations, etc.)? These services are provided by a third party on the basis of a contract, and therefore they are reflected in the BP element with code 244.

If an employee of a municipal government agency goes on a business trip, then everything related to his expenses during the trip goes under code 112 (other payments to staff other than wages). If the seconded person works in any government agency (hereinafter referred to as a division into civil and military bodies), then his expenses are coded 122 (other payments to the personnel of municipal government agencies except for wages). If a military serviceman or a person equivalent to him is sent on a business trip, there will be code 134 (other payments to personnel with special ranks). And finally, if the business traveler is an employee of an extra-budgetary state fund, then his expense code is 142 (other payments to staff other than wages).

Travel expenses

Let’s say a civil legal contract is concluded with a certain citizen for the provision of any services or performance of work. Question: how to spend these expenses if compensation for his travel expenses is part of the payment under the contract and if this is paid separately? In the first case, the payment is reflected in the same BP code as the contract. These expenses are paid depending on the budget level and type of institution - according to expense element 244 or 242. In the second case (when separate compensation), travel costs are reflected under element BP 244 (other purchase of goods, services and works for municipal needs).

Next, you need to act according to the elements of VR group 100 (expenses for payment of personnel for the functioning of state bodies, management bodies of extra-budgetary state funds, government institutions), codes 142, 134, 122, 112, which reflect the payment of travel by employees for reporting. But in the second case (when a civil legal contract was concluded), it is under no circumstances possible to apply the elements of VR group 100, because labor legislation does not apply to citizens who are not employees of government agencies and institutions. And such expenses do not apply to subgroups 230, 220, 210, or to elements 243, 242, 241. Only one code is suitable here - 244.

Entertainment expenses

Expenses associated with the reception of official delegations must be reflected in element RV 244 (other purchase of goods, services and works for municipal needs), because this type of expense cannot be attributed to any other element. This cannot be coded 241 as scientific, research or experimental design work; it does not fit code 243 as the purchase of goods, services and work for major repairs of municipal property; these expenses cannot in any way be designated by code 242 as the purchase of goods, services and work in the sphere ICT.

Section III of the instructions, which were approved by order of the Ministry of Finance of the Russian Federation No. 65N dated July 2013, states that all entertainment expenses of each institution must be reflected according to element BP 244. All other decisions will be incorrect and may entail accusations of misappropriation of public funds .

Outsourcing

Outsourcing (providing the necessary personnel under a contract) also involves costs for paying for services. For example, an institution needed a watchman, a disinfector or a plumber. Expenses for payment for such services according to the contract must be reflected in element BP 244 (other purchase of goods, services, works for municipal needs).

In the legislation of our state there is no such thing as outsourcing. However, there are private explanations where specialists from the Ministry of Finance indicate that concluding an outsourcing agreement is equal to an agreement for the provision of services or the performance of work by contract. Costs under the contract are considered as expenses for the purchase of security services (watchman), disinfection, and repair of water supply or sewerage systems. Such expenses cannot be attributed to any of the BP elements, except for the element under code 244. Just as in the previous examples, this type of expense does not fit either code 241, 242, or 243.

Providing subsidies

Often a situation arises when a subsidy is provided from the regional budget to an operator in the region (an autonomous non-profit organization) in order to carry out major repairs of apartment buildings. The transfer of subsidies is reflected in the BP element of code 630, while in the financial statements, in parallel, these expenses are designated under the KOSGU subarticle with code 242. Government authorities have the right to provide subsidies to autonomous non-profit organizations that are not municipal and state-owned, since such organizations are created to perform precisely such functions.

Expense type element 630 and subitem 242 reflect subsidies to organizations (except municipal and state). This fully fits the situation when a regional operator is renovating apartment buildings. Providing a subsidy to a non-governmental organization and monitoring repairs does not contradict the law; moreover, even BP codes are provided for such payments.

KVR and KOSGU are special codifiers that are used by public sector employees for accounting, planning and reporting. Officials adjusted the procedure for compiling the CVR and KOSGU. Starting from 2019, we need to work according to new rules. Let's figure out what KVR and KOSGU are, and how to work with codes in procurement.

What is KOSGU

First of all, let’s define: deciphering what KOSGU is in the budget sounds like this: classification of operations of the public administration sector. The numeric code allows you to accurately classify the transaction performed according to its content.

The determination of KOSGU in 2019 for budgetary institutions, as well as autonomous and state-owned ones, should be carried out in accordance with the new procedure. The rules are enshrined in Order of the Ministry of Finance of Russia dated November 29, 2017 No. 209n (as amended on November 30, 2018). The new provisions apply from 01/01/2019.

There are the following budget classification groups:

- “100” - income, including profit;

- “200” - expenses;

- “300”—receipt of the NFA;

- “400” - retirement of the NFA;

- “500” – FA receipt;

- “600”—FA retirement;

- “700”—increase in liabilities;

- “800”—reduction of obligations.

Until January 2016, all operations of budgetary, government and autonomous institutions were classified according to KOSGU. Then this rule was canceled. Now, in 18-20 categories of accounting accounts, all public sector institutions are required to apply CVR.

The full list of current codes is contained in the Appendix to the Order of the Ministry of Finance of Russia dated November 29, 2017 No. 209n (as amended on November 30, 2018).

KOSGU: application in work

The exclusion of the code from the KBK structure does not mean that the codes in the budget have become irrelevant. Codifiers still need to be used. For example, government institutions are required to plan and receive expenses exclusively in terms of classifiers of the public administration sector. It is impossible to prepare a budget list, estimates, as well as justification for budget allocations without the KOSGU codifier.

Budget reporting should be formed in the context of transaction codes of the general government sector. For example, reporting forms such as a statement of financial results, 0503121 - for corporate accounting and 0503721 - accounting. And also a cash flow statement: 0503123 - for CU and 0503723 - BU.

KOSGU in procurement

Planning of expenses of the organization of the public sector is also compiled in the context of OSGU codes. After drawing up the cost plan, the institution prepares a procurement plan and schedule for the corresponding financial period. These procurement documents are also prepared on the basis of the OSSU code classifiers.

Until 2016, decoding of schedules and procurement plans was compiled in the context of KOSGU. But at present, the old codifier has been replaced by new ciphers - KVR. It is a mistake to believe that now KOSGU are not involved in procurement activities. This is fundamentally wrong.

To plan any purchase, an institution needs to correctly determine the CWR and only then reflect the operation in planning documentation. But it is impossible to choose the correct KVR without first determining the KOSGU. This is the key principle of using codifiers and their direct relationship.

Transcript of KVR

Beginners may be unfamiliar with what CWR is in the budget. Special codifiers should be used in accounting and planning the expenses of a public sector institution. The cipher is not used separately, since it is a structural part of the whole - the budget classification code.

If you are trying to figure out what is in the budget with the CWR, then here is the answer. The expense type code is a special numeric code that allows you to group homogeneous types of expense transactions according to their content in order to manage the budget process in terms of spending funds, as well as control over its execution in accordance with the current requirements of budget legislation.

From 01/01/2019 we work according to new rules! CVR for budgetary institutions in 2019 should be determined in accordance with Appendix No. 7 to Order of the Ministry of Finance of Russia dated 06/08/2018 No. 132n (as amended on 03/06/2019).

The legislation provides for the following grouping of codes:

Capital investments in state (municipal) property

Interbudgetary transfers

Providing subsidies to budgetary, autonomous institutions and other non-profit organizations

Service of state (municipal) debt

Other budget allocations

The procedure for determining KVR and KOSGU

Detailing each expenditure transaction of an economic entity in the budgetary sphere is the basis for budget planning and execution. Effective and transparent planning, ensuring the intended use of allocated funds and the reliability of financial statements depend on the correctness of the chosen code for the type of expense and the classification of operations of the public administration sector.

To accurately link CVR and KOSGU, officials recommend using a table of correspondence between codes of types of expenses and classification of the public administration sector.

Example. Expense operation: car repair. KOSGU - Article 225 "". But the CVR depends on the type of repair. For the current one there will be 244 “Other procurement of goods, works and services to meet state (municipal) needs.” And for major repairs, the solution to the issue will be KVR 243 “Purchase of goods, works, services for the purpose of major repairs of state (municipal) property.”

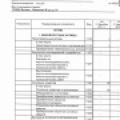

Separately, we will designate the new links between CVR and KOSGU for 2019 for budgetary institutions in the form of a table.

Compliance table between KVR and KOSGU for 2019 for procurement

The table includes only the KVR 200 group, which is most often used in procurement activities. The full version with all codes is attached in the file.

|

Type of expenses |

Notes |

|||

|

Name |

Name |

|||

|

200 Purchase for state (municipal) needs |

||||

|

210 Development, purchase and repair of weapons, military and special equipment, industrial and technical products and property |

||||

|

Supply of weapons, military and special equipment and military-technical property within the framework of the state defense order in order to support the state weapons program |

Other works, services |

|||

|

Supply of weapons, military and special equipment and military-technical property within the framework of the state defense order outside the state armament program |

Other GWS |

|||

|

Increase in the value of fixed assets |

||||

|

Increase in the cost of inventories |

||||

|

Supply to meet government needs in the field of geodesy and cartography within the framework of the state defense order |

||||

|

Increase in the value of fixed assets |

||||

|

Repair of weapons, military and special equipment and military-technical property within the framework of the state defense order in order to support the state weapons program |

Works and services for property maintenance |

|||

|

Increase in the value of fixed assets |

||||

|

Increase in the cost of inventories |

||||

|

Repair of weapons, military and special equipment and military-technical property within the framework of the state defense order outside the state armament program |

Works and services for property maintenance |

|||

|

Increase in the cost of inventories |

||||

|

Fundamental research in the interests of ensuring the defense and national security of the Russian Federation within the framework of the state defense order in order to support the state weapons program |

||||

|

Increase in the value of intangible assets |

||||

|

Research in the field of development of weapons, military and special equipment and military-technical property within the framework of the state defense order in order to support the state weapons program |

||||

|

Increase in the value of intangible assets |

||||

|

Research in the field of development of weapons, military and special equipment and military-technical property within the framework of the state defense order outside the state weapons program |

||||

|

Increase in the value of intangible assets |

||||

|

Delivery for the purpose of ensuring tasks of the state defense order |

||||

|

Increase in the value of fixed assets |

||||

|

Increase in the cost of inventories |

||||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with an indefinite useful life |

||||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with a certain useful life |

||||

|

220 Purchase for the provision of special fuel and fuels and lubricants, food and clothing supplies to bodies in the field of national security, law enforcement and defense |

||||

|

Providing fuel and lubricants within the framework of the state defense order |

Transport services |

The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area |

||

|

Rent for the use of land plots and other isolated natural objects |

||||

|

Increase in the value of fixed assets |

||||

|

Increase in the cost of fuels and lubricants |

||||

|

Food supply within the framework of the state defense order |

The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area |

|||

|

Increased food costs |

||||

|

Food supply outside the framework of the state defense order |

||||

|

Clothing provision within the framework of the state defense order |

The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area |

|||

|

Increasing the cost of soft inventory |

||||

|

230 Purchase for the purpose of forming a state material reserve |

||||

|

Purchase for the purpose of forming a state material reserve within the framework of the state defense order |

||||

|

Purchase in order to ensure the formation of the state material reserve, reserves of material resources |

Payment for work and services |

|||

|

Receipt of non-financial assets |

||||

|

240 Other purchases of goods, works and services to meet state (municipal) needs |

||||

|

Research and development work |

||||

|

Increase in the value of intangible assets |

||||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with an indefinite useful life |

||||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with a certain useful life |

||||

|

Procurement in the field of information and communication technologies |

Communication services |

|||

|

Rent for the use of property (except for land plots and other isolated natural objects) |

||||

|

Works and services for property maintenance |

||||

|

Increase in the value of fixed assets |

||||

|

Increase in the value of intangible assets |

||||

|

Increase in the cost of other working inventories (materials) |

||||

|

Increasing the value of inventories for capital investment purposes |

||||

|

Increase in the cost of other disposable inventories |

Regarding strict reporting forms |

|||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with an indefinite useful life |

||||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with a certain useful life |

||||

|

Purchase for the purpose of major repairs of state (municipal) property |

Transport services |

|||

|

Rent for the use of property (except for land plots and other isolated natural objects) |

||||

|

Works and services for property maintenance |

||||

|

Services, work for capital investment purposes |

||||

|

Increase in the value of fixed assets |

||||

|

Increased cost of building materials |

||||

|

Increase in the cost of other working inventories (materials) |

||||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with an indefinite useful life |

||||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with a certain useful life |

||||

|

Other procurement of goods, works and services |

Other non-social payments to staff in kind |

In terms of recording transactions for the purchase of milk or other equivalent food products for free distribution to employees engaged in work with hazardous working conditions |

||

|

Payment for work and services |

Including costs for the delivery (shipment) of pensions, benefits and other social payments to the population |

|||

|

Increase in the value of fixed assets |

||||

|

Increase in the value of intangible assets |

||||

|

Increase in the cost of inventories |

||||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with an indefinite useful life |

||||

|

Increase in the value of non-exclusive rights to the results of intellectual activity with a certain useful life |

||||

|

Purchase to meet state (municipal) needs in the field of geodesy and cartography outside the framework of the state defense order |

Payment for work and services |

|||

|

Increase in the value of fixed assets |

||||

|

Increase in the value of intangible assets |

||||

|

Increase in the cost of other working inventories (materials) |

||||

Download the full text of the KVR and KOSGU correspondence table for 2019

Plan differently for 2019

Specialists from the Ministry of Finance published Letter No. 02-05-11/56735 dated August 10, 2018, in which they provided explanations on how to apply the new BP codes in 2019. Now the list of codes has been supplemented with new types of expenses, some group names have been changed. Let's consider the changes in the CVR and KOSGU for 2019 for budgetary institutions in the form of a table.

|

Name in 2018 |

Name in 2019 |

|

|---|---|---|

|

Subsidies (grants in the form of subsidies) for financial support of expenses, the procedure (rules) for the provision of which establishes the requirement for subsequent confirmation of their use in accordance with the conditions and (or) purposes of the provision |

Subsidies (grants in the form of subsidies) subject to treasury support |

|

|

Subsidies (grants in the form of subsidies) for financial support of expenses, the procedure (rules) for the provision of which do not establish requirements for subsequent confirmation of their use in accordance with the conditions and (or) purposes of the provision |

Subsidies (grants in the form of subsidies) not subject to treasury support |

|

|

Other subsidies to non-profit organizations (except for state (municipal) institutions) |

Grants to other non-profit organizations |

|

|

Subsidies (grants in the form of subsidies) for financial support of costs in connection with the production (sale of goods), performance of work, provision of services, the procedure (rules) for the provision of which establishes a requirement for subsequent confirmation of their use in accordance with the conditions and (or) purposes of the provision |

Subsidies (grants in the form of subsidies) for financial support of costs in connection with production (sale of goods), performance of work, provision of services, subject to treasury support |

|

|

Subsidies (grants in the form of subsidies) for financial support of costs in connection with the production (sale) of goods, performance of work, provision of services, the procedure (rules) for the provision of which do not establish requirements for subsequent confirmation of their use in accordance with the conditions and (or) purposes of the provision |

Subsidies (grants in the form of subsidies) for financial support of costs in connection with the production (sale) of goods, performance of work, provision of services, not subject to treasury support |

|

|

Other subsidies to legal entities (except for non-profit organizations), individual entrepreneurs, individuals - producers of goods, works, services |

Grants to legal entities (except non-profit organizations), individual entrepreneurs |

Main mistakes in using CVR

An incorrectly defined type of expense for the operations of public sector institutions is recognized as an inappropriate use of budget funds. This violation is subject to significant fines and administrative penalties. Let's determine which violations occur most often and how to avoid them.

|

Fine, punishment |

How to avoid |

|

|

The applied linkage KVR-KOSGU is not provided for by current legislation |

Art. 15.14 Code of Administrative Offenses of the Russian Federation:

|

If an institution is planning an operation that is not included in current Order No. 132n, write a letter to the Ministry of Finance demanding clarification. It is not recommended to use a “non-existent” link before receiving an official response. |

|

The BP code is determined by the intended description (purpose) of the product |

It is unacceptable to plan and carry out expenses using codes that do not correspond to the documentary description (purpose) of goods, works or services. Before making a transaction, read the technical or other documentation for the purchased product (or the technical characteristics of similar products). |

|

|

CVR 200 includes costs not related to procurement |

Such violations often involve accountable expenses. To avoid mistakes, it is necessary to strictly differentiate the purpose of expenses: purchases for the needs of the organization or other types. |

|

|

CVR applied that does not correspond to the type of institution |

Before carrying out a “controversial” operation, double-check yourself. Compare the selected CVR with the approved codes of Order No. 132n. |