A generalized quarterly calculation of calculated and withheld personal income tax has been submitted to the inspectorate for the second year in a row, but questions regarding filling out the form nevertheless remain.

Deadlines and procedure for submitting calculations

The calculations are submitted by tax agents (clause 2 of Article 230 of the Tax Code of the Russian Federation).

A zero calculation is not submitted if personal income tax-taxable income was not accrued and paid (letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11/13984@).

If a “zero” is nevertheless submitted, then the Federal Tax Service will accept it (letter of the Federal Tax Service of the Russian Federation dated May 4, 2016 No. BS-4-11/7928@).

Calculations for the first quarter, half a year and 9 months are submitted no later than the last day of the month following the specified period. Therefore, quarterly calculations in 2017 are submitted within the following terms (clause 7, article 6.1, clause 2, article 230 of the Tax Code of the Russian Federation):

- for the first quarter - no later than May 4 (including postponements of weekends and holidays);

- for half a year - no later than July 31;

- for 9 months - no later than October 31.

The annual calculation is submitted in the same way as 2-NDFL certificates: for 2017 - no later than 04/02/2018 (April 1 is a day off).

Calculation of 6-NDFL is submitted only in electronic form according to the TKS, if in the tax (reporting) period income was paid to 25 or more individuals, if 24 or less, then employers themselves decide how to submit the form: virtually or on paper (clause 2 of Article 230 Tax Code of the Russian Federation).

As a general rule, the calculation must be submitted to the Federal Tax Service at the place of registration of the organization (registration of individual entrepreneurs at the place of residence).

If there are separate divisions(OP) payment in form 6-NDFL is submitted by the organization in relation to the employees of these OPs to the Federal Tax Service Inspectorate at the place of registration of such divisions, as well as in relation to individuals who received income under civil contracts to the Federal Tax Service Inspectorate at the place of registration of the OPs who entered into such agreements (clause 2 Article 230 of the Tax Code of the Russian Federation).

The calculation is filled out separately for each OP, regardless of the fact that they are registered with the same inspection, but in the territories of different municipalities and they have different OKTMO (letter of the Federal Tax Service of the Russian Federation dated December 28, 2015 No. BS-4-11/23129@).

If the OPs are located in the same municipality, but in territories under the jurisdiction of different Federal Tax Service Inspectors, the organization has the right to register with one inspectorate and submit calculations there (clause 4 of Article 83 of the Tax Code of the Russian Federation).

The employee worked in different branches. If during the tax period an employee worked in different branches of the organization and his workplace was located at different OKTMO, the tax agent must submit several 2-NDFL certificates for such an employee (according to the number of combinations of TIN - KPP - OKTMO code).

Regarding the certificate, the tax agent has the right to submit many files: up to 3 thousand certificates in one file.

Separate calculations are also submitted in form 6-NDFL, differing in at least one of the details (TIN, KPP, OKTMO code).

Regarding the registration of 6-NDFL and 2-NDFL: in the title part, the TIN of the parent organization, the checkpoint of the branch, OKTMO at the location of the individual’s workplace is affixed. The same OKTMO is indicated in the payment slips (letter of the Federal Tax Service of the Russian Federation dated July 7, 2017 No. BS-4-11/13281@).

If the company has changed its address, then after registering with the Federal Tax Service at the new location, the company must submit to the new inspection 2-NDFL and 6-NDFL:

- for the period of registration with the Federal Tax Service at the previous location, indicating the old OKTMO;

- for the period after registration with the Federal Tax Service at the new location, indicating the new OKTMO.

At the same time, in the 2-NDFL certificates and in the 6-NDFL calculation, the checkpoint of the organization (separate division) assigned by the tax authority at the new location is indicated (letter of the Federal Tax Service of the Russian Federation dated December 27, 2016 No. BS-4-11/25114@).

The calculation for 2017 is submitted using an updated form

From reporting for 2017, but not earlier than March 26, 2018, the updated form 6-NDFL is used (Order of the Federal Tax Service of the Russian Federation dated January 17, 2018 No. ММВ-7-11/18@).

The innovations are mainly related to the fact that from January 1, 2018, during reorganization, the legal successor needs to submit a settlement (certificate of income) for the reorganized company, if it has not done so.

In accordance with these innovations, the title page of the calculation and the rules for filling out the form have been changed:

- Details for legal successors have appeared:

1) “form of reorganization (liquidation) (code)”, where one of the values is indicated: 1 - transformation, 2 - merger, 3 - division, 5 - accession, 6 - division with simultaneous accession, 0 - liquidation;

2) “TIN/KPP of the reorganized organization”, where the legal successor puts down his TIN and KPP (other organizations put dashes);

- codes have been established for the legal successor (215 or 216, if he is the largest taxpayer), entered in the details “at the location (accounting) (code)”;

- in the “tax agent” field the name of the reorganized organization or its separate division is indicated;

- it became possible for the successor to confirm the accuracy of the information.

However, the changes apply not only to legal successors, but also to all tax agents,

The codes for legal entities that are not major taxpayers have changed: instead of code 212 in the details “at location (accounting) (code)” they will have to indicate 214.

To confirm the authority of the representative, you will need to indicate not only the name of the document, but also its details.

In addition, the barcode has changed.

Fines for violations of the procedure for submitting calculations and for errors in it

The fine for failure to submit the form is 1 thousand rubles for each full or partial month from the date established for its submission (clause 1.2 of Article 126 of the Tax Code of the Russian Federation).

If the payment is not submitted within 10 days after the expiration of the established period, then the bank accounts may be blocked (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

The fine for errors in calculation will be 500 rubles. If you correct the error yourself, there will be no fine if you submit an updated calculation before it becomes known that the inspectors have discovered false information (Article 126.1 of the Tax Code of the Russian Federation).

The fine for failure to comply with the format for submitting the calculation (paper instead of electronic form) is 200 rubles (Article 119.1 of the Tax Code of the Russian Federation).

Also, in addition to tax liability for the organization, administrative liability is provided for the official.

The fine for failure to submit a calculation on time for an employee of the organization responsible for submitting it is from 300 to 500 rubles (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Editor's note:

if the organization has a chief accountant whose job description specifies timely submission of reports, then he must be involved (Resolution of the Armed Forces of the Russian Federation dated 03/09/2017 No. 78-AD17-8).

Features of filling out the calculation

It must show all the income of individuals from whom personal income tax is calculated. Form 6-NDFL will not include income on which the tax agent does not pay tax (for example, child benefits, payment amounts under a property purchase and sale agreement concluded with an individual).

Section 1 calculation is filled in with a cumulative total, it reflects:

- on page 010 - the applied personal income tax rate;

- on page 020 - income of individuals since the beginning of the year;

- on page 030 - deductions for income shown in the previous line;

- on page 040 - calculated from personal income tax;

- on pages 025 and 045 - income in the form of dividends paid and the tax calculated on them (respectively);

- on page 050 - the amount of the advance payment paid by the migrant with a patent;

- on page 060 - the number of those people whose income was included in the calculation;

- on page 070 - the amount of tax withheld from the beginning of the year;

- on page 080 - personal income tax, which the tax agent cannot withhold;

- on page 090 - the amount of tax returned to the individual.

When using different personal income tax rates, you will have to fill out several blocks of lines 010-050 (a separate block for each rate). Lines 060-090 show the summed figures for all bets.

Section 2 includes data on those transactions that were carried out over the last 3 months of the reporting period. Thus, section 2 of the calculation for 9 months will include payments for the third quarter.

For each payment, the date of receipt of income is determined - on page 100, the date of tax withholding - on page 110, the deadline for paying personal income tax - on page 120.

Article 223 of the Tax Code of the Russian Federation determines the dates of occurrence of various types of income, and Art. 226-226.1 of the Tax Code of the Russian Federation indicate the timing of tax transfer to the budget. We present them in the table:

Main types of income | Date of receipt of income | Deadline for transferring personal income tax |

Salary (advance), bonuses | The last day of the month for which the salary or bonus for the month was calculated, included in the remuneration system (clause 2 of Article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service dated 08/09/2016 No. GD-4-11/14507, dated 08/01/2016 No. BS- 4-11/13984@, Ministry of Finance Letters of the Ministry of Finance dated 04/04/2017 No. 03-04-07/19708). If an annual, quarterly or one-time premium is paid, the date of receipt of income will be the day the premium is paid (Letter of the Ministry of Finance of the Russian Federation No. dated September 29, 2017 No. 03-04-07/63400) | No later than the day following the day of payment of the bonus or salary upon final payment. If the advance is paid on the last day of the month, then in essence it is payment for the month and when it is paid, personal income tax must be calculated and withheld (clause 2 of Article 223 of the Tax Code of the Russian Federation). In this case, the advance amount in the calculation is shown as an independent payment according to the same rules as salary |

Vacation pay, sick pay | Payment day (Clause 1, Clause 1, Article 223 of the Tax Code of the Russian Federation, Letters of the Federal Tax Service No. BS-4-11/1249@ dated January 25, 2017, No. BS-4-11/13984@ dated August 1, 2016). | No later than the last day of the month in which vacation pay or temporary disability benefits were paid |

Payments upon dismissal (salary, compensation for unused vacation) | Last day of work (clause 1, clause 1, clause 2, article 223 of the Tax Code of the Russian Federation, article 140 of the Labor Code of the Russian Federation) | No later than the day following the day of payment |

Help | Payment day (Clause 1, Clause 1, Article 223 of the Tax Code of the Russian Federation, Letters of the Federal Tax Service dated May 16, 2016 No. BS-4-11/8568@, dated August 9, 2016 No. GD-4-11/14507) |

|

Dividends | No later than the day following the day of payment (if the payment is made by LLC). No later than one month from the earliest of the following dates: the end of the relevant tax period, the date of payment of funds, the date of expiration of the agreement (if it is a JSC) |

|

Gifts in kind | Day of payment (transfer) of the gift (clauses 1, 2, clause 1 of Article 223 of the Tax Code of the Russian Federation, Letters of the Federal Tax Service dated November 16, 2016 No. BS-4-11/21695@, dated March 28, 2016 No. BS-4-11/5278@ ) | No later than the day following the day the gift was issued |

The date of tax withholding almost always coincides with the date of payment of income (clause 4 of Article 226 of the Tax Code of the Russian Federation), but there are exceptions. So, the date of personal income tax withholding:

- from the advance payment (salary for the first half of the month) there will be a payday for the second half (letter of the Federal Tax Service of the Russian Federation dated 04/29/2016 No. BS-4-11/7893, Ministry of Finance of the Russian Federation dated 02/01/2017 No. 03-04-06/5209);

- for excess daily allowances - the nearest salary payment day for the month in which the advance report was approved (letter of the Ministry of Finance of the Russian Federation dated 06/05/2017 No. 03-04-06/35510);

- for material benefits, gifts worth more than 4 thousand rubles (other income in kind) - the nearest salary payment day (clause 4 of article 226 of the Tax Code of the Russian Federation).

Income in line 130 of the calculation is indicated in full, without reduction for personal income tax and deductions.

Income for which all three dates on lines 100-120 coincide are reflected in one block of lines 100-140. For example, together with the salary, you can show the bonus paid for the month; vacation and sick pay are always shown separately from the salary.

If the tax payment deadline occurs in the fourth quarter (for example, the September salary was paid in October or September 30), there is no need to show income in section 2 of the calculation for 9 months, even if it is reflected in section 1. Such income will be reflected in section 2 of the annual calculation ( letter of the Federal Tax Service of the Russian Federation dated July 21, 2017 No. BS-4-11/14329@).

Nuances of filling out the annual form:

- in Sect. 1 will include amounts of accrued income, the date of actual receipt of which falls within the past year;

- in Sect. 2 will reflect the income paid, the personal income tax payment deadline for which expires in October - December;

- December salary paid in January will not be included in the annual calculation; it must be shown in section. 2 calculations for the first quarter of next year.

Example of filling out 6-NDFL for 2017

The company was established in January 2017, it employs 3 employees, who in 2017:

- accrued income for a total amount of RUB 2,550,000;

- provided standard deductions in the amount of 7,000 rubles;

- Personal income tax was calculated on all payments - 330,590 rubles.

The tax calculated on wages for December amounted to 25,350 rubles, the company withheld and paid it to the budget in January 2018 (when paying wages). For the remaining payments, personal income tax was calculated and withheld by the tax agent.

Thus, for 12 months of 2017, the amount of tax withheld is RUB 305,240. (RUB 330,590 - RUB 25,350).

In the fourth quarter, the company carried out the following operations:

- On 10/02/2017 I transferred personal income tax from vacation pay paid on 09/12/2017. The amount of vacation pay is 45,000 rubles, the amount of personal income tax is 5,850 rubles;

- 10/05/2017 paid the salary for September in the amount of 145,000.00 rubles, withheld personal income tax from the salary - 18,850 rubles;

- 10/06/2017 transferred personal income tax to the budget from the salary for September;

- On 10/31/2017, I accrued the salary for October in the amount of 205,000.00 rubles, calculated personal income tax from the salary - 26,650 rubles;

- 03.11.2017 paid the salary for October, withheld personal income tax from this income;

- 11/07/2017 transferred personal income tax to the budget from the October salary;

- On November 30, 2017, I accrued the salary for November in the amount of RUB 195,000.00, and calculated personal income tax from the salary in the amount of RUB 25,350;

- On December 5, 2017, I paid my salary for November and a bonus for the 3rd quarter in the amount of RUB 75,000. (order dated November 25, 2017, personal income tax on bonus - 9,750 rubles), withheld personal income tax from this income;

- 12/06/2017 transferred personal income tax to the budget from salaries for November and bonuses for the 3rd quarter;

- 12/21/2017 paid sick leave benefits in the amount of 28,000.00 rubles, accrued and withheld personal income tax - 3,640 rubles;

- On December 31, 2017, I accrued wages for December in the total amount of 195,000.00 rubles, and calculated personal income tax on it - 25,350 rubles.

We hand over the “clarification”

You will have to clarify the calculation if you forgot to indicate any information in it or if errors were found (in the amounts of income, deductions, tax or personal data, etc.).

Also, the “clarification” is submitted when recalculating personal income tax for the past year (letter of the Federal Tax Service of the Russian Federation dated September 21, 2016 No. BS-4-11/17756@).

The Tax Code of the Russian Federation does not determine the deadline for submitting the updated calculation. However, it is better to send it to the inspectorate before the tax authorities find an inaccuracy. Then you don’t have to worry about a fine of 500 rubles.

In the “Adjustment number” line, “001” is indicated if the calculation is corrected for the first time, “002” when submitting the second “clarification,” and so on. In the lines where errors are found, the correct data is indicated, in the remaining lines - the same data as in the primary reporting.

The calculation indicates incorrect checkpoints or OKTMO. In this case, you also need to submit a “clarification.” In this case, two calculations are submitted to the inspection (letter of the Federal Tax Service of the Russian Federation dated August 12, 2016 No. GD-4-11/14772):

- in one calculation, the adjustment number “000” is indicated, the correct values of the checkpoint or OKTMO are entered, the remaining lines are transferred from the primary calculation;

- the second calculation is submitted with the correction number “001”, KPP or OKTMO indicate the same as in the erroneous report, zeros are entered in all sections of the calculation.

If the calculation with the correct checkpoint or OKTMO is submitted late, the fine under clause 1.2 of Art. 126 of the Tax Code of the Russian Federation (for violation of the reporting deadline) does not apply.

To reliably formulate the status of settlements with the budget, in the event that the data of the CRSB changes after the submission of updated calculations, you can submit an application to clarify the erroneously filled in details of settlement documents.

Editor's note:

In connection with the transfer of personal income tax administration by interregional (interdistrict) inspectorates for the largest taxpayers to the territorial tax authorities, the Federal Tax Service of the Russian Federation reported the following.

Starting from reporting for 2016, the largest taxpayers with OP need to submit 6-NDFL and 2-NDFL to the territorial tax authorities. Moreover, if “clarifications” on personal income tax for past periods are submitted after 01/01/2017, then they should also be sent to regular inspectorates (letter of the Federal Tax Service of the Russian Federation dated December 19, 2016 No. BS-4-11/24349@).

By what date do I have to submit the completed 6-NDFL calculation for the 2nd quarter of 2017 to the Federal Tax Service? Examples of filling out 6-NDFL for the first half of 2017.

6-NDFL for the first half of 2017: example of filling out

Who should report

To begin with, let us remind you of who should attend to the issue of submitting the calculation in Form 6-NDFL for the first half of 2017.

It is correct to call the calculation “6-personal income tax for the half-year”, and not “6-personal income tax for the 2nd quarter”. After all, reporting is compiled on a cumulative basis from the beginning of 2017, and not just for the 2nd quarter (May-June). Consequently, many total indicators are formed for the entire first half of 2017, starting in January. However, it is worth recognizing that it is more convenient for some accountants to call current reporting “reporting for the second quarter,” since it is submitted for the second reporting period of 2017.

Duty of tax agents

All tax agents for income tax are required to submit to the Federal Tax Service the calculation in form 6-NDFL for the 2nd quarter of 2017 (clause 2 of Article 230 of the Tax Code of the Russian Federation). Let us recall that tax agents for personal income tax are, as a rule, employers (firms and individual entrepreneurs) paying income under employment contracts. Tax agents also include customers - organizations and individual entrepreneurs who pay income to performers on the basis of civil contracts (for example, a contract or the provision of services).

If there were no payments in the first half of the year

If during the period from January 1 to June 30, 2017, an organization or individual entrepreneur did not accrue or pay any income to individuals, did not withhold or transfer personal income tax to the budget, then there is no need to submit a 6-personal income tax calculation for the six months. This is explained by the fact that in such a situation, an organization or individual entrepreneur is not considered a tax agent. However, we note that an organization (or entrepreneur) has the right to submit a zero calculation to the Federal Tax Service.

If there were no actual payments in favor of individuals in the first half of 2017, but the accountant calculates salaries, then 6-NDFL must be submitted. After all, personal income tax must be calculated from recognized income even if it has not yet been paid (clause 3 of Article 226 of the Tax Code of the Russian Federation). In such a situation, in 6-NDFL you will need to show the income accrued from January to June and the personal income tax that was not withheld. A similar situation may be encountered, for example, by companies that, during a financial crisis, are unable to pay salaries, but continue to pay them.

If there was a one-time payment in the first half of the year

It is possible that income was accrued and paid only once in the first half of the year (for example, in the first quarter of 2017). Do I then need to submit 6-personal income tax for the 2nd quarter? Yes, in this case, 6-NDFL calculations must be submitted not only for the 1st quarter, but also for six months, nine months and for the entire 2017. After all, the 6-NDFD calculation is filled in with a cumulative total. If the payment to an individual was a one-time payment, then it will appear in the report throughout the year.

What payments should be included in the calculation?

In the calculation using Form 6-NDFL for the first half of 2017, you need to transfer all income in relation to which an organization or individual entrepreneur is recognized as a tax agent. Such income is, for example, wages, all types of bonuses, payments under civil contracts, benefits, vacation pay, dividends.

Non-taxable income under Article 217 of the Tax Code of the Russian Federation does not need to be shown in the calculation. At the same time, take into account the peculiarity of income that is not subject to personal income tax within the established standards (letter of the Federal Tax Service of Russia dated August 1, 2016 No. BS-4-11/13984).

How to show income listed in Art. 217 Tax Code of the Russian Federation

Article 217 of the Tax Code of the Russian Federation lists income that is subject to personal income tax only partially (that is, not in full). These are, for example, gifts and financial assistance. In the calculation of 6-NDFL for the first half of 2017, such payments must be reflected as in 2-NDFL certificates: the entire amount paid should be included as income, and the non-taxable part should be shown as tax deductions.

Example: Employee Lobanov A.S. In connection with the anniversary, they presented a gift worth 6,000 rubles. Gifts in the amount of 4,000 rubles are exempt from taxation. (clause 28 of article 217 of the Tax Code of the Russian Federation). Therefore, in section 1 of the 6-NDFL calculation, the entire gift must be indicated on line 020, and the deduction amount on line 030. As a result, the tax base for this income is 2,000 rubles. (6,000 rubles – 4,000 rubles), and the amount of personal income tax that must be withheld from the cost of the gift is 260 rubles. (RUB 2,000 × 13%). In section 2, on line 130, indicate the entire amount of income paid (6,000 rubles), and on line 140, the amount of tax actually withheld (260 rubles).

Calculation deadline

6-NDFL must be submitted to the Federal Tax Service no later than the last day of the month following the reporting period (Article 230 of the Tax Code of the Russian Federation). If the deadline for submitting form 6-NDFL falls on a weekend or non-working holiday, then the calculation is submitted on the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

The last day of July is the 31st (Monday). Therefore, no later than this date, you need to submit the 6-NDFL report for the first half of 2017 to the tax office.

Where to submit your semi-annual bill

Calculation of 6-NDFL for the first half of 2017 is submitted to the Federal Tax Service at the place of registration of the organization or individual entrepreneur (clause 2 of Article 230 of the Tax Code of the Russian Federation). Most often, organizations submit 6-NDFL to the inspectorate, where they are registered at their location, and individual entrepreneurs at their place of residence (Clause 1 of Article 83 and Article 11 of the Tax Code of the Russian Federation). However, if employees of separate divisions receive income from these divisions, then 6-NDFL must be submitted to the location of the divisions.

Which form to use

Has the new form of calculation of 6-NDFL been approved since 2017? Which form should I download to fill out a “paper” calculation for the first half of 2017? Has the format required for submitting payments electronically changed? Questions of this kind always arise before submitting regular tax reports.

For reporting for the first half of 2017, fill out form 6-NDFL, approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450. This form should have been used before. No new form of calculation was approved. The procedure for filling out 6-NDFL and the format required for submitting a report to the Federal Tax Service in electronic form via the Internet also continue to apply. You can download the current 6-NDFL form for free.

It is worth noting that tax authorities plan to change the 6-NDFL calculation form. Information about this appeared on the official portal of draft regulations. It is expected that the new form will need to be used from 2018. Therefore, in 2017 the new form will not be used yet. And the entire 2017 year will need to be reported using the form approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450.

Composition of form 6-NDFL

The current calculation form for 2017 includes:

- title page

- Section 1 “Generalized indicators”

- Section 2 “Dates and amounts of income actually received and withheld personal income tax”

Title page 6-NDFL: example

When filling out 6-NDFL for the first half of 2017, at the top of the title page you need to note the TIN, KPP and the abbreviated name of the organization (if there is no abbreviated name, the full name). If you need to submit a settlement in relation to individuals who received payments from a separate division, then fill in the “separate” checkpoint. Individual entrepreneurs, lawyers and notaries only need to indicate their TIN.

In the “Adjustment number” line for the year, mark “000” if the calculation for the first half of 2017 is submitted for the first time. If they submit a corrected calculation, then they reflect the corresponding adjustment number (“001”, “002”, etc.).

In the line “Submission period (code)”, enter 31 - this means that you are submitting 6-NDFL for the first half of 2017. In the “Tax period (year)” column, mark the year for which the semi-annual calculation is submitted, namely 2017.

Indicate the code of the division of the Federal Tax Service to which the annual reports are sent and the code on the line “At location (accounting)”. This code will show why you are submitting 6-NDFL here. Most tax agents reflect the following codes:

- 212 – when submitting a settlement at the place of registration of the organization

- 213 – when submitting the calculation at the place of registration of the organization as the largest taxpayer

- 220 – when submitting a settlement at the location of a separate division of a Russian organization

- 120 – at the place of residence of the individual entrepreneur

- 320 – at the place of business of the entrepreneur on UTII or the patent taxation system

If filled out correctly, a sample of filling out the title page of the 6-NDFL calculation for the first half of 2017 may look like this:

In Section 1 of 6-NDFL for the 2nd quarter of 2017, “Generalized Indicators,” you need to summarize data on the total amount of accrued income from January 1 to June 30, 2017, tax deductions and the total amount of accrued and withheld personal income tax. Take the information to fill out from the personal income tax registers.

This is what section 1 looks like:

Section 1 is filled in with a cumulative total

The first section of 6-NDFL is filled out with a cumulative total: for the first quarter, half a year, nine months and 2017 (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). In general indicators, include income (deductions, tax amounts) for transactions performed during the reporting period - half a year. That is, section 1 should reflect indicators for the period from January 1 to June 30 inclusive.

Let us explain in the table which lines of generalized values are in section 1 of the 6-NDFL calculation for the six months:

| Section 1 lines | |

| Line | Meaning |

| 10 | Personal income tax rate (for each rate, fill out section 1). |

| 20 | The amount of accrued income from January 1 to June 30, 2017. |

| 25 | Income in the form of dividends from January to March 2017 inclusive. |

| 30 | Amount of tax deductions in the 1st quarter of 2017. |

| 40 | The amount of calculated personal income tax from January 1 to June 30, 2017. To determine the value of this indicator, add up the personal income tax amounts accrued from the income of all employees. |

| 45 | The amount of calculated personal income tax on dividends on an accrual basis from January 1 to June 30, 2017. |

| 50 | The amount of fixed advance payments that are offset against personal income tax on the income of foreigners working under patents. This amount should not exceed the total amount of calculated personal income tax (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/3852). |

| 60 | The total number of individuals who received income in the reporting period (January-June). |

| 70 | The amount of personal income tax withheld in the first half of 2017. |

| 80 | The amount of personal income tax not withheld by the tax agent. This refers to amounts that a company or individual entrepreneur should have withheld until the first half of 2017, but for some reason did not do so. |

| 90 | The amount of personal income tax returned in the first half of 2017 (under Article 234 of the Tax Code of the Russian Federation). |

Section 2: for what indicators

In section 2 of 6-NDFL for the first half of 2017 you need to indicate:

- specific dates for receiving and withholding personal income tax

- deadline established by the Tax Code of the Russian Federation for transferring personal income tax to the budget

- the amount of income actually received and personal income tax withheld

Section 2 of the calculation looks like this:

| Line | Filling |

| 100 | Dates of actual receipt of income. For example, for salaries, this is the last day of the month for which the salary is accrued. For some others, payments have different dates (clause 2 of Article 223 of the Tax Code of the Russian Federation). |

| 110 | Personal income tax withholding dates. |

| 120 | Dates no later than which personal income tax must be transferred to the budget (clause 6 of article 226, clause 9 of article 226.1 of the Tax Code of the Russian Federation). Typically, this is the day following the day the income is paid. But, let’s say, for sick leave and vacation pay, the deadline for transferring taxes to the budget is different: the last day of the month in which such payments were made. If the tax payment deadline falls on a weekend, line 120 indicates the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). |

| 130 | The amount of income (including personal income tax) received as of the date indicated on line 100. |

| 140 | The amount of tax withheld as of the date on line 110. |

It is important to note that in section 2 of the 6-NDFL report for the first half of 2017, only indicators related to the last three months of the reporting period should be included (recommendations of the Federal Tax Service in Letter No. BS-3-11/650 dated February 18, 2016). That is, you need to show income and personal income tax broken down by date - only for transactions made in April, May and June 2017 inclusive. Transactions from the 1st quarter of 2017 should not fall into this section.

The principle of “carrying over” payments in section 2

Section 2 of the calculation of 6-NDFL for the first half of 2017 is filled out on the reporting date - June 30 (Letter of the Federal Tax Service dated 02.25.2016 No. BS-4-11/3058. The section provides generalized indicators only about those incomes from which personal income tax was withheld and transferred to the budget during the last three months of the period for which the calculation is submitted (April, May and June).

If income was received during April, May and June 2017, but the deadline established by the Tax Code of the Russian Federation for transferring personal income tax on this income has not yet arrived, then this income is not reflected in Section 2. Such income and the personal income tax withheld from it will need to be shown in section 2 of the 6-personal income tax calculation for the period in which the tax should be transferred to the budget (Letters of the Federal Tax Service dated January 25, 2017 No. BS-4-11/1249).

For example, the monthly salary payment deadline is the 30th of the current month. Accordingly, the salary for June 2017 was paid on 06/30/2017, and personal income tax from it must be transferred to the budget no later than 07/03/2017 (07/01/2017 and 07/02/2017 are weekends). Therefore, even if the personal income tax withheld from the salary was transferred to the budget earlier (06/30/2017), then the June salary and the personal income tax from it should still fall into section 2 of the 6-personal income tax calculation for 9 months of 2017. 6-NDFL for the 2nd quarter of 2017 will reflect:

- on line 020 – salary for January – June

- in section 2 - salary for January - May. The salary for June 2017 will fall into section 2 of the 6-NDFL calculation only for 9 months of 2017.

For convenience, we have presented the dates of receipt of income, withholding and transfer of personal income tax from the most common payments in the table below. Using this table, you can determine which payments made need to be shown in section 2 of the calculation for the half-year, and which - in the calculation for 9 months of 2017.

| Dates of receipt of income according to the Tax Code of the Russian Federation | |||

| Payments | 100 "Dates of receipt of income" |

110 "Tax Withholding Date" |

120 "Tax payment deadline" |

| Salary | Last day of the month | Pay day | |

| Vacation pay | Pay day | Pay day | Last day of the month |

| Disability benefits (sick leave) | Pay day | Pay day | Last day of the month |

| Material aid | Pay day | Pay day | The day following the payment day |

| Excess daily allowance | The last day of the month in which the advance report is approved | The nearest day of payment of income in cash | The working day following the day of payment of income |

| Remuneration under a civil contract | Pay day | Pay day | The day following the payment day |

Salaries for March were paid in April

The most controversial issues regarding filling out the 6-NDFL calculation are payments for “transition” periods. They are encountered when, for example, a salary or bonus is accrued in one reporting period and paid in another. A similar situation arose with salaries for March, which were paid in April 2017. How to show it in 6-NDFL for six months? Let's understand it with an example.

Example:

salary for March 2017

- on line 100 – date of payment of vacation pay

- on line 110 – the date of personal income tax withholding (coincides with the date of payment of income)

- on line 120 - the last day of the month in which vacation pay was paid

- on line 130 – amount of income

- on line 140 – tax amount

- on line 100 – date of payment of the premium

- on line 110 - the same date as on line 100

- on line 120 - the first working day after the one indicated on line 110

- on line 130 – bonus amount

- on line 140 – personal income tax amount

- on lines 020, 040, 070 - the corresponding total indicators

- on line 060 – the number of individuals who received income

- on line 100 “Date of actual receipt of income” – 04/30/2017

- on line 110 “Tax withholding date” – 04/10/2017

- on line 120 “Tax payment deadline” – 04/11/2017

- on lines 130 “Amount of income actually received” and 140 “Amount of tax withheld” - the corresponding total indicators

- For December 2016, salaries were accrued in the amount of 150,000 rubles. The amount of personal income tax is 19,500 rubles. Salaries were paid on January 13, 2017.

- For January 2017, salaries were accrued in the amount of 250,000 rubles. Personal income tax amount – 32,500 rubles. Salaries were paid on February 15, 2017.

- For February 2017, salaries were accrued in the amount of 250,000 rubles. Personal income tax amount – 32,500 rubles. Salaries were paid on March 15, 2017.

- For March 2017, salaries were accrued in the amount of 350,000 rubles. Personal income tax amount – 45,500 rubles. Salaries were paid on April 14, 2017.

- For April 2017, salaries were accrued in the amount of 350,000 rubles. Personal income tax amount – 45,500 rubles. Salaries were paid on May 15, 2017.

- For May 2017, salaries were accrued in the amount of 350,000 rubles. The amount of personal income tax is 45,500 rubles. Salaries were paid on June 15, 2017.

- For June 2017, salaries were accrued in the amount of 350,000 rubles. Personal income tax amount – 45,500 rubles. Salaries were paid on July 14, 2017.

- All data for filling out form 6-NDFL for the 2nd quarter of 2017 is presented in the table.

- on line 020 - accrued salary for January-June 2017 - 1,900,000 rubles;

- on line 040 – the amount of calculated personal income tax from wages for January–June – 247,000 rubles;

- on line 070 - the amount of personal income tax withheld from wages for December-May - 221,000 rubles. (247,000 + 19,500 – 45,500).

The March salary had to be reflected in section 1 of the 6-NDFL calculation for the 1st quarter of 2017 - lines 020, 030 and 040. In section 2 of the 6-NDFL calculation for the 1st quarter of 2017, there was no need to show the March salary, since the payment and payment operation tax ended in April (that is, already in the second quarter of 2017).

Personal income tax from the March salary must be withheld only in April at the time of payment. Therefore, line 070 of section 1 should be added to the withheld tax, and the transaction itself should be entered into section 2 of the half-year report. This is consistent with the letter of the Federal Tax Service of Russia dated 01.08. 2016 No. BS-4-11/13984.

It will look like this:

Conclusion

Section 2 should include only transactions that relate to the last three months of the reporting period (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). In this case, focus on the date no later than which personal income tax must be transferred to the budget. That is, reflect the income paid and the tax withheld in the reporting period in which the deadline for paying personal income tax falls. It doesn’t matter when you actually paid the income, withheld and transferred the tax. In section 2 of the calculation of 6-NDFL for the half-year, it is necessary to reflect data on the payment of income (tax withholding), for which the deadline for payment of personal income tax falls for the period from April 1 to June 30 inclusive.

Salaries for June were paid in July

The most common situation: wages for June were paid in July (that is, already in the third quarter of 2017). The advance and salary for June 2017 do not need to be reflected in section 2 of form 6-NDFL for the six months, because the tax will actually be withheld only in July 2017. Accordingly, the amounts of advance payment and salary for June, as well as withheld tax, will be reflected in section 2 for calculations for 9 months of 2017. But in section 1, the advance and salary amounts for June should be, because the dates for calculating personal income tax fall in the first half of 2017. Here's an example to fill out.

Example: salary for June 2017

The organization paid the salary advance for June on June 27 - 35,000 rubles. The organization paid the second part of the salary on July 10, 2017 in the amount of 40,000 rubles. Total – 75,000 rubles. This amount is subject to income tax at a rate of 13 percent in the amount of RUB 9,750. (RUB 75,000 x 13%). On the day of salary payment (July 10), this tax will be withheld, and the next day it will be transferred.

Show the June salary paid in July 2017 in section 1 of the 6-NDFL calculation for the six months. Moreover, enter into the report only accrued income, deductions and personal income tax (lines 020, 030 and 040). In lines 070 and 080, do not show data on the June salary. After all, the tax withholding date (the day of actual salary payment) has not yet arrived. Such a tax cannot be called unwithheld.

You will withhold personal income tax from your June salary only in July at the time of payment. Therefore, show it in line 070 of section 1, and the operation itself in section 2 of the report for 9 months. This is consistent with the letter of the Federal Tax Service of Russia dated 01.08. 2016 No. BS-4-11/13984.

How to reflect vacation pay

As we have already said, for income in the form of wages, the date of actual receipt of income is the last day of the month for which the employee was accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation). However, for vacation pay, this date is defined as the day of payment of income (letter of the Ministry of Finance of Russia dated January 26, 2015 No. 03-04-06/2187). The date of withholding personal income tax will coincide with the date of payment of income, because the tax agent is obliged to withhold tax from the income of an individual upon their actual payment (clause 4 of article 226 of the Tax Code of the Russian Federation).

The deadline for transferring personal income tax from vacation pay, i.e., the deadline when the tax agent must transfer the tax withheld from an individual, is the last day of the month in which the employee’s vacation pay was issued. Below we give an example of including vacation payments in 6-NDFL. Information about holidays is given in the table. For convenience, it will be agreed that there were no other payments.

| Worker | Vacation pay date | Vacation pay amount (including personal income tax) | Personal income tax (13%) |

| Lyskova A.A. | 42 880 | 39 816,78 | 5 176 |

| Kravchenko T.P. | 42 527 | 25 996,12 | 3 379 |

| Petrov A.S. | 42 533 | 13 023,41 | 1 693 |

| Total | 78 836,31 | 10 248 | |

A situation with “transitional” vacation pay is also possible. Let's assume that an employee goes on annual paid leave in July 2017 (in the third quarter). According to the Labor Code of the Russian Federation, vacation pay must be paid in advance - no later than 3 working days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). Therefore, it is possible that holiday pay was paid in June 2017 (in the second quarter). In this case, when calculating for the first half of 2017, show vacation pay in both Section 1 and Section 2. After all, the employee’s income arose in June, when he received the money. The company had to calculate and withhold personal income tax from vacation pay on the day of payment, and transfer the withheld amount to the budget no later than June 31. That is, no difficulties should arise with such vacation pay, since operations do not carry over to the third quarter.

If vacation followed by dismissal

What to do if an employee quits immediately after a vacation? There are also no special features in filling out section 2. Show vacation pay in the general manner (letter of the Federal Tax Service of Russia dated May 11, 2016 No. BS-3-11/2094):

How to reflect sick leave

The date of actual receipt of income (line 100) for sick leave is the date of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). It also coincides with the date of tax withholding (line 110), since on the date of actual payment of income, personal income tax must be withheld by the tax agent (clause 4 of Article 226 of the Tax Code of the Russian Federation).

But the deadline for transferring personal income tax on sick leave is special. The employer can sum up the tax on sick leave paid during the month and transfer it to the budget in one payment - no later than the last day of the month in which such payments were made (paragraph 2, paragraph 6, article 226 of the Tax Code of the Russian Federation). If the last day of the month falls on a weekend or holiday, then personal income tax must be paid on the next working day (clauses 6, 7, Article 6.1 of the Tax Code of the Russian Federation).

Is it necessary to reflect sick leave benefits accrued in June but paid in July in 6-NDFL for the six months? No no need. Sick leave income must be taken into account on the day when it was paid to the employee (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

In the situation under consideration, sick leave benefits were accrued, that is, calculated in June. But they paid already in July. In this case, there is no reason to include the benefit in the calculation of 6-personal income tax for the six months. Reflect the amount in sections 1 and 2 of 6-NDFL for 9 months.

How to show awards

It is worth noting that the method of determining the date of actual receipt of income in the form of a bonus depends on the results of the period for which the employee was awarded a bonus (based on the results of the month, quarter or year). It also matters what bonus is paid: production or non-production.

Non-production bonus

Non-production bonuses are incentive payments, not rewards for work performed. Therefore, they cannot be equated to wages.

When calculating 6-NDFL, reflect the non-production bonus on the date of payment. On this day, you must simultaneously recognize income and withhold personal income tax (subclause 1, clause 1, article 223, clause 3, article 226 of the Tax Code of the Russian Federation). The monthly non-production bonus in section 2 is distributed as follows:

An example of reflecting a non-production bonus

On June 8, 2017, the employee received a monthly bonus in the amount of 35,000 rubles for May. Personal income tax on this amount is 4,550 rubles. In section 2 of the semi-annual calculation, the bonus will be reflected as follows:

Production bonuses

Production bonuses are labor bonuses. That is, for work performed, and not incentive payments.

For production bonuses, there is a special procedure for reflection in the calculation of 6-NDFL. The method for determining the date of actual receipt of income in the form of a bonus for performing job duties depends on the results of the period for which the employee was awarded the bonus (based on the results of the month, quarter or year). This clarification is provided in the letter of the Federal Tax Service dated January 24, 2017 No. BS-4-11/1139.

Thus, when paying bonuses for a month, the date of actual receipt of income is considered to be the last day of the month for which the employee was accrued bonuses. For example, when paying a bonus based on the results of April 2017, the date of receipt of bonus income is 04/30/2017.

But if a production bonus is paid based on the results of work for the quarter, you should focus on the date of the bonus order. That is, in the case when, for example, a bonus based on the results of work in the first quarter of 2017 on the basis of an order dated 04/06/2017 was paid on 04/10/2017, this operation should be reflected in 6-NDFL for the first half of 2017 as follows:

If, based on the results of work in the second quarter, employees are also paid a quarterly bonus, and the order for its payment is issued in July 2017, then it will be reflected in the calculation of 6-NDFL for 9 months of 2017.

Example of filling out 6-NDFL for the 2nd quarter of 2017

Many accountants are interested in filling out the calculation line by line in Form 6-NDFL. In this regard, we believe it would be advisable to provide a sample of filling out 6-NDFL for the 2nd quarter of 2017 using specific figures. So, here is an example of conditions for filling in a cumulative total from the beginning of the year:

Indicators for filling out the calculation

| Month | Amount of accrued salary, rub. | Personal income tax amount | Date of actual receipt of income | Personal income tax withholding date | Deadline for transferring personal income tax |

| January 2017 | 250 000 | 32 500 | 42 766 | 42 781 | 42 782 |

| February 2017 | 250 000 | 32 500 | 42 794 | 42 809 | 42 810 |

| March 2017 | 350 000 | 45 500 | 42 825 | 42 839 | 42 842 |

| April 2017 | 350 000 | 45 500 | 42 855 | 42 870 | 42 871 |

| May 2017 | 350 000 | 45 500 | 42 886 | 42 901 | 42 902 |

| June 2017 | 350 000 | 45 500 | 42 916 | 42 930 | 42 933 |

| Total | 1 900 000 | 247 000 | X | X | X |

In the calculation of 6-NDFL for the 2nd quarter of 2017, these indicators are reflected as follows. In section 1, the accountant reflected:

In section 2, the accountant reflected the amount of wages paid and personal income tax withheld for March - May 2017.

Here is a sample line-by-line completion of Section 2 of 6-NDFL for the six months:

| Line | Filling |

| According to salary for March 2017 | |

| 100 | 42 825 |

| 110 | 14.04.2017 |

| 120 | 42 842 |

| 130 | RUB 350,000 |

| 140 | RUB 45,500 |

| According to salary for April 2017 | |

| 100 | 42 855 |

| 110 | 42 870 |

| 120 | 42 871 |

| 130 | 350,000 rub. |

| 140 | RUB 45,500 |

| According to salary for May 2017 | |

| 100 | 42 886 |

| 110 | 42 901 |

| 120 | 42 902 |

| 130 | 350,000 rub. |

| 140 | RUB 45,500 |

Since the salary for June was paid in July and, accordingly, tax was withheld in the same month, the accountant will reflect these indicators in section 2 of the calculation of 6-NDFL for 9 months.

In 2016, it began to be used on the territory of the Russian Federation new report form 6-NDFL. All employers began to submit it based on the results of the first reporting quarter. The new declaration differs from the calculation of 2-NDFL not only in content and form, but also in the filing deadlines, but no one has canceled the 2-NDFL form.

What is the 6-NDFL declaration and who should submit it

Form 6-NDFL represents type of tax reporting, which must be submitted by all business entities using hired labor. It contains information about all deductions and accruals made by the employer for payroll taxes for full-time employees.

Individual entrepreneurs and commercial organizations can use special software 1C, which automatically performs mathematical calculations.

The declaration is submitted only those entrepreneurs who have hired workers.

If during the reporting period individual entrepreneurs and commercial organizations did not make any payments to employees and did not withhold personal income tax from them, then they do not need to submit a zero declaration.

In order to insure themselves against possible claims from regulatory authorities, legal entities and individual entrepreneurs should submit a letter to the tax authority at the place of registration, which indicates the reason for failure to submit Form 6-NDFL. Such an appeal is made in free form, but it should indicate the reason why payments were not made, provided that the legal entity has employees.

When to take it in 2018

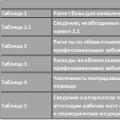

Form 6-NDFL is submitted by commercial organizations and individual entrepreneurs 1 time per quarter. The Tax Code of the Russian Federation for 2018 establishes the following deadlines for submitting reports:

When submitting the form to the regulatory authority, business entities must take into account one nuance. If the cut-off date established by Federal law falls on a weekend or holiday, then the last day for submitting the report is moved to the next working day.

The Tax Code of the Russian Federation takes into account the following dates for filing calculations:

Form 6-NDFL is submitted by business entities at the place of their registration. If individual entrepreneurs and commercial organizations use the UTII regime, then the declaration is submitted at the place of registration as a payer of this tax.

Difference from 2-NDFL

Main changes:

- Information is detailed for each individual who received any income from a business entity during the reporting period.

- Not only accrued and paid income is reflected, but also all deductions made, as well as calculated taxes.

- Filled out and submitted to the regulatory authority based on the results of the reporting quarter.

Rules and procedure for filling out

Form 6-NDFL can be submitted on paper or in electronic form.

Through telecommunication channels, the declaration is submitted only by those business entities that had more than 25 employees during the reporting period.

Such employers submit calculations to regulatory authorities as follows:

- on flash drives;

- on disks;

- via the Internet (for this they use a special service posted on the Federal Tax Service website www.nalog.ru, or engage e-document flow operators);

- through State Services https://www.gosuslugi.ru/.

The 6-NDFL calculation is filled out by commercial organizations and individual entrepreneurs whose number of employees is does not exceed 25 people, by hand or using special software (1C).

When filling out this form, employers must take into account the basic norms and provisions of the Tax Code of the Russian Federation and comply with the following requirements:

- The calculation is completed based on data obtained from the accounting and tax registers.

- If it is not possible to place all the data on one page, the employer must fill out as many sheets as necessary.

- If a mechanical or mathematical error was made in the calculation, corrections must be made in accordance with the regulations of Federal law.

- The Tax Code prohibits double-sided printing of a document and binding together all sheets of the form.

- All empty lines must be filled with dashes, and each page of the form (starting with the title page) must be numbered.

- If the employer fills out a paper form, he can use three colors of ink: black, purple and blue.

- When generating a report on a computer, you should use a font with a point height of 16-18, Courier New.

- Form 6-NDFL must be filled out for each OKTMO code separately.

- Business entities must fill out all text and numeric fields from left to right.

Sanctions for failure to submit a declaration

For late submission of form 6-NDFL, the Tax Code of the Russian Federation provides penalties. If employers violate the deadlines established by law, they will have to pay to the budget 1000 rubles for each month of delay.

Controlling authorities are empowered to block the current accounts of those individual entrepreneurs and commercial organizations that more than 10 days were delayed in submitting reports. If business entities submit Form 6-NDFL with inaccurate data, then they face fine of 500 rubles for each incorrectly completed report.

The tax office expects quarterly reports from entrepreneurs on the amounts of accrued and paid personal income tax. A special mold was produced for these purposes.

In this article you can familiarize yourself with example of filling out and changes to 6 personal income taxes in 2017, and also find out the current dates for submitting these documents to the tax authorities.

Thanks to this information, it will be possible to avoid common mistakes and financial fines that threaten an inattentive entrepreneur.

Who submits 6-NDFL in 2017

In 2017 (exactly as in the previous year), this report is submitted by all personal income tax agents, namely firms and individual entrepreneurs who make payments to individuals subject to personal income tax.

The 6-NDFL calculation includes items with data on the income of individuals, withheld and paid personal income tax, without singling out each person separately. This is the main difference between the 2-NDFL certificate and the 6-NDFL certificate.

Example and details of filling

The current form 6-NDFL was ratified by order of the Federal Tax Service dated October 14, 2015 and consists of a title page, section No. 1 and section No. 2.

The title page must display general information about the company (address, Federal Tax Service, etc.) and the reporting period. Section No. 1 contains summary data, and section No. 2 reflects detailed data with exact dates and amounts. In order for this report to be completed correctly, you must adhere to certain rules that will be relevant in 2017.

Title page

In the “Submission field” column you should indicate the period for which the report is provided. Depending on the month in which the papers are sent to the tax service, select line 21, 31, 33 or 34.

When going to the item “Provided to the tax number”, do not forget to indicate the code of the Federal Tax Service where you are submitting the report. In the “Location” column, you should note the peculiarity of the position, i.e. whether a company or individual entrepreneur submits a report to the simplified tax system, UTII, etc. As a rule, the code “212” is written in this line.

Section No. 1

In this section, the filler must indicate the total indicator of all employees. In the event that different personal income tax rates are used, you should fill out several images of section No. 1 - these are lines from 010 to 050. All other lines, namely 060-090, will be common. Please note that data is entered in this way only on the first copy.

In line “010” you need to enter the personal income tax rate. All income is indicated as a cumulative total at the beginning of the year in line “020”. In addition, do not forget about the option of rolling salaries. This means that the final result of income in section No. 1 and section No. 2 may be different. If the company had income in the form of dividends, then it should be displayed in line “025”.

Field “030” is intended for entering tax deduction amounts. This may include property, social, child deductions and others. The amounts of calculated and withheld tax are entered in lines “040” and “070”. If the company employs foreigners under a patent, field “050” must be filled in.

The total number of employees at the enterprise who received income is recorded in line “060”. In addition, the organization can indicate the amount of tax that was returned to it - “090”.

It happens that an enterprise was unable to withhold personal income tax, then this amount must be recorded in line “080” - this is practiced with rolling salaries.

Section No. 2

This area on the form is intended to display detailed data, where income is deciphered and exact dates are indicated. The enterprise records transactions in the sequence in which they occurred over the last three reporting months.

“Date of actual receipt of income” (line “100”) is used to display employee income in accordance with Article 223 of the Tax Code of the Russian Federation. To correctly record wages, the last day of the month should be set, while sick leave and vacation payments are recorded on the date of their actual receipt.

In field “110” enter the date of tax withholding - it is withheld on the day the income is received (not counting wages) in accordance with current legislation.

Line “120” “Tax payment deadline” is filled in depending on the type of income received. In most cases, vacation and sick leave are issued before the end of the reporting month, all other cases are indicated the next day after the date of receipt of funds.

“The amount of income actually received,” and this line “130” contains information about income (with kopecks) before the personal income tax was deducted. In turn, the withheld is noted in column “140”.

No room for error

When filling out the 6-NDFL document, you must carefully monitor what data you enter into it. It is extremely undesirable to make a mistake in such a matter, because the company may suffer serious losses in the form of fines imposed on it. To avoid making mistakes, remember:

- In the first section, indicate only the total amounts for income and personal income tax. Each bet must be displayed in its own section No. 1. For example, employees have income that is taxed at a rate of 13, 30, 35 percent. It turns out that three sections No. 1 will be filled out in the calculation, each on a separate sheet.

- Fields “060-090” should be filled in with the total amount for all available bets and only on the first page. On subsequent sheets you should put “0” and then write dashes. For example, you have one rate of 13%, and section No. 2 displays income on several sheets. This means that section No. 1 must be filled out only on the first page.

- In section No. 2, income is distributed by date. Here you should enter only those incomes that were received within three months.

- If an operation began in one reporting period and ended in another, then in section No. 2 the period of its completion must be indicated.

6-NDFL filing period and penalties

Despite rumors that claim that the deadline for submitting 6-NDFL will be “shifted” in 2017, there has been no official confirmation of this. This means that the report should be submitted to the National Assembly within the period approved by law, namely:

- for the first quarter - until May 2, 2017 (weekends and holidays are taken into account);

- six months before July 31, 2017;

- 9 months - until October 31, 2017;

- annual - until April 2, 2018.

Those business representatives who submit untimely may subject their company to penalties in the amount of 1,000 rubles (if the delay is no more than 1 month); Each subsequent overdue month will bring an additional 1000 rubles.

In addition, false data entered into 6-NDFL may result in a fine of 500 rubles.

Video