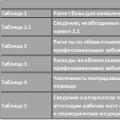

We remind you of the deadlines for submitting reports to regulatory authorities and the deadlines for paying taxes for the 3rd quarter of 2015.

Deadlines for submitting reports and paying insurance premiums for the 3rd quarter (9 months) of 2015.

Individual entrepreneurs with employees and all companies must pay insurance premiums every month and submit reports to regulatory authorities every quarter. If wages and insurance premiums were not accrued in the reporting quarter, then zero reporting must be submitted.

Organizations and individual entrepreneurs whose average number of employees exceeds 25 people are required to report to the funds only in electronic form via telecommunication channels.

Deadline for submitting reports to the Social Insurance Fund for the 3rd quarter (9 months) of 2015:

Paper submission must be submitted no later than October 20, 2015.

Electronic submission must be submitted no later than October 26, 2015 (since the deadline of October 25, 2015 falls on a weekend)

Deadline for submitting reports to the Pension Fund for the 3rd quarter (9 months) of 2015:

Paper submission must be submitted no later than November 16, 2015.

Must be submitted electronically no later than November 20, 2015.

Deadlines for payment of insurance contributions to the funds:

Entrepreneurs, employers and organizations must pay insurance premiums every month by the 15th day of the month following the month in which contributions are calculated. If the 15th falls on a non-working day, then the expiration date is considered to be the nearest working day.

Deadlines for paying contributions to the funds in the 3rd quarter of 2015 and for the 3rd quarter of 2015.

the following:

No later than: July 15 (for June), August 17 (for July), September 15 (for August), October 15 (for September).

Deadlines for submitting reports to the Federal Tax Service for the 3rd quarter (9 months) of 2015.

Deadlines for submitting reports and paying taxes when applying the simplified tax system for the 3rd quarter (9 months) of 2015.

Submission of quarterly tax reports when applying the simplified tax system is not provided.

Organizations and entrepreneurs using the simplified tax system must pay an advance tax payment no later than October 26, 2015.

We remind you that organizations using the simplified taxation system are exempt from VAT, income tax, and property tax (except for real estate that has a cadastral value). And simplified entrepreneurs are also exempt from personal income tax (in terms of income from “simplified” activities).

Other taxes are paid by “simplified” residents in the usual manner in accordance with the legislation on taxes and fees.

Deadlines for submitting reports by UTII payers, deadlines for paying UTII for the 3rd quarter of 2015.

Deadline for submitting the UTII declaration for the 3rd quarter of 2015: no later than October 20, 2015.

Deadline for payment of UTII tax for the 3rd quarter of 2015: no later than October 26, 2015.

Deadlines for submitting VAT returns, deadlines for paying VAT for the 3rd quarter of 2015.

Taxpayers (tax agents) must submit a VAT return no later than October 26, 2015 (since the deadline of October 25 falls on a day off)

Deadlines for paying VAT for the 3rd quarter of 2015: October 26, November 25, December 25 (1/3 of the tax amount accrued for the 3rd quarter).

Deadlines for submitting income tax reports, deadlines for paying income tax for the 3rd quarter (9 months) of 2015.

Taxpayers for whom the reporting period is a quarter must submit a tax return for 9 months (3rd quarter) no later than October 28, 2015.

The quarterly advance payment of income tax for the 3rd quarter must be paid no later than October 28, 2015.

Monthly advance payments due during the quarter are due no later than the 28th day of each month of the quarter.

Taxpayers who calculate monthly advance payments based on actual profits received submit tax returns and pay advance payments no later than 28 days after the reporting month. Namely: August 28, 2015 (for the period January-July); September 28 (for the period January-August), October 28 (for the period January-September).

Deadlines for submitting excise tax reports, deadlines for paying excise taxes.

The advance payment of excise tax is paid no later than the 15th day of the current tax period (month).

Taxpayers who have paid an advance payment of excise duty submit documents confirming the payment of the advance payment to the tax authority.

Payment of excise tax for the expired tax period (month) is made before the 25th day of the next month. The tax return is submitted within the same period.

Deadlines for submitting property tax reports for the 3rd quarter of 2015 Deadlines for paying property taxes (advance payments)

The deadline for submitting the property tax report (tax calculation for advance payments) for the 3rd quarter of 2015 is October 30, 2015.

Deadlines for payment of land tax for the 3rd quarter of 2015

Because the established deadline of October 31 falls on a day off, then the deadline for payment of the advance payment of land tax for the 3rd quarter is postponed to the next working day - no later than November 2, 2015.

Deadlines for payment of transport tax (advance payments) for the 3rd quarter of 2015.

Deadline for payment of advance payments for transport tax for organizations for the 3rd quarter of 2015. – no later than November 2, 2015 (since the deadline of October 31 falls on a day off)

Tax returns are submitted by organizations once a year, based on the results of the year.

Deadline for submitting a report for negative environmental impact, deadline for payment for negative environmental impact.

The calculation and payment for the negative impact on the environment for the 3rd quarter of 2015 must be submitted no later than October 20, 2015.

Deadline for submitting a single simplified declaration for the 3rd quarter (9 months) of 2015.

If there was no activity, and there were no transactions on current accounts, there are no objects of taxation, then it is possible to submit a single simplified declaration. The filing deadline is the 20th day of the month following the reporting quarter. For the 3rd quarter of 2015 – October 20, 2015

October is a difficult month for an accountant: in addition to the monthly activities of sending documents and transferring funds to the budget and funds, regulatory authorities are waiting for reports for nine months or the third quarter of the year. Late payment may result in a fine or blocking of your current account. To ensure that you complete all the necessary actions on time, we will tell you about the important October dates for submitting reports and payments to the budget.

Financial statements

If an entrepreneur runs a business without employees or the organization exists with a single founder-director with whom there is no signed agreement (employment or contract), then in October they only need to submit accounting reports to the tax office. The forms of documents depend on the tax regime and the frequency of tax payments.

Declaration on UTII for the 3rd quarter of 2017

The tax period for imputation is a quarter, so payers in October report tax data for the previous three months. The declaration is submitted to the tax authorities at the actual place of business. If the actual place of activity cannot be determined, for example, during cargo transportation or trade with the distribution of goods, then we submit the document: individual entrepreneurs - at their place of residence, companies - at their legal address. Imputation is a convenient mode for companies whose real income exceeds the imputed one (check this on the website of your tax office). In this article we talked about how to evaluate the profitability of using UTII compared to a simplified one.

VAT return for the 3rd quarter of 2017

OSNO payers submit quarterly VAT returns. This document is also required to be provided by tax agents and firms or entrepreneurs that have issued or received an invoice with a dedicated value added tax. The document is submitted only via the Internet, regardless of the number of staff. A paper declaration will be accepted from you only in exceptional cases; they are given in paragraph 5 of Article 174 of the Tax Code of Russia.

Income tax return

All OSNO payers submit the declaration. Most often, the document is provided quarterly, and then in October we send a declaration for nine months. Companies with a high level of profit that make advances monthly submit a declaration at the end of the month. And then in October the declaration for September is sent. The document is filled out with a cumulative total at any frequency of submission. Companies often incorrectly reflect advances in this report, as well as contributions and taxes; please enter the data carefully. It is convenient that in the current declaration you can correct an error in the previous declaration so as not to send an amendment.

Reporting on employees in October 2017

If an individual entrepreneur or organization has employees on employment or contract contracts, then the number of regular reports immediately increases. Reports are added to funds and tax authorities in connection with contributions, the number of personnel and the amount of employee income. Some reports are submitted every month, some - based on the results of the quarter or year.

SZV-M report for September 2017

This is a monthly report for policyholders, its purpose is to identify working pensioners. Only organizations with a single founder-director who does not have an employment or contract agreement concluded with his own company do not submit a report. We send the report to the Pension Fund.

Report 4-FSS for 9 months of 2017

This is the only document that employers submit to Social Security. It is formed four times during the year. The report includes the amounts of contributions paid for injuries and occupational diseases, payments in case of accidents, funds for medical examination of personnel and special assessment of workplaces. If the number of employees is no more than 25, the report can be sent to Social Security in printed form, with a larger number of employees - only via the Internet. Individual entrepreneurs submit the document at their place of residence, organizations - at their legal address, and payroll departments - at their place of registration.

Calculation of insurance premiums for 9 months of 2017

We submit this calculation to the Federal Tax Service, which controls the procedure for submitting insurance premiums from the beginning of the current year. The document shows the amounts of contributions paid for pension, social and health insurance. The tax office accepts calculations based on the results of the quarter. A printed version of the calculation can be submitted to policyholders with a staff of up to 25 people, the rest submit the document only via the Internet. We submit both payment options within the same time frame.

Report 6-NDFL for 9 months of 2017

Employers and tax agents submit this report quarterly. It reflects income, personal income tax and deductions of employees with whom employment or contract agreements have been signed. The form contains information about the entire enterprise. With its help, officials check the correctness of the actions of tax agents who become employers: they must withhold income tax from employees and transfer it to the state.

Payments in October

In October, companies remit taxes for the past quarter or month, and also pay staff contributions. Timely transfers are important if you do not want to pay fines or lose access to your account.

Insurance premiums for September 2017

In addition to sending reports, you need to transfer contributions to the tax and Social Insurance Fund for employees. This is done by employers in all taxation systems in the same order.

Advance payment under the simplified tax system for 9 months of 2017

In October, simplifiers make their third single tax advance of the year. It is calculated on an accrual basis and transferred to the Federal Tax Service details. We told you how to calculate the advance and legally reduce it in this article.

UTII tax for the 3rd quarter of 2017

Payers of the imputed tax system in October transfer tax according to UTII for the third quarter of the year. Remember, tax is paid even if the enterprise did not operate and there was no movement of funds through the current account.

VAT for the 3rd quarter of 2017

In October, OSNO payers transfer VAT to the budget for the 3rd quarter. The payment can be divided into three equal parts and paid three months after the reporting quarter. Also, VAT for the 3rd quarter is paid by companies in special modes that issued or accepted an invoice with allocated VAT.

Advance payment for income tax

OSNO payers make another advance payment of income tax. If the company’s income over the previous four quarters was more than 60 million rubles, tax advances can be paid monthly. Then in October you need to make the first advance for the fourth quarter. Otherwise, the company pays nine months in advance.

Property tax for 9 months of 2017

All organizations on OSNO, simplified, patent or imputation that own property subject to taxation pay this tax based on quarterly results. We talked about calculating property taxes and different categories of payers in this article.

In 2019, organizations and individual entrepreneurs submit income tax returns on OSNO. The form for the 1st quarter of 2019 must be submitted by April 29, 2019. Submit the report on the form approved by Order of the Federal Tax Service dated October 19, 2016 No. ММВ-7-3-572@. In this article we will talk about filling out the declaration and checking key indicators.

Sections of the income tax return

The declaration contains standard sheets, appendices and sections. There are a lot of them, but you don't have to fill them all out. Taxpayers who received income during 3 months of 2019 must fill out the required forms:

- title page;

- section No. 1, subsection 1.1 with the amount of tax that the payer needs to pay to the budget;

- the second sheet with the calculation of income tax and its annexes;

- Appendix No. 1 to the second sheet with sales and non-sales income;

- Appendix No. 2 to the second sheet with production and sales costs, non-operating expenses and losses that are equivalent to these expenses .

The remaining sections will have to be completed if there are special conditions:

- Appendix No. 3 to the second sheet with calculations of all expenses for operations for which the results of financial activities are taken into account when taxing profits under Art. , 275.1 , , , art. 323 of the Tax Code of the Russian Federation, except for those reflected in the fifth sheet - filled out by organizations that sold depreciable property;

- Appendix No. 4 to the second sheet with the calculation of the loss or part thereof, which affects the reduction of the tax base - behindfill up organizations that carry forward losses incurred in previous years;

- Appendix No. 5 to the second sheet with the calculation of the distribution of payments to the budget of the subject between the organization and its divisions— filled in by organizations with separate divisions(except for those who pay tax for detached houses at the head office address);

- Appendix No. 6 to the second sheet with the calculation of tax payments to the budget of the subject among the consolidated group - filled out by organizations included in the consolidated group of taxpayers. Participants of consolidated groups with separate divisions fill out Appendix No. 6a;

- third sheet - filled out by tax agents who pay dividends and interest on securities;

- fourth sheet with calculation of income tax at a separate rate (clause 1 of Article 284 of the Tax Code of the Russian Federation) ;

- fifth sheet with the calculation of the tax base for organizations that carry out transactions with special consideration of the financial result (except for those that are in the appendix. № 3 to the second sheet) - filled out by organizations that received income from transactions with securities, bills and derivatives transactions;

- sixth sheet with expenses, income and tax base of non-state pension funds - filled out by non-state pension funds;

- seventh sheet with a report on the purpose of using property, money, work, and charitable services, targeted income and targeted financing - filled out by organizations that received targeted funding, target revenues, and only in the annual declaration;

- eighth sheet - filled out by organizations that independently adjust income and expenses, received through controlled transactions;

- ninth leaf - filled out by organizations that received income in the form of profits of a controlled foreign company;

- Appendix No. 1 to the declaration - filled out by organizations with income and expenses that are listed in Appendix No. 4 to the Procedure for filling out the declaration;

- Appendix No. 2 to the declaration - filled out by tax agents(under Article 226.1 of the Tax Code of the Russian Federation).

How to fill out an income tax return

Filling out the declaration is regulated in the Order of the Federal Tax Service of the Russian Federation dated October 19, 2016 No. ММВ-7-3/572@. The main questions are revealed there: what the declaration consists of, how to fill it out and how to submit it, according to what regulations to fill out individual sheets.

Part of the Order is made in the form of line-by-line instructions (Appendix No. 2) for filling out the declaration. It explains what numbers and indicators need to be indicated, what standards the information must comply with, what information should be reflected in what line.

If during the reporting period the company did not operate and did not receive income, the income tax return for the 1st quarter can be submitted in a simplified form, filling out only the title page and section 1.1 c dashes of tax amounts to be paid.

- In order for the tax office to understand for what period you are submitting the declaration, indicate on the title page the reporting period code “21” for 3 months (1 quarter). Carefully fill out the details fields and check the current OKVED code, they are updated frequently.

- In Appendix No. 1 to sheet 02, indicate the amount of income.

- In Appendix No. 2 to sheet 02, indicate your expenses.

- Complete the remaining sections if your company has special conditions.

- In sheet 02, transfer the total amounts of income and expenses from appendices 1 and 2 and calculate the tax and advance payments.

- Reflect the amounts payable in section 1.1

Who must file an income tax return?

The list of taxpayers who need to submit a declaration is indicated in Art. 246 Tax Code of the Russian Federation. The declaration must be submitted by:

- organizations from the Russian Federation and other countries that are on OSNO and pay this tax;

- income tax agents;

- responsible participants of consolidated groups of taxpayers;

- companies on a simplified basis or unified agricultural tax, paying tax on profits on securities or dividends of foreign companies.

By what day should the declaration be submitted?

How and where to file an income tax return

According to the Tax Code of the Russian Federation, you need to submit a declaration in the city (district) where your business is registered. If the business involves the presence of branches and divisions, then documents must be submitted both at their location and at the place of registration of the head office. An exception is made for very large taxpayers; they can submit a declaration to the tax authority at the place of registration (Clause 1, Article 289 of the Tax Code of the Russian Federation).

There are two ways to submit your declaration: electronically and in paper form. The paper version is submitted by mail or through a special representative with the appropriate authority. An electronic declaration can be sent through the Federal Tax Service website or using an EDF operator.

Important! If the organization has more than 100 employees or you are among the largest taxpayers, then you can submit your income tax return only in electronic format.

Consequences of late filing of the declaration

If you do not have time to submit your declaration by April 29, you will not avoid a fine. This is stated in Art. 119 Tax Code of the Russian Federation. The amount of the fine depends on the length of the delay.

- Up to six months, you will have to pay 5% of the tax amount to the budget for each month of delay, but not less than 100 rubles and not more than 30% of the total tax.

- More than six months - you will have to pay 30% of the tax amount indicated in the declaration + 10% for each month of delay. Let us remind you that even partial months are taken into account.

If you paid your tax on time, but forgot or were unable to file your return, a fine will also be assessed. The minimum fine in this case is 1,000 rubles.

Managers and accountants according to Art. 15.5 of the Code of Administrative Offenses of the Russian Federation can also be fined for lack of control and failure to meet deadlines. Fine - from 300 to 500 rubles.

Easily prepare and submit your income tax return online using the online service Kontur.Accounting. The declaration is generated automatically based on accounting and is checked before sending. Get rid of routine, submit reports and benefit from the support of our service experts. For the first two weeks, new users work in the service for free. For new LLCs, the gift is 3 free months of work and reporting.

In this material, the reader will find deadlines for submitting reports for the 3rd quarter of 2016 for individual entrepreneurs and organizations.

Let us remind you that according to the tax calendar for 2016-2017, for the specified period, policyholders and taxpayers, in accordance with the current legislation of the Russian Federation, must submit reports to the Federal Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund.

It should be noted that some reports for the specified period are submitted within a time frame depending on the method of reporting: electronically or in paper form.

Also, before we give specific deadlines for submitting reports for the 3rd quarter of 2016, let us remind you that if the deadline falls on a weekend or holiday, it is postponed to the next working day following the weekend.

What reports are submitted for the 3rd quarter of 2016?

Employers and insurers are required to submit the following reports for the third quarter of 2016:

- UTII declaration - for individual entrepreneurs and organizations working on this taxation system. Download . Question related to submitting a zero UTII declaration;

- VAT declaration for VAT payers. Instructions for filling out and form;

- 6-NDFL for employers. Instructions for filling, sample and form;

- RSV-1 for employers. Can be downloaded on this page;

- 4-FSS for employers. Details and ;

- SZV-M for employers. Nuances of filling out the form;

Explanations

If the average number of employees is less than the established limit for filing reports exclusively in electronic form, then the person has the right to choose the form and method of reporting at his own discretion.

As a general rule, filing a VAT return must be done exclusively electronically. The only exception is the case when this report is submitted by a tax agent who does not pay VAT. That is, when an individual entrepreneur or organization is exempt from paying VAT, according to Art. 145 of the Tax Code of the Russian Federation or applies a special tax regime. In this situation, the return can be filed either in paper or electronic form, at the discretion of the taxpayer.