At the beginning of 2017, organizations and entrepreneurs will have to report for 2016. We'll tell you what the annual reporting for 2016 includes, and we'll give you deadlines for submitting reports.

What reports need to be submitted for 2016

Annual reporting for 2016, reporting deadlines see the table below, it can be accounting, tax, insurance premiums and statistics.

The annual financial statements consist of a balance sheet, a statement of financial results and appendices to them (a statement of changes in capital, a statement of cash flows, a report on the intended use of funds and explanations drawn up in text and (or) tabular forms).

Small businesses, non-profit organizations, as well as participants in the Skolkovo project can submit annual financial statements for 2016 in a simplified form.

The composition of tax reporting depends on the taxation system used by the organization or businessman. Companies under the general regime submit declarations for income tax, VAT, transport and land tax, and property tax. Entrepreneurs using the common system submit all the same reports. Only instead of an income tax return they submit a personal income tax return.

Companies and individual entrepreneurs submit simplified tax, transport and land tax declarations using the simplified tax system. And the “imputers”, instead of a declaration under the simplified tax system, submit a declaration under UTII.

In addition, individual entrepreneurs, if they have employees, must submit a 2-NDFL certificate and a calculation in accordance with form 6-NDFL to the inspectorate.

See also: Schedule of reporting in 2017

Annual reporting for 2016 on insurance premiums includes calculations of 4-FSS and RSV-1.

Attention: since 2017, instead of RSV-1 and the first section of 4-FSS, a new calculation of contributions has been introduced, which will need to be submitted to the Federal Tax Service. What kind of report is this, and when it will need to be submitted, read in the magazine "Salary". Two ways to subscribe - or.

The composition of statistical reporting depends on the type of activity and where the company is located. It is easy to determine the deadlines for submitting reports to statistics - they are always indicated on the forms of these forms.

What determines the reporting deadlines?

Submission procedure reporting for 2016, reporting deadlines depend on the number of employees of the company. Thus, tax reporting can only be submitted electronically in two cases:

- the average number of employees is more than 100 people;

- The organization is the largest taxpayer.

And the VAT return must be submitted via the Internet, regardless of how many people work in the organization.

Submit reports on insurance premiums via the Internet if the organization employs 25 people or more. In this case, you cannot report on paper.

See also: Reporting contributions since 2017

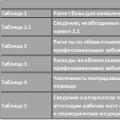

Specific See the table for deadlines for submitting annual reports for 2016 below.

Deadlines for submitting annual reports for 2016: table

What to take |

Deadline |

|---|---|

|

Calculation of 4-FSS for 2016 on paper; Report on average headcount for 2016 Declaration on UTII for 2016 |

|

|

Calculation of 4-FSS for 2016 via the Internet; VAT return for the 4th quarter of 2016 |

|

|

Land tax declaration for 2016; Transport tax return for 2016 |

|

|

RSV-1 for 2016 in the Pension Fund on paper |

|

|

RSV-1 for 2016 via the Internet |

|

|

income tax return for 2016 |

|

|

corporate property tax return for 2016 |

|

|

Declaration under the simplified tax system (legal entities) for 2016 Annual financial statements for 2016 |

|

|

2-NDFL for 2016 6-NDFL for 2016 Declaration 3-NDFL (individual entrepreneurs in the general regime) |

|

|

Declaration under the simplified tax system (for individual entrepreneurs) for 2016 |

Responsibility for late submission of reports for 2016

With composition annual reports for 2016, reporting deadlines figured it out. Now let's discuss what will happen if you do not submit reports on time.

The organization will be fined for late submission of reports. So, if you are late with submitting your accounting reports, the fine will be 200 rubles for each document that the organization did not submit on time.

According to tax reporting, the fine will be from 5 to 30% of the amount of tax that the organization must pay to the budget, but not less than 1000 rubles. The FSS will also calculate the fine.

Completing and meeting deadlines for submitting statistical reports must be taken seriously. After all, if you miss a deadline or make a mistake in the information, the company will be fined in the amount of 20,000 rubles. up to 70,000 rub. Repeated violations result in a fine of RUB 100,000. up to 150,000 rub.

An entrepreneur for failure to submit statistical reports will be fined 10,000-20,000 rubles, for a repeated violation - 30,000-50,000 rubles.

See also: Fines for accountants in 2017

Organizations must submit financial statements () to the tax authority at the place of registration by March 31 (Friday) inclusive. Ours also reminds us of this, which we recommend bookmarking so as not to miss other deadlines for paying taxes and fees, as well as submitting tax returns and calculations.

Accounting statements of organizations (except for credit, state and municipal) include ():

- balance sheet (form according to OKUD 0710001);

- financial results report (form according to OKUD 0710002);

- statement of changes in capital (form according to OKUD 0710003);

- cash flow statement (form according to OKUD 0710004);

- report on the intended use of funds (form according to OKUD 0710006);

- An example of formatting explanations for the balance sheet and financial results statement (form according to OKUD 0710005).

Let us recall that the taxpayer is obliged to submit annual accounting (financial) statements to the tax authority at the location of the organization no later than three months after the end of the reporting year, except in cases where the organization is in accordance with Federal Law of December 6, 2011 No. 402-FZ " " (hereinafter referred to as Law No. 402-FZ) is not required to keep accounting records or is a religious organization that did not have an obligation to pay taxes and fees during the reporting (tax) periods of the calendar year ().

In turn, individual entrepreneurs and persons engaged in private practice may not keep accounting records - if, in accordance with the legislation of the Russian Federation on taxes and fees, they keep records of income or income and expenses and other objects of taxation or physical indicators characterizing a certain type of business activities. Also, a branch, representative office or other structural unit of an organization established in accordance with the legislation of a foreign state located on the territory of the Russian Federation is exempt from accounting, if, in accordance with the legislation of the Russian Federation on taxes and fees, they keep records of income and expenses and other objects of taxation in the manner established by the specified legislation ().

At the same time, simplified methods of accounting, including, have the right to apply ():

- small businesses;

- non-profit organizations;

- organizations that have received the status of project participants to carry out research, development and commercialization of their results in accordance with Federal Law of September 28, 2010 No. 244-FZ " ".

Let us add that there are a number of exceptions to this norm ().

In addition to submitting reports to the tax authorities, organizations, up to March 31, 2017 inclusive, must submit to Rosstat a mandatory copy of the annual accounting (financial) statements for 2016, as well as an auditor’s report on them, if they are subject to a mandatory audit ().

What is the deadline to submit the balance sheet for 2017 to the Federal Tax Service? Who should take it? Are individual entrepreneurs required to submit a balance sheet? The answers to these questions are given in this consultation.

Who must submit the balance sheet for the past year?

Those who are responsible for accounting are required to prepare and submit financial statements. And these include all organizations. So, for example, companies using the simplified tax system, UTII and OSNO are required to keep accounting records. The tax system does not play a role in this case (Part 1, Article 6, Part 2, Article 13 of the Law of December 6, 2011 No. 402-FZ).

At the same time, under certain conditions, only individual entrepreneurs should not generate financial statements. This follows from Part 2 of Article 6 of the Law of December 6, 2011 No. 402-FZ. To be exempt from accounting, they must keep records of income or income and expenses and (or) other objects of taxation or physical indicators (for example, when applying UTII) in the manner established by Russian tax legislation.

Composition of financial statements for 2017

As part of the financial statements for 2017, the organization must submit the following forms:

- Balance sheet;

- Income statement;

- Statement of changes in equity;

- Cash flow statement;

- Explanations in tabular and text forms.

Balance due date in 2018

As a general rule, the balance sheet must be submitted no later than three months after the end of the reporting year. The reporting year in our case is 2017.

The reporting period for annual financial statements (i.e., reporting year) is the calendar year - from January 1 to December 31 inclusive. An exception is cases when an organization is registered, reorganized or liquidated in the middle of the year.

It turns out that the balance sheet for 2017 must be submitted no later than April 2, 2018 (this is Monday).

Read also Cash flow statement in 2017: form 4

New organizations

For companies created after September 30, 2017, the first reporting year is from the date of their registration to December 31, 2018 (Part 3, Article 15 of Law No. 402-FZ). For the first time, they must submit a balance sheet only based on the results of 2018.

Example

Zhdun LLC was organized and registered with the Federal Tax Service as a new company on November 8, 2017. In this case, for the first time, the company must submit its balance sheet for 2018 no later than April 1, 2019 inclusive (since March 31, 2019 is a Sunday).

If the company was organized no later than September 30, 2017, then the first reporting period will begin from the date of registration and end on December 31, 2017 (Part 3, Article 15 of Law No. 402-FZ).

Liquidated organizations

For liquidated organizations, the last reporting year is the period from January 1 to the date of making an entry about liquidation in the Unified State Register of Legal Entities (Article 17 of the Law of December 6, 2011 No. 402-FZ). Therefore, reports must be submitted within three months from this date. For example, an entry on the liquidation of an organization was made in the Unified State Register of Legal Entities on October 27, 2017, prepare financial statements as of October 26, 2017, the reporting period is from January 1 to October 26, 2017.

Reorganized companies.

In case of reorganization, the last reporting year is from January 1 of the year in which the last of the companies that emerged was registered until the date of such registration (Part 1, Article 16 of Law No. 402-FZ). An exception is cases of merger, when the last reporting year is the period from January 1 to the date when an entry was made in the Unified State Register of Legal Entities about the termination of the activities of the merged company (Part 2 of Article 16 of Law No. 402-FZ).

The reorganized company must submit its balance sheet no later than three months from the day that precedes the date of state registration of the last of the established companies or the date when an entry was made in the Unified State Register of Legal Entities about the termination of the activities of the affiliated organization (Part 3 of Article 16, Part 2 of Article 18 of the Law No. 402-FZ).

Currently, the state requires that a balance be submitted only once a year: on any suitable day from March 1 to March 31. Such deadlines for submitting the balance sheet are specified in both accounting (clause 2, article 18 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ) and tax legislation (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation).

NOTE! The balance sheet for owners and other interested parties can be submitted at any other frequency (Clause 4, Article 13 of Law No. 402-FZ). Tax authorities and statistics do not need to submit such reports.

The balance sheet can be submitted to the Federal Tax Service both electronically and on paper. But with reporting for 2019, the rules change.

And from June 1, 2019, the forms of the balance sheet and other accounting records changed (Order of the Ministry of Finance dated April 19, 2019 No. 61n). The key changes are:

- now reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- OKVED in the header has been replaced by OKVED 2;

- The balance sheet must contain information about the audit organization (auditor).

The auditor mark should only be given to those companies that are subject to mandatory audit. Tax authorities will use it both to impose a fine on the organization itself if it ignored the obligation to undergo an audit, and in order to know from which auditor they can request information on the organization in accordance with Art. 93 Tax Code of the Russian Federation.

More significant changes have occurred in Form 2. For more details, see.

If you fail to submit your report on time, punishment will inevitably come. Fortunately, its value does not depend on the balance sheet, as happens in the case of a late tax return.

If you do not send the balance to the tax authorities or do it with a delay, you will be fined 200 rubles. (clause 1 of article 126 of the Tax Code of the Russian Federation). Administrative punishment is also possible for officials under paragraph 1 of Art. 15.6 of the Code of Administrative Offenses of the Russian Federation in the amount of 300-500 rubles.

If the balance is not received by the statistical authorities, then the amount of punishment will be 10,000-20,000 rubles in case of a violation committed for the first time. for officials and 20,000-70,000 rubles. for legal entities (clause 1 of article 13.19 of the Code of Administrative Offenses of the Russian Federation). If the offense is repeated, the fines will increase respectively to 30,000-50,000 and 100,000-150,000 rubles. (clause 2 of article 13.19 of the Code of Administrative Offenses of the Russian Federation).

Typically the reporting period is one year. During this time, you need to draw up a balance sheet and submit it to all authorities within the established time frame.

But you can register and start working from any date within the calendar year, and then the reporting period will be shorter than traditional. At the same time, the deadline for preparing the balance sheet is usual: within 3 months after the end of the reporting period.

Another case is the liquidation of a company. For such a company, the reporting period ends with the date of entry into the Unified State Register of Legal Entities on liquidation (Article 17 of Law No. 402-FZ), and the same 3-month period applies for the preparation and submission of reports.

For more information about where the liquidation balance is submitted, read the material “Where to submit the liquidation balance sheet” .

An extended reporting period occurs when the decision to start a business is made at the end of the year and registration occurs after September 30 (for example, in October 2019). Then, according to paragraph 3 of Art. 15 of Law No. 402-FZ, the reporting period increases and lasts from October 1, 2019 to December 31, 2020. Such an increase does not affect the deadline established by law for submitting the balance sheet.

Results

Reports must be submitted no later than the deadlines established by law. Failure to submit a balance or delay in submitting it will result in penalties.

Download quickly and free of charge the correct sample balance sheet for 2016 for the organization in excel format. How to distribute amounts across accounts between balance sheet items, what should you remember when filling out the Form 1 report in 2017?

Form and example of filling out a balance sheet in 2017- download .

In 2017, organizations must submit a balance sheet to the tax authorities based on accounting data for 2016. To fill out, you should use the balance sheet approved by Order No. 66n of the Federal Tax Service. The article provides detailed instructions for filling out the articles of this report, as well as links where you can download the current form and a sample of filling out the balance sheet for 2016 for free.

The balance sheet of an enterprise is the main accounting report that is prepared by each organization at the end of the year. If the enterprise itself wishes, interim balance sheets are also drawn up throughout the year to verify the recorded information. There is no need to submit interim reports anywhere; the company itself needs them for self-checking. Regulatory authorities require the mandatory submission of a balance sheet at the end of the year.

Balance due date

For 2016, the balance sheet (formerly also called Form 1) must be submitted on the last day of March 2017; the report can be submitted earlier. March 31 is the deadline for submitting reports, and in 2017 this date falls on a working day, and therefore there will be no postponements of the deadline.

The place for submitting the balance is the Federal Tax Service branch at the place of registration of the organization, as well as Rosstat. At the same time, the balance sheet must be submitted to the statistics agency in electronic format; for the tax office, there are no strict requirements for the form of reporting.

Balance sheet form in 2017

When submitting reports for 2016, you must use the form approved by Order 66n, the last edition of which was on 04/06/2015. That is, the form has not changed, you need to submit the same form as last year.

If the company is considered small in terms of its indicators, then you can fill out the balance sheet in an abbreviated simplified version.

As an example, the process of filling out the balance sheet for 2016 is analyzed, the instructions are presented below, the result is a completed sample, the link to which is given below.

Sample of filling out the balance sheet for 2016

Form 1 contains two sections, the first shows the assets of the enterprise, the second collects liabilities.

Each section is represented by articles by which accounting data for the year is distributed. The level of detail of the information reflected is determined by each organization independently. The presented balance sheet form is recommended and can be adjusted, supplemented with items for greater detail. Unnecessary lines for which there is no data can be crossed out or deleted.

At the same time, it is important that the organization uses the same balance sheet items from year to year, since information for the last 3 years is shown in one form. Therefore, there should not be a situation where in one year there is a certain line in the form, but not in another. In this regard, it is better not to exclude lines that are not used in the reporting year; perhaps they will be needed next year; it is better to put a dash in the empty line.

Only enterprises in any tax regime fill out the balance sheet. Individual entrepreneurs do not fill out the report, since they have no obligation to keep accounting.

Line by line filling of balance sheet assets

|

Line |

Filling |

| 1110 NMA | The debit balance for accounts 04 and 08.5 is added up, and the accrued depreciation on the loan account 05 is subtracted from the result obtained. That is, the line of the form shows the residual value of intangible assets and investments in them. |

| 1150 OS | The debit balance for accounts 07, 08 (except for subaccount 08.5) and 01 is added up, and depreciation on the loan account 02 is subtracted from the result obtained. The balance sheet line reflects the residual value of fixed assets and investments in them. |

| 1170 Financial investment | To obtain the result, the debit balance of account 58 is taken, from which the credit balance of accounts 59 and 63 is subtracted. In this case, only data related to long-term investments are taken into account. This is convenient to do if you initially distribute short-term and long-term investments, conducting analytics on them. Long-term investments have a repayment period exceeding 1 year. This includes shares, contributions to the capital of other companies, loans, bonds. |

| 1210 Reserves | This concept must include all the inventories the organization has, information about which can be distributed among accounts 10, 15, 20, 21, 23, 41, 44, 45, 97. The debit turnover on these accounts is taken, after which the credit balance on counts 14 and 42. |

| 1230 Debit.request. | The debt of others to the organization filling out the balance sheet. For the calculation, the debit balance of account 46 is taken, as well as data on subaccounts 60, 62, 68, 69, 70, 71, 73, 75, 76. The credit balance of account 63 is subtracted from the result. |

| 1240 Financial investment | This line of form 1 shows short-term investments, the maturity of which must occur in the next 12 months. The procedure for calculating the indicator is similar to that given in balance line 1170, only data on short-term investments is taken. Again, it is convenient to take this information if it was taken into account in advance in separate analytical accounts. |

| 1250 Den.av. | This line of the balance sheet shows the sum of all assets of the enterprise in monetary terms. The indicator can be calculated by adding up the debit balance of accounts 50, 51, 52, 57. |

Line by line filling out the liabilities of the balance sheet form

|

Line |

Filling |

| 1340 Revaluation | If during 2016 the value of fixed assets was recalculated, then the result is shown in account 83; the data from this account must be shown in this line of the balance sheet. |

| 1370 Profit/loss | The final result of the activity, expressed in the form of annual profit or loss, is entered in this line of the balance sheet form. The results are summed up after the reformation. If the account balance is 84 credit, then this is the profit that is entered in this line without brackets. If the balance of account 84 is debit, then this is a loss that is entered in parentheses. |

| 1410 Borrowed avg. | Loans that are long-term in nature are shown, that is, the repayment period will not occur in the next 12 months. The indicator for filling out the balance line is the credit balance of account 67. |

| 1510 Replace medium | Loans that are short-term in nature are shown, that is, the repayment period will occur in the next year. The indicator to be filled out is taken from account 66. |

| 1520 Credit.back. | The organization's debt to contractors, suppliers, customers, and personnel at the end of 2016. The indicator is calculated as the sum of credit balances on subaccounts 60, 62, 68, 69, 70, 71, 73, 75.2, 76 |

| 1540 Est. oblig. | The indicator to be entered in this line of the balance sheet is the credit balance according to account 96. |

After all the data on the accounts as of December 31, 2016 is distributed among the balance sheet items, it is necessary to summarize the results by calculating the amount of all assets and entering it in line 1600, and then calculating the amount of all liabilities and entering it in line 1700.