Form 4-FSS indicates data on insurance contributions to the Social Insurance Fund for employees accrued and paid in the reporting quarter. All employers submit these reports every quarter to the territorial office of the Social Insurance Fund:

- Individual entrepreneur - at his place of residence;

- Organizations (legal entities) - at their location.

ATTENTION: from the 3rd quarter of 2016, a new form 4-FSS (with amendments) will be in effect, and from January 2017, in connection with the transfer, 4-FSS reporting will be practically canceled (only reporting on contributions to social insurance against accidents at work and professional will remain. diseases).

Deadlines for submitting 4-FSS

From January 2015, new reporting deadlines:

- On paper- no later than the 20th day of the month following the reporting quarter;

- Electronic- no later than the 25th day of the month following the reporting quarter.

If the day of reporting falls on a weekend or holiday, then the whole matter is postponed to the next working day.

4-FSS submission methods

1) Reports are submitted on paper if the number of employees is less than 25 people (but if possible and desired, no one forbids submitting them in electronic form). You can submit it in the following ways:

- In person or through a representative by proxy;

- By mail in a valuable letter with a list of the contents.

The form is printed in 2 copies (one will be returned to you with a receipt stamp). In addition to the paper version, inspectors are also asked to bring an electronic version of the completed 4-FSS on a flash drive.

2) In electronic form, using an Enhanced Qualified Electronic Signature (EDS), it is submitted by individual entrepreneurs and organizations with an average number of employees of more than 25 people. The day of submission of electronic reporting is the date of its dispatch. Registration of such a signature takes 1-2 days and costs an average of 6500-7500 rubles. It's better to take care of this in advance.

Zero reporting 4-FSS

If an individual entrepreneur or organization is registered with the Social Insurance Fund as an employer, then Form 4-FSS must be submitted in any case, even if no activity was carried out.

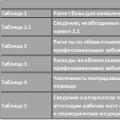

Mandatory completion: Title page, table 1, table 3, table 6, table 7, table 10. All other tables, in the absence of indicators, do NOT need to be filled out and included in the report.

Fines for failure to submit 4-FSS

For failure to submit Form 4-FSS, you are fined under 2 articles at once (Article 46 of the Law of July 24, 2009 No. 212-FZ and Article 19 of the Law of July 24, 1998 No. 125-FZ), because reporting is submitted for 2 types of insurance premiums:

In case of temporary disability and in connection with maternity;

From industrial accidents and occupational diseases (injuries).

1) For failure to submit 4-FSS within the prescribed period for contributions for sick leave and in connection with maternity (Section 1), the fine is:

- 5% of the amount of contributions that must be paid for the last 3 months of the reporting period (quarter), but not more than 30% and not less than 1,000 rubles. The minimum fine is usually paid when it comes to zero reporting.

2) For late submission of Form 4-FSS for contributions for injuries (Section 2), the fine is:

- If the delay does not exceed 180 calendar days, then 5% of the amount of contributions for each full or partial month of delay, but not more than 30% and not less than 100 rubles;

- If the delay exceeded 180 calendar days, then 30% of the amount of contributions + an additional 10% of the amount of contributions will be added for each full or partial month, starting from 181 days. In this case, the minimum fine is 1,000 rubles, and the maximum is unlimited.

Administrative responsibility. If the FSS sues, then officials of the organization (accountant, manager) may pay a fine of 300 to 500 rubles (Article 15.33 of the Code of Administrative Offenses of the Russian Federation) for late submission of 4-FSS.

Instructions for filling out form 4-FSS

Click on each instruction field of interest to see detailed information.

General filling rules

1) At the top of each page to be filled out, the fields “Insured Registration Number” and “Subordination Code” are filled in in accordance with the notification received upon registration with the Social Insurance Fund as an insured.

2) The calculation form is filled out using a computer or by hand with a black or blue ballpoint pen in block letters.

3) When filling out the Calculation form, only one indicator is entered in each line and the corresponding columns. If there are no indicators provided for in the Calculation form, a dash is placed in the line and the corresponding column.

Note: although in practice, it happens that someone puts dashes, instead they leave an empty space or write a zero, and the FSS inspectors did not find fault with this.

4) Title page, table 1, table 3, table 6, table 7, table 10 of the Calculation form are mandatory for submission by all payers of insurance premiums.

If there are no indicators to fill out Table 2, Table 3.1, Table 4, Table 4.1, Table 4.2, Table 4.3, Table 5, Table 8, Table 9 of the Calculation form, these tables are not filled out and are not submitted.

5) Errors cannot be corrected using a correction tool.

To correct errors, you must cross out the incorrect value of the indicator, enter the correct value of the indicator and sign the policyholder or his representative under the correction indicating the date of correction.

All corrections are certified by the seal (if any) of the insurance premium payer (legal successor) or his representative.

6) After filling out the Calculation form, sequential numbering of the completed pages is entered in the “page” field.

7) At the end of each page of the Calculation, the signature of the payer of insurance premiums (legal successor) or his representative and the date of signing of the Calculation are affixed.

Title page

In the field “Insured Registration Number” the registration number of the policyholder is indicated.

Field "Subordination code" consists of five cells and indicates the territorial body of the Fund in which the payer of insurance premiums (policyholder) is currently registered.

Note: the above fields are filled in in accordance with the notification received upon registration with the Social Insurance Fund as an insured.

In the “Adjustment number” field:

- when submitting the primary Calculation, code 000 is indicated;

- when submitting a Calculation to which changes or corrections have been made, a number is entered indicating which account the Calculation, taking into account the changes and additions made, is being submitted to the territorial body of the Fund (for example: 001, 002, 003, ... 010).

ATTENTION: The updated Calculation is presented in the form in force in the period for which errors (distortions) were identified.

Field "Reporting period (code)". The first two cells contain the code of the period for which the Calculation is being presented:

- 1st quarter - 03;

- Half-year - 06;

- 9 months - 09;

- Calendar year - 12.

The last two cells of the field indicate the number of requests from the payer of insurance premiums (the policyholder) for the allocation of the necessary funds for the payment of insurance compensation: for example, 01, 02, 03, etc.

In the "Calendar year" field The calendar year for the billing period of which the Calculation (or updated calculation) is submitted is indicated.

Field "Cessation of activity" is filled out only in case of termination of the organization’s activities due to liquidation or in case of termination of activities as an individual entrepreneur. In these cases, the letter “L” is entered in this field.

In the field “Full name of organization.../Full name” IP..." the name of the organization is indicated in accordance with the constituent documents or a branch of a foreign organization operating on the territory of the Russian Federation, a separate division.

When submitting a Calculation by an individual entrepreneur, a lawyer, a notary engaged in private practice, the head of a peasant farm, an individual not recognized as an individual entrepreneur, his last name, first name, patronymic (the latter if available) are indicated (in full, without abbreviations) in accordance with the document, identification.

Field "TIN"(taxpayer identification number). Organizations and individual entrepreneurs indicate the TIN in accordance with the certificate of registration with the tax authority.

For organizations, the TIN consists of ten characters, and the field on the form has twelve cells. Therefore, the first two cells should be filled with zeros (00), for example, 001234567892.

Field "Checkpoint"(reason code for registration). The checkpoint is indicated in accordance with the certificate of registration with the tax authority at the location of the organization (separate division).

Individual entrepreneurs do not fill out this field.

Field “OGRN (OGRNIP)”. Organizations and individual entrepreneurs indicate their OGRN (OGRNIP) in accordance with the received state registration certificate.

When filling out the OGRN of a legal entity (organization), which consists of 13 characters, in the field of 15 cells reserved for recording the OGRN indicator, zeros (00) should be entered in the first two cells, for example, 001234567891122.

In the “Contact phone number” field indicate a landline or mobile phone number with a city code or cellular operator. The numbers are filled in in each cell WITHOUT using the dash and parenthesis signs.

In the fields provided for indicating the registration address:

- Organizations (legal entities) - indicate the legal address;

- Individual entrepreneurs - indicate the registration address at the place of residence.

In the field “Code of the payer of insurance premiums (policyholder)” a code is indicated that determines the category of the insurance premium payer (the policyholder).

- In the first three cells, the code is indicated in accordance with Appendix No. 1 to the Procedure for filling out 4-FSS;

- In the next two cells - the code in accordance with Appendix No. 2;

- In the last two cells there is a code in accordance with Appendix No. 3.

In the field “Average number of employees” indicates the average number of employees calculated as of the reporting date (in other words, as of the last day of the reporting period: quarter, half-year, nine months and year).

In the field reserved for filling in the indicator “of which: women” the average number of working women is indicated.

Information about the number of pages of the submitted Calculation(for example, “007”) and the number of attached sheets of supporting documents is indicated in the fields “Calculation submitted on” and “with supporting documents attached or their copies on”.

Field “I confirm the accuracy and completeness of the information specified in this calculation”:

At the top of the field the code of the person confirming the accuracy and completeness of the information contained in the Calculation is indicated:

- 1 - payer of insurance premiums (head of an organization or individual entrepreneur);

- 2 - representative of the payer of insurance premiums;

- 3 - legal successor of the liquidated organization;

- by the head of the organization - the surname, first name, patronymic (the latter if available) of the head of the organization is indicated completely in accordance with the constituent documents;

- individual entrepreneur - indicate the last name, first name, patronymic (last if available) of the individual entrepreneur;

- a representative of the payer of insurance premiums (or legal successor), who is an individual - indicate the surname, first name, patronymic (last if available) of the individual in accordance with the identity document;

- representative of the payer of insurance premiums (or legal successor), who is a legal entity - the name of this legal entity is indicated in accordance with the constituent documents.

In the fields “Signature”, “Date”, “M.P.” the signature of the payer of insurance premiums (successor) or his representative is affixed, as well as the date of signing the Calculation; A stamp (if any) is placed in the “M.P.” field.

In the field “Document confirming the authority of the representative” the type of document confirming the authority of the representative of the insurance premium payer (legal successor) is indicated, for example, “Power of Attorney No.... dated...”.

Section 1. Insurance in case of temporary disability and in connection with maternity

Table 1. Calculations for insurance in case of temporary disability. and in connection with motherhood

In the “OKVED code” field the code of the main type of economic activity is indicated according to the OKVED classifier. This field is filled in by insurance premium payers who apply reduced rates. The OKVED code can be found from the Unified State Register of Individual Entrepreneurs (USRIP) for individual entrepreneurs or the Unified State Register of Legal Entities (USRLE) for legal entities. persons

When filling out the table:

In lines 2, 3, 5, 6, 15, 16 the amounts are shown on a cumulative basis from the beginning of the billing period (column 3) with the division “At the beginning of the reporting period”, “for the last three months of the reporting period” (column 1).

By line 1 reflects the amount of debt on insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, accumulated by the payer of insurance contributions at the beginning of the billing period. This indicator should be equal to the indicator of line 19 for the previous billing period, which does not change during the billing period.

By line 2 reflects the amount of insurance premiums calculated from the beginning of the billing period, subject to payment to the territorial body of the Fund.

On line 3 the amounts of insurance premiums accrued to the payer of insurance premiums by the territorial body of the Fund based on the results of on-site and desk audits are reflected.

On line 4

On line 5 the amounts of expenses not accepted for offset for previous billing periods are reflected according to reports of on-site and desk inspections conducted by the territorial body of the Fund.

On line 6 the amounts of funds received from the territorial body of the Fund by the payer of insurance premiums for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity are reflected.

On line 7

Line 8 - control line, which indicates the sum of indicators of lines 1 to 7.

On line 9 the amount of debt is reflected at the end of the reporting (calculation) period based on the accounting data of the insurance premium payer:

- On line 10 reflects the amount of debt owed to the territorial body of the Fund at the end of the reporting (settlement) period, formed due to the excess of expenses incurred for the purposes of compulsory social insurance in case of temporary disability and in connection with maternity over the amount of insurance contributions subject to transfer to the territorial body of the Fund.

- On line 11

On line 12 the amount of debt at the beginning of the billing period is reflected:

- On line 13 reflects the amount of debt owed to the territorial body of the Fund at the beginning of the billing period, formed due to the excess of expenses for the purposes of compulsory social insurance in case of temporary disability and in connection with maternity over the amount of insurance contributions subject to transfer to the territorial body of the Fund, which does not change during the billing period (based on accounting data of the insurance premium payer).

- On line 14

The indicators of lines 12 - 14 must be equal to the indicators of lines 9 - 11 of the Calculation for the previous billing period, respectively.

On line 15 expenses for the purposes of compulsory social insurance in case of temporary disability and in connection with maternity, made by the payer of insurance contributions from the beginning of the billing period, are reflected. This indicator must correspond to the indicator of control line 15, column 4 of table 2 of the Calculation.

On line 16

On line 17 the written-off amount of debt of the payer of insurance premiums is reflected in accordance with the regulatory legal acts of the Russian Federation adopted in relation to specific insurers or the industry for writing off arrears, as well as in the event that the court adopts an act in accordance with which the authorities monitoring the payment of insurance premiums lose the ability to collect arrears in due to the expiration of the established period for their collection, including the issuance of a ruling on the refusal to restore the missed deadline for filing an application to the court for the collection of arrears.

Line 18- control line, which indicates the sum of indicators of lines 12, 15 - 17.

On line 19

Table 2. Insurance costs for temporary disability. and in connection with motherhood

This table reflects expenses for the purposes of compulsory social insurance in case of temporary disability and in connection with maternity from the beginning of the billing period in accordance with the current regulations on compulsory social insurance.

When filling out the table:

In column 3:

- lines 1 - 6, 12 indicate the number of paid days;

- on lines 9 - 11 - the number of payments made;

- on lines 7, 8, 14 - the number of benefits.

In column 4 expenses are reflected on an accrual basis from the beginning of the billing period, offset against insurance premiums accrued to the Fund, including in column 5 expenses incurred from funds financed from the federal budget are reflected: in excess of the established norms for persons affected by radiation exposure, in cases established by the legislation of the Russian Federation, payment of additional days off for caring for disabled children, as well as additional costs for the payment of benefits for temporary disability, pregnancy and childbirth associated with the inclusion in the insurance record of the insured person of service periods during which the citizen was not subject to compulsory social insurance in case of temporary disability and in connection with maternity, in accordance with Part 4 of Article 3 of the Federal Law of December 29, 2006 No. 255-FZ, affecting the determination of the amount of benefits from January 1, 2007.

By line 1 expenses for payment of benefits for temporary disability are reflected, made at the expense of compulsory social insurance in case of temporary disability and in connection with maternity on the basis of primary certificates of incapacity for work for the reporting period, including benefits paid in favor of working insured persons who are citizens of member states of the Eurasian economic union (hereinafter referred to as the EAEU), and the number of cases of assignment of temporary disability benefits without taking into account the costs of paying temporary disability benefits in favor of working insured foreign citizens and stateless persons temporarily staying in the Russian Federation (column 1), of which:

- By line 2- expenses for the payment of temporary disability benefits to persons working part-time, and the number of cases of assignment of temporary disability benefits (column 1).

On line 3 expenses for the payment of benefits for temporary disability, made at the expense of compulsory social insurance in case of temporary disability and in connection with maternity on the basis of primary certificates of incapacity for work for the reporting period, and the number of cases of assignment of benefits for temporary disability (column 1) to working foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists in accordance with Federal Law No. 115-FZ of July 25, 2002 “On the legal status of foreign citizens in the Russian Federation”...), of which:

- On line 4- expenses for the payment of temporary disability benefits to foreign citizens and stateless persons temporarily residing in the Russian Federation, working part-time, and the number of cases of assignment of temporary disability benefits (column 1).

On line 5 expenses for the payment of maternity benefits made at the expense of compulsory social insurance in case of temporary disability and in connection with maternity are reflected on the basis of initial certificates of incapacity for work for the reporting period, and the number of cases of assignment of maternity benefits (column 1), from them:

- On line 6- payments to persons working on external part-time jobs, and the number of cases of assignment of maternity benefits (column 1).

On line 7 expenses for the payment of a one-time benefit to women registered with medical organizations in the early stages of pregnancy are reflected.

On line 8 expenses for the payment of a one-time benefit for the birth of a child made by the payer of insurance premiums are reflected.

On line 9 expenses for the payment of monthly child care benefits are reflected, reflecting the number of recipients in column 1, including:

- On line 10- for caring for the first child, reflecting the number of recipients in column 1;

- On line 11- for caring for the second and subsequent children, reflecting the number of recipients in column 1.

On line 12 expenses for additional days off to care for disabled children incurred by the payer of insurance premiums are reflected.

On line 13 expenses for paying insurance premiums to state extra-budgetary funds accrued to pay for additional days off to care for disabled children are reflected.

On line 14 expenses for social benefits for burial or reimbursement of the cost of a guaranteed list of funeral services made by the payer of insurance contributions are reflected.

Line 15- control line, where the sum of lines 1, 3, 5, 7, 8, 9, 12, 13, 14 is indicated.

On line 16

Table 3. Calculation of the base for calculating insurance premiums

By line 1 the corresponding columns reflect the amount of payments and other remuneration accrued in favor of individuals in accordance with Article 7 of the Federal Law of July 24, 2009 No. 212-FZ, as well as accrued in accordance with international treaties, including under the Treaty on the Eurasian Economic Union of May 29, 2014 (ratified by Federal Law No. 279-FZ of October 3, 2014), cumulatively from the beginning of the billing period and for each of the last three months of the reporting period.

For payments in favor of persons who are citizens of EAEU member states, the payer of insurance premiums pays insurance premiums at a rate of 2.9%.

By line 2 the corresponding columns reflect amounts not subject to insurance premiums in accordance with Article 9 of the Federal Law of July 24, 2009 No. 212-FZ and in accordance with international treaties.

On line 3 the corresponding columns reflect the amounts of payments and other remuneration made in favor of individuals that exceed the maximum base for calculating insurance premiums established annually by the Government of the Russian Federation in accordance with Part 5 of Article 8 of the Federal Law of July 24, 2009 No. 212-FZ.

On line 4 the base for calculating insurance premiums is reflected, which is defined as the difference in line indicators (line 1 - line 2 - line 3).

On line 5 the corresponding columns indicate the amount of payments and other remuneration made by pharmacy organizations and individual entrepreneurs with a license for pharmaceutical activities to individuals who, in accordance with the Federal Law of November 21, 2011 No. 323-FZ “On the fundamentals of protecting the health of citizens in the Russian Federation » have the right to engage in pharmaceutical activities or are allowed to carry them out, and pay a single tax on imputed income for certain types of activities, applying the tariff established by part 3.4 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ.

On line 6 the corresponding columns indicate the amount of payments and other remuneration made by payers of insurance premiums to crew members of ships registered in the Russian International Register of Ships, with the exception of ships used for storage and transshipment of oil and petroleum products in the seaports of the Russian Federation, applying the tariff established by part 3.3 of the article 58 of the Federal Law of July 24, 2009 No. 212-FZ.

On line 7 the corresponding columns indicate the amount of payments and other remuneration made to individuals by individual entrepreneurs applying the patent taxation system, in respect of which the insurance premium rate is established by part 3.4 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ.

On line 8 the corresponding columns indicate the amount of payments and other remuneration in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists), except for persons who are citizens of the EAEU member states.

For payments in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists), the payer of insurance premiums (the policyholder) pays insurance premiums at a rate of 1.8%.

Table 3.1. Information about foreign citizens and stateless persons, temporarily held. in the Russian Federation

The table is filled out by insurance premium payers who have entered into employment contracts with foreign citizens and stateless persons temporarily residing in the Russian Federation (with the exception of highly qualified specialists), with payments and other remunerations calculated in their favor. Persons who are citizens of EAEU member states are not indicated in Table 3.1.

In columns 3 - 5 the information corresponding to an individual - a foreign citizen or a stateless person is indicated: TIN of an individual - a foreign citizen or a stateless person, the insurance number of the individual personal account of the insured person (SNILS) in the personalized accounting system of the Pension Fund of the Russian Federation, citizenship (if any).

Table 4-4.3. Information required to apply a reduced insurance premium rate

Tables 4-4.3 are filled out only by policyholders applying reduced rates.

Table 4. “Calculation of compliance of conditions for the right to apply a reduced tariff of insurance premiums by insurance premium payers specified in paragraph 6 of part 1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ.”

The table is filled out by organizations operating in the field of information technology (with the exception of organizations carrying out technology innovation activities) and applying the tariff established by Part 3 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ.

In order to comply with the criteria specified in Part 2.1 of Article 57 of the Federal Law of July 24, 2009 N 212-FZ, and to comply with the requirements of Part 5 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ, organizations operating in the field of information technologies, fill out columns 3 and 4 of the table on lines 1 - 4.

In order to comply with the criteria specified in Part 2.2 of Article 57 of the Federal Law of July 24, 2009 N 212-FZ, and to comply with the requirements of Part 5 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ, newly created organizations fill out only column 4 tables for rows 1 - 4.

When filling out the table:

By line 1 the average/average number of employees calculated in the prescribed manner is indicated.

By line 2 the total amount of income is reflected, determined in accordance with Article 248 of the Tax Code of the Russian Federation.

On line 3 reflects the amount of income from the sale of copies of computer programs, databases, transfer of exclusive rights to computer programs, databases, granting rights to use computer programs, databases under license agreements, from the provision of services (performance of work) for development, adaptation and modification computer programs, databases (software and information products of computer technology), as well as services (work) for installation, testing and maintenance of these computer programs.

Row value 4 is defined as the ratio of the values of rows 3 and 2 multiplied by 100.

On line 5 the date and number of the entry in the register of accredited organizations operating in the field of information technology are indicated, based on the received extract from the said register, sent by the authorized federal executive body in accordance with paragraph 9 of the Regulations on state accreditation of organizations operating in the field of information technology, approved by Decree of the Government of the Russian Federation of November 6, 2007 N 758.

Table 4.1. Calculation of compliance of conditions for the right to apply a reduced tariff of insurance premiums by insurance premium payers specified in paragraph 8 of part 1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ.

The table is filled out by organizations and individual entrepreneurs using a simplified taxation system, as well as combining the use of a taxation system in the form of a single tax on imputed income for certain types of activities and a simplified taxation system, as well as individual entrepreneurs combining the use of a patent taxation system and a simplified taxation system, the main type of economic activity classified in accordance with the All-Russian Classifier of Types of Economic Activities, which is named in paragraph 8 of part 1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ and applying the tariff of insurance contributions to payments and remunerations in favor of all employees - individuals persons established by Part 3.4 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ.

When filling out the table:

By line 1 indicates the amount of income determined in accordance with Article 346.15 of the Tax Code of the Russian Federation on an accrual basis from the beginning of the reporting (settlement) period.

By line 2 the amount of income from the sale of products and (or) services provided in the main type of economic activity is indicated, determined for the purposes of applying Part 1.4 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ.

On line 3 the share of income determined for the purposes of applying Part 1.4 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ is indicated. The indicator value is calculated as the ratio of the values of rows 2 and 1, multiplied by 100.

Table 4.2. Calculation of the compliance of conditions for the right to apply a reduced tariff of insurance premiums by insurance premium payers specified in paragraph 11 of part 1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ.

The table is filled out by payers of insurance premiums - non-profit organizations (with the exception of state (municipal) institutions), registered in the manner established by the legislation of the Russian Federation, applying a simplified tax system and carrying out activities in accordance with the constituent documents in the field of social services for the population, scientific research and development, education , healthcare, culture and art (the activities of theaters, libraries, museums and archives) and mass sports (except for professional), applying the tariff established by part 3.4 of article 58 of the Federal Law of July 24, 2009 N 212-FZ.

In order to comply with the criteria specified in Part 5.1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ, non-profit organizations fill out lines 1 - 5 of column 3 of the table when submitting the Calculation for each reporting period.

In order to comply with the requirements of Part 5.3 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ, non-profit organizations fill out lines 1 - 5 of column 4 of the table based on the results of the billing period, that is, when submitting the Calculation for the year.

When filling out the table:

By line 1 the total amount of income is reflected, determined in accordance with Article 346.15 of the Tax Code of the Russian Federation, taking into account the requirements of Part 5.1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ.

By line 2 the amount of income is reflected in the form of targeted revenues for the maintenance of non-profit organizations and the conduct of their statutory activities, named in paragraph 11 of part 1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ, determined in accordance with paragraph 2 of Article 251 of the Tax Code of the Russian Federation.

On line 3 reflects the amount of income in the form of grants received for the implementation of activities named in paragraph 11 of part 1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ, determined in accordance with subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

On line 4 the amount of income from carrying out the types of economic activities specified in subparagraphs r - f, i.4 - i.6 of paragraph 8 of part 1 of article 58 of the Federal Law of July 24, 2009 N 212-FZ is reflected.

On line 5 reflects the share of income determined for the purposes of applying Part 5.1 of Article 58 of Federal Law No. 212-FZ of July 24, 2009, which is calculated as the ratio of the sum of lines 2, 3, 4 to line 1, multiplied by 100.

Table 4.3. Information necessary for the application of the reduced rate of insurance premiums by the payers of insurance premiums specified in paragraph 14 of part 1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ.

The table is filled out by insurance premium payers - individual entrepreneurs on the patent taxation system, applying the insurance premium tariff established by part 3.4 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ - in relation to payments and rewards accrued in favor of individuals employed in the type of economic activity specified in the patent, with the exception of individual entrepreneurs carrying out the types of business activities specified in subparagraphs 19, 45 - 47 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation.

The number of completed lines in Table 4.3 must correspond to the number of patents received by an individual entrepreneur during the billing (reporting) period for carrying out the types of business activities named in paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation, with the exception of the types of business activities specified in subparagraphs 19, 45 - 47 of paragraph 2 of this article.

In this case, columns 4 and 5 indicate the start date and expiration date of the patent issued to the individual entrepreneur by the tax authority at the place of registration as a taxpayer applying the patent taxation system.

When filling out the table:

In column 6 reflects the amount of payments and other remuneration accrued by individual entrepreneurs in favor of individuals engaged in the type of economic activity specified in the patent, with the exception of individual entrepreneurs carrying out the types of business activities specified in subparagraphs 19, 45 - 47 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation .

In columns 7 - 9 reflects the amount of payments and other remuneration accrued by individual entrepreneurs carrying out the type of activity specified in the patent in favor of individuals in accordance with Part 1 of Article 7 and Clause 14 of Part 1 of Article 58 of the Federal Law of July 24, 2009 N 212-FZ, for the last three months of the reporting period.

According to the line “Total payments” in columns 6 - 9 reflects the total amount of payments and other remuneration accrued by individual entrepreneurs in favor of individuals carrying out the type of activity specified in the patent:

- according to column 6 must be equal to the data in line 7 of column 3 of table 3 “Calculation of the base for calculating insurance premiums”;

- The value of the line “Total payments” according to column 7 must be equal to the data in line 7, column 4 of table 3 “Calculation of the base for calculating insurance premiums”;

- The value of the line “Total payments” according to column 8 must be equal to the data in line 7, column 5 of table 3 “Calculation of the base for calculating insurance premiums”;

- The value of the line “Total payments” according to column 9 should be equal to the data in line 7, column 6 of table 3 “Calculation of the base for calculating insurance premiums.”

If table 4.3 consists of several pages, the value of the “Total payments” line is reflected on the last page.

Table 5. Breakdown of payments made from funds financed from the federal government. budget

In column 3 lines 1 - 5 indicate the number of recipients of benefits paid to citizens in the billing period in an amount in excess of that established by the legislation of the Russian Federation on compulsory social insurance financed from the federal budget; on line 6 - the number of employees who exercised the right to receive additional days off to care for disabled children.

In columns 4, 7, 10, 13, 16, 19 Lines 1 - 2 indicate the number of paid days; on lines 3 - 5 - the number of payments paid to citizens in the billing period in excess of that established by the legislation of the Russian Federation on compulsory social insurance financed from the federal budget; in column 4 on line 6 the number of paid additional days off for caring for disabled children is indicated.

In columns 5, 8, 11, 14, 17, 20 lines 1 - 5 reflect the amount of expenses for payment of benefits; in column 5 on line 6 - the amount of payment for additional days off for caring for disabled children; on line 7 - the amount of insurance contributions to state extra-budgetary funds accrued to pay for additional days off to care for disabled children.

The indicators in column 5 of the table must correspond to the indicators reflected in column 5 of table 2 “Expenses for compulsory social insurance in case of temporary disability and in connection with maternity and expenses carried out in accordance with the legislation of the Russian Federation through interbudgetary transfers from the federal budget provided to the Fund’s budget social insurance of the Russian Federation" (lines 1, 5, 9, 12, 13).

In columns 6, 9, 12, 15, 18 the number of benefit recipients is reflected.

In columns 7, 10, 13, 16, 19 the number of days, payments, benefits is reflected.

In columns 8, 11, 14, 17, 20 expenses incurred by citizens are reflected.

In columns 6 - 17 payments financed from the federal budget are reflected in amounts in excess of those established by the legislation of the Russian Federation to citizens who suffered:

- according to columns 6 - 8- as a result of the disaster at the Chernobyl Nuclear Power Plant (Law of the Russian Federation of May 15, 1991 N 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl Nuclear Power Plant”);

- according to columns 9 - 11- as a result of the accident at the Mayak production association (Federal Law of November 26, 1998 N 175-FZ “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the river Techa");

- according to columns 12 - 14- as a result of nuclear tests at the Semipalatinsk test site (Federal Law of January 10, 2002 N 2-FZ “On social guarantees for citizens exposed to radiation as a result of nuclear tests at the Semipalatinsk test site”);

- according to columns 15 - 17- persons from special risk units (Resolution of the Supreme Council of the Russian Federation of December 27, 1991 N 2123-1 “On the extension of the RSFSR Law “On Social Protection of Citizens Exposed to Radiation as a result of the Chernobyl Nuclear Power Plant Disaster” to citizens from special risk units” (Gazette of the Congress of People's Deputies of the RSFSR and the Supreme Soviet of the RSFSR, 1992, No. 4, Art. 138, Collection of Legislation of the Russian Federation, 2004, No. 35, Art. 3607; 2005, No. 1, Art. 25; 2012, No. 53, Art. 7654), persons who received or suffered radiation sickness or became disabled as a result of radiation accidents, except for the Chernobyl Nuclear Power Plant (Resolution of the Council of Ministers - Government of the Russian Federation of March 30, 1993 N 253 “On the procedure for providing compensation and benefits to persons affected by radiation exposure” ).

In columns 18 - 20 information is reflected on additional payments of benefits for temporary disability, pregnancy and childbirth related to the inclusion in the insurance record of the insured person of service periods during which the citizen was not subject to compulsory social insurance in case of temporary disability and in connection with maternity in accordance with Part 4 of the article 3 of the Federal Law of December 29, 2006 N 255-FZ, affecting the determination of the amount of benefits from January 1, 2007.

Line 8- control line, which shows the sum of the values of lines 1, 2, 3, 6, 7.

Section 2. Insurance against industrial accidents and occupational diseases

General requirements

The payer of insurance premiums, who has independent classification units, allocated in accordance with the order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 N 55, submits a Calculation compiled for the entire organization, and section II of the Calculation for each division of the payer of insurance premiums, being an independent classification unit.

In the “OKVED code” field the code of the main type of economic activity is indicated according to the OKVED classifier. The OKVED code can be found from the Unified State Register of Individual Entrepreneurs (USRIP) for individual entrepreneurs or the Unified State Register of Legal Entities (USRLE) for legal entities. persons

Newly created organizations - payers of insurance premiums for compulsory social insurance against industrial accidents and occupational diseases indicate a code according to the state registration authority, and starting from the second year of activity - a code confirmed in the prescribed manner in the territorial bodies of the Fund.

In the fields“The number of working disabled people”, “The number of workers engaged in work with harmful and (or) hazardous production factors” is indicated on the reporting date (as of the last day of the reporting period: quarter, half-year, nine months and year) the list number of working disabled people, workers, employed in work with harmful and (or) hazardous production factors.

Table 6. Base for calculating insurance premiums

On line 1 the corresponding columns reflect the amounts of payments and other remuneration accrued in favor of individuals on an accrual basis from the beginning of the billing period and for each of the last three months of the reporting period.

On line 2 the corresponding columns reflect amounts not subject to insurance premiums in accordance with Article 20.2 of the Federal Law of July 24, 1998 N 125-FZ.

On line 3 the base for calculating insurance premiums is reflected, which is defined as the difference in line indicators (line 1 - line 2).

On line 4 the corresponding columns reflect the amount of payments in favor of working disabled people.

On line 5 the amount of the insurance tariff is indicated, which is set depending on the class of professional risk to which the payer of insurance premiums (division) belongs.

On line 6 a percentage discount is applied to the insurance rate established by the territorial body of the Fund for the current calendar year in accordance with the Rules for establishing discounts and surcharges for policyholders to insurance rates for compulsory social insurance against industrial accidents and occupational diseases, approved by the Decree of the Government of the Russian Federation of May 30, 2012 .N 524.

On line 7 the percentage of the premium to the insurance tariff established by the territorial body of the Fund for the current calendar year is entered in accordance with Decree of the Government of the Russian Federation of May 30, 2012 N 524.

On line 8 the date of the order of the territorial body of the Fund to establish a premium to the insurance tariff for the payer of insurance premiums is indicated.

On line 9 the amount of the insurance rate is indicated taking into account the established discount or surcharge to the insurance rate. The data is filled in with two decimal places after the decimal point.

Table 6.1. Information necessary for calculating insurance premiums by policyholders specified in paragraph 2.1 of Article 22 of the Federal Law of July 24, 1998 N 125-FZ

The table is filled out by insurers who temporarily send their employees under a contract for the provision of labor for workers (personnel) in the cases and under the conditions established by the Labor Code of the Russian Federation, Law of the Russian Federation of April 19, 1991 N 1032-1 “On Employment of the Population in the Russian Federation” , other federal laws to work for another legal entity or individual entrepreneur.

When filling out the table:

The number of completed lines in Table 6.1 must correspond to the number of legal entities or individual entrepreneurs to which the insurer temporarily sent its employees under an agreement on the provision of labor for workers (personnel) in cases and under the conditions established by the Labor Code of the Russian Federation, the Law of the Russian Federation of April 19, 1991 year N 1032-1 “On employment of the population in the Russian Federation” (hereinafter referred to as the agreement), other federal laws;

In columns 2, 3, 4 the registration number in the Fund, TIN and OKVED of the receiving legal entity or individual entrepreneur are indicated accordingly.

In column 5 the total number of employees temporarily assigned under a contract to work for a specific legal entity or individual entrepreneur is indicated.

In column 6 payments in favor of employees temporarily assigned under a contract, from whom insurance premiums are charged, are reflected on an accrual basis, respectively, for the first quarter, half a year, 9 months of the current period and the year.

In column 7 payments in favor of working disabled people temporarily assigned under a contract, from whom insurance premiums are calculated, are reflected on an accrual basis, respectively, for the first quarter, half a year, 9 months of the current period and the year.

In columns 8, 10, 12 payments in favor of employees temporarily assigned under a contract, from whom insurance premiums are calculated, are reflected on a monthly basis.

In columns 9, 11, 13 payments in favor of working disabled people temporarily assigned under a contract, from whom insurance premiums are calculated, on a monthly basis.

In column 14 the amount of the insurance tariff is indicated, which is set depending on the class of professional risk to which the receiving legal entity or individual entrepreneur belongs.

In column 15 the size of the insurance tariff of the receiving legal entity or individual entrepreneur is indicated, taking into account the established discount or surcharge to the insurance tariff. The data is filled in with two decimal places after the decimal point.

Table 7. Calculations for insurance against accidents at work and professional. diseases

The table is filled out based on the accounting records of the insurance premium payer.

When filling out the table:

By line 1 reflects the amount of debt for insurance premiums from industrial accidents and occupational diseases that the payer of insurance premiums has at the beginning of the billing period.

This indicator should be equal to the indicator of line 19 for the previous billing period, which does not change during the billing period.

By line 2 the amount of accrued insurance contributions for compulsory social insurance against industrial accidents and occupational diseases from the beginning of the billing period is reflected in accordance with the amount of the established insurance tariff, taking into account the discount (surcharge). The amount is divided “at the beginning of the reporting period” and “for the last three months of the reporting period.”

On line 3 the amount of contributions accrued by the territorial body of the Fund based on acts of on-site and desk audits is reflected.

On line 4 the amounts of expenses not accepted for offset by the territorial body of the Fund for previous billing periods are reflected according to acts of on-site and desk inspections.

On line 5 reflects the amount of insurance premiums accrued for previous billing periods by the payer of insurance premiums, subject to payment to the territorial body of the Fund.

On line 6 the amounts received from the territorial body of the Fund to the bank account of the payer of insurance premiums in order to reimburse expenses exceeding the amount of accrued insurance premiums are reflected.

On line 7 the amounts transferred by the territorial body of the Fund to the bank account of the payer of insurance premiums are reflected as a return of overpaid (collected) amounts of insurance premiums, offset of the amount of overpaid (collected) insurance premiums towards the repayment of debt on penalties and fines subject to collection, as well as offset, produced in accordance with Part 21 of Article 26 of the Federal Law of July 24, 2009 N 212-FZ.

Line 8- control line, where the sum of the values of lines 1 to 7 is indicated.

On line 9 shows the amount of debt at the end of the reporting (calculation) period based on the accounting data of the insurance premium payer:

- On line 10 reflects the amount of debt owed to the territorial body of the Fund at the end of the reporting (settlement) period, formed due to the excess of expenses incurred for compulsory social insurance against industrial accidents and occupational diseases over the amount of insurance premiums subject to transfer to the territorial body of the Fund.

- On line 11 reflects the amount of debt owed to the territorial body of the Fund, formed due to the amounts of insurance premiums overpaid by the policyholder at the end of the reporting period.

On line 12 shows the amount of debt at the beginning of the billing period:

- On line 13 reflects the amount of debt owed to the territorial body of the Fund at the beginning of the billing period, formed due to the excess of expenses for compulsory social insurance against accidents at work and occupational diseases over the amount of insurance contributions subject to transfer to the territorial body of the Fund, which does not change during the billing period (by based on the accounting data of the insurance premium payer).

- On line 14 reflects the amount of debt owed to the territorial body of the Fund, formed due to the amounts of insurance premiums overpaid by the policyholder at the beginning of the billing period.

The indicator of line 12 must be equal to the indicator of lines 9 of the Calculation for the previous billing period.

On line 15 expenses for compulsory social insurance against industrial accidents and occupational diseases are reflected on an accrual basis from the beginning of the year, broken down “at the beginning of the reporting period” and “for the last three months of the reporting period.”

On line 16 the amounts of transferred insurance premiums by the payer of insurance premiums are reflected in the personal account of the territorial body of the Fund, opened with the Federal Treasury, indicating the date and number of the payment order.

On line 17 the written off amount of debt of the payer of insurance premiums is reflected in accordance with the regulatory legal acts of the Russian Federation adopted in relation to specific payers of insurance premiums (policyholders) or the industry for writing off arrears, as well as in the event that the court adopts an act in accordance with which the authorities control the payment of insurance premiums contributions lose the opportunity to collect arrears and arrears of penalties due to the expiration of the established period for their collection, including the issuance of a ruling on the refusal to restore the missed deadline for filing an application to the court for the collection of arrears and arrears of penalties.

Line 18- control line, which shows the sum of the values of lines 12, 15 - 17.

On line 19 the debt owed by the payer of insurance premiums is reflected at the end of the reporting (settlement) period based on the accounting data of the payer of insurance premiums, including arrears (line 20).

Table 8. Costs of insurance against industrial and professional accidents. diseases

By lines 1, 4, 7 expenses incurred by the payer of insurance premiums are reflected in accordance with the current regulatory legal acts on compulsory social insurance against industrial accidents and occupational diseases, of which:

- On lines 2, 5- expenses incurred by the payer of insurance premiums to victims working on an external part-time basis;

- By lines 3, 6, 8- expenses incurred by the payer of insurance premiums who suffered in another organization.

On line 9 expenses incurred by the payer of insurance premiums to finance preventive measures to reduce industrial injuries and occupational diseases are reflected. These expenses are made in accordance with the Rules for financial support of preventive measures to reduce industrial injuries and occupational diseases of workers and sanatorium and resort treatment of workers engaged in work with harmful and (or) dangerous production factors, approved by order of the Ministry of Labor and Social Protection of the Russian Federation dated 10 December 2012 N 580n.

Line 10- control line, which shows the sum of the values of lines 1, 4, 7, 9.

On line 11 The amount of accrued and unpaid benefits is reflected for reference, with the exception of the amounts of benefits accrued for the last month of the reporting period, in respect of which the deadline for payment of benefits established by the legislation of the Russian Federation was not missed.

In column 3 the number of paid days for temporary disability due to an accident at work or occupational disease (vacation for sanatorium treatment) is shown;

In column 4 expenses are reflected on an accrual basis from the beginning of the year, offset against insurance contributions for compulsory social insurance against industrial accidents and occupational diseases.

Table 9. Number of victims in connection with insured events in the reporting period

By line 1 the data is filled out on the basis of reports of industrial accidents in form N-1 (Appendix No. 1 to the resolution of the Ministry of Labor and Social Development of the Russian Federation of October 24, 2002 No. 73), highlighting the number of fatal cases (line 2).

On line 3 The data is filled in on the basis of reports on cases of occupational diseases (appendix to the Regulations on the investigation and recording of occupational diseases, approved by Decree of the Government of the Russian Federation of December 15, 2000 N 967.

On line 4 the sum of the values of lines 1, 3 is reflected, highlighting on line 5 the number of victims (insured) in cases that resulted only in temporary disability. The data on line 5 is filled in on the basis of certificates of incapacity for work.

When filling out lines 1 - 3, which are filled out on the basis of reports on industrial accidents in form N-1 and reports on cases of occupational diseases, insured events for the reporting period should be taken into account on the date of the examination to verify the occurrence of the insured event.

Table 10. Information on the results of a special assessment of working conditions and medical examinations of workers at the beginning of the year

On line 1 in column 3 data on the total number of employer's jobs subject to a special assessment of working conditions is indicated, regardless of whether a special assessment of working conditions was carried out or not.

On line 1 in columns 4 - 6 data on the number of jobs in respect of which a special assessment of working conditions was carried out, including those classified as harmful and dangerous working conditions, contained in the report on the special assessment of working conditions is indicated; if a special assessment of working conditions was not carried out by the insurer, then “0” is entered in columns 4 - 6.

If the validity period of the results of certification of workplaces for working conditions, carried out in accordance with the procedure in force before the date of entry into force of the Federal Law of December 28, 2013 N 426-FZ “On Special Assessment of Working Conditions”, has not expired, then line 1 in columns 3 - 6 in accordance with Article 27 of the Federal Law of December 28, 2013 N 426-FZ, information based on this certification is indicated.

On line 2 in columns 7 - 8 data is indicated on the number of workers engaged in work with harmful and (or) hazardous production factors who are subject to and have passed mandatory preliminary and periodic inspections.

Columns 7 - 8 are filled out in accordance with the information contained in the final acts of the medical commission based on the results of periodic medical examinations (examinations) of workers (clause 42 of the Procedure for conducting mandatory preliminary (upon entry to work) and periodic medical examinations of workers engaged in heavy work and work with hazardous and (or) hazardous working conditions, approved by order of the Ministry of Health and Social Development of the Russian Federation dated April 12, 2011 N 302n and in accordance with the information contained in the conclusions based on the results of a preliminary medical examination issued to employees who have undergone these examinations in the previous year.

In column 7 indicates the total number of employees engaged in work with harmful and (or) hazardous production factors, subject to mandatory preliminary and periodic inspections;

In column 8 the number of employees engaged in work with harmful and (or) hazardous production factors who have undergone mandatory preliminary and periodic inspections is indicated.

In this case, the results of mandatory preliminary and periodic medical examinations of workers as of the beginning of the year should be taken into account, taking into account that, according to paragraph 15 of the Procedure, the frequency of periodic medical examinations is determined by the types of harmful and (or) hazardous production factors affecting the employee, or the types of work performed .

→ Instructions for filling out the new Form 4-FSS

The Ministry of Health and Social Development of the Russian Federation, by its order No. 216n dated March 12, 2012, approved the new FSS Form-4.

Appendix No. 1 to Law 216n contains Form-4 FSS, Appendix No. 2 to Law 216n contains the procedure for filling out the form itself.

I. General requirements

1. Calculation form for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against industrial accidents and occupational diseases, as well as for the costs of paying insurance coverage (form - 4 FSS ) (hereinafter referred to as the Calculation form) is filled out using computer technology or by hand with a ballpoint (fountain) pen in black or blue in block letters.

Policyholders submit the Calculation on paper, and policyholders whose average number of individuals in whose favor payments and other remunerations are made exceeds 50 people for the previous billing period, as well as newly created (including during reorganization) organizations whose number of the specified individuals exceeds this limit, submit the Calculation in established formats in electronic form with an electronic digital signature in accordance with paragraph 10 of Article 15 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Fund Insurance of the Russian Federation, Federal Compulsory Medical Insurance Fund" (Collected Legislation of the Russian Federation 2009, No. 30, Art. 3738; 2010, No. 31, Art. 4196; No. 49, Art. 6409; No. 50, Art. 6597; 2011, No. 1, Article 40; No. 29, Article 4291; No. 49, Article 7057) (hereinafter referred to as Federal Law of July 24, 2009 No. 212-FZ). The basis for filling out the Calculation form is accounting data.

2. When filling out the Calculation form, only one indicator is entered in each line and the corresponding columns. If there are no indicators provided for in the Calculation form, a dash is placed in the line and the corresponding column.

The title page, table 1, table 3, table 6, table 7 of the Calculation form are mandatory for submission by all policyholders.

If there are no indicators to fill out Table 2, Table 3.1, Table 4, Table 4.1, Table 4.2, Table 4.3, Table 5, Table 8, Table 9 of the Calculation form, these tables are not filled out and are not submitted.

To correct errors, you must cross out the incorrect value of the indicator, enter the correct value of the indicator and sign the policyholder or his representative under the correction indicating the date of correction.

All corrections are certified by the seal of the organization (stamp for foreign organizations) or the signature of an individual entrepreneur, an individual not recognized as an individual entrepreneur, or their representatives.

Errors may not be corrected by correction or other similar means.

3. After filling out the Calculation form, sequential numbering of the completed pages is entered in the “Page” field.

At the top of each completed page of the Calculation, the fields “Registration number of the policyholder” and “Subordination code” are filled in in accordance with the notice (notification) of the policyholder issued upon registration (registration) with the territorial body of the Social Insurance Fund of the Russian Federation (hereinafter referred to as the Fund).

At the end of each page of the Calculation, the signature of the policyholder (successor) or his representative and the date of signing of the Calculation are affixed.

II. Filling out the title page of the Calculation

4. The title page of the Calculation form is filled out by the policyholder, except for the subsection “To be filled out by an employee of the Fund.”

5. When filling out the cover page of the Calculation form:

5.1. in the first ten cells of the field “Registration number of the policyholder” the registration number of the policyholder is indicated, in the additional ten cells - an additional code provided for a separate division of the organization - the policyholder;

5.2. the “Subordination Code” field consists of five cells and indicates the territorial body of the Fund in which the policyholder is currently registered;

5.3. in the “Adjustment number” field:

when submitting the primary Calculation, code 000 is indicated;

when submitted to the territorial body of the Settlement Fund, which reflects changes in accordance with Article 17 of the Federal Law of July 24, 2009 No. 212-FZ (updated Calculation for the corresponding period), a number is entered indicating which account is the Calculation taking into account the changes made and additions are submitted by the policyholder to the territorial body of the Fund (for example: 001, 002, 003,...010, etc.).

The updated Calculation is presented in the form that was in force in the period for which errors (distortions) were identified;

5.4. in the “Reporting period (code)” field, the period for which the Calculation is being submitted and the number of requests from the policyholder for the allocation of the necessary funds for the payment of insurance compensation are entered.

When presenting the Calculation for the first quarter, half a year, nine months and a year, only the first two cells of the “Reporting period (code)” field are filled in. When applying for the allocation of the necessary funds for the payment of insurance coverage, only the last two cells are filled in the “Reporting period (code)” field.

Reporting periods are the first quarter, half a year and nine months of the calendar year, which are designated respectively as “03”, “06”, “09”. The billing period is the calendar year, which is designated by the number “12”. The number of requests from the policyholder for the allocation of the necessary funds to pay insurance compensation is indicated as 01, 02, etc.;

5.5. in the “Calendar year” field, enter the calendar year for the billing period of which the Calculation (adjusted calculation) is being submitted;

5.6. The field “Cessation of activities” is filled in only in the event of termination of the activities of the organization - the insured in connection with liquidation or termination of activities as an individual entrepreneur in accordance with Part 15 of Article 15 of the Federal Law of July 24, 2009 No. 212-FZ. In this case, the letter “L” is entered in this field;

5.7. in the field “Full name of the organization, separate division/F.I.O. individual entrepreneur, individual" indicates the name of the organization in accordance with the constituent documents or a branch of a foreign organization operating on the territory of the Russian Federation, a separate division; when submitting a Calculation by an individual entrepreneur, a lawyer, a notary engaged in private practice, the head of a peasant farm, an individual who is not recognized as an individual entrepreneur, his last name, first name, patronymic (in full, without abbreviations, in accordance with the identity document);

5.8. in the field “TIN” (identification number of the policyholder (hereinafter referred to as TIN), the TIN of the policyholder is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at the location in the territory of the Russian Federation.

For an individual who is not recognized as an individual entrepreneur (hereinafter referred to as an individual), an individual entrepreneur's TIN is indicated in accordance with the certificate of registration with the tax authority of the individual at the place of residence in the territory of the Russian Federation.

When an organization fills out a TIN, which consists of ten characters, in the area of twelve cells reserved for recording the TIN indicator, zeros (00) should be entered in the first two cells;

5.9. field “KPP” (code of the reason for registration at the location of the organization (hereinafter referred to as the KPP) is indicated by the KPP in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at the location on the territory of the Russian Federation .

The checkpoint at the location of the separate subdivision is indicated in accordance with the notice of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at the location of the separate subdivision on the territory of the Russian Federation;

5.10. field “OGRN (OGRNIP)” indicates the main state registration number (hereinafter referred to as OGRN) in accordance with the certificate of state registration of a legal entity formed in accordance with the legislation of the Russian Federation, at its location on the territory of the Russian Federation.

For an individual entrepreneur, the main state registration number of an individual entrepreneur (hereinafter referred to as OGRNIP) is indicated in accordance with the certificate of state registration of an individual as an individual entrepreneur.

When filling out the OGRN of a legal entity, which consists of thirteen characters, in the area of fifteen cells reserved for recording the OGRN indicator, zeros (00) should be entered in the first two cells;

5.11. in the “Contact phone number” field, indicate the city or mobile phone number of the policyholder (successor) or the policyholder’s representative with the city code or mobile operator, respectively. The numbers are filled in in each cell without using the dash and parenthesis signs;

5.12. in the field “Code according to OKATO” (code of the all-Russian classifier of objects of administrative-territorial division (hereinafter - OKATO)) the code is indicated based on the corresponding information letter from the state statistics body;

5.13. in the field “Code according to OKVED” the code is indicated according to the All-Russian Classifier of Types of Economic Activities OK-029-2001 (NACE Rev. 1) (hereinafter referred to as OKVED) for the main type of economic activity of the insured.

Newly created organizations - insurers for compulsory social insurance against industrial accidents and occupational diseases indicate a code according to the state registration authority, and starting from the second year of activity - a code confirmed in the prescribed manner in the territorial bodies of the Fund;

5.14. in the fields provided for indicating the registration address:

legal entities - legal address is indicated;

individuals, individual entrepreneurs - indicate the registration address at the place of residence;

5.15. in the “Insured Code” field, indicate the code that determines the category of the insured. In the first three cells of the “Insured Code” field, a code is indicated that determines the category of the policyholder in accordance with Appendix No. 1 to this Procedure, in the next two cells - a code in accordance with Appendix No. 2 to this Procedure, in the last two cells - a code in accordance with Appendix No. 3 to this Procedure;

5.16. In the “Number of employees” field the following is indicated:

filled out by organizations - the average number of employees, calculated in the manner determined annually by orders of the Federal State Statistics Service;

filled out by individual entrepreneurs, individuals not recognized as individual entrepreneurs (including lawyers, notaries) making payments to individuals within the framework of labor relations - the number of insured persons in respect of whom these payments were made.

In the cells reserved for filling out the indicator “of which: “women”, “working disabled people”, “working people engaged in work with harmful and (or) hazardous production factors”, the number of working women and working disabled people, as well as workers employed in working with harmful and (or) hazardous production factors.

5.17. information on the number of pages of the submitted Calculation and the number of sheets with supporting documents attached is indicated in the fields “Calculation submitted on” and “with supporting documents attached or their copies on”;

5.18. in the field “I confirm the accuracy and completeness of the information specified in this calculation”:

in the field “policyholder”, “authorized representative of the policyholder”, “legal successor”, if the accuracy and completeness of the information contained in the Calculation is confirmed by the head of the organization, individual entrepreneur or individual, the number “1” is entered; in case of confirmation of the accuracy and completeness of the information, the authorized representative of the policyholder enters the number “2”; if the accuracy and completeness of the information is confirmed, the legal successor of the liquidated organization enters the number “3”;

in the “Full name” field head of an organization, individual entrepreneur, individual, representative of the policyholder" when confirming the accuracy and completeness of the information contained in the Calculation:

- the head of the organization - the insured (legal successor) - the surname, name, patronymic of the head of the organization is indicated in full in accordance with the constituent documents, the seal of the organization is affixed;

- an individual, individual entrepreneur - indicate the surname, first name, patronymic of the individual, individual entrepreneur;

- representative of the policyholder (legal successor) - an individual - indicate the surname, first name, patronymic of the individual in accordance with the identity document;

- representative of the insured (legal successor) - legal entity - the name of this legal entity is indicated in accordance with the constituent documents, the seal of the organization is affixed;

in the fields “Signature”, “Date”, “M.P.” the signature of the policyholder (legal successor) or his representative is affixed, the date of signing the Calculation, if the Calculation is submitted by an organization, the organization’s seal is affixed;

in the field “Document confirming the authority of the representative” the type of document confirming the authority of the representative of the insured (legal successor) is indicated;

5.19. in the field “To be filled in by a Fund employee”, “Information on submission of calculation”:

field “This calculation is presented (code)” indicates the method of presentation (“01” - on paper, “02” - on magnetic media, “03” - in the form of electronic documents using information and telecommunication networks, including a single portal of state and municipal services, “04” - by post);

in the field “with the attachment of supporting documents or their copies on sheets” the number of sheets, supporting documents or their copies attached to the Calculation is indicated;

in the “Date of Calculation Submission” field, enter the date of submission of the Calculation in person or through a representative, when sent by mail;

the date of dispatch of the mail item with a description of the attachment, when submitted electronically - the date of dispatch recorded by the transport (mail) server.

In addition, this section indicates: the date of submission of the Calculation, the last name, first name and patronymic of the Fund employee who accepted the Calculation, and his signature.

III. Filling out section 1 “Calculation of accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred” of the Calculation form

Filling out Table 1 “Calculations for compulsory social insurance in case of temporary disability and in connection with maternity” of the Calculation form

6. When filling out the table:

6.1. lines 2, 3, 5, 6, 15, 16 show cumulative amounts from the beginning of the billing period (column 3) with the subdivision “At the beginning of the reporting period”, “for the last three months of the reporting period” (column 1);

6.2. line 1 “Debt owed by the policyholder at the beginning of the billing period” reflects the amount of debt for insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, accrued by the policyholder at the beginning of the billing period.

This indicator should be equal to the indicator in line 19 “Debt owed by the policyholder at the end of the reporting (calculation) period” for the previous billing period, which does not change during the billing period;

6.3. line 2 “Accrued for payment of insurance premiums” reflects the amount of insurance premiums calculated from the beginning of the billing period, subject to payment to the territorial body of the Fund;

6.4. line 3 “Accrued insurance premiums based on inspection reports” reflects the amount of insurance premiums accrued to the policyholder by the territorial body of the Fund based on the results of on-site and desk inspections;

6.5. line 4 “Accrued insurance premiums by the policyholder for past billing periods” reflects the amount of insurance premiums accrued for past billing periods by the policyholder, subject to payment to the territorial body of the Fund;

6.6. line 5 “Not accepted for offset of expenses by the territorial body of the Fund for past billing periods” reflects the amounts of expenses not accepted for offset for past billing periods according to reports of on-site and desk inspections conducted by the territorial body of the Fund;

6.7. line 6 “Received from the territorial body of the Fund in reimbursement of expenses incurred” shows the amount of money received from the territorial body of the Fund by the policyholder for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity;

6.8. line 7 “Return (offset) of amounts of overpaid (collected) insurance premiums” reflects the amounts transferred by the territorial body of the Fund to the policyholder’s bank account as a return of overpaid (collected) amounts of insurance premiums, as well as offset of the amount of overpaid (collected) insurance premiums contributions to pay off debts on penalties and fines subject to collection;

6.9. line 8 “Total (sum of lines 1+2+3+4+5+6+7)” – control line, which indicates the sum of indicators of lines 1 to 7;