INTRODUCTION

Of course, in the difficult conditions of Russia's transition to market relations, it is especially important for domestic enterprises to ensure the normal functioning of the enterprise and to ensure the necessary availability of certain funds and sources of economic funds.

The importance of this problem lies in the need to properly manage the process of using fixed assets of any organization. This is especially important for an organization, since the slightest mistake can result in significant losses of part of the profit due to improper organization.

Fixed production assets, consisting of buildings, structures, machines, equipment and other means of labor that participate in the production process, are the most important basis for the company's activities. Without their presence, it is unlikely that anything could have happened. Naturally, for the normal functioning of each enterprise, fixed assets are necessary. Rational and economical use of both fixed assets is the primary task of the enterprise. Therefore, it is necessary to consider the composition and structure of fixed production assets.

Fixed assets of the organization

The concept of fixed assets

The fixed assets of an organization (association) are a set of material assets created by social labor, long-term participating in the production process in an unchanged natural form and transferring their value to manufactured products in parts as they wear out.

Fixed production assets are part of the means of production that perform the functions of means of labor in the production process. Fixed production assets, while maintaining their original shape during their service life, transfer their value to the products being created as they wear out.

The fixed assets of organizations, according to their role in the production process, are divided into fixed production assets for construction purposes, fixed production assets of other industries and non-productive fixed assets.

The main production assets include industrial buildings and structures, power machines and equipment, working machines and equipment, vehicles and other assets.

Industrial buildings and structures - these are buildings occupied by offices, warehouses, laboratories, garages and other services that are intended to service construction production.

Structures include bridges, overpasses, power lines, water towers, and roads.

Power machines and equipment include generators that produce electrical and thermal energy, engine machines, steam boilers, turbines, and compressors.

Vehicles are cars, platforms, wagons and other means.

Other production fixed assets include working tools, fixtures, measuring instruments, as well as household and office equipment worth over 500 UAH. and a service life of more than one year.

The relationship between different groups of funds, called fund structure, is shown below in percentage:

Facilities

Transfer devices

cars and equipment

Vehicles

Tools and inventory

Other funds

The composition of fixed assets includes fixed production assets, as well as non-productive fixed assets.

The main production assets include the above funds. They are taken into account on the balance sheet of the main activities of the construction and installation organization.

Production fixed assets of other industries are also listed on the balance sheet of the main activities of organizations. However, according to their purpose, they are not related to the performance of basic work, but are intended for the production of industrial products and the repair of machinery and equipment. These also include funds for subsidiary agricultural production.

According to the degree of active participation of fixed production assets in the production process, they are divided into active and passive.

Active funds include all means of labor that affect objects of labor in the production process (machines, mechanisms, equipment, vehicles, and tools).

Passive funds are funds that are not directly related to human activity in the production process, but only create the conditions necessary for his activity (buildings and structures).

The share of the active part of fixed production assets (b a) characterizes the progressiveness of the structure of fixed production assets, reflecting the share of their active part (machines, mechanisms, vehicles, etc.) as a percentage of the total value of the assets of the industry, ministry, trust, organization and determined by the formula:

b a = OF a / OF * 100

where: OF a - book value of the active part of fixed production assets;

PF - the full book value of all fixed production assets.

The structure of active funds by type of machinery and equipment is presented below (in percentage):

Power machines and equipment

Working machines and equipment

Measuring instruments and laboratory equipment

Computer Engineering

Other machines and equipment

In the structure of the organization's fixed production assets, the share of the active part predominates (up to 60%). The optimal ratio between the active and passive parts of fixed assets depends on a number of conditions:

type of work;

location of the organization;

degree of concentration of production.

For example, in areas with difficult meteorological conditions (in the northern regions), an increase in the share of passive funds will be natural, since this is caused by the need to improve working conditions, maintenance and repair of the active part of the funds. In many areas with favorable climatic conditions, it is possible to use some of the production equipment outside buildings, in open areas, under canopies. This allows you to significantly reduce the share of the passive part of fixed assets.

Fixed assets for non-productive purposes, taken into account on the balance sheet of the organization's main activities, consist of funds for housing and communal services, educational organizations, health care, culture and other non-productive organizations.

Non-productive fixed assets include fixed assets of housing and communal services, education, culture and art, healthcare, physical education and sports, which are on the balance sheet of a construction organization.

They do not belong to fixed assets, but are objects of labor:

low-value and high-wear items (IBP);

individual structures and parts, parts and assemblies of machines, equipment and rolling stock, intended for repair purposes and assembly;

equipment and machines listed as finished products in the warehouses of manufacturing enterprises, supply and sales organizations, as well as equipment that requires installation and is listed on the balance sheet of capital construction;

machinery and equipment completed installation, but not in operation and listed on the balance sheet of capital construction,

perennial plantings before their entry and operation (nurseries).

The structure of fixed assets is characterized by the share (in percentage) of various groups (types) of fixed assets in their total value. The indicators of the sectoral, technological, and age structure of fixed assets are determined.

The sectoral structure of fixed production assets is characterized by the share of the value of fixed production assets of a particular industry (sub-industry) in the total book value of these funds as a whole for the republic, ministry, etc. It can also be calculated for individual elements of fixed assets of the industry (buildings, structures, machinery and equipment, etc.).

The age structure of fixed assets is characterized by the share of different age groups of fixed assets (machines and mechanisms) in their total value (and for funds of the same type - in their total quantity in physical terms). In statistical reporting, three age groups are accepted: up to 10, from 10 to 20 and over 20 years.

The technological structure of fixed assets is characterized by the specific weight (in percentage) of various types of fixed assets within a certain group of them and depends on the specifics of the activities of the construction organization.

Fixed assets(fixed assets; FA) - a set of material assets in the form of means of labor, which are repeatedly involved in the process of production and commercial activity and transfer their value to the product in parts.

It should be noted that there is still no unity in the use of terms. The term “fixed capital” established in international practice has different names and can be called fixed assets or fixed assets.

Fixed assets (,) are part of. They are created during the production process, are repeatedly used in production (the economy) and gradually (in parts, by) transfer their value to the created products and services without changing their natural material form.

Fixed assets are the most important element of national wealth.

The essence of fixed assets:

- they are materially embodied in the means of labor;

- their cost is transferred in parts to the products;

- they retain their natural shape for a long time as they wear out;

- are recovered on the basis of depreciation at the end of their service life.

Signs of fixed assets:

- operate for a long time, repeatedly participate in the production of products and services;

- transfer their value to the result of labor in parts, as they wear out;

- during operation they do not change their material form.

Distinguish production And non-productive fixed assets enterprises (the latter include social infrastructure facilities and other types of fixed assets that are not directly involved in the production process). In turn, in the composition of production fixed assets there are their active part(machines, equipment and mechanisms directly involved in the production and technological process) and their passive part(buildings, structures, etc.).

The following groups and subgroups of fixed production assets are distinguished:

- Building(architectural and construction facilities for industrial purposes: workshop buildings, warehouses, production laboratories, etc.).

- Facilities(engineering and construction facilities that create conditions for the production process: tunnels, overpasses, highways, chimneys on a separate foundation, etc.).

- Transfer devices(devices for transmitting electricity, liquid and gaseous substances: electrical networks, heating networks, gas networks, transmissions, etc.).

- cars and equipment(power machines and equipment, working machines and equipment, measuring and control instruments and devices, computer technology, automatic machines, other machines and equipment).

- Vehicles(diesel locomotives, wagons, cars, motorcycles, carriages, trolleys, etc., except for conveyors and transporters included in production equipment).

- Tool(cutting, impact, pressing, compacting, as well as various devices for fastening, mounting, etc.), except for special tools and special equipment.

- Production equipment and supplies(items to facilitate production operations: work tables, workbenches, fences, fans, containers, racks, etc.).

- Household equipment(office and household supplies: tables, cabinets, hangers, typewriters, safes, duplicating machines, etc.).

- Other fixed assets. This group includes library collections, museum values, etc.

(intangible produced assets):

- Mineral exploration expenses.

- Computer software and databases.

- Original works of entertainment, literature and art.

- High-tech industrial technologies.

- Other intangible fixed assets that are objects of intellectual property, the use of which is limited by the ownership rights established on them.

Fixed assets include not only existing fixed assets, but also the cost of unfinished objects that are transferred in this state from the manufacturer to the ownership of the user or, upon stage payment, are actually financed by the customer. Consequently, assets are taken into account as part of fixed assets from the moment they become the property of the owner. As a result, fixed assets increase by the value of unfinished produced material assets, i.e. by the amount of the cost of unfinished equipment production (with a long production cycle) in the part paid by the customer, uninstalled equipment paid by the customer. This group also includes livestock, young animals, plantations of perennial plantings that have not reached fruiting age, grown for repeated production of appropriate products, as well as bee families, poultry and fish grown for the production of livestock products and breeding purposes.

1. Economic essence of fixed assets........... 2

2. Physical and moral wear and tear of fixed assets.. 5

3. Reproduction of fixed assets................................... 7

4. Depreciation charges and their use in the enterprise.... 9

5. Repair and modernization of fixed assets.................................. 11

6. Production capacity of the enterprise.................... 12

7. Ways to improve the use of fixed assets...... 13

Literature used................................................... 13

1. Economic essence of fixed assets

Fixed assets are the most significant component of the enterprise's property and its non-current assets.

Fixed assets are fixed assets expressed in value terms.

Fixed assets - these are means of labor that are repeatedly involved in the production process, while maintaining their natural shape, and their value is transferred to the manufactured products in parts as they wear out. These include: buildings, structures, various machines and equipment, instruments and instruments, production and household equipment, land plots owned by the enterprise, on-farm roads and other fixed assets.

By functional significance, fixed assets for production and non-production. TO production fixed assets These include those means of labor that are directly involved in the production process (machines, equipment, etc.), create conditions for its normal implementation (industrial buildings, structures, etc.) and serve for storing and moving objects.

Non-production fixed assets – these are fixed assets that are not directly involved in the production process (residential buildings, kindergartens, schools, etc.), but are managed by industrial enterprises.

Based on ownership, fixed assets are divided into owned and leased.

Basic production assets, depending on the degree of their impact on the subject of labor, are divided into active and passive.

TO active also include funds that, in the production process, directly influence the subject of labor, modifying it (machines and equipment, measuring and adjusting instruments, vehicles).

All other fixed assets can be classified as passive, since they do not directly affect the subject of labor, but create the necessary conditions for the normal flow of the production process (buildings, structures, etc.).

There are production (type), technological and age structure of fixed assets.

Under production structure is understood as the ratio of various groups of fixed production assets (FPF) by material composition in their total average annual value.

The most important indicator of the production structure of OPF is the share of the active part in their total cost. This is due to the fact that the volume of output, production capacity and other economic indicators of the enterprise largely depend on the size of the active part of the general operating fund.

Technological structure OPF characterizes their distribution among the structural divisions of the enterprise as a percentage of their total value. In a “narrow” plan, the technological structure can be presented as the share of dump trucks in the total number of vehicles available at the enterprise.

Age structure OPF characterizes the distribution by age groups (up to 5 years; from 5 years to 10 years; from 10 to 15 years; from 15 to 20 years; over 20 years). The average age of equipment is calculated as a weighted average.

The main task at the enterprise should be to prevent excessive aging of the OPF, since the results of the enterprise depend on this.

Fig 1. Classification of fixed assets (funds)

2. Physical and moral wear and tear of fixed assets

Under physical wear and tear refers to the loss of fixed assets involved in the production process, their original characteristics as a result of their use and natural wear and tear.

The level of physical depreciation of fixed assets depends on: the initial quality of fixed assets; the degree of their exploitation; the level of aggressiveness of the environment where OPFs are used; level of service personnel; timely implementation of scheduled maintenance work, etc.

A number of indicators are used to characterize the degree of physical deterioration of fixed assets.

Physical wear rate fixed assets (Ki.f)

Where AND– the amount of depreciation of fixed assets over the entire period of their operation.

Ps– initial or replacement cost of fixed assets.

The coefficient of physical wear and tear of buildings and structures can be calculated using the formula:

Where di– share of the ith structural element in the cost of the building, %;

Li– percentage of wear of the i-th structural element of the building.

Fixed assets serviceability ratio characterizes their physical condition on a certain date and is calculated using the formula

All these formulas assume uniform physical wear and tear of fixed assets, which does not always coincide with reality.

Obsolescence is depreciation, loss of value before their physical wear and tear and the end of their physical service life.

Obsolescence comes in two forms.

First form obsolescence lies in the fact that machines of the same design that were produced earlier depreciate in value due to the reduction in the cost of their reproduction in modern conditions.

Second form obsolescence consists in the depreciation of old machines that are still physically usable due to the emergence of new, more technically advanced and productive machines that displace the old ones.

At each enterprise, the process of physical and moral wear and tear of fixed assets must be managed. The main goal of this management is to prevent excessive physical and moral deterioration of fixed assets. This process is managed through the implementation of a certain policy of reproduction of fixed assets.

3. Reproduction of fixed assets.

Reproduction of fixed assets – this is a continuous process of updating them through the acquisition of new, modern technologies, modernization and overhaul.

The main goal is to maintain fixed assets in working condition.

In the process of reproduction of fixed assets, the following tasks are solved:

- ? compensation of fixed assets retiring for various reasons;

- ? increasing the number and mass of fixed assets in order to expand production volumes;

- ? improvement and increase in the technical level of production;

The process of reproduction of fixed assets can be carried out from various sources. Fixed assets for reproduction at the enterprise can be supplied through the following channels:

- ? as a contribution to the authorized capital;

- ? as a result of capital investments;

- ? as a result of gratuitous transfer;

- ? rent.

The quantitative characteristics of the reproduction of fixed assets during the year are reflected in the balance sheet of fixed assets at their full original cost using the following formula:

F k. = F n. + F c. – F l.

Where F k. – the cost of PF at the end of the year;

Fn.– the cost of PF at the beginning of the year;

F in. – cost of PF put into operation during the year;

F l.– the cost of PF liquidated during the year.

For a more detailed analysis, the following indicators are used: PF renewal rate, PF disposal rates, capital-labor ratio, technical equipment of labor, etc.

where K obl. – renewal coefficient, %; F k. – cost of office at the end of the year, rub.

where K select – fixed assets retirement rate, %.

Exceeding the value of K obl. Compared to K select. Indicates that the process of updating fixed assets is underway.

4. Depreciation charges and their use in the enterprise

Depreciation- this is a gradual transfer of the cost of the fixed assets to manufactured products, that is, to compensate for the physical and moral wear and tear of the fixed assets, their cost in the form of depreciation charges is included in the costs of production.

Depreciation deductions are made by enterprises on a monthly basis based on established depreciation rates and the cost of the enterprise's assets.

Depreciation rate represents the annual percentage of repayment of the cost of fixed assets established by the state and determines the amount of annual depreciation charges, i.e. is the ratio of the amount of annual depreciation to the cost of the general fund, expressed as a percentage.

Depreciation charges have their own characteristics:

Firstly, depreciation deductions for major repairs have been cancelled, and now enterprises carry out all types of repairs at the expense of production costs.

Secondly, for machinery, equipment, and vehicles, upon expiration of their service life, depreciation accrual ceases in the same way as previously accruals were made during the entire period of operation, regardless of the service life they were designed for;

Thirdly, in order to increase the interest of enterprises in updating fixed assets, acceleration of depreciation is used, that is, the complete transfer of the book value of these assets to production costs.

Accelerated depreciation allows:

- ? speed up the update process;

- ? accumulate enough funds (depreciation charges) to reconstruct production;

- ? reduce income tax;

- ? increase production volume and reduce costs.

The annual amount of depreciation charges is determined:

- ? with the linear method - based on the original cost of the fixed asset and the depreciation rate calculated based on the useful life of this object;

- ? with the reducing balance method - based on the residual value of the fixed asset item at the beginning of the reporting year and the depreciation rate calculated based on the useful life of this item;

- ? with the method of writing off the cost by the sum of the numbers of years of the useful life - based on the original cost of the fixed asset object and the annual ratio, where the numerator is the number of years remaining until the end of the service life of the object, and the denominator is the sum of the numbers of years of the service life of the object.

Planning depreciation charges at an enterprise is important, as this allows you to determine their value for the planned period; it is necessary for planning the cost of production and the financial results of the enterprise.

The initial data for determining depreciation charges for the planned period are: indicators of the value of fixed assets at its beginning; plans for the commissioning of other fixed assets; data on the projected disposal of fixed assets; depreciation rates.

Careful planning of depreciation charges at the beginning of the year makes it possible to further simplify their calculation during the planning period. In this case, depreciation charges (A) for each month are determined according to a simplified scheme: depreciation charges for the previous month (Ao) are added to depreciation charges for newly introduced fixed assets (Abv.) and depreciation charges for retired fixed assets (Avyb.) are subtracted.

The amount of depreciation charges at the enterprise is accumulated in depreciation accounts and is recorded until the depreciable property is disposed of from the enterprise.

In each reporting period, the amount of depreciation is written off from depreciation accounts, to accounts for recording production costs and distribution costs. Together with revenue for sold products and services, depreciation is transferred to the current account of the enterprise where it is accumulated. Depreciation charges are spent directly from the current account to finance new capital investments in fixed assets, for the purchase of building materials, equipment, etc.

5. Repair and modernization of fixed assets

The fixed assets of an enterprise constantly wear out during their operation, and to maintain them in working condition, periodic repairs are necessary.

There are three types of repairs: restoration, current and major.

Refurbishment – this is a special type of repair caused by various circumstances: natural disasters (fire, flood, etc.), military destruction. Restoration repairs are carried out at the expense of special state funds.

Maintenance– these are minor repairs and are carried out without a long interruption in the production process. For minor repairs, individual parts and assemblies are replaced.

Modernization represents a technical improvement of fixed assets in order to eliminate obsolescence and increase technical and economic indicators to the level of the latest equipment.

Major renovation – this is a significant repair of fixed assets and is associated with complete disassembly of the machine, replacement of all worn parts and assemblies.

Repair costs depend on physical wear and tear, the quality of repairs performed and the level of qualifications of the personnel servicing the machinery and equipment.

6. Production capacity of the enterprise

Production capacity is the maximum possible annual (daily) volume of product output for a given nomenclature and assortment, taking into account the best use of all resources available at the enterprise.

The production capacity of the enterprise depends on the following factors: quantity and quality of equipment; the maximum possible performance of each piece of equipment; the adopted work decision (shift, duration of one shift, intermittent or continuous production, etc.); nomenclature and product range, labor intensity of products, level of labor organization, etc.

In general, the production capacity (M) of an enterprise can be determined by the formula:

Where Ta– effective operating time fund of the enterprise

t– labor intensity of manufacturing a unit of production

7. Ways to improve the use of fixed assets

Improving the use of fixed assets is reflected in the financial results of the enterprise by increasing production output, reducing costs, improving product quality, reducing property taxes and increasing profits.

Improvements in the use of fixed assets in an enterprise can be achieved by:

- ? freeing the enterprise from excess equipment, machinery and other fixed assets;

- ? timely and high-quality implementation of scheduled preventive maintenance;

- ? increasing the level of qualifications of service personnel;

- ? improving the quality of preparation of raw materials and supplies for the production process;

- ? increasing the level of mechanization and automation;

- ? introduction of new technologies (low-waste, non-waste, fuel-saving;

Ways to improve the use of fixed assets depend on the specific conditions prevailing at the enterprise over a given period of time.

Used Books

- Sergeev I.V. “Enterprise Economics”: Textbook. Manual.-2nd ed., - M.: Finance and Statistics, 2000.

- Enterprise Economics: Textbook / Ed. O.I. Voikova. – 2nd ed. – M., 2000.

- Ruzavin G.I. Fundamentals of a market economy: Textbook. Manual - M.: Banks and exchanges: UNITY, 1996.

- Enterprise Economics: Textbook / Ed. ON THE. Safronova. – M.: Yunost, 2000.

- Gruzinov V.P., Gribov V.D. Economics of enterprise: textbook. Benefit. – M., 2000.

The enterprise must have some property (assets) to conduct business.

Starting from the computer, ending with the warehouse and equipment. Economics calls this the means of labor. Financial management identifies the term which represents means of labor that are repeatedly used in production and gradually wear out. Examples of fixed assets: real estate, vehicles, land plots, structures, various types of equipment, tools, roads within the territory of an enterprise, in agriculture - livestock, perennial plantings.

Criteria for fixed assets

Russian accounting classifies as fixed assets such property that simultaneously meets the following requirements:

1. Property is directly involved in the production process and provision of services, is used in management activities, or is leased to third parties.

2. The property is used for a long time (more than a year or one production cycle if it exceeds one year).

3. Management does not plan to sell these enterprise funds. Of course, the possibility of sale in the future cannot be ruled out if they are no longer needed, are obsolete or their maintenance is impractical.

4. The fixed assets of the enterprise allow you to generate income (that is, there must be feasibility of use).

5. The initial cost of the property is not less than 40,000 rubles.

Types of fixed assets

Fixed assets of an enterprise are divided into non-productive and production assets. Non-production funds perform an infrastructural and social role, create comfort and favorable conditions for enterprise employees and their family members, for example, kindergartens, schools, apartments and houses, rest homes, and dispensaries. Without these facilities, the company’s activities will continue and the production cycle will not be suspended.

But the importance of these objects cannot be overestimated, since caring for employees is important and necessary both for humanistic reasons and from the point of view of justification - good social security and working and living conditions have a positive effect on the growth of labor productivity. The production assets of the enterprise contribute to the implementation of the main activity, for example, equipment, machines, industrial real estate, where products are produced, works and services are performed, as well as warehouses and other storage facilities, conveyors, vehicles for moving and transporting products. Without the above funds, it is impossible to produce and conduct the main activities of the enterprise. This even includes a personal computer from a small advertising agency or online store. It should be borne in mind that the fixed assets of an enterprise are subject to wear and tear and obsolescence, therefore it is necessary to constantly update them by writing off old ones, repairing existing ones, selling unnecessary ones, purchasing new, modern, progressive and economical objects.

During operation, fixed production assets (FPAs) gradually wear out, and their value is transferred to manufactured products.

Classification of OPF

To classify OPF, two criteria are used - the degree of participation in the production process and the function being implemented.Within the framework of the implemented function, the OPF is divided into:

- Building. Production facilities, warehouses, offices, buildings, etc. Buildings can accommodate personnel and production equipment.

- Facilities. Facilities for obtaining and storing natural resources. For example, quarries, mines, tanks for storing raw materials, etc.

- Equipment. Machine tools, units, measuring instruments and computers used to convert raw materials into finished products.

- Tools. Inventory with a service life of more than one calendar year.

- Transport. Cars and special equipment for transporting raw materials, materials and finished products.

- Transfer devices. They deliver heat, electricity, gas or oil products.

Valuation of fixed assets

The structure and composition of the OPF affects:- cost of finished products;

- the possibility of introducing new production technologies;

- the feasibility of privatization and rental of funds.

- Initial. Calculation of the necessary costs for putting the fund into operation.

- Restorative. Determining the cost of an object taking into account current prices.

- Residual. Cost calculation taking into account wear and tear.

Types of wear of OPF

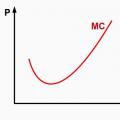

Deterioration of the OPF can be moral and physical.Obsolescence

Reducing the cost of OPFs makes their use inappropriate due to the emergence of new technologies and equipment samples.Physical deterioration

Material wear and tear of assets and deterioration of their technical characteristics due to thermal, chemical and mechanical effects during operation.The result of using OPF

The result of the use of fixed production assets reflects:- capital intensity;

- capital productivity.

You can increase the return on use of fixed assets by:

- hiring qualified employees;

- increasing the intensity of use of OPF;

- conducting high-quality operational planning;

- increasing the share of equipment in the structure of the enterprise;

- carrying out technical modernization.