COMPLETING THE SPECIALIZED FORM OF ACCOUNTING REPORTING "COSTS FOR THE MAIN PRODUCTION" (No. 8-APK)

Form 8-APK "Costs of the main production" contains information on the costs of the main production in the reporting period in the context individual elements, taken into account not only in the reporting period, but also allocated to the main production costs of auxiliary, servicing industries and expenses for organizing and servicing both the industry and the economy. Information on costs is given in this form both for the main production as a whole and for individual industries: crop production and animal husbandry.

On the line "Costs for wages with deductions for social needs", column 1 reflects the remuneration of all personnel for the main activities of the organization, including hired and attracted persons (reflected in the form 5-APK under codes 110, 121-130, 160), except for remuneration of workers: housing and communal services, cultural and community institutions, trade and public catering, children's institutions and educational institutions, capital construction and other activities. Also in this line indicate the cost of remuneration of non-roster staff of other organizations, attributed to the main activity, and wages for loading and unloading works written off in the reporting year to the accounts material assets.

The same line also reflects mandatory contributions in accordance with the norms established by law to the Fund for Social Protection of the Population from all types of remuneration for workers engaged in the production of relevant products (works, services), except for those for which these contributions are not made.

To fill in the indicators for this line in the context of individual industries (crop and livestock), an auxiliary calculation is made (see table 4), using data from production reports and other analytical accounting registers recorded on accounts: 20 "Main production", 23 "Auxiliary production" , 25 “General production expenses”, 26 “General expenses” and 08 “Investments in non-current assets”.

The costs of crop production (table 1) and animal husbandry (table 2) reflected in production reports are taken into account.

|

Table 1 Extract from the production report on crop production (from the beginning of the year) (thousand roubles.) |

||||

| Production costs | ||||

| Items and cost elements | Winter cereals | Winter grains for next year's harvest | Chill rise | |

| Last year's expenses | Reporting year expenses | |||

| Salary | ||||

| man-hour | 5 303 | 24 150 | 6 386 | 3 806 |

| Sum | 5 325 | 24 680 | 7 548 | 4 628 |

| Deductions to the Social Security Fund | 1 560 | 7 404 | 2 264 | 1 388 |

| seeds | ||||

| Sum | 27 700 | 12 740 | ||

| Fertilizers: | ||||

| - mineral | 7 850 | 21 450 | 6 370 | |

| - organic | 2 240 | 5 640 | 3 890 | 6 640 |

| Plant protection products | 3 840 | |||

| The cost of maintaining fixed assets, including |

27 790 | 100 424 | 22 739 | 9 015 |

| - cost of fuel | 6 100 | 39 670 | 9 472 | 4 340 |

| - repair costs | 4 960 | 17 620 | 3 778 | 1 451 |

| - depreciation | 16 730 | 43 134 | 9 489 | 3 224 |

| works and services, including |

1 981 | 34 552 | 339 | 551 |

| - freight transport | 571 | 4 492 | 339 | 551 |

| - power supply | 23 890 | |||

| - horse-drawn transport | 140 | 1 280 | ||

| - third parties | 1 270 | 4 890 | ||

| Other | 1 260 | 6 270 | 6 870 | 1 260 |

| 4 680 | 14 545 | 4 175 | 1 564 | |

| Total | 80 386 | 218 805 | 66 935 | 25 046 |

|

table 2 Extract from the livestock production report (from the beginning of the year) (thousand roubles.) |

|

| Items and cost elements | Total livestock |

| Salary | |

| man-hour | 52 980 |

| Sum | 53 890 |

| Deductions to the Social Security Fund | 16 167 |

| Feed, c.ed. | 21 840 |

| Sum | 94 197 |

| Animal protection means | 13 140 |

| The cost of fuel | 3 160 |

| Repair costs | 2 170 |

| Depreciation | 15 532 |

| Freight transport | 3 475 |

| Power supply | 3 890 |

| case | 4 150 |

| bedding | 2 790 |

| Other | 1 120 |

| Costs for the organization of production and management | 20 480 |

| Total | 234 161 |

Wages with deductions, accounted for overhead costs and distributed, are reflected in table 3.

Using the data of the above indicators, we will calculate the distribution of wages with deductions (table 4).

|

Table 4 Calculation of the distribution of wages with deductions (thousand roubles.) |

|||

| Types of production | Accounted for direct wages with deductions | Attributed to distributable wages with deductions | Total |

| Primary production | |||

| crop production | 47 912 | 4 748 | 60 445 |

| General production costs of crop production | 7 785 | ||

| Livestock (including poultry and fur farming) | 70 057 | 7 167 | 88 433 |

| General production costs of animal husbandry | 11 209 | ||

| Total main production (agriculture) | 136 963 | 11 915 | 148 878 |

| Industrial production, repair shops, electricity and water supply; services rendered by employees of the main activity to construction (without the cost of laying perennial plantings) |

35 170 | ||

| Total direct wages with contributions | 172 134 | ||

| Distributed remuneration with deductions, incl. | 14 969 | ||

| - vehicles, horse-drawn transport, services rendered on the side and for the repair of fixed assets | 4 218 | ||

| - general running costs | 10 751 | ||

| Total wages with deductions by organization | 187 103 |

Calculation procedure:

1. Determination of direct wages with deductions in agriculture (the amount of wages with deductions taken into account in crop production, animal husbandry, for general production costs of crop production and animal husbandry, for services provided for the establishment and cultivation of perennial plantations) - 136,963 thousand rubles.

2. Determination of wages distributed across all branches of the organization (the amount of wages with deductions, accounted for services rendered to the side, for the sale of products, trucks, horse-drawn transport, repair of fixed assets) - 14,969 thousand rubles.

3. Determination of the share of wages with deductions for all wages (without distribution): (136,963 / 172,134 x 100 = 79.6%).

4. Determination of the distributed wages with deductions attributable to agriculture: (14,969 x 79.6% = 11,915 thousand rubles).

5. Determination of the total wages in agriculture based on the data of the previous calculation: (136,963 + 11,915 = 148,878 thousand rubles).

In order to calculate wages with deductions in crop production and animal husbandry, it is necessary to determine the ratio of wages in these industries. To do this, the direct wages with deductions in crop production (the amount of wages with deductions, including general production costs for crop production and the laying of perennial plantations) must be divided by the total wages with deductions in agriculture: (55,697 / 136,963 x 100 = 40 .7%.

The share of labor costs in animal husbandry will be 59.3% (100% - 40.7%).

Based on these data, the salary with deductions will be equal to:

in crop production - 60,445 thousand rubles. (148,878 x 40.6 / 100), i.e. 60 million rubles,

in animal husbandry - 88,433 thousand rubles. (148,878 - 60,445), or 88 million rubles.

The amounts of wages calculated in this way with deductions are recorded respectively in the columns “including for the production of products: crop and livestock”.

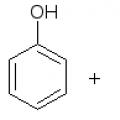

On the line "Material costs included in the cost of production" show the cost of agricultural and industrial products, services of third-party organizations used in the production of products (works, services) of the organization.

In the lines "seeds and planting material", "feed" products of agricultural and industrial production(grain fodder) and other agricultural products are shown at actual purchase prices, and those produced on the farm - at actual (production) cost.

The costs of both purchased and produced on the farm seeds, feed and other agricultural products do not include any other expenses of the current year (transportation to the farm and within the farm, refinement, preparation for feeding, etc.) are not included. They are attributed to production according to the relevant cost elements (wages, fuel, payment for services performed by third parties, etc.).

Under the items “mineral fertilizers” and “plant and animal protection products”, they show the actual cost of fertilizers applied to the soil for plant nutrition and protection products used in the reporting year to protect plants and animals.

The costs of transporting them to the farm, preparing them for application to the soil, transporting them to the fields, etc. are not included in the costs under this article, but are taken into account for the corresponding cost elements.

The line "petroleum products" reflects the cost of fuels and lubricants used for the operation of tractors, combines and other agricultural machines and vehicles that were directly involved in the production of crop and livestock products and their transportation.

The cost of fuel and lubricants of the fleet that participated in the export of products to the state, the costs of which are reimbursed to the economy, are not reflected in this line, since these works are services to third parties.

Since the cost of the fuel used by the fleet is not directly related to the objects of analytical cost accounting for crop and livestock production, it must be found using the data from the production report on auxiliary production, maintenance and operation of machines and equipment of Form 18-B or other accounting registers, where cost accounting for auxiliary production is kept.

For this you need:

1. Find the share of services rendered by motor vehicles to crop and livestock production.

Let's assume that the total volume of services performed by road transport for the reporting period is 2,233 thousand tkm, incl. services were provided: crop production - 335 thousand tkm, livestock - 480 thousand tkm, services for the industry: crop production - 13 thousand tkm, animal husbandry - 45 thousand tkm.

In this case, the share of services rendered by motor transport to crop production will be 15.6% ((335 + 13) / 2233), livestock - 23.5% ((480 + 45) / 2233).

2. The found share of services is multiplied by the cost of accounted for petroleum products by road transport.

For example, for the reporting period, oil products were accounted for by vehicles in the amount of 7,102 thousand rubles.

Consequently, the cost of petroleum products for services provided by vehicles to crop production is 1,108 thousand rubles. (7,102 x 0.156), livestock - 1,669 thousand rubles. (7102 x 0.235)

The cost of oil products directly recorded for crop and livestock production is added to the distributed amounts, and the results are reflected in the line "oil products" in columns 2 and 3, respectively, and in the column "for the main production" the sum of these columns.

The line “spare parts, repair, construction and other materials for repair” is filled in the same way. These calculations can be presented in table 5.

|

Table 5 List of distribution of the cost of spare parts and fuels and lubricants attributable from auxiliary production to the main production |

|||||

| Types of production | Specific weight, % | Cost of spare parts, thousand rubles | The cost of fuel for trucks, thousand rubles. | ||

| MTP | motor transport | ICC | motor transport | ||

| crop production | 88,3 | 15,6 | 5 916 | 1 263 | 1 108 |

| animal husbandry | 5,2 | 23,5 | 348 | 1 903 | 1 669 |

| Accounted for by auxiliary production | X | X | 6 700 | 8 098 | 7 102 |

Thus, the cost of petroleum products will be:

Crop production - 54,590 thousand rubles. (39 670 + 9 472 + 4 340 + 1 108),

Animal husbandry - 4 829 thousand rubles. (3 160 + 1 669);

spare parts cost:

Crop production - 7,179 thousand rubles,

Animal husbandry - 2,251 thousand rubles.

Repair materials used for the repair of the vehicle fleet and the machine and tractor fleet for crop and livestock production are classified as specific gravity respectively: work performed (for the transportation of goods) in these industries in the entire volume of work of the vehicle fleet and distributed costs for the machine and tractor fleet (similarly as for oil products).

This line does not show the cost of tires used in the operation of machinery and equipment, which are reflected in the item "Other material costs".

In the lines "electricity", "gas" and "fuel", respectively, reflect the costs of electricity, gas and fuel. The cost of electricity includes both its cost received from the outside, and the electricity generated by its own power plants for the production needs of the organization (technological, motor, energy, etc.).

The cost of purchased electricity is taken taking into account its indexation.

The line “payment for services and work performed by third parties” reflects the cost of services rendered by third parties for the repair of agricultural machinery, vehicles, fertilization, payment for cargo transportation, soil chemicalization, pest control of agricultural plants, repair of agricultural machinery and payment for plowing, cleaning and other agricultural work.

The work of third-party vehicles for the export of products to the state, the costs of which are reimbursed to the organization, is not taken into account in the costs. By industries, these costs are distributed in proportion to the volume of work performed in a particular industry.

The line “Depreciation of fixed assets and intangible assets” reflects the amount of depreciation and its indexation, not only directly accounted for, but also distributed at the end of the reporting period, depreciation for the machine and tractor fleet, distributed in accordance with the Recommendations for Accounting Costs and Calculating the Cost of Production of Agricultural Enterprises, approved by order of the Ministry of Agriculture and Food of the Republic of Belarus of December 14, 1999 No. 316.

Depreciation of tractors, tractor trailers, garages, sheds, storage areas for equipment is distributed to accounting objects (crops, groups of crops, types and technological types livestock, etc.), including the transport work of tractors, in proportion to the cost of fuel consumed.

Depreciation of tillage machines is distributed among accounting objects in proportion to the area of cultivation; seeders - in proportion to the sowing area; machines for hay harvesting - in proportion to the harvested area; machines for applying fertilizers to the soil - in proportion to the physical mass of fertilizers applied under agricultural crops (groups of crops), etc.

The same line reflects the depreciation of leased fixed assets.

On the line "Other expenses" reflect:

Taxes, fees and other targeted payments to the budget and extra-budgetary funds, made in accordance with the procedure established by law and attributable to the cost of production;

Accrued interest on a loan (except for interest on overdue and deferred loans and loans received for the purchase of fixed assets and intangible assets);

Payment for communication services, computer centers, banks related to servicing organizations;

The cost of services of third-party organizations for fire and guard protection;

Expenses for training and retraining of personnel, payment for consulting, information and audit services, advertising expenses, hospitality expenses;

Compensation for depreciation of personal vehicles, equipment, tools, devices used for the needs of the organization;

The cost of consumed samples and samples of products to establish their compliance with the requirements of standards, building codes in accordance with the current regulatory documents on standardization, as well as the costs of testing (analysis, measurements) by the standardization, metrology and certification bodies of the State Standard in the manner determined by the Council of Ministers of the Republic of Belarus;

Payment for certification of products, goods, works, services;

The cost of warranty repair and maintenance of products for which the warranty period is set;

Expenses for organized recruitment of employees;

rent;

Leasing payments;

Travel and hospitality expenses;

Deductions to the repair fund and the reserve for future expenses for the repair of fixed assets.

The costs of all types of repairs (current, medium, capital) of fixed production assets are included in the cost of products (works, services) for the relevant cost elements (material costs, wages, etc.). In order to evenly write off the costs of repairing production assets to the cost of products (works, services), it is allowed to include them in the cost based on the standard established by the organization, reflecting the difference between the total cost of repairs and the amount attributable according to the standard to the cost of products (works, services) as part of future expenses;

Other costs included in the cost of products, works, services, but not related to the previously listed cost elements.

A distinctive feature of the reflection of costs in this form from forms 9-APK and 13-APK is that all actual costs of the reporting year are reflected in the form 8-APK, i.e. and costs accounted for in the work in progress of the reporting year (crop and livestock), and do not include the costs of previous years (balance at the beginning of the reporting year).

Therefore, the linkage between these forms is as follows.

The total amount of costs for crop production of form No. 8-APK (line 600 of column 2) should be equal to the total amount of costs in form No. 9-APK (line 250 of column 2) minus the cost of used green mass for laying silage and haylage and straws of fiber flax for flax processing (line 0671), minus the value of work in progress at the beginning of the year and plus the value of work in progress at the end of the reporting year (increase in work in progress).

If an organization is not engaged in beekeeping, fish farming and egg incubation, then it will usually not have work in progress. Therefore, the sum of the total costs for animal husbandry, reflected in the form 8-APK (line 600 of column 3), must be equal to the sum of the total costs for livestock, reflected in the form 13-APK (line 220 of column 2).

Otherwise, in the form 8-APK, the total costs for livestock breeding will exceed those reflected in the form 13-APK by the amount of the increase in work in progress (balance at the end minus the balance at the beginning of the year on subaccount 20-2 "Livestock").

Using the data from the above calculations (table 4) and production reports (tables 1 and 2), the indicators of form 8-APK will be reflected in table 6.

|

Table 6 Costs for the main production (form 8-APK) |

||||

| Cost elements | The code | Total for main production | including production | |

| crop production | animal husbandry | |||

| BUT | B | 1 | 2 | 3 |

| 1. Labor costs with social contributions | 100 | 148 | 60 | 88 |

| 2. Material costs included in the cost of production (the sum of codes from 211-216), incl. | 200 | 303 | 182 | 121 |

| - seeds and planting material | 201 | 13 | 13 | X |

| - feed | 202 | 94 | X | 94 |

| - other agricultural products (manure, bedding, eggs for incubation) | 203 | 19 | 16 | 3 |

| - mineral fertilizers | 204 | 28 | 28 | X |

| - plant and animal protection products | 205 | 17 | 4 | 13 |

| - oil products | 206 | 60 | 55 | 5 |

| - electricity | 207 | 28 | 24 | 4 |

| - gas | 208 | - | - | - |

| - fuel | 209 | - | - | - |

| - spare parts, repair, construction and other materials for repairs | 210 | 9 | 7 | 2 |

| - payment for services and works performed by third parties, incl. | 211 | 35 | 35 | - |

| for transportation cargo |

212 | 2 | 2 | - |

In agriculture, specialized forms include: f. No. 5-APK "Number and wages of employees of agricultural enterprises (organizations)", f. No. 6-APK "Main indicators", f. No. 7-APK "Sales of products", f. No. 8-APK "Costs for the main production", f. 9-APK "Production and cost of crop production", f. No. 13-APK "Production and cost of livestock products", f. No. 15-APK "The presence of animals", f. No. 16-APK "Product Balance", f. No. 17-APK "Movement of the main agricultural machinery and equipment."

Consider the content and procedure for compiling these reporting forms.

Form No. 5-APK "Number and wages of employees of agricultural enterprises (organizations)". The report contains detailed information: on the number of employees of an agricultural organization by categories and wages, on social payments by categories of employees, on the use of the wage fund and the distribution of labor costs by sectors and types of activity.

In the main table of the report on page 010, the average annual number of employees, the wage fund and the amount of social payments are reflected for the enterprise as a whole, on line 020 these data are reflected for employees engaged in agricultural production, on line 030 - for permanent workers, on lines 031-050 - for the main categories of employees and separately for managers and specialists. In addition, data are provided for employees of other categories (pp. 055-085).

A separate table shows the distribution of labor costs of agricultural workers and employees by industry and type of activity.

The report is compiled in the first part according to the data of statements No. 58-APK, 59-APK, 78-APK, in the second part - based on the data of personal accounts (production reports) of industries and industries f. No. 83-apk.

Form No. 6-APK "Main indicators". This form provides both general economic indicators and indicators on specific types of activities.

The first group of indicators provides data on total gross income (p. 10), including crop production (p. 20), livestock (p. 30). The next group of general indicators is given at the cost of production.

The following are indicators for fixed assets: the average annual cost of all fixed assets (line 90), including production fixed assets of core activities (line 100), production fixed assets of other industries (line 110), non-production fixed assets (line 120 ).

Then private indicators of energy capacities in the economy are reflected: total horsepower (p. 130), electricity generated by own power plants (p. 140), electricity received from outside (p. 150), total electricity supplied (p. 160), including - for production needs (p. 170).

The first group of indicators is determined by calculation, the second group - according to the data of production cost accounts, the third - on the basis of accounting data on account 01 "Fixed assets", the fourth - on the basis of the sub-account "Power supply" of account 23 "Auxiliary production".

Two certificates are provided for this reporting form: on the material and technical means received under leasing and on the breeding stock as of January 1; about the funds received from the special budgetary fund of concessional lending.

Data on property received under leasing is filled in on the basis of analytical accounting for the relevant sub-accounts of account 03 “Profitable investments in material assets” and 08 “Capital investments”. Data on the receipt of breeding young animals from leasing are filled in on the basis of analytical accounting for accounts 03 “Profitable investments in material assets” and 11 “Animals for rearing and fattening”.

It should be noted that this form of reporting (however, like some others) is overloaded with private information. Most of the indicators in this and a number of other forms of the annual report are available in the corresponding forms of statistical reporting, and the annual report should not duplicate the indicators of statistical reports.

Form No. 7-APK "Product sales". It reflects data on the sale of agricultural products, goods, works, services performed on the side.

Lines 010-019 show sales of grain crops products by type (including corn), lines 020-060 and 080-110 - products of industrial crops, lines 070, 120-180 - potatoes, vegetable growing products, horticulture, melons , subtropical crops, according to line 200 - crop products of own production, sold in a processed form.

Lines 230-414 reflect the sale of livestock products, including meat and meat products in terms of live weight.

Line 460 reflects the sale of processed products of purchased raw materials, line 470 - products of processing of industries and crafts (except for the processing of agricultural raw materials), line 480 - the sale of goods, line 490 - the sale of works and services.

For the implementation of each type of product, the number of products sold in total in kind, the total cost, and revenue are reflected; put into state funds; delivered to businesses and organizations. The table provides complete data on the sale of products of all industries with the possibility of reflecting for each type of financial result of activity, since the full cost and revenue are reflected.

The table is filled out on the basis of the “Statement of Sales of Products, Works and Services of an Agricultural Enterprise” (form No. 62-APK), where annual results are displayed in the form for December, taking into account the amounts of the adjustment. The table is accompanied by a certificate “In addition, subsidies and reimbursement of expenses from the budget have been received.”

Form No. 8-APK "Costs for the main production." This report provides information on the costs of the main production by economic elements:

labor costs with deductions for social needs;

material costs included in the cost of production;

depreciation of fixed assets;

other costs.

For each economic element, the total costs for the main production are reflected, including for the main types of manufactured products - separately for crop production and animal husbandry. For reference, the report provides data on the costs of establishing perennial plantations and growing perennial plantations (for each type, the total amount of costs, including wages with deductions for social needs).

The report and reference data are filled out on the basis of the data of consolidated personal accounts (production reports) f. No. 83-apk.

Form No. 9-APK "Production and cost of crop production." This report provides information on the production of crop products by its main types, its cost - in total and in the context of the main cost items, the output of the industry by main types, the cost of a unit of production, direct labor costs for the production of main types of products.

Page 0010 provides general data on the production and cost of cereals and legumes (winter and spring crops) without corn: actually sown area; the cost of everything, including wages with deductions for social needs, seeds and planting material, mineral and organic fertilizers; maintenance of fixed assets, including expenses for fuel and lubricants, collection of products (total and from 1 ha); the cost of everything and a unit of production; direct labor costs for the product.

According to this scheme, data are provided on the main types of crop production.

For reference, the report contains data (according to pages 0251-0253) for annual and perennial grasses: the area actually harvested for hay and total area crops on the farm.

The reference data reflects the costs for the harvest of the next year (number of hectares and amount). A separate appendix to the report gives the area of orchards, vineyards, other perennial plantations and the gross harvest of pome, stone fruit, berry, etc.

Report on f. No. 9-APK is compiled on the basis of the data of consolidated personal accounts (production reports) f. № 83-APK in general for the crop industry for December on sub-account 20-1 "Crop production".

At the end of the report, data on the land use of the farm as of January 1 (according to state land records) are provided. Information on land use is provided on the basis of data from the land cadastral book with the involvement of land inventory lists (form No. INV-25-APK). If the farm has acquired land plots, then the data of the relevant acts for their posting are involved (standard form No. 111-APK).

Form No. 13-APK "Production and cost of livestock products." The report provides data on industries and types of animals on the production of livestock products by type and cost.

Report pages 010-040 reflect information on the cattle industry for each accounting group of animals: average annual livestock; total costs, including wages with deductions for social needs, feed, maintenance of fixed assets; the number of products received by its main types; production cost; direct labor costs for the product.

For the cattle industry, according to the indicated nomenclature of indicators, data are given for the main dairy herd (p. 010); on animals for growing and fattening (p. 020); for beef cattle. Similar data are given for pig breeding, sheep breeding, poultry farming, horse breeding, etc.

For each accounting group of animals, the output in the corresponding units, the cost of the total output of the product and the unit cost of the product are indicated. The report is accompanied by a table on the cost of live weight of livestock.

The data of the first part of the report on the output and cost of each type of livestock product are filled in on the basis of the information contained in the consolidated personal account (production report) of the livestock industry f. No. 83-apk.

Form No. 15-APK "Presence of animals". It provides information on the presence of animals for each accounting group and species at the end of the year (heads and total book value of livestock). A certificate is attached to the report, which reflects losses from the case and death of animals (according to the book value). The report and certificate are compiled on the basis of the final data of the statement f. No. 73-APK "Statement of analytical accounting of the movement of animals."

Form No. 16-APK "Product Balance". The report provides complete data on the movement of products in kind for the reporting year. The form is built in the form of a balance: the lines reflect the types of products, the columns show their movement for the year in terms of income and expenditure.

The report is compiled by transferring the relevant data from the statement f. No. 46-APK analytical accounting of material assets, goods and containers. The report is accompanied by a certificate of sale and issuance of products in the order of remuneration to employees of the farm (at actual selling prices). The certificate is compiled on the basis of data from analytical accounting for the sale of products in the statement f. No. 62-apk.

Form No. 17-APK "Movement of the main agricultural machinery and equipment" is included in the financial statements, since industry experts have long expressed fair complaints about the lack of information in the annual reporting on fixed assets, which essentially decide the fate of agricultural production. Over the past 10 years, a number of farms have undergone irreversible changes in the composition of machinery and equipment, especially machines that decide the fate of production - tractors, combines, tillage machines, seeders, specialized harvesters, etc. Without objective information on these issues, managers enterprises and industries, the heads of regional agricultural bodies were deprived of the opportunity to purposefully take measures to correct the abnormal situation that had arisen, to radically improve the structure of the fleet of machines.

This report form provides data on the movement of machinery and equipment on the farm for the year: availability at the beginning of the year (column 1); total received (column 2), including new (form 3); retired in total (column 4), including written off (form 5); availability at the end of the year (f. 6).

The main types of agricultural machinery and equipment that decide the fate of production are given along the lines of the report: tractors of all brands (without tractors on which the machines are mounted); tractors on which machines are mounted; tractor trailers, seeders, potato planters, tractor hay mowers, all combines (including grain harvesters, corn harvesters, forage harvesters, potato harvesters, flax harvesters, sugar beet harvesters); sprinkling plants, row and roller headers, milking machines and units, feed distributors, manure conveyors. For each type of machinery and equipment, the report provides data on those received under leasing.

The introduction of this report will undoubtedly make it possible in the next few years to correct the difficult situation with the provision of agricultural production with the most important types of machinery and equipment.

In the explanatory note to the annual report, the following is required: disclose the main provisions of the organization's accounting policy and their observance; indicate what deviations from the current rules are allowed in the report in accordance with paragraph 6 of PBU 4/99; disclose data on changes that have occurred during the reporting year in terms of the most important indicators - profitability, yield, productivity, capital, and the reasons for these changes; competently comment on significant changes in each table, highlighting the main areas for improving the organization's activities.

Ministry of Agriculture Russian Federation

FGOU VPO Tyumen State Agricultural Academy

Institute of Economics and Finance Department of Accounting, Finance and Audit

Course work

in the discipline "Accounting financial statements" on the topic:

"The procedure for compiling specialized forms on the costs of production and sale on the example of the SEC "Poloye" of the Armizon region"

Performed:

Checked:

Tyumen 2010

1. General provisions preparation of annual reports ……………………6

2.1. Section I "Crop production" of the form

No. 9-AIC “Information on production, costs, cost and sales of crop products” …………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

2.2. Section II "Sold crop products" form

No. 9-AIC "Information on production, costs, cost and sales of crop products" ……………………………………………………..16

3.1 Section I "Livestock production" of the form

livestock products” …………………………………………………..19

3.2 Section II "Sold livestock products" form

No. 13-APK "Report on production, cost and sales

livestock products” ………………………………………………….22

Conclusions and suggestions ………………………………………………….28

References…………………………………………………………30

Appendix……………………………………………………………….32

Introduction

All organizations of any form of ownership are required to draw up financial statements based on synthetic and analytical accounting data, which is the final stage of the accounting process. Financial statements in the established forms contains a system of comparable and reliable information about the products sold, works and services, the costs of their production, the property and financial situation of the organization and the results of its economic activity. Currently, organizations submit quarterly and annual financial statements.

Reporting data is used by external users to evaluate the performance of the organization, as well as internal users for economic analysis in the organization itself. At the same time, reporting is necessary for the operational management of economic activities and serves as the initial basis for subsequent planning. Reporting must be accurate and timely. It should ensure the comparability of reporting indicators with data for past periods.

The relevance of the chosen topic lies in the fact that accounting financial statements are one of the most important documents filled out by an organization based on the results of its business activities. The financial condition of the enterprise, its stability depends on the results of its production, commercial, financial activities. The purpose of this course work is to consider the procedure for compiling specialized forms on the costs of production and sales of products for a certain period of time - 2009.

Based on the goal, it is possible to formulate a range of tasks that need to be resolved in the process of considering this topic:

Identify the general provisions for the preparation of annual reports;

Consider the content and procedure for compiling a specialized form No. 9-APK "Information on production, costs, cost and sales of crop products";

Find out the content and procedure for compiling a specialized form No. 8-APK “Report on the costs of the main production”;

Consider the content and procedure for compiling a specialized form No. 13-APK “Report on production, cost and sales

livestock products".

The object of the study is the Agricultural Production Cooperative "Poloe" was formed on May 17, 1999, in accordance with the Order of the Administration of the Armizon region. SPK "Poloe" is located in the southern part of the Armizon region, 28 km. from the regional center. Distance from the regional center 280 km., 100 km. from the railway and the road of republican significance. The amount of the authorized capital is 424 thousand rubles.

The main activities of the production cooperative are:

– production and sale of agricultural products;

– trade and purchasing activities;

- provision of services to the population.

Accounting in the SPK "Poloye" is carried out according to the journal-order form, carried out completely manually due to the lack of computers and software, accounting registers are unified forms of primary accounting documentation.

The staff of the planning and accounting apparatus consists of: the head, the chief accountant and the accountant.

The organization keeps accounting records of property, liabilities and economic transactions (facts of economic activity) by double entry on interrelated accounting accounts included in the working chart of accounting accounts. Taking into account the specifics of the activity, the enterprise uses a working chart of accounts necessary for maintaining synthetic and analytical accounting, developed on the basis of the Chart of Accounts for the financial and economic activities of enterprises and organizations of the agro-industrial complex, approved. Order of the Ministry of Agriculture of the Russian Federation dated 13.06.01 No. 654.

Accounting in 2010 was carried out in accordance with the accounting policy, in accordance with the Law of the Russian Federation "On Accounting" dated November 21, 1996. No. 129-FZ, on the basis of orders of the Ministry of Finance of the Russian Federation dated 09.12.98. No. 60n "On approval of the Accounting Regulation" Accounting policy enterprises" and dated 29.07.98. No. 34n “On Approval of the Regulations on Accounting and Accounting in the Russian Federation” and in order to form complete, objective and reliable information about the activities of the enterprise.

1. General provisions for the preparation of annual accounts

Financial statements are a unified system of data on the property and financial position of an organization as of the reporting date and on the results of its economic activities, compiled on the basis of accounting data in accordance with established forms.

Annual reporting is prepared based on the results of the calendar year from January 1 to December 31 inclusive.

Financial statements should give a reliable and complete picture of the property and financial position of the organization, as well as the financial results of its activities. Accounting statements are considered to be reliable and complete if they are formed and compiled on the basis of their rules established by regulations accounting. If during the preparation of financial statements it is revealed that there is insufficient data to form a complete picture of the property and financial position of the organization, as well as the financial results of its activities, then relevant additional indicators are involved in the financial statements of the organization.

Changes in the accepted content and form of the balance sheet, income statement and explanations to them are allowed in exceptional cases, for example, when changing the type of activity. The rationale for each such change shall be confirmed by the organization.

A significant change is disclosed in the notes to the balance sheet and income statement, along with an indication of the reasons that caused this change.

Reporting data is used by external users to evaluate the performance of the organization, as well as for economic analysis in the organization itself. At the same time, reporting is necessary for the operational management of economic activities and serves as the initial basis for subsequent planning. Reporting must be accurate and timely. It should ensure the comparability of reporting indicators with data for past periods.

Organizations draw up reports according to the forms and instructions approved by the Ministry of Finance and the State Statistics Committee of the Russian Federation. The unified system of reporting indicators of the organization makes it possible to compile reporting summaries for individual industries, economic regions, republics and for the entire national economy as a whole.

In accordance with the Federal Law “On Accounting” (November 21, 1996 No. 129-FZ) and the Accounting Regulation “Accounting Statements of an Organization” (PBU 4/99), the annual financial statements of organizations, with the exception of the statements of budgetary organizations, consist of from:

Balance sheet (form No. 1);

Profit and loss statement (form No. 2);

Statement of changes in equity (Form No. 3);

Cash flow statement (Form No. 4);

Appendix to the balance sheet (form No. 5);

explanatory note;

And agricultural producers also draw up specialized forms of financial statements:

Report on the number and wages of employees of the organization (form No. 5 - APK);

Report on sectoral performance indicators of organizations of the agro-industrial complex (form No. 6 - APK);

Report on the costs of the main production (form No. 8 - APK);

Report on production, costs, cost and sales of crop products (Form No. 9 - APK);

Report on production, cost and sales of livestock products (form No. 13 - APK);

Report on special-purpose financing (form No. 10 - APK);

Report on the presence of animals (form No. 15 - APK);

Balance of products (form No. 16 - APK);

Report on agricultural machinery and energy (form No. 17 - APK).

Forms of financial statements of organizations, as well as instructions on how to fill them out, are approved by the Ministry of Finance of the Russian Federation.

For each numerical indicator of financial statements, except for the report drawn up for the first reporting period, data must be provided for at least two years - the reporting and the previous reporting ones. If the organization decides to disclose data for each numerical indicator for more than two years (three or more) in the presented financial statements, then it provides, when developing, adopting and preparing the forms of these forms, the appropriate number of columns (lines) necessary for such disclosure.

Each form of financial statements must contain the following data: the name of the form, an indication of the reporting date for which the statements were prepared, the name of the organization indicating its organizational and legal form, the form for presenting numerical indicators of financial statements

Basic requirements for financial statements:

1. The financial statements of the organization are final

step in the accounting process. It reflects on an accrual basis

property and financial position of the organization, results

economic activity for the reporting period (month, quarter, year).

2. Accounting statements are prepared on the basis of data

synthetic and analytical accounting and inventory results

property and financial obligations.

3. Accounting statements must be prepared in Russian and in the currency of the Russian Federation.

4. Accounting statements are compiled according to standard forms,

developed and approved by the Ministry of Finance of the Russian Federation.

5. Ministries and departments of the Russian Federation, republics that are part of the Russian Federation,

in addition to standard forms, they can establish

specialized forms of accounting for the organization

systems as agreed, respectively, with the ministries of finance of the Russian Federation and

republics that are part of the Russian Federation.

6. Organizations whose reporting is subject to mandatory

audit, as part of the financial statements represent

final part of the auditor's report.

7. Correction of reporting data after the approval of annual reports

made for the reporting period in which misstatements are discovered.

The organization prepares financial statements that reflect

composition of property and sources of its formation, including property

production facilities, farms, other structural divisions, as well as branches

and representative offices allocated to a separate balance sheet and not being

legal entities.

If the organization has subsidiaries and affiliates

in addition to its own accounting report, consolidated financial statements are also prepared, including the indicators of the reports of such companies located on the territory of the Russian Federation and abroad, in the manner established by the Ministry of Finance of the Russian Federation.

In order for the financial statements to meet the requirements for it, the following conditions must be met when compiling accounting reports: a complete reflection for the reporting period of all business operations and the results of an inventory of all production resources, finished products and calculations; full coincidence of the data of synthetic and analytical accounting, as well as indicators of reports and balance sheets with the data of synthetic and analytical accounting; recording business transactions in accounting only on the basis of properly executed supporting documents or equivalent technical data carriers; correct assessment of balance sheet items.

Reporting should be preceded by significant preparatory work carried out according to a predetermined schedule. An important stage in the preparatory work of reporting is the closing at the end of the reporting period of all operating accounts: calculation, collection and distribution, matching, financially effective. Prior to the start of this work, all accounting entries on synthetic and analytical accounts (including inventory results) must be made, and the correctness of these entries must be verified.

When compiling forms of financial statements, mainly the data of the General Ledger are used. The procedure for compiling reporting forms is detailed in the Instructions on the procedure for filling out forms of annual financial statements.

The reporting year for all organizations is the period from January 1 to December 31 inclusive.

Changes in the financial statements relating to both the current and the previous year (after its approval) are made in the statements compiled for the reporting period in which distortions of their data were discovered.

Corrections of errors in the financial statements are confirmed by the signature of the persons who signed them, indicating the date of correction.

Financial statements are signed by the head and chief accountant (accountant) of the organization. In an organization where accounting is maintained on a contractual basis by a specialized organization or specialist, the financial statements are signed by the head of this organization and the accounting specialist.

This form (Appendix No. 7) reflects the costs of producing crop products and its cost, as well as transactions for the sale of agricultural crop products.

Form No. 9-APK "Information on production, costs, cost and sales of crop products" consists of two sections:

I. "Produced crop products"

P. "Sold crop products."

Let's consider each section of this form separately.

2.1. Section I "Produced crop products" form No. 9-APK "Information on production, costs, cost and sales of crop products"

This section is filled out on the basis of analytical accounting data for sub-account 20-1 "Crop production".

The section includes data on the production of all types of crop products and the cost of their cultivation.

First of all, for each crop, the areas under crops are reflected (the first stage of filling out section I “Produced crop products” of form No. 9-APK). SPK Poloye grows winter spring crops (line 010: column 3 - 1165 ha, column 4 - 975 ha), annual grasses (line 010: column 3 - 190 ha, column 4 - 190 ha). For winter crops and perennial seeded grasses, in section I “Produced crop products” of form No. 9-APK “Information on production, costs, cost and sales of crop products” show the area of crops that have survived by the end of the mass sowing of spring crops. The dead winter crops include: completely dead crops in the autumn-winter period before the start of mass sowing of spring crops (regardless of whether they were oversown with spring crops or not); winter crops that died in the spring and were sown with spring crops, not sown areas of winter crops that died in the spring, on which sown perennial grasses were preserved.

For spring crops, they reflect the entire initial area of sowing, that is, the entire area sown in spring, not excluding summer death.

If the area under crops of a particular crop was used for other than its original purpose, then this area is reflected in the report on actual use. However, crops of grain crops (winter (line 020) and spring (line 030)) that died in the summer and were not resown (including those used for grazing, hay, green fodder, silage) are not excluded from the number of grain crops and are not transferred to fodder crops.

If spring crops that died during the summer period were resown with other crops, then the report indicates the sown areas of those crops that were resowed.

Crops produced in the aisles of orchards or nurseries are included in the total of the sown area of the respective crops, as well as the total sown area in the number of hectares occupied by crops.

The second step when filling out section I is to indicate the mass of products obtained for each crop (column 16: line 011 - 16696 q., line 012 - 16172 q., line 021 - 16696 q., line 022 - 16172 q., line 241 - 1520 c., line 271 - 1980 c.). Moreover, the mass of grain, soybeans and sunflower seeds is indicated taking into account refinement, minus unused waste and shrinkage after refinement, but including useful grain waste in kind in terms of full-fledged grain. In a separate column 17, the collection of products from one hectare (yield) is given (line 011 - 17.1 c / ha., Line 012 - 16.6 c / ha., Line 021 - 17.1 c / ha., Line 022 - 16.6 q/ha, line 241 - 8.0 q/ha, line 271 - 8.0 q/ha).

The third stage consists in filling in column 5 "Costs - total" for each crop on the basis of the relevant analytical accounting data for each crop on sub-account 20-1 "Crop production" (with the exception of costs for completely dead crops that did not produce products) (line 010 - 2332 thousand rubles, line 020 - 2332 thousand rubles, line 240 - 244 thousand rubles, line 270 - 132 thousand rubles). These costs are debited from subaccount 20-1 "Crop production" to the debit of subaccount 76-1 "Settlements for property and personal insurance", and for uninsured crops - the debit of account 91 "Other income and expenses", that is, at a loss.

The costs for each crop are divided into main components (main cost items):

Remuneration of labor with contributions for social needs (column 6: line 010 - 395 thousand rubles, line 020 - 395 thousand rubles, line 240 - 63 thousand rubles, line 270 - 79 thousand rubles);

Seeds and planting material (column 7: line 010 - 721 thousand rubles, line 020 - 721 thousand rubles, line 240 - 141 thousand rubles, line 270 - 0 thousand rubles);

Mineral and organic fertilizers (column 8: line 010 - 0 thousand rubles, line 020 - 0 thousand rubles, line 040 - 0 thousand rubles);

Chemical plant protection products (column 10: line 010 - 71 thousand rubles, line 020 - 71 thousand rubles);

Electricity (column 11: line 010 - 14 thousand rubles, line 020 - 14 thousand rubles, line 240 - 3 thousand rubles, line 270 - 2 thousand rubles);

Oil products (column 12: line 010 - 553 thousand rubles, line 020 - 553 thousand rubles, line 240 - 70 thousand rubles, line 270 - 70 thousand rubles);

Maintenance costs of fixed assets used in

crop production (remuneration of workers serving the main

funds (except for tractor drivers, whose payment was included in the first

article), depreciation (depreciation) of fixed assets, costs for all types of

repairs of fixed assets used in crop production (column 13: line 010 - 103 thousand rubles, line 020 - 103 thousand rubles, line 240 - 15 thousand rubles, line 270 - 15 thousand rubles);

The next step is to determine the cost of all received crop products (column 18: line 012 - 2307 thousand rubles, line 022 - 2307 thousand rubles, line 241 - 244 thousand rubles, line 271 - 132 thousand rubles) and unit cost of production (column 19: line 012 - 142.62 rubles, line 022 - 142.65 rubles, line 241 - 160.53 rubles, line 271 - 66.67 rubles). To do this, the amount of costs for each crop is attributed to the resulting crop products. If one type of product is received from a culture, then all costs under the culture are attributed to it. If they receive the main and by-products (grain and straw), then part of the costs, in accordance with the current procedure for their distribution, is attributed to by-products, and the rest - to the main one. If several types of basic products are received, then the costs are distributed between them either according to specially established coefficients (for the production of seeded herbs), or in proportion to the cost of each type of product in selling prices (fruits, vegetables, etc.).

For each type of crop production, column 20 indicates direct labor costs for products (total man-hours) (line 012 - 8.0 thousand man-hours, line 022 - 8.0 thousand man-hours, line 241 - 1.0 thousand man-hours, line 271 - 1.0 thousand man-hours).

After section I “Produced crop products” to form No. 9-APK “Information on production, costs, cost and sales of crop products”, several certificates are drawn up for the main sectors of crop production.

In the certificate of costs for the next year's harvest, data on work in progress is indicated: the number of hectares (column 3 - line 332 "spring crops" - 1070 hectares) and the amount of costs (column 4 - line 330 "costs for next year's harvest" - total - 217 thousand rubles, line 332 "spring crops (pairs and plowing)" - 217 thousand rubles, line 360 "work in progress at the beginning of the year" - 139 thousand rubles, line 361 "work in progress at the end of the year" - 217 thousand rubles).

The certificate on horticulture, vineyards and other perennial plantings provides data for each crop on areas (column 4 - at the end of the year), gross harvest (column 6) and costs: total per crop (column 9) and unit cost of production (column 10) .

The certificate of land use indicates the total land area (line 550) and with a breakdown by land: total agricultural land (line 560), including arable land (line 570), hayfields (line 580), pastures (line 590); forest areas (line 630), ponds and reservoirs (line 650), personal plots(line 660), availability of irrigated land (line 700), availability of drained land (line 710), availability of owned land (line 720), swamps (line 680) and roads (in km) (line 670). In this certificate, data are given in the following columns: total land (according to state records) (column 3: line 550 - 804 hectares, line 560 - 804 hectares, line 570 - 804 hectares), from it: used by the organization (column 5: line 550 - 804 ha, line 560 - 804 ha, line 570 - 804 ha), transferred to the use of other persons (column 6), not used (column 7).

2.2. Section II "Sold crop products" form No. 9-APK "Information on production, costs, cost and sales of crop products"

This section reflects operations for the sale of crop products, which are accounted for on account 90 "Sales".

The full cost of sold crop products and revenue is shown in section II “Crop products sold” of form No. 9-APK without the amount of value added tax, excise taxes, expert customs duty.

In this section, the data is presented in the following columns. Column 3 shows the amount of crop production (in kind) sold (delivered) in the reporting year (line 740 "cereals and leguminous crops - total" - 6161 centners, line 741 "wheat" - 5701 centners, line 749 "barley" - 302 q., line 770 "oats" - 158 q.). Column 4 shows the full actual cost of sold crop products, including non-reimbursable delivery costs and all marketing expenses for other sales (line 740 - 879, line 741 - 813, line 749 - 43, line 770 - 23). In column 5, the actual proceeds from the sale of crop products are recorded, that is, those actually paid (transferred) or payable (transferred) to the agricultural enterprise, minus the amount of VAT, excises and export customs duties (line 740 - 1622 thousand rubles, line 741 - 1454 thousand rubles, line 749 - 132 thousand rubles, line 770 - 36 thousand rubles). .

Lines 740 - 970 reflect the sale of own crop products in an unprocessed form. Line 980 reflects the sale of processed crop products of own production.

Line 740 reflects the sale of grain in general for all grain crops (including rice, corn). Grain handed over in the reporting year for the return of seed and fodder loans is also shown in section II "Sold crop products" of form No. or fodder loans, grain was taken to the balance of the economy.

Lines 830, 840, 850 provide indicators for the sale of fiber flax products. Sugar beet sold from fodder crops is reflected in the general order in line 810 "Sugar beet". At the same time, for the physical mass, which is indicated on line 810 in column 3, the mass after manual cleaning of sugar beets after weighing (without land) is taken.

Line 990 is the final line. In this line, column 4 reflects the full cost of all crop production (879 thousand rubles). Column 5 of line 990 reflects the proceeds from the sale of all crop products (1622 thousand rubles). This line is calculated as the sum of line 740 plus the amount from line 790 to line 980 in the corresponding columns.

All digital indicators are given in accordance with form No. 9 - AIC "Information on production, costs, cost and sales of crop products" of the annual financial statements of the agricultural production cooperative "Poloe".

This form (Appendix No. 8) includes data on the production of all types of livestock products and the costs of raising, rearing and fattening livestock, both own and received from participating farms. The costs of livestock industries that did not produce products are not included in the form. And also in the form No. 13-APK reflect transactions for the sale of agricultural livestock products.

Form No. 13-APK "Report on production, cost and sales of livestock products" consists of two sections:

I. "Produced livestock products"

II. "Sold livestock products." Let's consider each section of this form separately.

3.1. Section I "Produced livestock products" form No. 13-APK "Report on production, cost and sales of livestock products"

This section provides data on the production of all types of livestock products and the costs of growing, rearing and fattening livestock, both own and received from participating farms.

The line section reflects the relevant data for each livestock sector: cattle (line 010), pig breeding (line 030), sheep breeding (without karakul and smushkovy) (line 040), sheep breeding karakul and smushkovy (line 050), poultry farming (line 160), horse breeding (line 180), beekeeping (line 190), fur farming (line 200), fish farming (line 210), rabbit breeding (line 230), sericulture (line 240), other animal industries (line 250), total animal husbandry (line 280).

According to the columns, the report reflects indicators characterizing the state of each livestock sector: the average annual livestock (column 3: line 021 "cows" - 97.0 heads, line 022 "young animals up to 8 months" - 24.0 heads, line 023 "animals for rearing and fattening" - 74.0 heads, line 181 "horse breeding: young animals for rearing" - 13 heads), maintenance costs, total (column 4: line 020 - 388 thousand rubles, line 023 - 687 thousand . rub., line 181 - 137 thousand rubles), including wages with contributions for social needs (column 5: line 020 - 143 thousand rubles, line 023 - 142 thousand rubles, line 181 - 59 thousand rubles), total feed (column 6: line 020 - 169 thousand rubles, line 023 - 185 thousand rubles, line 181 - 71 thousand rubles), feed of own production (column 7: line 020 - 169 thousand rubles, line 023 - 185 thousand rubles, line 181 - 71 thousand rubles), electricity (column 8: line 020 - 4 thousand rubles, line 023 - 4 thousand rubles), oil products ( column 9: line 020 - 46 thousand rubles, line 023 - 3 thousand rubles), the cost of maintaining fixed assets (column 10: line 020 - 57 thousand rubles, line 023 - 54 thousand rubles, line 181 - 3 thousand rubles).

Further, the columns reflect the output of products for each group of animals: product name (column 11: line 024 - weight of calves at birth, line 025 - offspring, line 028 - growth), unit of measurement (column 13: line 024 - c., line 025 - head., line 028 - q.), the number of units (column 14: line 024 - 27 q., line 025 - 97 heads., line 028 - 145 q.).

The last columns determine the cost of each type of livestock product: total costs (column 15: line 024 - 388 thousand rubles, line 028 - 687 thousand rubles, line 184 - 137 thousand rubles), per unit of production (column 16 : line 028 - 4737.93 rubles). Column 17 is intended to reflect direct labor costs for each type of product (line 025 - 2.0 thousand man-hours, line 028 - 6.0 thousand man-hours, line 184 - 1.0 thousand people .-hour.

The average annual number of animals for each group is determined by summing up the number of feeding days of animals per year (including feeding days of dead animals) and dividing this sum by the number of days in a year (365) .

The costs of keeping the corresponding type of animals are the data of analytical accounting for the debit of sub-account 20-2 "Livestock". At the same time, the costs of maintaining sires (or the costs of artificial insemination of animals) are also included in the costs of the main dairy herd. The gross milk yield from the main dairy herd does not include milk obtained from cows transferred to fattening, as well as those used for suckling feeding of animals.

In the column "Payment with deductions for social needs" they reflect only direct wages with deductions for workers directly involved in the production of livestock products (milkmaids, cattlemen, calves, and so on).

The column "Feed" shows the actual cost of all types of feed consumed for the maintenance, including the cost of green mass, cultivated pastures, seeded feed fed to animals by grazing. The costs of preparing feed in feed shops and feed kitchens are also indicated under this article.

In the column "Costs of maintaining fixed assets" reflect the costs of maintaining industrial buildings for livestock purposes, working machines and equipment used directly in the production of livestock products.

The production of animals for growing and fattening is their weight gain (increase in live weight minus the weight of dead animals).

Milk from beef cows is considered a by-product and valued at selling prices.

In egg poultry farming, eggs obtained only from adult birds are reflected as the main product. Eggs from young birds are considered a by-product of rearing of young birds and are shown on a separate line.

Livestock work-in-progress costs are not shown in this report, but are reflected only in line 213 in the balance sheet asset (Appendix No. 1) (this includes work in progress in fish farming, poultry farming (incubation of eggs) and beekeeping (honey supply in hives for winter feeding of bees ) .

The distribution of costs between certain types of livestock products obtained from certain types animals are produced according to the procedure established by the relevant methodological recommendations: in dairy farming between milk and offspring - 90% for milk and 10% for offspring; in sheep breeding, the costs for wool and live weight gain are distributed in proportion to the consumption of feed (in feed units) for these types of products in accordance with established zootechnical standards. Sheep shearing costs are for sheep only.

For "Other industries" the costs and output of products for those branches of animal husbandry that are not included in the lines allocated for the main industries are given. Other industries include: buffalo breeding, camel breeding, yak breeding, herd horse breeding, reindeer breeding, elk breeding and the like.

3.2. Section II "Sold livestock products" form No. 13-APK "Report on production, cost and sales of livestock products"

This section reflects transactions for the sale of livestock products, which are recorded on account 90 "Sales".

The full cost of sold livestock products and revenue is shown in section II “Sold livestock products” of form No. 13-APK without the amount of value added tax, excises, expert customs duties.

In this section, the data is presented in the following columns. Column 3 gives the amount of livestock products (in kind) sold (delivered) in the reporting year. Column 4 shows the full actual cost of livestock products sold, including non-reimbursable shipping costs and all selling expenses for other sales. In column 5, the actual proceeds from the sale of livestock products are recorded, that is, actually paid (transferred) or payable (transferred) to the agricultural enterprise, minus the amount of VAT, excises and export customs duties.

Lines 600 - 710 reflect the sale of own livestock products in an unprocessed form. Line 720 reflects the sale of processed livestock products.

Lines 601 - 607 indicate data on the sale of young animals, livestock from fattening, as well as on the sale of culled livestock of the main herd with its transfer to fattening, regardless of the purposes for which the animals were sold - for meat, for growing, for a tribe ( line 601: column 3 - 89.0 cents, column 4 - 452.00 thousand rubles, column 5 - 466.00 thousand rubles).

Line 640 provides data on the sale of wool from sheep, goats, camels, and other animals. At the same time, wool in column 3 is shown in natural weight.

Line 620 shows the sale of eggs obtained from all types of poultry (hens, geese, ducks, turkeys and others), including quail eggs on farms with quail farms.

Line 670 reflects the sale of fresh fish grown in the ponds and reservoirs of the farm as a result of fish farming.

Line 690 "Other aquatic biological resources" and line 680 "Fish products" (including canned food). Lines 690 and 680 are filled in by fisheries.

On line 700, fur farming products are taken into account, including skins and fluff of rabbits, skins and antlers of deer. Rabbits and deer sold in live weight are accounted for along with the sale of other animals in line 607.

On line 720, they show sold livestock products of their own production, processed both on their own farm and on the side (on a give-and-take basis). On line 720, column 4 shows the full cost of sold livestock products of own production in processed form, including the cost of raw materials and costs associated with the sale (594.00 thousand rubles), and column 5 - all proceeds from the sale of livestock products of own production in processed form (505 thousand rubles).

Line 740 reflects the sold meat and meat products in terms of live weight (column 3 - 117 centners, column 4 - 594 thousand rubles, column 5 - 505 thousand rubles).

Line 750 is the final line. In this line, column 4 reflects the full cost of all own livestock products (1046 thousand rubles) Column 5 of line 750 reflects the proceeds from the sale of all own livestock products (971 thousand rubles) This line is calculated as the sum of lines from 600 to 720 according to the respective columns.

In the certificate to the form No. 13-APK “Report on the production, cost and sale of livestock products” it is indicated on line 290 how much livestock and poultry are grown in live weight, on line 300 - how much was purchased from citizens under contracts, on line 310 - costs, that did not produce products (in thousand rubles), in line 320 - losses from the case and death of animals due to original cost(in thousand rubles).

The cost of live weight of young cattle of all ages and fattening of adult cattle is indicated in lines from 400 to 520. The columns indicate the number of heads (column 6), live weight in centners (column 7), the cost of animals in thousand rubles. for each type of animal (column 8).

All digital indicators are given in accordance with form No. 13 - AIC "Report on the production, cost and sale of livestock products" of the annual financial statements of the agricultural production cooperative "Poloe".

Form No. 8-APK “Report on the costs of the main production” reflects the production costs for the main industries (crop, livestock, auxiliary production, and others) in the context of cost elements:

Material costs (line 100) (including by components)

(lines 110 to 130);

Wages (line 200);

Social contributions (line 300);

Depreciation charges (line 400);

Other costs (line 500).

Line 600 is intended to reflect all costs for the main production.

Costs are divided into columns:

Total for production (column 3 - for the reporting year: line 100 - 2337 thousand rubles, line 200 - 784 thousand rubles, line 300 - 97 thousand rubles, line 500 - 780 thousand rubles, line 600 - 3998 thousand rubles); (column 4 - for the previous year: line 100 - 3528 thousand rubles, line 200 - 710 thousand rubles, line 300 - 87 thousand rubles, line 400 - 61 thousand rubles, line 500 - 701 thousand rub., line 600 - 5087 thousand rubles);

Including for the production of crop products (column 5 - for

reporting year: line 100 - 1778 thousand rubles, line 200 - 478 thousand rubles, line 300 - 59 thousand rubles, line 500 - 471 thousand rubles, line 600 - 2786 thousand rubles); (column 6 - for the previous year: line 100 - 2845 thousand rubles, line 200 - 423 thousand rubles, line 300 - 52 thousand rubles, line 400 - 61 thousand rubles, line 500 - 699 thousand rub., line 600 - 4080 thousand rubles),

Including for the production of livestock products (column 7 - for

reporting year: line 100 - 559 thousand rubles, line 200 - 306 thousand rubles, line 300 - 38 thousand rubles, line 500 - 309 thousand rubles, line 600 - 1212 thousand rubles); (column 8 - for the previous year: line 100 - 683 thousand rubles, line 200 - 287 thousand rubles, line 300 - 35 thousand rubles, line 500 - 12 thousand rubles, line 600 - 1007 thousand rub.).

The element "Costs of labor with contributions for social needs" reflects the remuneration of all personnel of the main activity of the economy, including involved persons, except for the remuneration of employees of housing and communal services and cultural and community institutions, trade and public catering, children's institutions and educational institutions , capital construction and other activities. This element also takes into account the remuneration of unpaid staff allocated to the main activity, and the wages for loading and unloading operations written off during the year to the accounts of accounting for material assets.

The costs for this element are collected by industry, for which the data of accounts 20 "Main production", 23 "Auxiliary production", 25 "General production costs", 26 "General business expenses" are used.

The element "Material costs" reflects the cost of agricultural and industrial products included in the cost of production, services of third-party organizations used for the production of farm products. At the same time, material costs in plant growing and animal husbandry are defined in a simplified way as the difference between costs and other elements, except for material costs.

For this element, the main components of material costs are reflected in the report: seeds and planting material (line 110), feed for agricultural and industrial production (line 112), mineral fertilizers (line 115), chemical plant protection products (line 116), electricity (line 117 ), petroleum products (line 120), spare parts, repair and Construction Materials for repairs (line 123), payment for works and services performed by third parties (line 124), and so on.

The element "Depreciation" reflects the amount of depreciation accrued for the year and attributed to production, except for deductions for fixed assets of housing and communal services, the social sphere, children's institutions, trade, public catering, capital construction in an economic way, and the like.

The "Other costs" element takes into account taxes attributable to costs (land tax, etc.), fees, payments for maximum permissible emissions of pollutants, remuneration for inventions and rationalization proposals, travel, lifting, payment to third parties for fire and guards, for training and retraining of personnel, payment for communication services, computer centers, banks, depreciation intangible assets, lease payments on leased land shares, insurance payments for crop insurance, lease payments, as well as other intangible costs included in the cost of production.

All digital indicators are given in accordance with form No. 8 - AIC "Report on the costs of the main production" of the annual financial statements of the agricultural production cooperative "Poloe".

Conclusions and offers

After analyzing this work, we can conclude that the annual financial statements of SEC "Poloye" are formed on the basis of the rules established by regulatory acts on accounting. Therefore, we can say that it gives a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position.

The preparation of annual financial statements is preceded by preparatory work. First of all, they conduct an annual inventory of property and liabilities. The results of the inventory are considered by the head of the enterprise. According to the discrepancies between the accounting data and the inventory data identified as a result of the inventory, appropriate accounting entries are made. As a result, the accounting data are brought into full compliance with the actual data identified by the inventory.

Since SPK Poloye is an agricultural enterprise, it includes standard reporting forms for commercial organizations and specialized reporting forms established for agricultural organizations in its annual financial statements.

Form No. 8-APK "Report on the costs of the main production", form No. 9-APK "Information on production, costs, cost and sales of crop products", form No. 13-APK "Report on production, cost and sales of livestock products" - these are specialized forms that contain data on costs, production and sales of products. In accordance with the theme of this work, I studied these forms.

Form No. 8-AIC "Report on the costs of the main production" reflects the costs of production in the main industries (crop, livestock, auxiliary production, and others) in the context of cost elements.

Form No. 9-APK “Information on production, costs, cost and sales of crop products” reflects the costs of producing crop products and their cost, as well as reflects transactions for the sale of agricultural crop products.

Form No. 13-APK “Report on the production, cost and sale of livestock products” includes data on the production of all types of livestock products and the costs of growing, rearing and fattening livestock, both own and received from participating farms. The costs of livestock industries that did not produce products are not included in the form. Also in the form No. 13-APK reflect transactions for the sale of agricultural livestock products.

The financial statements of SEC "Poloye" are compiled in accordance with the basic requirements for it, but there are significant shortcomings, such as a mismatch in the amounts for some reporting forms. For example, in the form No. 8-APK, the material costs for electricity for livestock for 2009 amount to 7 thousand rubles, and in the form No. 13-APK, these same costs amount to 8 thousand rubles. Another drawback is the absence in the income statement of the amount of general production and general business expenses, although this cannot be, this is contrary to the accounting policy of this enterprise.

There are no such shortcomings in financial statements as the absence of the signature of the head and chief accountant in the prescribed lines after each reporting form, as well as the absence of mandatory details in some reporting forms in the SEC "Poloye". This is a significant plus.

Bibliography

1. Federal Law "On Accounting" dated November 22, 1996, No. 129-FZ.

2. Regulation on accounting and accounting

reporting in the Russian Federation (approved by Order of the Ministry of Finance of the Russian Federation of July 29, 1998 N 34n).